Capex Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Dealing Room 2019 - Forex Awards

Pros

- The broker is well regulated in 4 jurisdictions by the CySEC, ADGM, FSA and FSCA, and has maintained a good track record since 2016

- There’s a good selection of educational content and extra features, including Trading Central analysis, ‘Hot Stocks’, and news sentiment

- Capex's shares offering is strong, with over 2000+ instruments available as fractional or whole shares with zero commissions

Cons

- The broker's Trading Central features are available only to Signature account holders, which recommends a $25,000 deposit

- The broker’s steep $50 monthly inactivity charge kicks in after only 60 days of no trading activity

- Capex does not offer any social/copy trading solutions for budding strategy followers or providers seeking other trading opportunities

Capex Review

Capex is a global broker with over 2,100 trading instruments across forex, commodities, indices, cryptocurrencies, ETFs, bonds, blends and shares. This review covers the account types offered, spreads, leverage, platforms and more. Read on to see whether Capex is the right broker for you.

Capex Company Details

Capex (formerly CFD Global), is a Cypriot based global company established in 2016. The brokerage is operated by Key Way Investments Limited and has been an official trading partner of the Juventus Football team since 2016.

Capex is regulated in a number of jurisdictions by the CySEC, FSCA,FSA and ADGM and is registered with national authorities across the world.

Note the broker does not accept traders from the US, Canada and Japan.

Trading Platforms

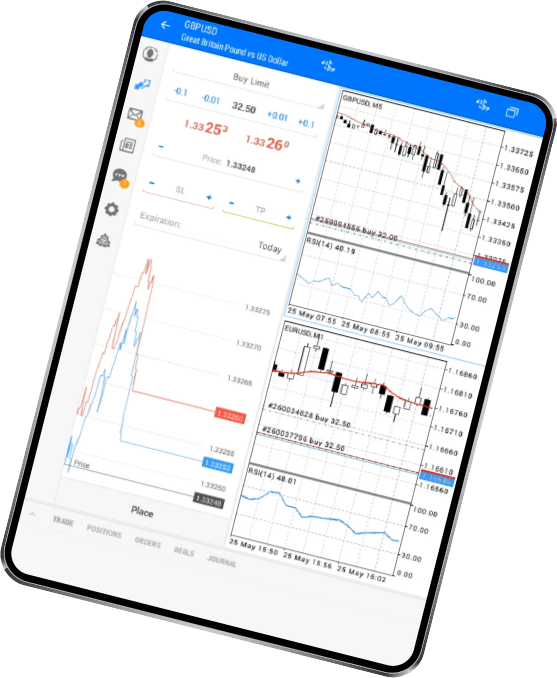

Capex offers two trading platforms, WebTrader and MetaTrader 5 (MT5).

MetaTrader 5

Members can trade with the industry-favourite MT5 platform. The online system is a world-renowned and trusted option among traders. The platform dashboard provides an intuitive interface that is fully customisable with advanced analytics.

Users benefit from:

- 30 built-in key performance indicators

- Run up to 10 charts simultaneously

- Easy-to-access control panels

- 2,000 custom indicators

- Instant execution

- 9 timeframes

- Watch lists

WebTrader

Capex also offers a proprietary WebTrader platform designed for more advanced traders. The platform is fully customisable with 6 chart types, 90 popular indicators, advanced analysis tools and Trading Central, which delivers analysis and recommendations from financial experts. The platform is easily accessible on any device and does not require any downloads.

Capex Assets

Clients can trade across a wide range of 2,100+ instruments:

- Forex – 55 major, minor and exotic currency pairs, including GBPUSD and USDJPY

- Cryptocurrencies – Trade with 5 cryptocurrencies, such as Bitcoin, Ethereum and Ripple

- Shares – A choice of over 2,000 companies, including Netflix, Google and Apple

- Bonds – 4 bond CFDs across corporate, municipal and government bonds

- Commodities – 18 commodities across gold, oil, coffee and gas

- Indices – 26 major indices, such as S&P 500 and JAPAN225

- Blends – Over 15 CFDs, including e-commerce and cannabis

- ETFs – Over 30 ETF instruments, such as SQQQ and USO

Spreads & Prices

Most spreads at Capex are floating, with only a handful of fixed spreads on selected forex pairs, including GBPUSD and EURUSD. Spreads come as low 0.01 pips. Typical spreads on leading pairs GBPUSD and EURUSD are 1.8. Typical spreads on FTSE100 are 1.2 and 0.65 on S&P 500.

