Ayondo Review 2024

- Daytrading Review TeamAyondo's copy trading support and commission-free pricing model may appeal to newer traders who want to try out diverse asset classes on a range of trading platforms. On the negative side, the client area and interface are subpar compared to alternatives.

Ayondo is a German broker that offers CFD trading on a wide range of assets including forex, stocks, indices, commodities and crypto. This market maker broker has a competitive pricing model with no commissions and spreads below 1 pip on popular assets. Traders benefit from MetaTrader 4, MetaTrader 5 and ActivTrader support as well as copy trading functionality.

Binary Options Trading

Ayondo offers binary options trading on popular financial markets like forex and stocks. The broker also runs a cashback scheme for active traders. But we don't recommend Ayondo for binary options traders - other firms offer more beginner-friendly platforms, higher payouts and a better reputation.

Forex Trading

Trade 15 major, 16 minor and 25 exotic currency pairs in leveraged CFDs with a floating spread and no commission fees. Overall this is a decent selection of forex pairs that competes well with similar brokers, and the sub-one-pip pricing is also better than average.

Stock Trading

Trade leveraged CFDs on 36 global stocks including blue chip companies from the UK, US, Germany, Asia and Latin America. While this includes some interesting companies not often offered by some Western brokers, overall the range on offer is much smaller than most good competitors.

CFD Trading

Trade CFDs on forex, stocks, indices, energies, metals and cryptocurrencies on the MT4, MT5 or ActivTrader platforms. The broker does not restrict hedging and scalping strategies and automated trading is supported on the MetaTrader platforms, which are advantages for experienced traders, though the lack of an ECN account may put these traders off.

Crypto Trading

Trade 11 crypto CFDs including BTC, ETH and XRP in pairs with USD. The commission-free trading and tight floating spreads are an advantage over similar brokers, but the range of cryptocurrencies is mediocre and interested traders may prefer a dedicated crypto firm.

Spread Betting

Customers from the UK and Ireland can register for a spread betting account. However, the selection of underlying assets is narrow compared to other brokers and the terminal is less user-friendly.

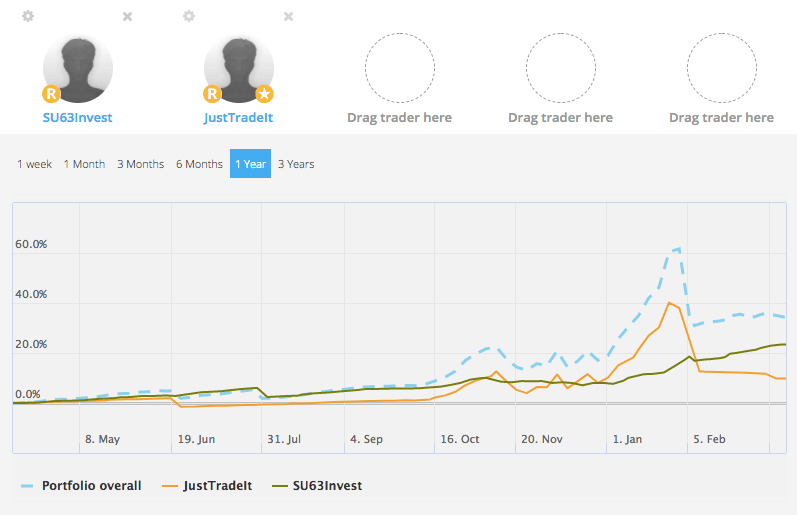

Copy Trading

You can copy Top Traders' positions automatically using the firm's popular social investing system. However it lags behind the usability and choice of better copy trading brokers like eToro.

