Best Brokers With VND Accounts 2026

VND trading accounts operate in the Vietnamese Dong. This means all deposits, trades and fees are processed and displayed in VND, making it easier for traders from Vietnam to manage their investing accounts.

Below is a list of our top-rated brokers with VND accounts. We also explain how to choose between VND brokers and check whether a trading platform accepts the Vietnamese Dong.

Top 2 Brokers With VND Accounts 2026

After reviewing 139 brokers through hands-on testing, we’ve identified the 2 best brokers for trading with VND accounts:

Why Are These Brokers With VND Accounts The Best?

Here’s why these brokers stand out for trading with VND accounts:

- Exness is the best broker with a VND account in 2026 - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- JustMarkets - JustMarkets is a multi-asset broker with both CySEC-regulated and offshore branches. Offering ultra-low spreads, copy-trading services, 170+ tradeable instruments and MetaTrader support, JustMarkets has a lot to offer both beginner and experienced traders.

Best Trading Platforms With Vietnamese Dong Accounts Comparison

| Broker | Minimum Deposit | Deposit Methods | Trading Instruments | Trading Software |

|---|---|---|---|---|

| Exness | Varies based on the payment system | Bitcoin Payments, JCB Card, Mastercard, Neteller, Perfect Money, Skrill, Sticpay, Visa, WebMoney, Wire Transfer | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| JustMarkets | $1 | Airtm, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, FasaPay, Mastercard, Perfect Money, Sticpay, Visa, Wire Transfer | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures | MT4, MT5 |

How Safe Are These Brokers Offering VND Accounts?

Discover how the top VND brokers protect your funds and ensure secure trading conditions:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Exness | ✘ | ✔ | ✔ | |

| JustMarkets | ✘ | ✔ | ✔ |

Compare Mobile Trading With VND

Check how these brokers with online VND accounts perform on mobile trading platforms:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Exness | iOS & Android | ✘ | ||

| JustMarkets | iOS & Android | ✘ |

Are The Best Brokers For VND Accounts Good For Beginners?

New traders benefit from brokers that support VND demo accounts, offer learning resources, and intuitive platforms:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | 0.01 Lots | ||

| JustMarkets | ✔ | $1 | 0.01 Lots |

Are The Best VND Brokers Good For Experienced Traders?

Seasoned traders should look for advanced tools, account flexibility, and comprehensive VND support:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Exness | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:Unlimited | ✔ | ✘ |

| JustMarkets | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:3000 | ✘ | ✘ |

Compare The Ratings Of The Best Brokers With VND Accounts

See how top VND brokers scored in our in-depth testing across key performance areas:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Exness | |||||||||

| JustMarkets |

Compare Trading Fees For VND Accounts

Funding a VND account is usually affordable, but trading fees can vary - here’s how the top brokers compare:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Exness | ✘ | $0 | |

| JustMarkets | ✘ | $5 |

How Popular Are These VND Account Brokers?

Here's how widely used the top brokers with VND accounts are:

| Broker | Popularity |

|---|---|

| JustMarkets | |

| Exness |

Why Open A VND Trading Account With Exness?

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

Why Open A VND Trading Account With JustMarkets?

"With some of the most affordable pricing in the game and access to the powerful MT4 and MT5 platforms, JustMarkets is a good choice for any investor."

Tobias Robinson, Reviewer

JustMarkets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, ZAR, MYR, IDR, AED, NGN, THB, VND, KWD, CNY |

Pros

- Fast order executions from 0.01 seconds

- Multiple accounts to suit different strategies and experience levels

- Trustworthy and regulated by CySEC

Cons

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

How Did DayTrading.com Find The Top Brokers Offering VND Accounts?

Our team conducted thorough research to identify brokers that support accounts denominated in Vietnamese Dong, utilizing our evolving database of 139 brokers. We evaluated and ranked these brokers based on a comprehensive rating system that incorporates:

- Quantitative Analysis: Assessment of more than 200 data points such as transaction costs, order execution speed, account funding methods and crucially, the availability of trading accounts denominated in the Vietnamese Dong.

- Qualitative Feedback: Practical reviews and testing carried out by our experienced traders who evaluate the platforms for usability, stability, and overall trading experience.

