Binary Options Trading Strategies

A binary options strategy is a structured plan that helps traders identify potential opportunities and take key decisions like whether to go high or low, how much to stake, and the length of the contract. Trading binaries without a strategy is tantamount to gambling, and may lead to blowing up your account.

This beginner’s guide explains the components of any good binary strategy that’s designed for account growth, though no setup is guaranteed to earn you money. We also walk through example strategies and list approaches to avoid.

Top Binary Options Brokers

These firms provide platforms and tools that cater to a wide range of binary trading strategies:

List Top Binary Trading Brokers

The binary options firms listed may not be authorized where you live – always check your local regulator’s register before opening an account. In some markets, regulators have issued product-intervention bans aimed at providers, meaning firms are prohibited from distributing binary options to retail clients, including in the UK. These measures are directed at platforms, not a blanket ban on traders, so check whether the provider is permitted to serve retail customers in your country.

Do I Really Need A Strategy To Trade Binaries?

Yes, if you want a chance at success. Most retail investors lose money trading binaries because it’s not easy despite the simple ‘all-or-nothing’ style contracts found on many over-the-counter (OTC) trading platforms.

Approaching binary trading without clear parameters is extremely high-risk – you could lose all your money quickly. This is something beginners should take note of in particular: no strategy = no plan = little chance of winning.

What Should A Strategy Include?

There are lots of strategies for trading binaries, but most include several essential components:

| Component | Rule to Define | Example |

|---|---|---|

| Entry trigger | A single, objective ‘go’ signal you can act on | Price closes beyond a level you marked earlier → enter at the next signal only once that close happens |

| High/Low direction | A simple rule that decides whether you’re speculating the price will rise or fall | If the trigger shows strength (higher close vs prior bar) → High; if weakness (lower close) → Low |

| Trade filter | A condition that blocks low-quality setups | Skip trades when the last few candles are small and alternating (chop), even if a trigger appears |

| Market choice | Which instruments you’ll trade and why | Stick to the most liquid forex pair/index you follow daily; avoid thin assets where jumps can flip outcomes fast |

| Expiry length | Match expiry to the timeframe of your alert | Possible opportunities built from 5-minute candles → pick an expiry around 3–6 candles (e.g., 15–30 minutes) |

| Stake size | A fixed risk rule you never break | Risk a small set % each trade (e.g., 1% or some of our team say lower) rather than changing size after wins/losses |

| Risk limits | Your ‘stop trading’ rules for the session | Stop for the day after a preset drawdown or a set number of losses to prevent spirals |

Like other types of online trading products, binary setups are often informed by a couple of key analytical approaches that can help identify potential opportunities:

- Technical: This typically involves using binary charts and indicators to analyze historical price data and identify patterns that may point to future price movements. It’s particularly popular with those day trading binaries and considering short to medium term opportunities.

- Fundamental: A fundamental strategy looks at the overall picture of a security, market and economy. However, many binary trading platforms specialize in short contract lengths, often less than a day and sometimes mere seconds, and fundamentals can have less impact on short-term price movements. For those trading binaries over weeks or months, especially if trading stocks, then your strategy may include looking at ‘fundamentals’.

We’ve noticed in our platform testing that some firms have added a ‘Double Up’ function. This allows you, often with a single click, to double your trade size while the contract is still open.This can be tempting but also presents a risk to any plan – doubling any payouts but also any losses, and going against defined position sizing.

With that in mind, be careful about using this tool, especially in volatile markets like crypto binaries where sharp price action can see a winning trade quickly switch into a losing one.

Examples of Binary Strategies

Below are examples of strategies that could be used to trade binaries. None should be considered investment advice – they are for educational purposes only. There is no guarantee they will work.

News-Based

News trading focuses on how markets reprice when new information hits – earnings, economic releases, policy decisions, and major headlines. For binaries, the goal isn’t predicting the full move, but timing a short volatility window with an expiry that matches how long the reaction typically lasts.

How to use it:

- Scheduled events (planned releases): Use an economic calendar (integrated on many binary platforms or available via third-parties) to identify high-impact times. Decide in advance whether you’ll trade pre-release (riskier) or post-release (wait for direction/volatility to show).

- Post-release reaction (usually cleaner): Let the first burst of volatility print, then trade only if price shows a clear direction (or if a level breaks and holds). Match expiry to the event type – often slightly longer expiries beat ‘instant’ timing.

- Unscheduled headlines (hard mode): Treat surprise news as higher risk. If you trade it at all, reduce frequency and only act when the market response is obvious and liquid (slippage can ruin short-term binary trades).