Islamic accounts are swap-free. Otherwise, Capex charges an overnight fee. A formula for how the swap fee is calculated can be found on the MT5 platform.

Capex makes its money through fixed and variable spreads. Thus, the broker does not charge any commission.

Leverage Requirements

For retail clients, leverage starts at 1:2, with maximum leverage capped at 1:30 based on ESMA regulation. However, professional clients can trade with leverage up to 1:300.

Under the website’s Trading Conditions page, you can view relevant information for each instrument. Here, you can find initial and maintenance margins, leverage, overnight rollover percentage, and trader trends.

Mobile Trading

Capex does have a proprietary mobile app for both iOS and Android devices. The app provides secure access to your trading account with all the tools you need to trade on-the-go. You can open and close trades, deposit or withdraw among other features. Over 200 users have also submitted positive reviews, citing that it is easy to navigate. The Capex mobile app is available to download on the App Store and Google Play.

Both MT5 and WebTrader platforms are also available as mobile apps on iOS and Android devices. Each mobile version has the same functionality and access to powerful instruments as the desktop terminals, with some limitations in charting and viewing options. However, customer reviews and rankings of the mobile solution are excellent.

Payments

Capex does not charge any deposit fees and the minimum deposit requirement is $100. Accounts can be opened in EUR, CZK, DKK, EUR, GBP, HUF, PLN, SEK and ZAR.

Deposit methods available include:

- Credit/debit card – Visa and Mastercard (Instant)

- E-wallets – Skrill, Neteller and Maestro (3 – 5 days)

- Bank wire – (Instant)

Withdrawals are only released via the same method in which the payment was originally submitted. All withdrawal requests are processed within one business day.

Demo Account

Capex provides a free demo account. This demo account is beneficial for traders of all levels who want to access the platform’s full capabilities while practicing trading plans without any monetary risk.

Capex Bonuses

Capex does not offer bonuses under CySEC and FSRA regulation. However, there are some bonus offers available under FSCA regulation. For example, traders can get up to a $5000 first time deposit bonus, a refer a friend bonus and rebates on the spread. Find the full details on Capex’s website. Users can also enter any promotional codes during the signup process.

Regulation & Licensing

Capex is regulated by trusted regulators, CySEC (license no. 292/16), FSCA (license no. 37166) and ADGM (license no. 190005). The company is also registered with national authorities all over the world. The comprehensive list of regulation and authorisation is indicative of how robust Capex’s operations are. Thus, clients should feel assured that the broker is not operating a scam.

Capex also offers all clients negative balance protection, which means users can’t lose more than the funds invested.