What Is a VND Trading Account?

A VND trading account is a brokerage account where your funds are held and traded in Vietnamese Dong (VND), and you can use this currency to make deposits, withdrawals and trades.

Brokers with VND accounts may also accept local bank transfers through NAPAS (National Payment Corporation of Vietnam) or other local Vietnamese payment methods.

This type of account is ideal for Vietnamese traders and investors who primarily operate in VND, helping to avoid currency conversion fees, speed up transaction times, and simplify trading in markets based on the Vietnamese Dong.

Pros Of Using A VND Trading Account

- No Currency Conversion Fees: Vietnamese traders can maximize their profits by avoiding or reducing exchange fees when depositing and withdrawing in VND.

- Convenient for Vietnamese Traders: Managing your trading funds in the same currency as your daily expenses simplifies financial management and reduces complications from frequent currency conversions.

- Quick and Cost-Effective Transactions: Many brokers we’ve evaluated provide fast deposits and withdrawals through bank transfers, cards, and e-wallets directly to VND accounts.

- Optimal for Trading Vietnamese Assets: Hanoi Stock Exchange stocks and other instruments denominated in Vietnamese dong can be easier and cheaper to trade via VND accounts.

How Can I Check If A Broker Supports VND Accounts?

After reviewing hundreds of brokers, we’ve found that good firms usually publish important information such as account currencies prominently, so it should be fast and easy to check whether a broker supports VND.

Here’s a quick four-step process you can follow:

- Visit the Website: Head over to the broker’s account or platform details page. Most brokers clearly list which base currencies are available.

- Browse the FAQ Section: Many brokers we’ve reviewed include information on supported currencies in their frequently asked questions area.

- Reach Out to Customer Support: Live chat or phone support usually gives you an answer right away. If not, email support generally replies within 24 hours.

- Start the Sign-Up Process: When creating an account, you’ll often see a drop-down menu where all supported fiat currencies are listed — that’s an easy way to check if VND is included.