✓ Pros

- Access a wide range of asset classes including stocks from diverse regions

- Mirror top traders' moves through a straightforward copy trading system

- Competitive spreads with some pricing below one pip and no commissions

- Low capital requirements make Ayondo attractive to beginners

- There is an effective automated risk management system

- Choose from three highly rated trading platforms

✗ Cons

- No longer regulated by the FCA

- Weak educational content vs competitors

- Low-quality website and interface vs alternatives

- There is only capital protection at the account level, not at trader level

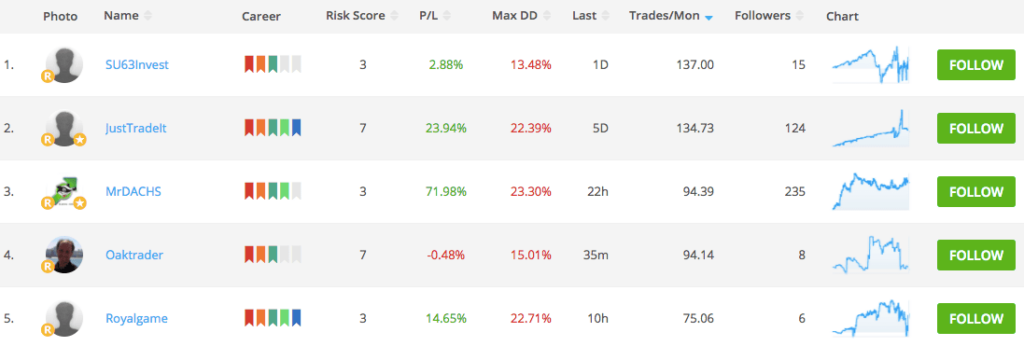

- There is a relatively small number of high performing signal providers to follow

- High fees for copy trading make this a less competitive option for casual traders

- Ayondo doesn't offer a listing of the contributions from individual traders toward your overall portfolio performance

Ayondo facilitates trading in forex, CFDs and binary options. This review will test each element of its offering, including fees, the demo account, and cryptocurrency capabilities. We also take an in-depth look at Ayondo’s proprietary social trading system and app, before concluding with a final verdict.

Company History

The founders, Robert Lempka and Thomas Winkler, launched Ayondo in 2009. Originally the company was based in Germany, but as the number of users grew the broker went global. The firm’s headquarters are now located at their London, UK office.

The company began making moves to go public in 2016. Initial Ayondo Ltd IPO forums in Singapore and the Business Times put price valuation at around $105.6 million. Press releases subsequently show that on the first day’s offering, nearly 81 million invitation shares were subscribed at S$0.26.

In 2017 the company acquired the popular investor education application TradeHero. Then following a failed reverse takeover (RTO) with Starland Holdings, the broker became the first FinTech enterprise to be listed on the Catalist growth board of the Singapore Exchange (SGX). However, in 2021 Ayondo had been delisted.

Since Ayondo launched their own broker solution, even if it is technically a white-labeled version of the Gekko Global Markets platform, the sign-up and login process has been noticeably smoother.

Ayondo Headlines

The owners and operators of the online broker are actually Ayondo Markets Ltd, a financial trading brand (FinTech company) boasting an annual revenue in excess of £15 million, according to reports.

The CEO and the rest of the Ayondo group have a clear mission – to connect investors so they can benefit from the success of ‘Top Traders’. This social element of their trading system will be broken down in detail further below.

Assets & Markets

Customers get an extensive list of 100+ instruments and markets to choose from:

- CFDs

- Precious metals

- Binary options

- Interest bond rates

- Over 30 FX currency pairs

- Major Asian, European, and US indices

- Cryptocurrencies (Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple)

- Shares in major blue-chip companies, including Starbucks and Coca-Cola

Customers from the UK and Ireland can also register for a spread betting account.

Trading Platform

In terms of user experience, the TradeHub live platform is streamlined and easy to pick up. There are generous levels of customization available, helping to speed up execution. Information and lot sizes are also clear, while the interface is clean and sleek. In addition, cash balances, margins, and trading products are clearly visible. User reviews also praise that OCO orders are easily accessible and guaranteed stop-losses are automatically included with positions.

Overall, Ayondo’s platform is ideal for beginners or those who are used to the high standards of the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) systems.

Spreads & Commissions

Ayondo follows a market maker business model. They take their fee from the difference between the buy and sell price. They also charge deposit fees, inactivity fees, and commissions on CFDs, but withdrawals are free.

Customer reviews show that Ayondo provides relatively competitive spreads. In fact, the minimum spread for the EUR/USD pair is 0.8 pips. Another bonus is that you don’t pay a commission to third-party brokers, unlike many social trading networks.

Other Trading Fees

There are several additional costs to be aware of:

- You will pay an overnight rollover fee of 3%

- Long positions will also incur financing charges

- You will pay a follower fee, depending on the remuneration model your Top Trader has selected. This could include a 25% performance fee, plus a 1% management fee

Leverage

Ayondo allows trading on margin. A live account gets you up to 1:200 leverage. This essentially allows you to borrow money from your broker to capitalize on a potential opportunity. However, leveraged trading comes with risks. In fact, you could actually lose more than your initial deposit.

