Amega Review 2026

See the Top 3 Alternatives in your location.

Pros

- The MetaTrader 5 platform is excellent for day trading with low latency, sophisticated order types, and up to 128 indicators and 21 timeframes to aid precise analysis.

- Amega supports a growing selection of payment options, including cryptos and international banking solutions with an accessible $20 minimum deposit.

- The One account keeps things simple for aspiring traders, featuring the full range of forex, stocks, indices and commodities with no hidden fees or swap fees, and $1 cashback per lot.

Cons

- Although the library of educational guides is growing, it falls far behind the likes of eToro which offers quizzes, videos and a social trading network for a complete learning journey.

- As brokers increasingly invest in their own trading software and add third-party solutions like cTrader to meet various trader preferences, Amega trails behind with just MT5.

- Despite offering negative balance protection, Amega still lacks authorization from a trusted regulator, making it a high-risk option with no access to investor protection.

Amega Review

Amega Finance is an offshore broker-dealer. The brand offers trading on stocks, forex and commodities via the MetaTrader 5 (MT5) platform and app. This Amega review will unpack the firm’s online trading products and financial solutions, from deposits and withdrawals to fees, leverage, and customer support.

Company Details & Overview

Amega Finance was founded in 2018. The firm is an STP broker acting as an intermediary between investors and liquidity providers. The company aims to offer online trading without restrictions, meaning full flexibility to invest with the strategies and tools desired.

Amega Global Ltd is a licensed investment company with the Mauritius Financial Services Commission (FSC). The broker’s technology service provider, Findeavour Ltd, is registered in the UK. Amega Markets LLC is incorporated in St Vincent and the Grenadines.

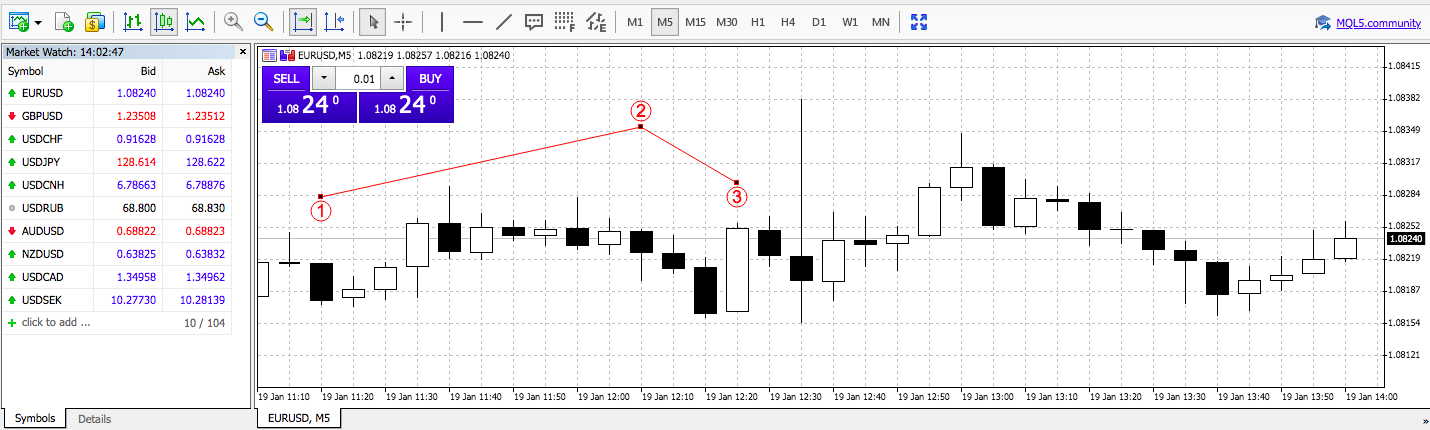

Trading Platform

Clients can trade through MetaTrader 5. MT5 is available for download to desktop and mobile devices, including Android, iOS, Windows, and macOS. Alternatively, it is can be used as a web terminal.

The multi-asset platform offers advanced functions for experienced traders, as well as easy-to-use tools for beginners. Day traders can view up to 100 charts at the same time, with 21 time-frames ranging from one minute to one month. The terminal also comes with automated trading functions, including signals and bots.