Example:

You’re watching EUR/USD for a forex binary trade on a 1-minute chart for a scheduled US CPI release. You avoid guessing pre-release.

- Setup: 1 minute after the number hits, the first spike whips both ways, then price breaks above the pre-news range high and holds there for 2–3 candles (no immediate snap-back).

- Trade: Open a Call (higher/buy) binary after the ‘break-and-hold’ is visible, with an expiry of 5–10 minutes (long enough to capture the initial repricing, not so long that it fades into random chop).

- Why it fits binaries: You’re not trying to catch the entire trend, just that the market is more likely to be above your entry after the first repricing wave.

- Limitations: If prices or payouts worsen or the move is a fast mean-reversion ‘fakeout,’ you can be right on direction but wrong by expiry. Keep a max trades per event rule (often 1–2 is plenty).

End-of Day

End-of-day (EOD) binary trading focuses on the final 30–60 minutes of a market’s regular session, when volume often increases and price can ‘lean’ toward a closing level.

The aim is to trade either (1) continuation into the close when a trend is clean, or (2) late-day fade when price looks stretched and starts to stall near a known level.

How to use it:

- Pick the right market window: Use the instrument’s regular session (not just your local time). EOD behavior is most visible in exchange-traded markets (stocks/indices); in 24-hour markets (FX/crypto) define your ‘session end’ by the major trading session you’re targeting.

- Choose one EOD playbook:

- Trend into the close: If price is above a rising baseline (e.g., MA) and pullbacks are shallow, bias Calls (buys) with expiries that land at/near the session close.

- Stretched + stalling: If price is extended (e.g., momentum/RSI-type extreme) and starts printing smaller candles/rejections at a clear level, consider a short fade with a modest expiry (several candles), not instant timing.

- Filter out “messy” closes: If price is whipping both sides or reacting to breaking news, EOD signals are less reliable, often a skip.

Risk notes: EOD can be fast. Limit trades per session, avoid revenge entries, and be careful around scheduled events (earnings, rate decisions) where prices and spikes can distort binaries.

Example (trend into the close):

You’re watching an index feed used for binaries. On a 5-minute chart in the final hour, price stays above a rising 20-period moving average and each dip is quickly bought.

- Setup: last hour of the regular session, trend clean, no major news due.

- Entry: after a small pullback holds above the MA and the next candle closes bullish.

- Trade: Call (higher/buy) with expiry set near the session close (or ~30 minutes if you can’t select ‘close’ precisely).

- Rationale: you’re not predicting a huge move – just that the market is more likely to finish above your entry if the late-day trend holds.

Reversal

A reversal setup aims to catch the moment a move runs out of momentum and price starts pushing the other way. In binaries, reversals can work because you’re targeting a short reaction window, but they’re also prone to false starts, so tight rules and selective trading matter.

How to use it:

- Extremes as a warning (not an entry): Overbought/oversold tools (e.g., RSI/MFI-style signals) can flag stretched conditions. The trade usually improves when you wait for confirmation (a momentum shift, a candle change, or a failed push to a new high/low) rather than entering on the first extreme print.

- Key level rejection: Reversal trades often have better odds near clear support/resistance (recent swing levels, round numbers, prior range edges). Look for price to test the level and fail to continue before taking the opposite direction.

- Expiry selection: Reversals can be sharp but messy. They often suit short-to-medium expiries (several candles), not ultra-short near-instant timing because the turn can form in stages.

Avoid when:

- The market is in a strong, clean trend with no slowing (extremes can stay extreme).

- Price is chopping with no clear levels (reversal signals become coin flips).

Some traders open an opposite contract to reduce exposure, but because payouts are typically below 100%, hedging with binary options often locks in a small expected loss unless timing is unusually precise – generally not a beginner tactic.

Example:

You’re tracking Gold (XAU/USD) on a 5-minute chart. Price has been rising for hours into a clearly marked prior swing high.

- Setup: Price tags the swing high, prints a rejection (long upper wick), and the next candle fails to make a higher high. Momentum indicator (RSI/MFI-style) is stretched, but you wait for the market to actually stall.

- Trade: Open a Put (sell) binary only after price drops back below the level it just failed at (the ‘failed break’), with expiry 10–15 minutes (a few candles) to allow the turn to develop.

- Why it fits binaries: Reversals often give a short ‘relief move’ even if the bigger trend later resumes, binaries only need price to be lower at expiry, not a massive swing.

