ZuluTrade Review 2025

See the Top 3 Alternatives in your location.

Awards

- Best Social Trading Solution at UF Awards 2022

- Best Social Wealth Management Platform at Forex Expo Dubai in October 2022

- Best Social Trading Solution Award at iFX EXPO Dubai 2023

- Best Wealth Management Platform Africa Awards at FAME Awards 2023

- Best Social Trading Solution at UF Awards APAC 2023Best Social Trading Solution at UF Awards Global 2023 in Cyprus

Pros

- Investors can comment directly on leaders’ profile pages

- Broker and Platform Agnostic, which means that users can enjoy the freedom of choice across a variety of brokers, markets and trading platforms

- Wide range of performance indicators and graphs to help evaluate leaders

Cons

- Employing an effective money management system can be difficult for beginners

- Some inconsistent leaders to be aware of

- Leaders are not formally vetted. The ZuluGuardTM feature does mitigate this risk, however, by automatically removing a leader when detecting a trading strategy has deviated from its expected loss profile

ZuluTrade Review

ZuluTrade is the oldest and most recognizable copy trading platform. Essentially, it allows investors to follow and mimic the trades of experienced traders in the forex and financial markets. However, the social element also enables leaders and investors to leave feedback and share ideas. Today it boasts more than 2.4 million users and executes a trade volume in excess of $800 billion.

This 2025 ZuluTrade review will break down how it works, covering costs, live accounts, user ratings, regulations, and more. Find out if our experts recommend signing up with ZuluTrade.

Company Details

ZuluTrade is a Finvasia Group company, founded in 2007 with an aim to make trading accessible and easy for everyone. Today it is regarded as one of the most innovative social trading tools in the world, operating from multiple locations including Greece, India and South Africa.

Throughout its history, the company goal has remained the same; ‘to become the world’s largest social trading community on the globe, offering customer-focused investment solutions where traders on a global level can connect to any trading platform and share their knowledge’.

Key milestones include:

- 2008 – ZuluTrade develops a software that connects to FXCM’s API. It enables the first basic form of copy trading strategies

- 2009 – The company had over 4,500 traders, and it was their portfolios that users could copy to make money

- 2011 – ZuluTrade releases several new features including the ability to follow other individuals rather than just signal providers

- 2013 – ZuluGuard™ launched to protect retail investors from adverse trading strategies offered by traders

- 2014 – ZuluTrade re-designed its website, added a number of features and had 120 employees, 40 of whom were in customer support

- 2015 – The platform was awarded an EU Portfolio Management License. This resulted in the company becoming both legitimate and respected in the trading world

- 2017 – Cryptos CopyTrading was introduced allowing retail investors to participate in the growing digital currency market

- 2020 – Stock CFDs and follow trading were introduced

- 2021 – ZuluTrade joins the Finvasia Group in December 2021

- 2022 – ZuluTrade wins 2 awards and also implements support for only licensed brokers on its platform, creating a more reliable and safe investing environment for its investors.

- 2023 – ZuluTrade upgrades its social trading platform with a transparent pricing plan, smoother onboarding process, and enhanced social feed. In the same year, the platform won multiple awards and got two new regulatory licenses: the FSCA in South Africa and the FSC in Mauritius.

Today, ZuluTrade has grown to become a leading social and copy trading platform with users in more than 150 countries and over 90,000 leaders to choose from. Countless brokers worldwide offer ZuluTrade’s cutting-edge technology with 2.4 million registered users across the globe.

Trading Platform

The ZuluTrade platform collaborates with brokers that provide trading solutions on numerous instruments, including crypto CFDs, stocks, forex, commodities such as oil, and indices such as the Nasdaq. Investors that have registered accounts with brokers that operate through the MT4/MT5, Act Trader, X Open Hub or Match-Trader trading platforms can connect to ZuluTrade and benefit from the numerous features of social trading.

