CFD Crypto Day Trading

Crypto contracts for difference (CFDs) are popular with day traders, allowing investors to speculate on the price of digital tokens without directly buying and storing cryptocurrencies.

The high volatility of digital assets has also made them a prime choice for CFDs, with frequent and large price fluctuations providing short-term trading opportunities. For example, in the first three months of 2024, the price of Bitcoin climbed from around $43,000 to over $70,000.

The guide will explain how crypto CFDs work, discuss their advantages and disadvantages, and list the steps to trade these short-term financial products.

Quick Introduction

- Crypto CFDs are derivatives where the buyer and seller pay the difference between the opening and closing price of a token when the trade is closed.

- Day traders can go long and short with these crypto-backed instruments, meaning you can make profits whether digital asset prices rise or fall.

- These securities are usually traded using leverage (borrowed capital). This can supercharge profits, but it can also amplify losses when the crypto market moves in an unexpected direction.

- Their high-risk nature means crypto CFDs are restricted in certain territories like the US and UK.

Best CFD Crypto Trading Brokers

Following our exhaustive tests, these 4 brokers stand out as the best for day trading crypto CFDs:

Best CFD Cryptocurrency Brokers

What Are Crypto CFDs?

Crypto CFDs are financial instruments that track price movements in cryptocurrencies, such as Bitcoin, Ethereum and Litecoin.

They enable speculators to bet on whether crypto prices will rise or fall without having to own the underlying asset itself, a characteristic of all CFDs.

You can bet on crypto prices rising by taking a ‘long’ position, or speculate that values will drop by going ‘short’.

Like many derivatives, crypto-backed CFDs are popular with short-term traders who wish to use leverage. These are funds that you can borrow from a brokerage to control a larger position.

You will put down a deposit (known as margin) that allows you to open and hold a position in a cryptocurrency. Your broker will specify the minimum balance you must maintain in your account relative to the total value of the leveraged position.

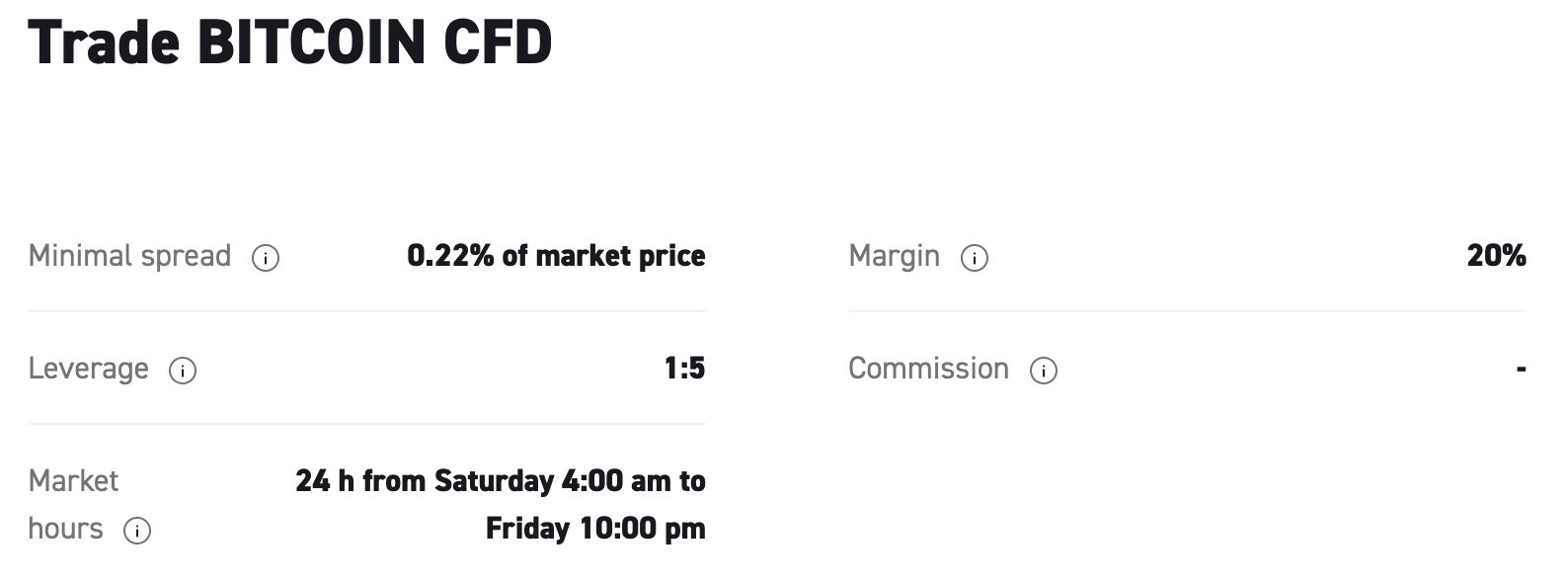

Based on our many years in the industry, the level of leverage available on crypto CFDs typically ranges from 1:2 to over 1:20. A $100 outlay with 1:2 leverage would give you $200 (2 x $100) in buying power, while 1:20 leverage would give you $2,000 (20 x $100).