Other functionality includes:

- Depth of Market

- Full trading history

- One-click order execution

- Netting and hedging permitted

- 80+ in-built technical indicators and analytical objects

- Two-factor authentication available for additional security

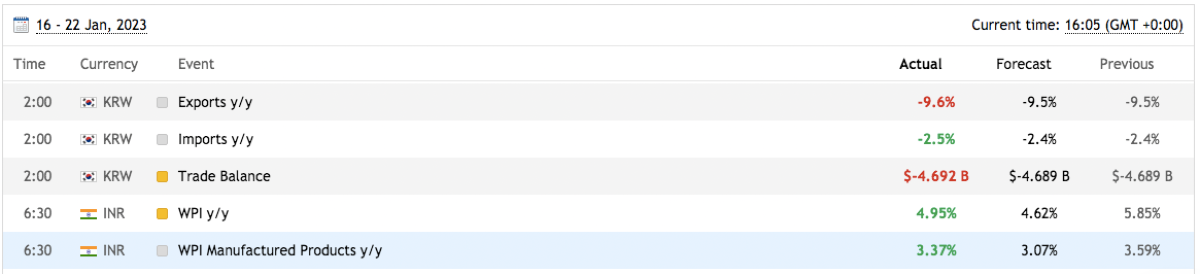

- Integrated economic calendar with upcoming events and company releases

On the downside, Amega does not offer MetaTrader 4 or its own bespoke trading technology, which is a negative vs alternative brokers.

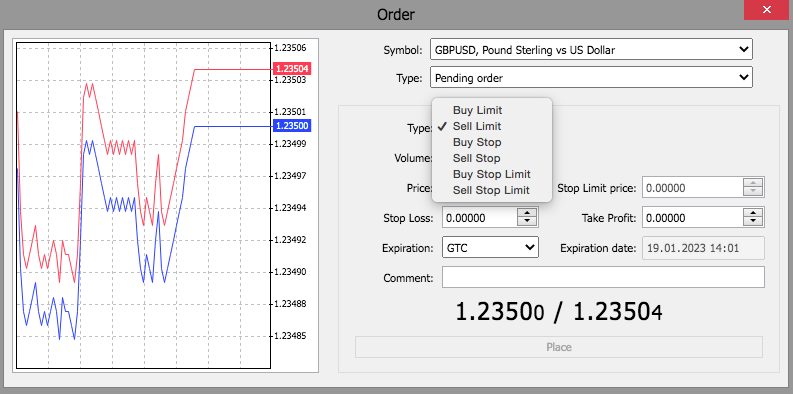

How To Place A Pending Order On MT5

- Open the platform, app or web trader

- Select the ‘Tools’ icon

- Choose ‘New Order’

- Double-click on the instrument symbol you wish to trade from the dropdown list

- Under ‘Order Type’, choose ‘Pending Order’

- Select ‘Buy Limit’, ‘Buy Stop’, ‘Sell Limit’, or ‘Sell Stop Limit’

- Input the order volume

- Insert the price to trigger the pending order

- Enter the expiration date

- Click on ‘Place Order’

Markets & Assets

Amega offers a good range of instruments to trade via contracts for difference (CFDs):

- 9 soft commodities including sugar, soybean, and coffee

- 25+ global company stocks such as Amazon, Netflix, and Tesla

- 10 global indices such as ASX200, S&P500, FTSE100 and DAX30

- 70+ major, minor, and exotic forex pairs including EUR/USD, GBP/CAD, and USD/JPY

- 7 precious metal and fiat currency pairs including Gold vs US Dollar and Silver vs Euro

- 2 energy futures contracts and 3 spot energies including Brent Oil and Natural Gas

Cryptocurrency investments are also available under the unregulated Amega Markets LLC entity.

Amega Fees

Amega Finance is a zero-commission broker, meaning that trading fees are integrated into spreads. The brand offers spreads from 0.8 pips, which is not particularly low vs alternative brokers.

We were offered spreads of 0.8 pips on GBP/USD and 1 pip on EUR/USD. Additionally, we received spreads of 1.5 on the S&P 500 and 2.1 on the FTSE 100.

Other charges to be aware of include a $5 monthly inactivity fee after 30 days of zero account activity.

The broker does not charge any deposit or withdrawal fees, though third-party charges may apply.

Swap fees also apply for clients that do not hold an Islamic trading account.

Leverage

While using Amega, our traders found that substantial leverage up to 1:1000 is available, much higher than regulated firms. This means for every $1 deposited, you can trade with $1000.