There are 3 types of brokers that Investors can connect their accounts to:

- Integrated Brokers – Brokers that have been integrated into the ZuluTrade platform allow copy trading by accessing and managing your account with the broker directly, all within the ZuluTrade platform. Every account opened through the integrated brokers will benefit from lifelong free copy trading on ZuluTrade since the expenses associated with copy trading are covered by the broker and never passed onto the client

- Co-Branded Brokers – These are brokers with a co-branded ZuluTrade website featuring an exclusive space tailored for the brokers and their users. Users need to open their account independently from the broker’s website and then connect it to the ZuluTrade platform. In some cases, Co-Branded brokers also cover the cost of copy trading.

- Standard Brokers – Any broker which offers trading accounts on MT4, MT5, ACT Trader, X Open Hub or Match Trader. Using your account with any broker from anywhere in the world (subject to any applicable geographical restrictions for regulatory purposes, you may join and use ZuluTrade services for a small fee of $10/strategy per month with no limits.

How it Works

The user base is essentially split into two categories:

- Leaders – These are normally traders who can link their trading account with ZuluTrade, make their account public and allow investors to copy their portfolios. Their compensation is determined by the number of trades executed by investors.

- Investors – These users can copy the strategies of the leaders.

Features

Once you have your ZuluTrade account login details, you can start using a number of useful features, including:

- Social network features – These include forums and comment sections, plus the ability to upload photos and videos. Here you can review traders, offer advice and ask questions.

- ZuluGuard™ – A unique feature that protects investors if erratic trades are opened by traders they are following. An excellent risk management addition.

- Calendar – An easy to access summary of all key events for the financial markets around the globe.

- Simulation – The ZuluTrade Simulator Tool lets you see how much you could earn by following our Leaders by testing their strategies based on their past performance, all without risking your capital.

- Watchlist – Investors can easily keep track of your favourite Leaders and Market Assets.

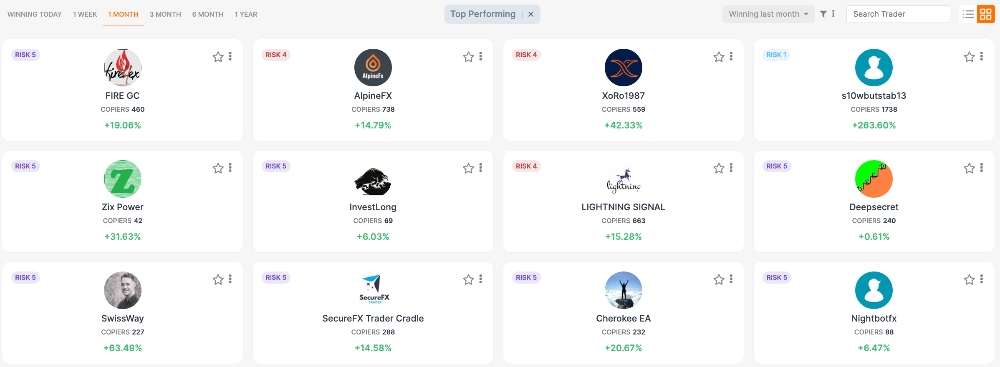

- Risk Score – To help investors make informed decisions, ZuluTrade displays the Risk score for all Leaders. Risk is calculated on a 1-5 scale, with 1 indicating Low Risk and 5 indicating High Risk.

In addition, if you’re concerned about how to choose a leader on ZuluTrade, you can use the ZuluRank calculation. This proprietary algorithm ranks leaders by a number of different factors, including:

- Sharpe ratio

- Amount of trade activity

- Low drawdowns, High profits

- Length of time trades stay open

- The frequency that a trader logs in

ZuluTrade also has a risk score, ranging from 1 to 5, which allows you to choose a Leader that aligns with your risk appetite.

ZuluTrade To MetaTrader

Our experts found it is possible to link an external live or demo MetaTrader 4 (MT4) platform to a ZuluTrade account. So, for those asking does ZuluTrade work with MetaTrader accounts? The answer is yes.