Fortunately, Ayondo allows you to manually adjust your leverage limits to a level you feel comfortable with.

If you are in an ESMA regulated region, such as Europe, the leverage percentage drops to 1:30 for major currency pairs, 1:20 for minor pairs, and 1:10 for commodities.

Mobile App

Ayondo offers a mobile version of the TradeHub platform. You can get the mobile trading app for both iOS and Android devices. Reviews of the iPhone and iPad apps are particularly positive. You get variable portfolio margining and just like the desktop-based platform, you can also place trailing stops while enjoying loss protection.

In addition, your Ayondo Markets mobile login details grant you access to:

- Usage tips

- Sophisticated charts

- Flexible search function

- Thorough manual and help section

Payment Methods

Once you complete registration, you will need to set about funding your account. Deposits and withdrawals can be made via debit, credit card, or wire transfer. You can open an account in EUR, GBP, and USD. You need $100 to open a live account and card deposits are free. The minimum withdrawal is $10. You will also need to verify your identity and address before you can withdraw funds for the first time.

On the whole, payment methods are an area Ayondo could improve in. There are competitors offering numerous other payment methods, including PayPal and digital wallets.

If you become a Top Trader, you also get a daily overview of your revenues and easy-to-read invoices.

Demo Account

If you are new to trading, Ayondo Markets offers a free demo account with $10,000 in virtual funds. Here you can test the broker and platform while getting familiar with the markets.

Your demo login details afford you access to a wide range of features, including viewing the performance of other traders. You can then build a portfolio of up to 5 traders and use a simulator to test their performance against historical data. Once you feel confident you can then upgrade to a live account from within your Ayondo area.

Bonuses & Promotions

Ayondo regularly run a range of welcome bonuses and offers. This can include 25% cashback deals, no deposit bonuses, and refer-a-friend schemes. Head over to the website to see what Ayondo Markets offers are currently available.

Regulation & Licensing

With an increase in the number of fake and fraudulent brokers, it is important to check your platform is regulated. Thankfully, Ayondo Portfolio Management GmbH is regulated by the Federal Financial Supervisory Authority (BaFin), registration number 145765.

Additional Features

The main feature of Ayondo is their social trading system, reviews of which are positive. There are thousands of traders to choose from and some of the best investors have over three years of experience. Finding and following Top Traders is also easy as their performance is graphically displayed on the Ayondo interface. You can actually track their performance against major indices too. You can also choose to follow traders based on specific criteria, such as profit-loss ratios.

Ayondo also facilitates access to educational resources. You can find webinars, training videos, and other manuals. The broker also has a TV spot on an online UK channel. There you can get more information on how to make the most of TradeHub.

In addition, the Research & Advisory team provides news, daily market content, reports, stock reviews, top picks, and more. You can also use their online newsletter to pick up useful tips and find out about new products.

Accounts

Opening a live account with Ayondo is straightforward. The real-time account allows you to trade in CFDs, spread betting, or to generate revenue from those copying your trades. However, you will need to have:

- A scanned color copy of your passport, driving license, or national ID

- A recent utility bill or bank statement proving your address

In addition, you will need to set aside a few minutes to answer some basic questions about your trading experience, among others.

For those that wish to be copied there are different levels to pass through, from Street Trader to Institutional. If you perform well, you will benefit from greater commissions with each increase in level.

For those who wish to copy others, there are three accounts on offer: Social Trading Follower, Social Trading Top Trader, and CFD or Spread Betting.

Trading Hours

Ayondo’s trading hours are fairly industry standard. Trading is available between 22:00 GMT on Sunday and 22:15 GMT on Friday. Head over to their official website for upcoming holiday hours. There you will also be able to find the opening and closing hours for particular products and markets.

Customer Support

Customer reviews are fairly positive in terms of customer support. Traders can contact Ayondo Markets via live chat, email, and telephone. Support is available in:

- English

- German

- Spanish

- Chinese

- Arabic

Employees are knowledgeable and can help you with a long list of technical and account queries.