Additional Features

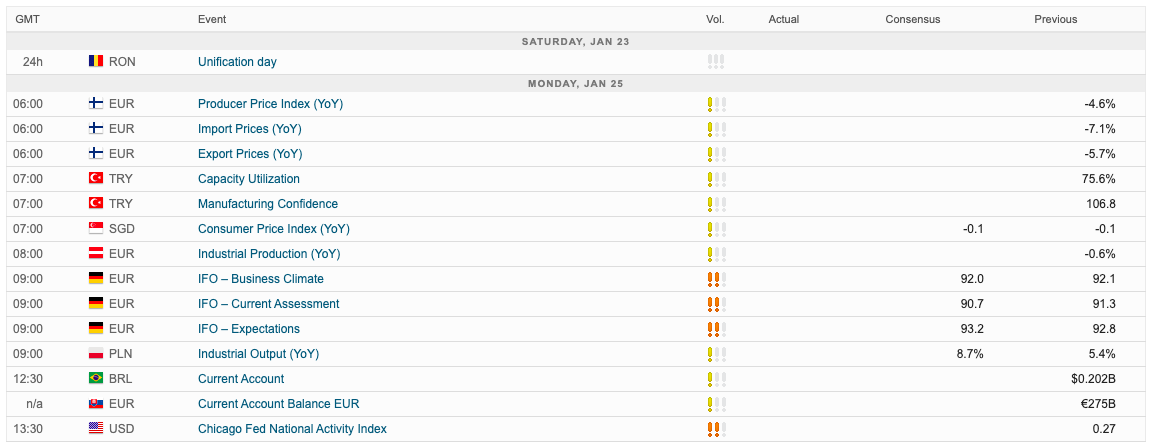

Capex provides a training academy suitable for beginners. The programme includes a vast library of educational training videos, which are mainly focussed on forex trading. There is also a comprehensive financial dictionary available on the website.

- Market analysis – Articles that detail financial events are published on the website daily. These market forecasts and calculations can inform trading decisions and help traders assess risk management strategies.

- Event calendar – The website also provides an economic calendar and a list of bank holidays.

- Webinars – Webinars are available every now and again, which are hosted by Capex’s Chief Market Analyst and offer strategy examples.

- Market news – Capex also publishes daily market news on events from around the world.

Trading Accounts

To open an account with Capex, you need to register in the top right corner of the broker’ website. You must also provide documentation and complete an ‘Appropriateness Test’ that evaluates your trading knowledge to determine your access to CFDs. Once a member, you can sign in to your account in the same area.

Capex offers three categories of account types, with varying value and features:

- Essential – A $1,000 deposit is recommended to open this account. Account holders get access to both platforms, a demo account, limited access to a video library, market reviews & financial research, daily analyst ratings and a dedicated account representative 2 days per week.

- Original – A $5,000 deposit is recommended to open this account. Account holders get the same features as the Essential package but with added open access to research and special trading conditions.

- Signature – This account is designed for advanced traders or corporate clients. A $25,000 deposit is recommended to open this account. Additional features include full access to a video library, a dedicated account representative on weekdays with one-to-one meetings, and access to Trading Central.

As mentioned earlier, all account types require a minimum deposit of $100.

Trading Hours

Each market is subject to specific trading hours. Opening hours on forex, indices and commodities markets are open 24/5 from Monday to Friday. Specific trading hours for each market can also be viewed on the Capex website under Trading Conditions or on the MT5 platform.

Customer Support

Capex Customer service can be contacted with questions via the Help option on the website. Alternatively, you can contact support on the telephone hotline at +27 100 065 481 or email at support@za.capex.com.

The company’s headquarters are based in South Africa – Suite 10, 21 Lighthouse Rd 201 Beacon Rock, Umhlanga Rocks, Kwa-Zulu Natal, 4320

Security

Capex is a transparent and legitimate broker. In accordance with FSCA, all client funds are held in segregated bank accounts with reputable banking institutions. As the broker is regulated in multiple jurisdictions, Capex is subject to strict regulatory stipulations, ensuring a secure trading environment. Furthermore, Capex only allows for internationally-recognised deposit and withdrawal methods.

Capex Verdict

Capex offers a promising service while being a secure and regulated broker. The company offers a wide range of instruments with competitive spreads and low costs. The tiered account structure will also meet individual needs. Overall, we’re comfortable recommending Capex to traders of all levels.

Best Alternatives to Capex

Compare Capex with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Capex Comparison Table

| Capex | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 3.9 | 4.3 | 3.6 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, bonds, ETFs, blends | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | CySEC, FSCA, ADGM, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | $5,000 deposit bonus | – | 100% Anniversary Bonus |

| Platforms | MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:30 (Retail), 1:300 (Pro) | 1:50 | 1:200 |

| Payment Methods | 7 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Capex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Capex | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | No | Yes |

Capex vs Other Brokers

Compare Capex with any other broker by selecting the other broker below.

Customer Reviews

4.7 / 5This average customer rating is based on 21 Capex customer reviews submitted by our visitors.

If you have traded with Capex we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Capex

FAQ

Is Capex regulated?

Yes. Capex is licensed and regulated by the CySEC under license number 292/16, FSCA under license no. 37166 and ADGM, under license no. 190005.

Does Capex offer a demo account?