Limitations: In strong trends, rejections can be pauses, not reversals. If price immediately reclaims the level, you may be in trend continuation territory – this is why the confirmation step matters.

Strangle

A strangle is designed for times you expect a large move but don’t have confidence on direction (e.g., major news releases). With standard high/low binaries, buying Call and Put at the same time usually locks in a loss because one side wins but the payout often doesn’t cover the losing stake. A binary ‘strangle’ only makes sense when the contract type and pricing allow the math to work.

When it can make sense:

- One-touch/barrier-style binaries: You place two one-touch contracts on the same asset and expiry – one barrier above price, one below. The idea is that a strong move hits at least one barrier. One-touch/barrier-style options are less widely available these days from our time using all the major binary platforms on the market.

- Exchange-style binaries (priced contracts): Some venues, particularly in the US, let you buy/sell binaries at market prices. A two-leg setup can work if the combined cost of the legs leaves enough upside when price breaks out.

How to use it:

- Pick a genuine volatility catalyst: scheduled macro data, earnings, central bank decision (something that can realistically push price far enough).

- Set levels that require a ‘real’ breakout: barriers too close get hit randomly; too far rarely get hit. Use wider levels for noisier markets.

- Check the math first: only take the setup if the winning payout (or price move in exchange binaries) can exceed the total cost of both legs. If not, skip it.

Main risk: If price stays in a range and doesn’t reach either level, you can lose both positions. This is why strangles are best treated as occasional event trades, not an everyday strategy.

Example:

You’re expecting a big move in S&P 500 around a central bank decision, but you don’t want to pick direction. Your platform offers one-touch binaries with payouts above 100% (not common everywhere – this matters).

- Setup: price is ~4,500. You choose two barriers that would require a real breakout: 4,560 above and 4,440 below, same expiry (e.g., 2 hours).

- Trade: Buy two one-touch contracts at the same time – one that pays if 4,560 is touched before expiry, and one that pays if 4,440 is touched before expiry. You only take it if the payout on a single win would more than cover the cost of both legs (e.g., combined stake $200; winning payout $330+).

- Why it fits binaries: It turns direction uncertainty into a volatility requirement – you win if price travels far enough in either direction within the time window.

Limitations: If price stays trapped in the middle, you can lose both. Also, if the barriers are set too close, you’re paying for noise; too far, you rarely get a touch. This is why strangles are best as occasional event trades, not daily setups.

Indicator-Based Setups

Below are several indicator-based setups for binary trading, that use charts and the analysis of historical price data to find possible opportunities.

Heiken Ashi

Heikin Ashi candles smooth price action, making trend direction easier to read and helping filter some choppy, false starts. They are an indicator-based framework and for binary options, they tend to work best as a trend filter in cleaner markets with slightly longer expiries, since the smoothing can lag fast moves.

How to use it:

- Trend continuation: Look for a run of same-colour candles with small or no opposite wicks (e.g., bullish candles with little/no lower wick). Trade with that direction and use expiries that span several candles, not ‘next candle’ timing.

- Reversal warning (not an entry on its own): Small bodies with wicks on both sides suggest weakening momentum. Wait for confirmation (e.g., colour flip plus a key level/secondary filter) and prefer longer expiries than continuation setups.

- Chop/range: Mixed colours and small candles usually mean low edge for direction trades. Consider no-trade unless you’re using a boundary/range product with a separate volatility check.

Limitations: Heikin Ashi doesn’t show exact market open/close the same way as standard candles and can visually mask gaps – treat it as a framework, not a precise entry trigger.

Ichimoku Cloud

Another indicator-based approach, the Ichimoku Cloud is a multi-part indicator that bundles trend direction, momentum cues, and rough support/resistance into one overlay. Because it smooths and layers several averages, it’s usually more useful in cleaner, directional markets and with slightly longer expiries than ultra-short ‘next candle’ trades.

Simple ways to use it (indicator-based, not a standalone system):

- Trend filter: Bias Calls when price is above the cloud and the faster line is above the baseline; bias Puts when price is below the cloud and the faster line is below the baseline.

- Momentum confirmation: Treat a bullish/bearish line cross as stronger when it happens in the direction of the cloud (crosses against the cloud are typically lower quality).

- Levels for variants: Use the cloud/lines as reference zones for potential barriers in touch/boundary setups, rather than precise ‘must-hold’ levels.

Caveat: Ichimoku can look busy and its signals can be late in choppy markets. If the cloud is flat and price is weaving through it, it’s often a no-trade environment for direction binaries.