Due to their volatile nature, crypto CFDs are normally available with less leverage than other financial instruments, such as fiat currencies, protecting against significant losses in fast-moving markets.

Importantly, if you fall short of the margin requirements, the brokerage will demand that you deposit more cash. This is known as a margin call. If you fail to do this you may find your cryptocurrency CFD position liquidated by your broker – an extremely frustrating situation.

Crypto CFDs are controversial financial securities. While they can significantly enhance your returns, they can result in whopping losses when things go wrong.

A Crypto CFD Trade In Action

To help you understand how a crypto CFD trade works in reality, let’s look at an example…

Initial Scenario

- Current Bitcoin Price: $60,000

- My Deposit (Margin): $1,000

Objective

I anticipate that the price of Bitcoin will increase following an announcement from an established public company that it’s bought a large amount of the digital currency, so I decide to enter a long position (buy) using a Bitcoin CFD with 10x leverage.

The 10x leverage means that my $1,000 deposit allows me to control a position worth 10 times my deposit, so $1000 x 10 = $10,000.

Trade Execution

- Price Movement: The price of Bitcoin rises over the next 6 hours

- New Bitcoin Price: $62,500

Importantly, Bitcoin CFDs are only settled when I choose (or the broker closes it because I have failed to meet margin requirements).

Calculating My Profit

- Determine the price movement: The price moved from $60,000 to $62,500, which is a $2,500 increase.

- Calculate the percentage increase: The increase is $2,500 on the original $60,000, which is a 4.17% increase.

- Apply the percentage to my controlled amount: Since I control $10,000 worth of Bitcoin, a 4.17% increase on my position is $10,000 x 4.17% = $417. My profit excludes trading fees.

If I had not used leverage and simply invested my $1,000 directly into Bitcoin, my profit from the price increase from $60,000 to $62,500 would have been approximately $41.67 ($1,000 x 4.17%), excluding any fees, demonstrating the huge impact of leverage.

If The Price Had Fallen

If, instead, the price of Bitcoin had fallen to $58,000, I would calculate my loss in a similar manner. The price movement would be a $2,000 decrease, equating to a 3.33% decrease. On my $10,000 position, a 3.33% decrease would result in a $330 loss.

While this won’t impact day traders, if you keep a Bitcoin CFD trade open overnight, you may incur interest charges, potentially increasing the cost of trading.

Should I Trade Crypto CFDs Instead Of Crypto Directly?

You can trade cryptocurrency directly on a specialist crypto exchange like Coinbase and Binance. However, trading a crypto-based CFD can have advantages over buying and selling digital currencies themselves. These include:

- Eliminating wallet management: If I buy cryptocurrency on an exchange, I also need to set up a digital wallet in which to store the asset. These can only be accessed via a private ‘key’, a code that can easily be lost or stolen. Trading cryptocurrency CFDs eliminates this threat and also makes day trading much simpler.

- Better liquidity: Crypto CFDs tend to have higher trading volumes than digital tokens and, as a consequence, much deeper liquidity. This can result in reduced costs through tighter bid and ask spreads, while short-term traders can also be able to enter and exit positions more quickly.

- Tighter regulation: Regulatory oversight of CFDs tends to be much tighter than the cryptocurrency market more broadly. This provides traders with an enhanced level of protection. However, day traders who use overseas brokers should carefully check their regulatory status.

- Leverage: I may be able to obtain higher leverage by trading a crypto-based derivative than by dealing in the digital currency itself, potentially increasing profits (and losses).

Trading crypto CFDs instead of the underlying cryptocurrency also has drawbacks. These can include the potential for higher trading fees and increased counterparty risk (the danger that the broker may fail to meet its contractual obligations).Also, despite improvements in recent years, there is still often a limited choice of digital tokens beyond the biggest and most well-known, such as Bitcoin, Ethereum and Litecoin.