The support email address is service@ayondo.com. Head over to the official website for the respective telephone hotline number. There you will also find details of their partner broker affiliate program and the addresses of their London, Frankfurt, Singapore, and Zug offices.

Security

With an increase in scams and hacking, it is important to ask – is Ayondo any good in terms of user security? Fortunately, the answer is yes. To ensure personal safety, the brokerage uses:

- Segregated bank accounts to keep customers’ funds separate from the firm’s operating capital

- Negative balance protection that ensures you cannot exceed your account balance

- Advanced encryption technologies to guard against attacks and fraud

- Daily internal reconciliations are undertaken to ensure solvency

- An annual audit is carried out by an independent auditor

Furthermore, this review was particularly impressed with Ayondo’s free insurance policy. Introduced in 2015, this covers up to £1,000,000 in excess of the standard FCSC cover for each client. In fact, this is among the most comprehensive cover in the industry.

Ayondo Verdict

Ayondo’s social trading system is fantastic for several reasons, including low fees, amenable entry levels, and access to Top Traders. Overall, the brokerage sits well among competitors with a minimum deposit of $100 and industry-standard fees and spreads. It also offers a big array of educational resources, which makes it an ideal choice for beginners, and you can even test drive the platform through the demo account first.

FAQs

What Deposit Methods Does Ayondo Accept?

The broker accepts only credit cards, debit cards, and bank wire transfers. E-wallets aren’t currently available.

What Is The Minimum Deposit At Ayondo?

The minimum deposit is $100, but you will need to deposit more if you wish to copy a number of investors.

Is Ayondo Regulated?

Yes, the broker is regulated by the German BaFin, which helps ensure Ayondo follows consumer-protection legislation.

Can I Use Ayondo In The US?

No, Canada and the US are two of the regions where you cannot access the platform.

Do I Need ID To Sign Up To Ayondo?

Yes, you will need a form of identification and proof of address when you sign up for an account.

Top 3 Alternatives to Ayondo

Compare Ayondo with the top 3 similar brokers that accept traders from your location.

-

Grand Capital – Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

Go to Grand Capital -

Videforex – Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

Go to Videforex -

Deriv.com – Deriv.com is a low cost, multi-asset broker with over 2.5 million global clients. With just a $5 minimum deposit, the firm offers CFDs, multipliers and more recently accumulators, alongside proprietary synthetic products which can’t be found elsewhere. Deriv provides both its own in-house charting software and the hugely popular MetaTrader 5.

Go to Deriv.com

Ayondo Comparison Table

| Ayondo | Grand Capital | Videforex | Deriv.com | |

|---|---|---|---|---|

| Rating | 2.3 | 3.9 | 3.4 | 4.4 |

| Markets | CFDs, forex, binary options, interest bond rates, metals, indices, shares, crypto, spread betting | CFDs, Forex, Indices, Shares, Energies, Metals, Cryptocurrencies, Binary Options | Binary Options, CFDs, Forex, Indices, Commodities, Crypto | CFDs, Multipliers, Forex, Stocks, Indices, Commodities |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $10 | $250 | $5 |

| Minimum Trade | – | 0.01 Lots | $0.01 | 0.01 Lots |

| Regulators | BaFin | FinaCom | – | MFSA, LFSA, VFSC, BFSC |

| Bonus | 25% cashback deal | 40% deposit bonus | 20% to 200% Deposit Bonus | – |

| Education | No | No | No | No |

| Platforms | Own | MT4, MT5 | TradingView | Deriv Trader, MT5 |

| Leverage | 1:30 | 1:500 | 1:500 | 1:1000 |

| Payment Methods | 3 | 14 | 8 | 23 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Grand Capital Review |

Videforex Review |

Deriv.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Ayondo and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Ayondo | Grand Capital | Videforex | Deriv.com | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Expiry Times | – | 1 minute – 48 hours | 5 seconds – 1 month | 15 seconds to 365 days |

| Ladder Options | No | No | No | Yes |

| Boundary Options | No | No | No | Yes |

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | Yes | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | No | Yes |

| ETFs | No | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | No | No | No |

| Spreadbetting | Yes | No | No | No |

| Volatility Index | No | Yes | No | Yes |

Ayondo vs Other Brokers

Compare Ayondo with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Ayondo yet, will you be the first to help fellow traders decide if they should trade with Ayondo or not?