How To Copy A Trader

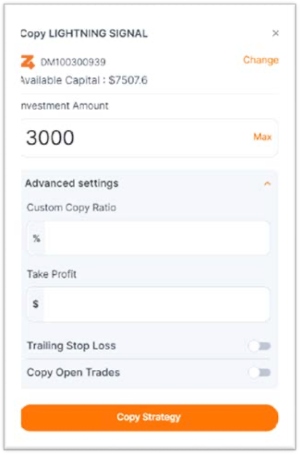

- Register for a ZuluTrade account

- Sign in using your credentials on the ZuluTrade site or sign up via a broker and connect your account to ZuluTrade. Look out for the logo

- Browse the best leader that reflects your risk appetite and investment goals. You can view their past performance and traded assets

- Select the ‘Copy Strategy’ button and enter how much you want to invest. You can also click on the ‘Advanced Settings’ dropdown list and fill out the ‘Custom Copy Ratio’ as well as ‘Take Profit’ fields. You even have the possibility to turn on the ‘Trailing Stop Loss’ and ‘Copy Open Trades’ options.

- Click on ‘Copy Strategy’ again. This will begin the copy trade function and the positions of the leader will be duplicated.

Spreads & Fees

Spreads and commissions vary depending on the broker you choose to connect your ZuluTrade account to. Broker commission and spreads (the difference between the buy and sell price) depend on the volume traded by the client. Spreads can be influenced by several factors, including asset type and time of the day the asset is being traded. For example, brokers often widen spreads during periods of high volatility.

The minimum deposit requirement varies between brokers. Some require a minimum deposit of just $1, others may require $250.

ZuluTrade fees also depend on the selected broker.

If your broker account is within ZuluTrade’s so-called ‘Integrated Brokers’ list, then you can use ZuluTrade’s copy and social trading services free of charge.

If your broker falls under ZuluTrade’s ‘Co-Branded Brokers’ category, you might be subject to a small monthly fee of $10 per strategy. Some ‘Co-Branded’ brokers may cover this cost of copy trading.

Finally, if you are using ZuluTrade through one of the platform’s ‘Standard Brokers’ you will need to pay the monthly fee of $10 per copy trading strategy.

Other Trading Fees

You may be charged an overnight rollover/swap fee by your broker. The amount will depend on the asset and volume you are trading. Although these costs can cut into profits over a long period, intraday traders shouldn’t usually encounter these fees.

Aside from that, there aren’t any other costs. As ZuluTrade makes clear, the leaders you copy are paid directly by ZuluTrade.

Leader compensation is volume-based. Precisely, Leaders earn 0.5 pips for each closed trade executed by a Real Investor account depending on the investor’s account setting.

Mobile App

ZuluTrade provides Android and iPhone trading apps. Once in the application, you can view your performance, review new leaders to copy, plus close trades manually.

Other features include:

- Open, close and edit traded positions

- Diversify risk among multiple assets and strategies

- Manually adjust stops and limits or close positions completely

- Execute your leaders’ systems’ signals without having to monitor the markets 24 hours a day

- Easily keep track of your favourite Leaders and Market Assets with Watchlist

- Make informed decisions with the Risk score attributed to each Leader

Overall, the ZuluTrade mobile application effectively complements the desktop-based platform. It is easy to navigate and operates seamlessly between devices. Plus, functionality has continuously improved with each update.

Payment Methods

Payment methods for leaders include Bank Transfer, PayPal and popular Cryptos.

As an investor, deposit and withdrawal methods will vary depending on the broker. It is also worth checking for any deposit and withdrawal fees applied by the online brokerage.

Demo Account

To open an account with ZuluTrade, first you need to Register by providing your name, residence country, email and password. Alternatively, you may register using your Google Account.

Upon successful registration, a free Demo account will be automatically created for you, with exactly the same functionality as a Live account. This means that you can try out ZuluTrade risk- free and experiment with different copy trading strategies before investing any real funds!

