Arum Capital Review 2024

Arum Capital Review

Arum Capital is a CySEC-regulated broker offering a diverse portfolio of assets, from forex to Bitcoin. In this review, we’ll explore the account management features including funding methods and platforms. We’ll also weigh up the main perks of trading with Arum Capital, as well as the features that traders might be limited by.

Arum Capital Details

ArumPro Capital Limited (Arum Capital) is based in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker’s liquidity providers are Swissquote Bank and LMAX Exchange, both reputable and regulated European exchanges, providing low spreads and ultra-fast execution.

The broker offers two ECN accounts and over 100 financial instruments, including forex pairs, metals, indices, cryptocurrencies, and energies. Traders also benefit from the trusted MetaTrader 5 trading platform.

MetaTrader 5 Trading Platform

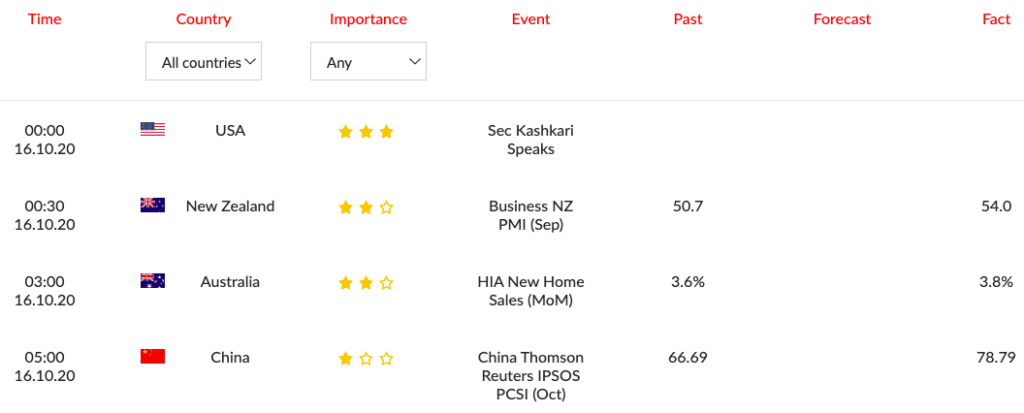

The MT5 trading terminal is available for all clients at Arum Capital, offering fast execution via FIX-protocol and advanced trading functionality. Traders can execute 6 types of pending orders, analyse price movements on 21 time intervals using over 80 indicators and graphical objects. Other advantages include:

- MQL5 unique signals service

- Economic calendar and financial news

- Access to trading robots and other tools via MetaTrader Market

- Direct connection in Equinix LD4 (London) and NY4 (New York) data centres

Windows and MacOS users can download the terminal after registering for an account.

Markets

You can trade on over 100 forex and CFD instruments at Arum Capital:

- 69 currency pairs, including EUR/USD and GBP/EUR

- 7 CFD contracts on precious metals, including gold and silver

- 3 CFD contracts on energies, such as crude oil and natural gas

- 11 CFD contracts on major indices, such as FTSE 100 and S&P 500

- 5 CFD contracts on cryptocurrencies, including Bitcoin and Ethereum

Spreads & Commission

Arum Capital offers tight ECN spreads, averaging around 0.3 pips for EUR/USD and 0.7 pips for GBP/USD. Average spreads for indices such as the FTSE 100 are 1.6 pips and around 3.0 pips for crude oil.

Commission charges do apply on all assets, ranging from $27 to $31.5 per 1 million USD of the traded volume for currency pairs. For CFD contracts, commission rates average around 6.26 units of contract profit currency per 1 trading lot.

Leverage

The maximum leverage available is 1:30 for currency pairs, up to 1:20 for metals and indices, 1:10 for energies, and 1:2 for cryptocurrencies. For margin requirements, a useful trading calculator is provided on the website.

Mobile Trading

The MetaTrader 5 smartphone app allows traders to monitor the markets and manage positions from anywhere with a stable internet connection. The app hosts all the necessary tools for trading, including 30 technical indicators and 24 graphical objects, financial news, and a community chat. You can download the app from the App Store or Google Play.

Payment Methods

Arum Capital offers funding via bank transfer, Qiwi, credit/debit cards, Neteller, and Skrill, in USD only.