Maximum leverage by instrument:

- Shares – 1:20

- Forex – 1:1000

- Indices – 1:20

- Energies – 1:20

- Commodities – 1:10

- Precious Metals – 1:200

Mobile App

MetaTrader 5 is available as a mobile-compatible app. Though currently unavailable for iOS users due to Apple App Store restrictions, the application is a good solution for trading on the go.

Our experts found it easy to use and were pleased to see that it offers all the functions and features found on the desktop terminal. Users can open and close trades, deposit to a live account and manage personal details such as passwords. Another major advantage is the seamless transition between platforms and apps. You can pick up exactly where you left off, whether that be on a computer or a mobile.

So whilst not as modern as some third-party tools, such as TradingView, there is plenty of market information and straightforward trading functions.

Payment Methods

Deposits

There is a $20 minimum deposit requirement to open an account with Amega. This is competitive and ideal for those starting out.

The broker accepts a range of international and local payment methods at no charge.

- SticPay

- PromptPay

- Online Naira

- Perfect Money

- African Mobile Money

- Local Bank Wire Transfers

- African Local Bank Cards/Bank Wire Transfers

- Cryptocurrency (Amega Markets LLC customers only)

On the downside, our experts were disappointed with the lack of international credit/debit card payment options. Traders must also verify their accounts before deposits and withdrawals can be made.

Withdrawals

Withdrawals must be made back to the same method used for deposits. The broker processes all withdrawal requests within a few minutes during business hours. However, our experts were disappointed to see that withdrawal charges apply:

- Online Naira – 1%

- PromptPay – 1.5%

- Perfect Money – 1%

- SticPay – 2.5% plus $0.30

- African Mobile Money – 2.5%

- Local Bank Wire Transfers – 1.5%

- African Local Bank Cards/Bank Wire Transfers – 2.5%

How To Make A Deposit & Withdrawal

Adding and removing funds is fast and easy:

- Log in to the Amega Finance client dashboard

- Select ‘Funds’ from the menu on the left and then ‘Deposit Funds’ or ‘Withdraw Funds’

- Select the account you wish to add or remove money from via the dropdown menu

- Choose the payment method

- Click ‘Continue’

- Enter the amount to deposit or withdraw

- Select ‘Continue’ to submit the request

Bonuses & Promotions

Amega offer a $20 bonus for all verified accounts. Terms and conditions apply, but this is a generous, uncomplicated offer.

There is also a monthly ‘Lucky Deposit’ draw, where clients can win up to $100 for their trading balance.

Cashback

The cashback incentive provides a $1 return for each lot traded.

The promotion is available to all forex and precious metal traders, with an unlimited maximum reward and no time restraint. For example, if you have traded 5 lots of silver, you could get a $5 return in cash, irrespective of whether your position produced a profit or not.

Note, withdrawals are only permitted once you have accrued $100. After this, you can withdraw the money or use it as additional trading funds. Also, eligible trades must remain open for more than one minute to qualify.

Regulation & Licensing

Amega operates through two entities:

- Amega Markets LLC – Registered and incorporated in St Vincent and the Grenadines. This entity is currently unregulated

- Amega Global Ltd – Authorized and regulated by the Financial Services Commission of Mauritius, license number GB22200548

Importantly, unregulated firms may not provide the levels of protection offered by those with financial watchdog backing. The Financial Services Commission of Mauritius is also not particularly well-regarded vs bodies like the FCA or SEC.

With that said, all customers benefit from negative balance protection. Amega also complies with anti-money laundering and know-your-customer guidelines.

Amega Account Types

Amega offers just one live account to retail traders depending on the entity. The Live account is available to traders under the Amega Global Ltd umbrella, whereas the Live MAX profile is for customers of Amega Markets LLC.

Both offer the same spreads, minimum deposit requirements, and platform access. You can trade all instruments on both accounts, however, cryptocurrency is also available with the Live MAX account. The majority of traders can sign up with either entity.

A swap-free Islamic account is also available. This can be requested via the client dashboard.

How To Open An Account

- Head to the ‘Visit’ button at the top of this Amega review

- Complete the simple online registration form

- Verify your email address

- Log in to the client area

- Select ‘Verification’ and provide phone, identity, and proof of residency details

- Select ‘Accounts’ from the menu on the left and then ‘Open Live Account’ from the dropdown

- Choose a ‘Netting’ or ‘Hedging’ profile and select a ‘Live’ or ‘Live MAX’ account

- Choose the leverage amount

- Select ‘Continue’

Clients must upload relevant documents to verify the details below before they can access all trading facilities.