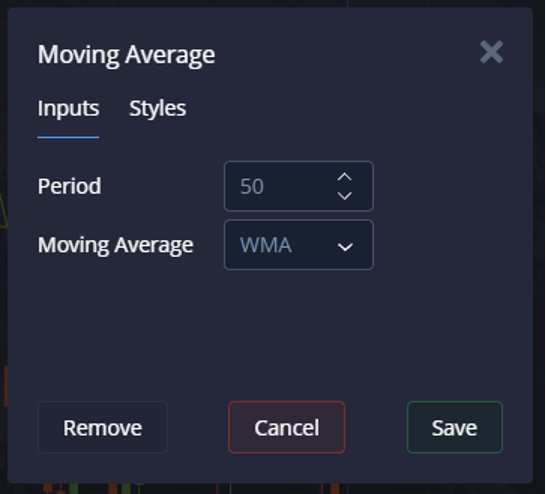

Moving Averages

Moving averages smooth price to highlight direction and reduce short-term noise. In binary options, they’re best used as a trend bias tool and a basic timing filter, not as a standalone ‘always-on’ signal – especially in choppy markets where whipsaws are common.

It can be used in a number of ways, including:

Trend bias (single MA):

- Favor Calls (buy/higher) when price is mostly above a rising MA.

- Favor Puts (sell/lower) when price is mostly below a falling MA.

This works best when the MA has a clear slope and price isn’t cutting through it repeatedly.

Momentum shift (two MAs):

- Use a faster MA and a slower MA. A fast-over-slow crossover can signal momentum turning up; slow-over-fast can signal momentum turning down. For binaries, crossovers tend to suit slightly longer expiries than next candle trades because the signal can arrive late.

Dynamic level check (pullbacks):

- In cleaner trends, the MA can act like a moving reference zone. If price pulls back toward the MA and then resumes in the trend direction, that’s often a higher-quality setup than trading the initial breakout.

Caveats:

- Moving averages lag by design, so signals can be late.

- If price keeps slicing through the MA(s), conditions are usually range/chop – often better to stand aside or use additional filters.

Setups To Avoid

We believe some binary approaches should be avoided, especially for beginners. One key one is the ‘binary options martingale strategy’.

The idea here is to double your trade size each time a loss is incurred until a win is achieved. The approach can be likened to gambling in a casino with the hopes of breaking even. In theory, by keeping doubling the stake when a loss occurs, a win will eventually occur, so long as you can go the distance.

But we would strongly suggest against this. Firstly, you may blow up your account before you ever hit a win, as stakes can double to large amounts very quickly. For example trade 1 at $100 becomes $200 at trade 2, $400 at trade 3, $800 at trade 4, and by just the 5th trade, you could be putting down $1,600. A beginner trading binary contracts that last seconds or minutes could lose a huge amount in just one day.

Secondly, with binary payouts on offshore, OTC platforms typically a percentage of your stake, and normally less than 100%, doubling doesn’t even guarantee that an eventual win recovers previous losses. Using the same example trades and sizes above, and assuming there’s an 80% potential payout, even if you win the 5th trade at $1,600, your profit is $1,280 ($1,600 x 0.8), but you’re still down $220 overall because before you’ve previously staked and lost $1,500 ($100 + $200 + $400 + $800), with $1,500 – $1,280 = $220.

Bottom Line

There is no single best binary options strategy that is guaranteed to make money. Different approaches will work for different types of traders depending on factors like their risk tolerance, capital, contract length, potential payout, and skills in running technical and fundamental analysis.

And importantly, some won’t work at all. Still, having a strategy is essential to avoid overtrading and wild speculation that could see you lose all your capital quickly.

Before deploying any strategy in a real-money environment, we recommend testing and developing your plan in a binary demo account.

FAQ

Is There A Binary Options Strategy That Really Works?

Some binary strategies do work, but not all the time and there’s no guarantee. That’s why managing your risk exposure and wallet is vital.

Many binary traders, members of our team included, have tried various different setups, as there’s no magic bullet approach that works for everyone and all trading conditions.

Which Binary Options Strategies Can Be Used For Day Trading?

There are multiple strategies that have been developed for day trading binaries. These typically use technical analysis, i.e. the analysis of historical price behavior using charts, indicators and drawing tools, to project future short-term price movements.

Our guide breaks down several binary strategies that are suitable for intraday traders.

Do Beginners Need A Strategy To Trade Binary Options?

Yes, newbies need a plan to trade binaries in the same way experienced traders do. Their setup might be more simple and involve less complex technical analysis, but trading without one only increases the risk of incurring large losses quickly.