How To Trade Cryptocurrency CFDs

If allowed in your jurisdiction, day trading crypto CFDs requires 3 steps:

Choose A Crypto Broker

The first step is to choose a broker with cryptocurrency CFDs. I always start by checking that the company is trusted; there are vast numbers of unregulated crypto CFD brokers doing business across the globe with scams prevalent.

Next, consider the levels of leverage that you’re able to take advantage of. After all, the ability to use borrowed funds from a broker is one of the major selling points of day trading crypto CFDs.

Also look for brokers with negative balance protection. This will ensure that you cannot lose more than the funds that are already in your account when trading with leverage.

Once you’re happy with these points, check the pricing – low spreads will help maximize profits, especially for active day traders.

Finally, make sure the trading platform is easy to use with the charting tools you need to analyze and forecast cryptocurrency price movements. This is really important – an intuitive platform can really enhance the trading environment in my experience.

Develop A Strategy

Successful CFD crypto trading requires a well-thought-out strategy, typically entailing technical analysis if you’re short-term trading, though it could also include fundamental analysis.

Determine in advance your entry and exit points, stop-loss orders, and take-profit levels. Backtest your strategy where possible, making use of a demo account if needed, and remain adaptable to changing market conditions – crypto prices are notoriously volatile.

Two popular strategies for short-term crypto CFD trading include:

Breakout Trading – This strategy involves identifying a channel of resistance and support levels that the asset is consistently oscillating between. A breakout trader would wait until the price breaks through either level and then open a position for the breakout to be consolidated and become a new trend.

Contrarian Trading – This strategy is similar to swing trading, entailing betting against a consolidated trend as you are anticipating its reversal. This can be indicated in several ways, for example, a declining trading volume.

Place A Trade

You should be able to execute a cryptocurrency CFD trade directly in the broker’s platform or mobile trading app in a few clicks, inputting long/short, position size and any risk management parameters.

Importantly, begin day trading crypto CFDs with an amount of capital you can afford to lose. Start small to test your strategy under real market conditions.

Always stay informed about market news and events that could affect crypto prices, and be prepared to adjust your strategy as needed.