You can copy trade unlimited strategies on a demo account, with virtual money, and without a subscription plan.

Overall, we found the demo account easy-to-use and replicates many of the features you will get, should you choose to upgrade to a live account.

Regulation & License

ZuluTrade is established globally and is regulated by:

- HCMC in EU (License No 2/540/17.2.2010)

- FSA in Japan (License No 0123-01-006371)

- FSC in Mauritius (License No IK21000018)

- FSCA in South Africa (License No 49299)

ZuluTrade’s Copy Trading Subscription Plan

1. Zero Subscription Plan

This plan is available to users signing up with Integrated and selected Co-Branded Brokers. Users who have an account or open a new account with one of these brokers can enjoy copy trading any number of Leader Strategies without being charged the monthly subscription fee. In this case, the copy trading subscription fee is entirely free.

2. Paid Subscription Plan

This plan requires a small fee of $10/ Leader Strategy / Month and discounts are also available for users who opt for quarterly, semi-annual or annual subscriptions, with cost savings of 5% (quarterly), 10% (semi-annual) and 17% (annual).

How To Become A Leader

Anyone can sign up to become a Leader. To become a leader, first you need to Register by providing your name, residence country, email and password. Alternatively, you may register using your Google Account.

Now, just follow the onboarding instructions, and when prompted click “Become a Leader”. If you already have a Trading Account linked to ZuluTrade, go into your Trading Accounts section and select the option “Make my Account Public”.

If you do not have a trading account, create one and then proceed.

Leaders are compensated on a volume basis and earn 0.5 pips for each closed trade executed in a Real Investor account.

Tips

Obviously, you can’t maintain a negative balance, but what else would a good leader guide recommend you do to get a sizeable amount following you?

- Due to inevitable broker slippage, you may want to avoid scalping strategies

- Upload a professional, friendly default photo. The right photo icon will help build trust

- Trade with a real money account. People will trust your decision-making more if they know you are risking real capital too

- Be clear and concise when you explain your strategy. For example, suggesting how many lots a follower should invest and how you plan to offset any potential pitfalls

- If people have questions about your strategy on a Mac, your score on the risk meter bar, or anything else, try to respond swiftly. Communication is key to building trust

- Make sure you meet any criteria, whether it’s necessary minimum equity or win ratio. Meeting the EU criteria is particularly important if you want to appeal to the European market

- Also, trading during news announcements can lead to substantially different results between yours and your follower’s accounts. This is because some brokers will widen spreads during news events

Trading Hours

The market opens on Sunday at 21:00 UTC and closes Friday at 21:00 UTC. During Eastern time daylight saving, the market will open on Sunday at 17:00 UTC and close on Friday at 17:00 UTC.

Note, trading hours are close to competitors and similar sites.

Contact & Customer Support

If you have any technical issues or account requests, such as to change leverage, simply head over to the ZuluTrade homepage. From there you can find live chat available 24 hours, 5 days a week. This is the most popular method of contact for ZuluTrade users at present. Your partnered broker should also be able to provide basic support such as a breakdown of commissions, step-by-step guides to copy trades and integrating ZuluTrade services to an MT4 demo profile.

On top of that, there is email and phone support, plus a 24-hour hotline, 5 days a week.

Safety & Security

While using ZuluTrade, our experts found the brand safeguards personal information via industry-standard SSL encryption on its PC and mobile platforms. Funds are also not held, as the service simply provides the platform between the leader and investor.

ZuluGuard™ is often highlighted as a particularly well-liked feature in customer testimonials and review forums. It is an effective account protection feature. It works by monitoring each leader’s behavior and removing a user when a draconian strategy is detected. This should help keep your income safe from erratic leaders.

ZuluTrade vs Competitors

What does ZuluTrade offer vs eToro, NinjaTrader and other systems? You can easily view rankings of investor performance. The simulation also shows the overall profit.

