Brokers With UAH Accounts

UAH trading accounts offer the Ukrainian hryvnia as the base currency. For Ukrainian traders, they reduce or eliminate currency conversion fees and facilitate convenient account management.

Explore our selection of the best brokers with UAH accounts, tested thoroughly by our analysts.

Best Brokers With UAH Accounts

These are the top 1 trading platforms that offer UAH accounts according to our tests:

Here is a short overview of each broker's pros and cons

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

Brokers With UAH Accounts Comparison

| Broker | UAH Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

How Did We Choose The Best Brokers?

To find the best trading platforms with UAH accounts we:

- Searched our database of 140 online brokers and trading platforms

- Narrowed it down to all those that offer accounts based in the Ukrainian hryvnia

- Ranked them by their rating, drawing on 100+ data points and first-hand tests

What Is A UAH Account?

A UAH account is a trading account where the base currency is set to Ukrainian hryvnia.

This means that all transactions, including trades and deposits/withdrawals, are carried out in UAH.

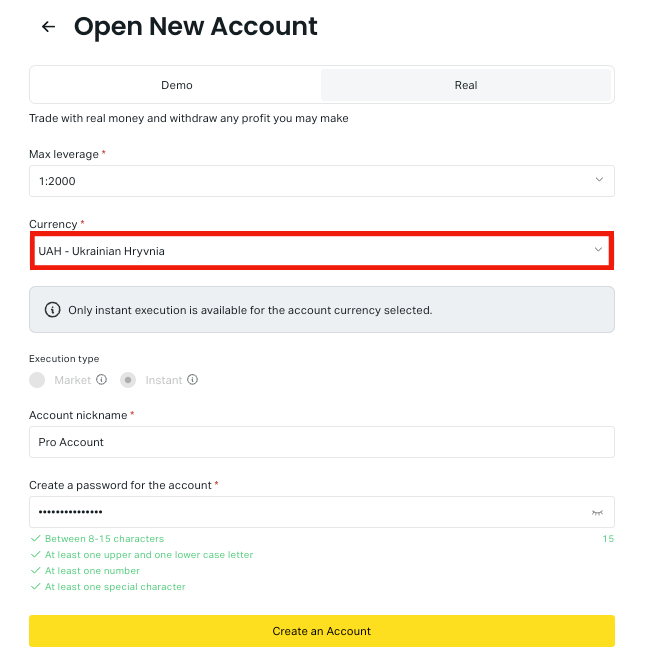

As an example, I opened a UAH account with Exness below:

Do I Need A UAH Account?

A UAH account might work for you if:

- You live in Ukraine and earn money in UAH because holding funds in your local currency is more convenient.

- You want to trade regional markets like eastern and central European stocks or currency pairs like the UAH/USD or UAH/EUR, though we’ve found these forex assets are not commonly supported for trading at retail brokers.

- You are an overseas trader looking to gain exposure to diverse markets by holding funds in another currency.

How Can I Check If A Broker Offers An Account In Ukranian Hryvnia?

You can follow the same simple steps that we took to ensure all our recommended platforms offer a UAH account:

- Head to the account options section on the broker’s website and find the list of available base currencies.

- Check that ‘UAH’ is listed as a supported currency in Ukraine.

- Sign up for an account and select UAH as your base currency.

Pros & Cons Of UAH Trading Accounts

Pros

- Active Ukrainian traders using a UAH account may face fewer or zero currency conversion fees when depositing in their local currency.

- While not many brokers are overseen by the National Bank of Ukraine, we’ve found some of the top brokers with UAH accounts are regulated by trusted ‘green tier’ authorities like the Cyprus Securities and Exchange Commission (CySEC), notably Exness.

- UAH accounts make account and trade management more convenient for Ukrainian day traders who prefer to deal in a familiar currency, especially when executing a high volume of orders.

Cons

- UAH accounts are extremely uncommon compared to other key currencies like the EUR or USD (accounting for less than 1% of all the brokers we’ve evaluated), giving traders limited choice in terms of online brokers

- Our tests have found that local and regional markets such as Eastern European stocks and UAH currency pairs are also very uncommon at most brokers – disappointing for Ukranian traders looking to trade local assets in their home currency.

- You may still be subject to conversion fees on other international assets, such as US stocks. CMC Markets, for example, charges 0.5%.

FAQ

Which Is The Best Broker With A UAH Account?

We’ve thoroughly tested the best trading platforms with UAH accounts. See our list to find the right option for you.

How Much Does It Cost To Open A Trading Account Based In Ukrainian Hryvnia?

Most brokers will allow you to open a trading account for 250 USD (around 9,810 UAH) or less. However, we’ve seen some trading platforms with UAH accounts offering much less.

Exness, for example, allows you to start with just $10, making it an ideal choice for beginners or those on a budget. For more experienced investors, I’ve also been impressed with its superb selection of platforms and research tools.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com