A Restricted Asset Class

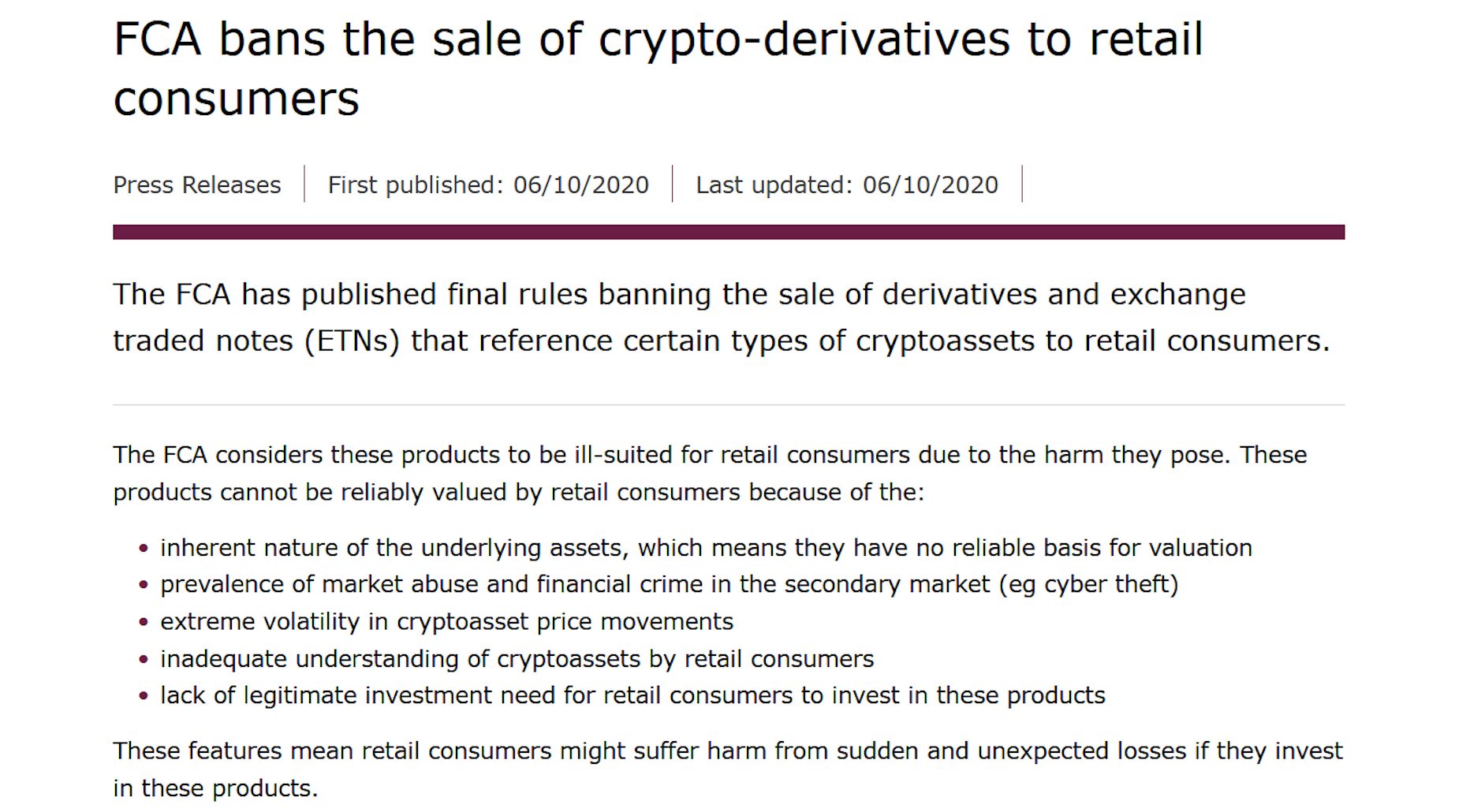

Their high-risk nature means that trading crypto CFDs is closely regulated in many countries and even outlawed in others.

For example, in January 2021, the Financial Conduct Authority (FCA) in the UK banned retail traders from speculating on cryptocurrencies through derivatives like CFDs. Retail clients in the UK can only trade crypto CFDs with offshore, weakly regulated brokers with limited legal protections.

That said, the FCA has left the door open for professional traders to continue dealing in crypto derivatives.

The high-risk nature of CFDs means many territories have prohibited them regardless of which underlying asset they are linked to. The Securities and Exchange Commission (SEC), for instance, has prohibited any US citizens from dealing in these contracts.

Certain regions like the European Union and Australia have strict rules on the trading of CFDs, including crypto CFDs, while some like Hong Kong prevent their citizens from trading them unless they use an overseas broker.

Bottom Line

Since the creation of Bitcoin in 2009, hundreds of other cryptocurrencies have been created and now form a massive part of the day trading landscape. CFDs are extremely popular ways to capitalize on these new-age assets, although the wide-scale availability of leverage adds extra danger to these trades.

Investors who decide to deal in these financial instruments should be fully aware of these risks, and must have a detailed understanding of cryptocurrency markets before taking the plunge.

To get started, see our ranking of the best brokers with crypto CFDs. Alternatively, trading cryptocurrency-backed CFDs via a demo account is an excellent first step for newer traders.

FAQ

How Does CFD Crypto Trading Work?

Two parties will enter a contract that states that the difference between the opening and closing values of the digital asset will be paid by either the broker or trader (depending on the type taken out and the direction of price movement).

Importantly, CFDs are derivatives, so you do not take ownership of the underlying digital asset, you simply make or lose money based on the change in its value.

Do I Need A Digital Wallet For CFD Crypto Trading?

No, you do not need a digital wallet. Digital wallets are used when you own digital currencies, which is not the case for CFD crypto trading, and is part of their appeal to short-term speculators.

What Cryptocurrencies Can I Trade CFDs With?

It is primarily the cryptos with the biggest market capitalization that brokers will offer CFDs for. These include Bitcoin, Ripple, Ethereum and Litecoin.

Having said that, we’re seeing brokers expand their suite of cryptocurrency CFDs, with Eightcap standing out for its around 100 crypto derivatives.

How Much Money Do I Need To Trade Crypto CFDs?

CFD crypto trading is much akin to betting in that you can put as much or as little money as you wish (to a point) on the trade.

The use of leverage can also increase market exposure by allowing you to front only a portion of a trade’s stake, for example, less than $100.

Importantly, given the derivative nature of CFDs, you do not need to be able to purchase one whole Bitcoin, for example, to begin trading.

What Time Does Crypto CFD Trading Cease?

As cryptocurrencies are not traded on one specific regulated exchange, they are open for CFD trading 24/7, all year round.

That said, there are times of higher and lower market activity that will often follow the peak trading hours of popular physical exchanges, which can affect profits through slippage and volatility.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com