Perhaps it is the sheer number of leaders you can copy that sets ZuluTrade apart. You have access to over 90,000 leaders from 150+ countries. You can then use ZuluTrade’s advanced platform to hone in on the best. For example, you can choose to see only those who are in the top 100, have a maximum drawdown of 20%, and have been rated by investors.

Many investors also like to copy more than one leader. So, you can utilize Watchlist to manage your potential candidates. This will also allow you to monitor an individual for a while before copying. In addition, you can share lists amongst users.

After you have found a leader you wish to follow, you can assign a specific amount you want to trade per signal you copy. Alternatively, there is a ‘Pro-rata %’ option. For example, 20% would mean if the leader opened 1 lot, 0.2 lots would be opened in your account. On top of that, you can set a ‘Max Open Position’ for a particular trader.

You can review your account performance at any time. In addition, you can review trade performance by trader and time frame. This should help you establish who has been generating gains and losses in your account.

Leaders on ZuluTrade can earn a lot more than signal providers on eToro through the volume-based compensation model and can serve in countries where eToro is not licensed to provide service.

ZuluTrade Verdict

Overall, ZuluTrade.com’s offering is attractive to leaders and investors of all experience levels. The ever-growing number of users alone demonstrates that. Yet despite being user-friendly, the service does work best if you opt for FXview, which is one of ZuluTrade’s integrated brokers.

In addition, staying profitable isn’t always straightforward. You need to be aware revenue can disappear just as quickly as it appears in your account. So, having an effective strategy and money management system in place is essential.

FAQs

What Is ZuluTrade?

ZuluTrade is a social wealth management platform that offers a copy trading platform on desktop and mobile. Investors can indulge themselves in social trading and copy trading across multiple assets and can copy trades of 90,000 Leaders.

What Is The ZuluTrade Minimum Copy Trading Fee?

You can start copy trading with a minimum of $0 subscription plan on ZuluTrade.

Is ZuluTrade Regulated?

Yes, ZuluTrade is regulated in the EU, Mauritius, South Africa and Japan. The firm holds a license with Greece’s Hellenic Capital Market Commission, the General Japan Investment Advisers Association, Mauritius FSC and the South African FSCA.

Can I Use Leverage When Trading With ZuluTrade?

Leverage opportunities vary between ZuluTrade-partnered brokers. Depending on local entity regulations, global brokers may offer margin of up to 1:1000.

Is ZuluTrade Legit?

ZuluTrade is an established social and copy trading platform. With over 16 years in the market, it has been serving clients across the world with a trusted and stable platform. If using the terminal through a broker, ensure they follow client safeguarding protocols such as segregated client funds and access to investor compensation schemes.

Best Alternatives to ZuluTrade

Compare ZuluTrade with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

ZuluTrade Comparison Table

| ZuluTrade | Interactive Brokers | xChief | |

|---|---|---|---|

| Rating | 3.1 | 4.3 | 3.9 |

| Markets | CFDs; Forex, Stocks, Cryptos, Commodities, Indices | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | Broker Dependant | $0 | $10 |

| Minimum Trade | $1 | $100 | 0.01 Lots |

| Regulators | HCMC in EU, FSA in Japan, FSC in Mauritius, FSCA in South Africa | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | – | – | $100 No Deposit Bonus |

| Platforms | X Open Hub, Match-Trader, MT4, MT5, ActTrader | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | Broker Dependent | 1:50 | 1:1000 |

| Payment Methods | 3 | 6 | 12 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by ZuluTrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ZuluTrade | Interactive Brokers | xChief | |

|---|---|---|---|

| CFD | No | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

ZuluTrade vs Other Brokers

Compare ZuluTrade with any other broker by selecting the other broker below.

The most popular ZuluTrade comparisons:

Customer Reviews

There are no customer reviews of ZuluTrade yet, will you be the first to help fellow traders decide if they should trade with ZuluTrade or not?