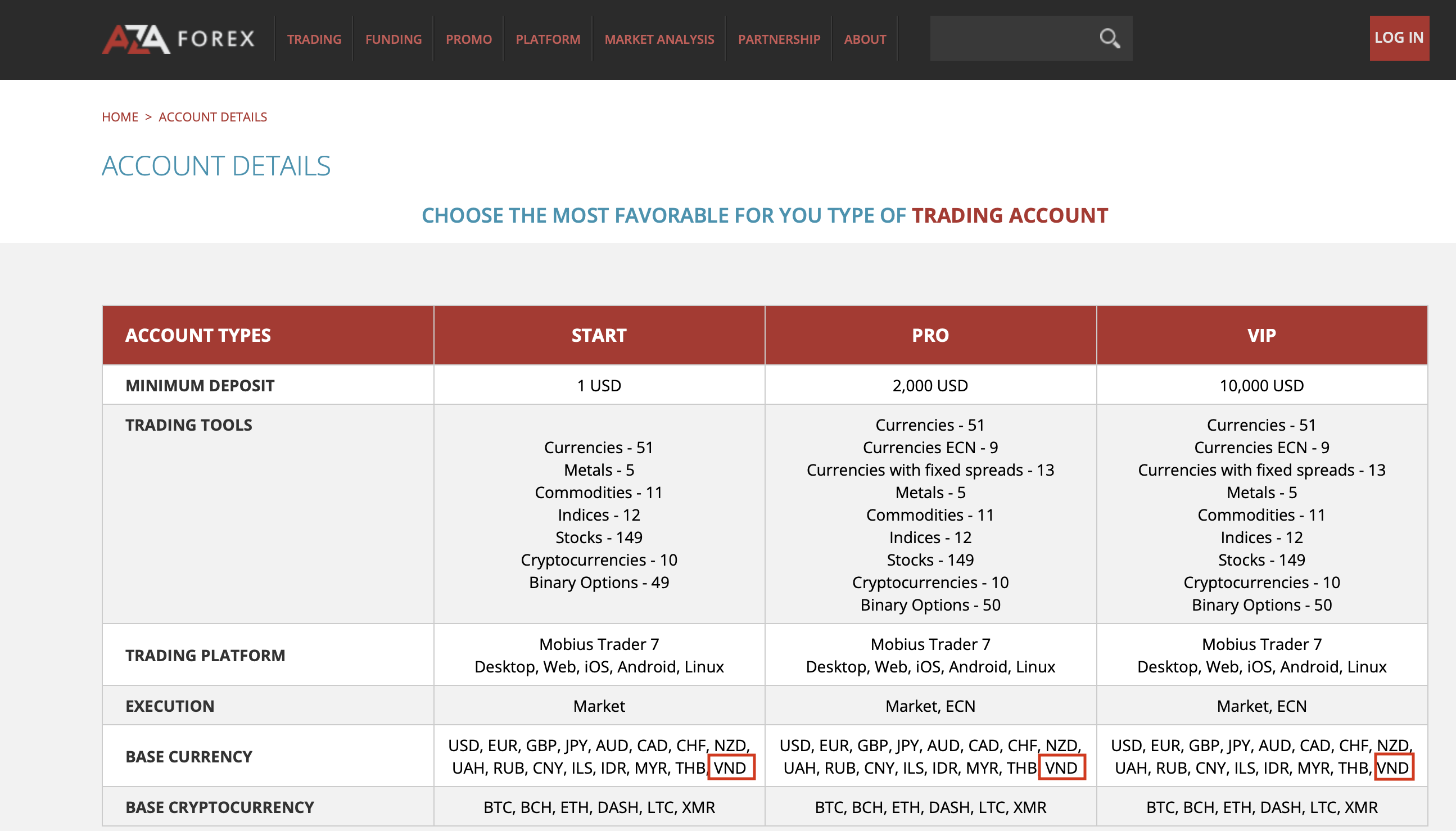

To give you a real example, below is where I confirmed that AZAforex supports VND as a base currency during registration. I simply visited the accounts page on the broker’s website and checked for VND as a base currency.

What To Look For In A VND Broker

Prospective traders should consider five key areas when comparing VND trading accounts:

- Low fees and commissions: The best brokers offer competitive spreads and commissions. This includes sub 1-pip spreads on major forex pairs. Note, exotic currencies like the VND often have wider spreads. Also check for overnight holding fees if trading CFDs.

- Platforms and tools: The best providers offer intuitive platforms with technical and fundamental analysis tools, trading signals, and customizable charts. Also check for additional services like copy trading, which can be a good way for beginners to learn about online trading from experienced traders.

- Account types: Leading brokers with VND accounts will offer different profiles to suit different trading styles and requirements. This might include cent or mini accounts for beginners and VIP profiles for active traders, who benefit from reduced fees in return for regular, large deposits.

- Deposit and withdrawal options: Look for local wire transfer options and e-wallet support with low to zero fees. Also check for any minimum and maximum transfer limits when making a payment in Vietnamese Dong. Online brokers also increasingly accept Bitcoin payments.

- Regulation and security: Signing up with a regulated broker is always advisable. Licensed brokerages usually provide various safety measures, such as negative balance protection and segregated client funds. Most brokers we’ve tested aren’t regulated by the State Bank of Vietnam (SBV), however some VND trading firms do hold a license with the Monetary Authority of Singapore (MAS).

Bottom Line

Brokers with VND accounts allow traders to trade and hold funds in Vietnamese Dong. This can reduce barriers to entry for budding traders from Vietnam, removing currency conversion fees and protecting profit margins. VND trading accounts are also more likely to come with localized customer support.

To get started, head to our list of the best brokers with VND accounts in 2026.

FAQ

How Do I Fund My VND Trading Account?

To fund your VND trading account, head to the broker’s cashier portal. Choose from the list of supported deposit options and follow the on-screen instructions.

You will need to enter the deposit amount and may need to verify the payment through a one-time passcode or alternative security measure.

Can I Withdraw My Trading Profits In VND?

Brokers with VND accounts allow traders to withdraw profits in Vietnamese Dong. Simply select Vietnamese Dong as the base currency when you register for an account and request a withdrawal using one of the broker’s supported payment methods.

Are VND Trading Accounts Suitable For Everyone?

VND trading accounts are best suited to Vietnamese clients or active forex traders. Other investors may find it easier to manage their trading activity in another currency, such as the USD or EUR.