Capex does not offer a free demo account. However, a demo account is provided with all account types once you are a registered Capex member.

How much capital do I need to trade with Capex?

A minimum deposit of $100 is required on all account types. The broker offers multiple account tiers to suit beginners up to experts.

Is Capex a good broker?

Capex is a good all-round broker, offering competitive spreads with no commissions. It also offers varying account options to suit different levels of skill. In addition, Capex offers a trusted trading platform, MT5.

Is Capex a trustworthy broker?

Capex is regulated in multiple jurisdictions by several reputable bodies. Furthermore, client funds are secured through segregated bank accounts. Thus, Capex is unlikely a scam and is trustworthy.

I want to talk about the number of 2100 financial instruments, I mean there are not many financial brokers which are able to provide such a number of instruments as Capex broker. That’s why I decided to cooperate with this company because I can trade whatever I want. The trading conditions are also superior to other brokerage firms. I’m not hating other companies, just commenting. xD

Damn, there is a truly immense number of tradable assets, like over 2k and I guess it’s enough to trade various of them and get good profits. As a big number of assets means more proper diversification.

Moreover, I like capex because of the advanced market analysis. Actually… chart analysis is advanced here too, cause Trading central, market overview, market news, everything helps to analyze the market landscape thoroughly and then making good decisions.

I have been trading here for a while and it’s awesome they have such a stable platform which helps traders to attain financial goals.

This is by far the best, most “modern” feeling broker i’ve tried. Their app is superb and i can see why they win so many fintech awards. Everything is modern, slick, and cool, their newsletters and TA are a joy to read.

What im sceptical about are bonuses. Why would a broker like this, doing eveyrting right, need 40% bonuses for new traders? I know its not a scam, they are merged with NAGA, so why do they even need it. Feels like too much of a good thing.

I finally understood why Capex has the min depo of $1000 for the basic Essential account. The thing is that with the 1:10 leverage it’s hard to trade stocks with smaller sum. You can, but it’s simply not safe.

With capex I can construct my shears and etfs portfolio safely. Btw I recommend to turn your attention to qualcomm stocks.

Not the cheapest of brokers I have used, but they do have many interesting tools and features to take advantage of. I do enjoy using the platform a lot.

You know that the broker has over two thousand trading instruments right? I do not even know what I do with all of those, but yeah… I actually have that kind of access. And I actually go around trading them because the broker also provides access to trading central and also provides its own trading analysis. It has been quite an interesting and rewarding expeirence.

There is quite a… versatile infrastructure in my opinion.

I came here not as a seasoned trader or smth, just an intermediate one with rather small experience on trading forex and other markets compared to some pros.

And I should say that those tools they integrate into their platform are useful. There is a bunch of them, and ofc I don’t use all. Sometimes when I trade highly volatile markets like crypto, I use news sentiment function to understand how they affect prie flucutations.

Also, they have some edu materials for complete rookies, but I ain’t use them. I suppose that’s all…

This seems to be quite good on the one hand, but the fact it’s not a very hyped company in the information field makes it less recognizable.

However, trading conditions here are pretty attractive. For instance, that abundance of various things like trading central, full-fledged academy, market insights and whatever else play into the hands of traders and help them accomplish their goals quicker.

At least, I speak about those who know how to use all those tools =))

Range of markets is also okayish, I like trading cryptos here with favorable pricing. So, pretty much commended.

A very colorful broker… I mean there is a lot of different tools plugins… integrations to their platform. You do not have to use all of them, but using a few of them cannot hurt. They have everything on this platform honestly. They got sweet trading conditions as well. I do not think they are as popular as they should be.

Seems like the cost for the Basic account is not fair very limited functionality. And the next step is already $1000 which is not reachable for the majority of individual traders.

Although it kinda makes sense if you want to be serious about trading. Basic account in this regard is a substitute of demo.

This platform has an excellent support system, I love how attentive they are to their users, which has made their clients have trust in their services. They always swiftly resolve all my issues or complaints and also attend to my questions. I genuinely have a positive experience trading on this platform and am happy to know that they take my happiness very seriously… It’s been very smooth and seamless.