BMFN Review 2024

Pros

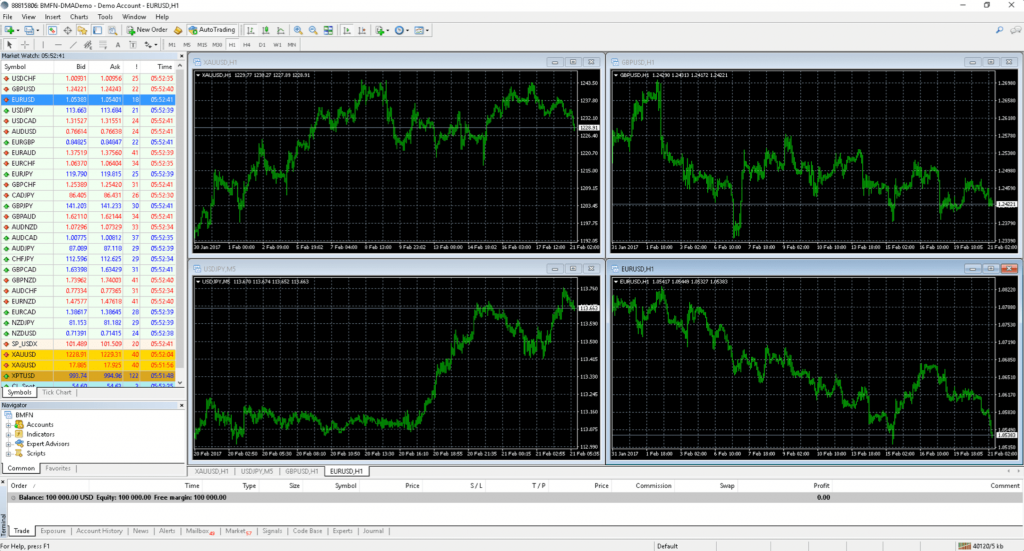

- I’m glad to see the reliable MetaTrader 4 platform available via desktop, web and mobile applications

- I appreciated the range of payment methods available during my tests, including credit/debit card, bank wire, Neteller and Skrill. Minimum deposits are also reasonable at $50

Cons

- The lack of transparency on the broker’s website, plus broken links and contradicting information, is also a concern for me and makes me question the broker’s safety

- I found fees at BMFN were not competitive compared to many brokers I review. Spreads start from 1.4 pips, which is above the industry average for EUR/USD

- BMFN is regulated offshore by the Vanuatu Financial Services Commission (VFSC) - a weak regulatory body with few safeguarding measures in place to protect clients

BMFN Review

BMFN Limited is a forex and CFD broker offering access to global markets, delivered locally, through some of the best trading platforms around. Whether you want to trade in the EMEA or Asia-Pacific regions of the world, BMFN could be the one for you. This review will give you the low-down on the broker’s services, the assets offered, leverage rates, commission charges, payment options and more.

BMFN Headlines

BMFN, standing for Boston Merchant Financial Network and not to be confused with BMFN Banking And Finance Consultant and Corporate Services Provider, was founded in 1988 in Sofia, Bulgaria. Today, BMFN Commercial Brokers LLC have their headquarters in the Republic of Vanuatu. The broker also has a Dubai (UAE) office and further offices in Sydney (Australia), Oakland (New Zealand) and Shanghai (China).

In Australia, the company is known as BMFN Pty Ltd (PLtd), although trade through the broker is not allowed in Australia, the US, Canada, Belgium, Turkey and Japan. Over 100,000 traders use BMFN and they have affiliations with over 16,000 businesses.

Trading Platform

BMFN only offers the MetaTrader 4 (MT4) platform for clients, available on desktop, web and mobile.

BMFN’s online web trading app simply requires users to login to the ‘my account’ section and begin trading. The app features an easy-to-understand interface suitable for any beginners. Opening and closing trades are simple and there is even an economic calendar provided.

For many, it may be no question whether or not to download BMFN MetaTrader 4. The download is available on both desktop (Windows and Mac OS) and mobile (iOS and Android). The platform is known for having a user-friendly interface, lots of technical analysis options and intuitive research tools. Opening and closing trades is very easy with MetaTrader 4, there are three execution modes: Instant execution, execution on request and execution by market.

Assets

BMFN facilitates access to a variety of assets, including 22 forex currency pairs and over 90 CFDs. The broker also offers commodities like oil, silver and gold, for that gold-plated experience. Finally, shares and ETFs from a range of stock exchanges can be traded.

Spreads & Commission

BMFN does not charge a commission, instead, they take a fee from the spread. The broker operates a floating spread system, targeting an average of 1.4 pips. Some testing revealed the spread for EUR/USD to range from 1.5 to 1.7 pips in the New York morning session. This is one of the most liquid times of the day and the offer is slightly worse than the average of some of their competitors.

Leverage

The leverage rate varies between different assets. The maximum leverage available is 1:400 on forex pairs, although the default is set at 1:200 and you must contact customer support to raise this. A leverage rate of 1:400 means that, if you put down £10, you can trade with £4,000, increasing potential winnings but also potential losses. Commodities and CFDs can be traded with a leverage of 1:33.