- Address

- Identity

- Phone number

Additional Features

The broker offers a blog-style analysis page, with daily market news and trends. These posts are up to date.

There is a separate education area for traders, though this is not particularly user-friendly. When we reviewed Amega’s materials, the content was mainly large blocks of text, with no integrated videos, diagrams, or charts. Information is also not posted regularly or categorized by experience level.

An integrated economic calendar is also available in the client area, as well as in the MetaTrader 5 platform. Aside from this, the additional services and analysis tools offered by Amega Finance are limited.

Opening Hours

Each market has different trading sessions:

- US Stocks – Available 1:30 PM to 8 PM (UTC), Monday to Friday

- Commodities – Available 8:45 AM to 5:25 PM (UTC), Monday to Friday

- Forex – Available 24 hours per day, from 9 PM Sunday to 9 pm Friday (UTC)

Customer Support

Amega’s customer support is available Monday to Friday 7 AM to 2 PM (UTC) though contact methods are pretty limited. There is no telephone number available, for instance.

- Email – support@amegafx.com

- Live Chat – Icon bottom right of each webpage

There is also a FAQ section available on the official website which has some useful guides and responses to common queries.

Security & Safety

Amega has the basics covered when it comes to trading safety, though much of this comes from its partnership with MetaTrader.

The MT5 platform is secure. All transactions are fully encrypted and transmitted via Secure Sockets Layer (SSL). Two-factor authentication is also available. The randomly generated code will be required each time you log in.

Amega Finance Verdict

Although it does have some advantages, such as MT5 trading tools and a loyalty reward program, Amega Finance is not the best broker in the market. The lack of robust regulatory oversight and an average selection of assets and fees do not separate it from most brokers. There is also little in terms of additional trading tools and educational materials to support beginners.

FAQs

Is Amega A Trustworthy Broker?

Despite there not being concerns the company is a scam, clients will receive limited legal protections. The brand operates through two entities: Amega Markets LLC is not currently regulated by a trusted financial authority while Amega Global Ltd is authorized by the Financial Services Commission of Mauritius (FSC).

Is It Easy To Fund An Amega Trading Account?

Yes, it is quick and easy to deposit funds into an Amega account. All payment requests are made within the client area and there are no commission fees. On the downside, it is a shame that international credit/debit card payments are not accepted.

Note, account verification must be completed before money can be transferred.

Is Amega A Good Or Bad Broker?

Amega Finance offers the basics of a good broker, including a demo account, a reliable trading platform and mobile app, plus a low minimum deposit. However, its weak regulatory oversight and limited trading tools won’t be enough to convince many traders to open an account. The broker’s suite of assets and trading fees are also fairly average, though commission-free trading is offered.

Can I Practise Trading With Amega Before Opening A Live Account?

Yes, Amega offers a demo account on the MT5 platform. The paper trading profile mirrors the conditions of the live account and provides up to $1,000,000 in virtual funds.

New traders can sign up for a demo account on the broker’s official website.

Does Amega Finance Offer High Leverage?

Yes, clients can trade with leverage up to 1:000 on major currency pairs and up to 1:200 on precious metals. This is significantly higher than most brokers, especially regulated trading firms.

However, higher leverage increases both the size of losses as well as profits.

Best Alternatives to Amega

Compare Amega with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Plexytrade – Established in 2024 and headquartered in Saint Lucia, Plexytrade is an ECN/STP broker. Geared towards active traders, it supports four account options, crypto deposits and withdrawals, plus very high leverage up to 1:2000 made possible by its unregulated status.

Amega Comparison Table

| Amega | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| Rating | 3.2 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Shares, Indices, Commodities, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Stocks, Commodities, Crypto |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $20 | $0 | $50 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | – |

| Bonus | $20 for all verified Accounts, Lucky Deposit draws and Unlimited Cashback | – | 120% Cash Welcome Bonus |

| Platforms | MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:2000 |

| Payment Methods | 4 | 6 | 2 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Plexytrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Amega and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Amega | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Amega vs Other Brokers

Compare Amega with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Amega yet, will you be the first to help fellow traders decide if they should trade with Amega or not?