Most methods are processed within 1 business day and require a minimum deposit or withdrawal amount of 10 USD. Note that bank transfers take up to 5 days and require a minimum deposit of 500 USD and a minimum withdrawal of 100 USD. Service fees are listed below.

- Visa/MasterCard – 3.5% to deposit, 2.5% to withdraw

- Bank transfer – Free to deposit, $40 to withdraw

- Neteller – 3.5% to deposit, 2.5% to withdraw

- Qiwi Wallet – 6% to deposit, 1% to withdraw

- Skrill – 3.5% to deposit, 1.5% to withdraw

Demo Account

Traders can experience narrow spreads and leverage up to 1:30 in the ECN demo accounts, which are suited to beginners who wish to execute simulated trades at no financial risk. A demo account is quick and easy to open from the website.

Arum Capital Bonuses

Aside from the VIP program, Arum Capital does not currently offer any promotional deals, due to strict regulatory restrictions.

Regulation

ArumPro Capital Limited is a Cyprus Investment Firm (CIF), regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 323/17.

Arum Capital is fully compliant with the European Markets in Financial Instruments Directives (MiFID) and therefore ensures full fund security and risk management. This includes segregated client accounts, as well as participating in the Investment Compensation Fund.

Additional Features

Arum Capital does not offer much in terms of educational resources and unique tools. There is a technical analysis section and video reviews, however both areas have been neglected. There’s also a trading calculator and an economic calendar, though these are generally offered as standard at most brokers.

Account Types

There are two account types to choose from at Arum Capital: ECN Standard and ECN Classic. Apart from the tighter spreads and commissions in the Standard, the accounts are identical.

The minimum deposit for both is $500, which will likely price out most beginners. The minimum order size is 0.01 lots and the maximum position volume is unlimited. The Margin Call and Stop Out levels are 100% and 80% respectively. Hedging is also permitted in both accounts.

Benefits

This review uncovered several benefits of trading with Arum Capital:

- CySEC-regulated

- Narrow ECN spreads

- Execution within 5 milliseconds

Drawbacks

However, traders may be limited by several factors:

- No choice of platforms or web trader

- Islamic account not offered

- $500 minimum deposit

- Shares not offered

Trading Hours

Trading sessions for currency pairs and cryptocurrencies are 22:05 Sunday to 22:00 Friday (UTC). For metals and most indices, trading hours are 23:00 Sunday to 22:00 Friday (UTC). A full list of specific trading sessions is provided on the website.

Customer Support

Customer support is provided in English by calling +357 251 232 91 or by emailing info@arumcapital.eu. There’s also a live chat service that you can access from the top of the website page.

Arum Capital’s head office is located at 2 Gregory Afxentiou Street, 2nd floor, Office 201, 4003, Limassol, Cyprus.

Security

The MetaTrader 5 platform connects to highly secure servers located in the Equinix data centres in London and New York. The platform is also protected with SSL technology and traders have the option to set a one-time password at login.

Arum Capital Verdict

Arum Capital offers tight ECN spreads on forex and CFD instruments, with advanced trading and account management in the MT5 platform. Traders should also have peace of mind signing up with a CySEC-regulated broker. However, with the $500 minimum deposit and lack of additional content, Arum Capital is not the best option for beginners.

Top 3 Alternatives to Arum Capital

Compare Arum Capital with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Arum Capital Comparison Table

| Arum Capital | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $500 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 4 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Arum Capital and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Arum Capital | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Arum Capital vs Other Brokers

Compare Arum Capital with any other broker by selecting the other broker below.

FAQ

How can I make a deposit at Arum Capital?

You can fund your account by logging in to the client portal and following the instructions within your profile.

What can I trade at Arum Capital?

You can trade over 100 forex and CFD instruments, including currencies, cryptos, indices, and commodities.

What accounts are available at Arum Capital?

The broker offers two account types: ECN Standard and ECN Classic. The accounts are characterised by spreads and commissions.

Where is Arum Capital located?

The broker is headquartered at 2 Gregory Afxentiou Street, 2nd floor, Office 201, 4003, Limassol, Cyprus.

How much capital do I need to trade at Arum Capital?

The broker requires a $500 initial deposit for both account types.

Customer Reviews

There are no customer reviews of Arum Capital yet, will you be the first to help fellow traders decide if they should trade with Arum Capital or not?