Mobile Apps

BMFN offers two fully functional mobile apps. There is a mobile version of UniTrader available on Android. The app features over 90 financial instruments, full control orders and detailed trading history. Technical analysis is made easy with eight different graphics that you can scroll through or zoom into. The UniTrader app lets you use open either a real trading account or a demo account.

BMFNs other mobile option is the MetaTrader 4 app. This is available on both iOS and Android. Again, this app is fully functional and provides access to all the financial instruments available. There are also over 30 technical indicators available to enhance your on-the-go analysis.

Payment Methods

The minimum deposit is $50, and the minimum withdrawal amount is $50. There are no charges for deposits and withdrawals, though all withdrawals are in USD so currency conversions could cost. Withdrawals/deposits are processed within 24 hours of receiving the request, although bank wire transfers can take 3-5 working days, depending on the bank. All withdrawals are processed to the account that funded the trading account.

Deposits and withdrawals can be made via several methods:

- Credit/debit card

- GLOBEPA

- Bank wire

- Neteller

- CASHU

- Skrill

Demo Account

BMFN does offer a demo account, where you can practise your trading skills and get used to the platform. The demo account is available on both the MetaTrader 4 platform and UniTrader, as well as the web trading interface. The demo account lets you trial the different markets and refine strategies with unlimited funds in a simulated, live environment.

Promotions

BMFN regularly runs bonuses and promotions for new and existing customers. These can include a 20% deposit bonus for deposits exceeding USD 500 and refer a friend promotions. Generally, these bonuses only apply to forex trading.

Head to the BMFN website to see what bonuses are currently available.

Regulation

BMFN is regulated offshore by the Vanuatu Financial Services Commission. The VFSC is not a particularly reputable financial authority, so clients won’t receive the same fund security measures as they would with a tier-one regulated broker. Crucially, traders will not have access to any compensation schemes if the broker goes insolvent, nor any formal dispute resolution schemes if there is a legal issue.

Additional Features

BMFN features a dedicated education centre with a variety of resources aimed at developing your trading skills. There is a beginner’s course fit for any newcomers, as well as a course on trading tools and strategies. The education centre also features dedicated MetaTrader tutorials so that you can learn about the platform and how to use it. The education centre provides access to a standard forex eBook and an advanced eBook for more experienced traders.

Account Types

BMFN has four different account types:

- MT4 CFD account with variable spread (MT4 CFD)

- MT4 DMA account with variable spread (MT DMA).

- MT4 account with fixed spread (MT4 FX)

- UniTrader account with variable spread

The UniTrader and MT4 CFD accounts offer access to all forex currency pairs and commodities, as well as CFDs. The MT4 FX and MT DMA accounts offer access to forex currency pairs and commodities but do not facilitate access to CFDs.

Trading Hours

Trading on BMFN begins on Sunday at 22:00 GMT and ends on Friday at 21:30 GMT for all asset types.

Customer Service

BMFN can be contacted via telephone, email or post using the details below.

- Phone: +359 2 401 26 33

- Email: operations_vt@bmfn.com

- Address: 84-86 “Aleksander Stamboliisky” Blvd., 3rd floor, office 9, Sofia, Bulgaria

The website also features a section where you can leave a message accompanied by your phone number and email and await a response.

Safety & Security

BMFN states that they used the latest security and encryption techniques, ensuring the security of your account information. Moreover, all payment information is encrypted via SSL certificates and servers are protected by firewalls. Regulation with the FCA and ASIC will also mean BMFN must segregate their company funds from those of their clients.

BMFN Verdict

BMFN offers access to over 90 assets and financial instruments on the MetaTrader 4 platform. Start trading forex and other assets on their demo platform today and, when you are ready to open a real account, just make sure to check restrictions in your country before opening an account.

FAQs

Where Is BMFN Regulated?

BMFN is regulated in Vanuatu by the Financial Services Commission (VFSC). This is an offshore financial authority with relatively lax rules when it comes to fund protection and security.

What Documents Are Required To Open A Trading Account?

To open an account, traders will need to show a colour copy of an unexpired government ID (such as a driver’s license or passport), and proof of address within the last 90 days (such as a utility bill or bank statement).

Does BMFN Offer A Demo Account?

BMFN does offer a demo account, which offers access to all the instruments available at real-time prices. However, all funds are virtual and the environment is simulated so there is no risk of real monetary loss.

How Much Capital Do I Need To Start Trading With BMFN?

BMFN requires a minimum deposit of USD 50. After this, you are free to trade.

Are There Countries Where Trading On BMFN Is Restricted?

There are a few countries where trading is not allowed on BMFN. These include the US, Canada, Japan, Turkey, Australia and Belgium.

Top 3 Alternatives to BMFN

Compare BMFN with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

BMFN Comparison Table

| BMFN | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 1.5 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, ETFs, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $0 | $1 |

| Minimum Trade | 1 Lot | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | VFSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:400 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by BMFN and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| BMFN | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

BMFN vs Other Brokers

Compare BMFN with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of BMFN yet, will you be the first to help fellow traders decide if they should trade with BMFN or not?