XE Prime Review 2024

XE Prime Review

XE Prime is an online broker that offers a broad range of markets including forex, indices, stocks, commodities and cryptos. A relatively new offshore broker, XE Prime is not necessarily as safe as other regulated brokers. Read on for an overview of the trading platform offered by XE Prime, its spreads and fees, and more.

XE Prime Headlines

XE Prime is an offshore trading broker. It is owned and operated by AN All New Investments (VA) Limited, a company that is regulated by the Vanuatu Financial Services Commission (VFSC). The holding company is XE Prime Ventures Ltd, which is based in the Cayman Islands. Razi Salih is the co-founder of the holding company.

XE Prime states on its website that the platform received awards for “Best Performance” and “Best Overall Design” in 2022. However, we have not been able to verify who handed out these awards. Regulatory oversight from the VFSC also does not compare to trusted financial watchdogs like the CySEC or FCA.

Trading Platform

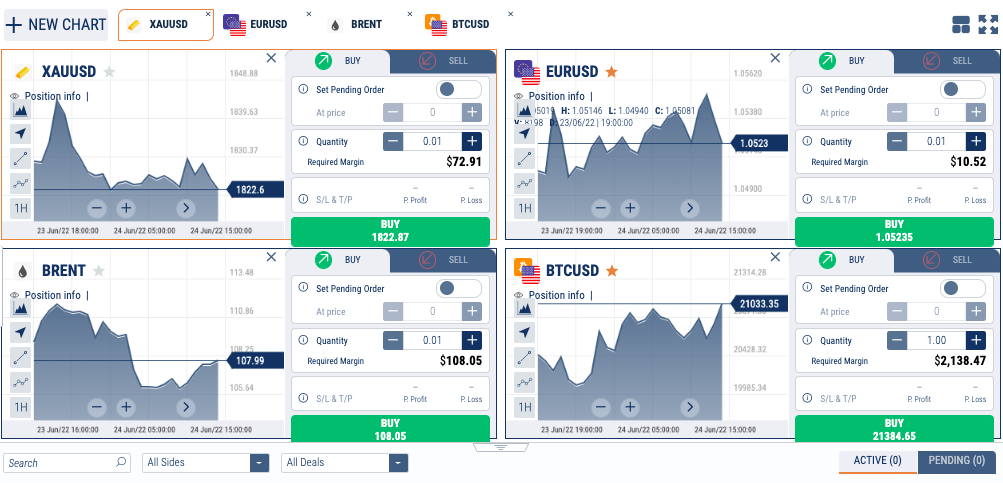

Unlike other brokers that use the MetaTrader 4 platform, XE Prime relies solely on its in-house software. The native program is easy to use and comes with a range of different indicators, drawing tools and timeframes. Stop loss and take profit orders are also available to help traders manage risk and make effective trades.

The platform is available on all major web browsers, as well as a mobile-optimized version for Android and iOS.

Products & Assets

XE Prime offers over 500 tradable assets spanning:

- Stocks (including Amazon and Apple)

- Forex (15 majors, 14 minors and 15 exotics)

- Indices (including the FTSE 100 and the US Tech 100)

- Commodities (agriculture, metals, energies and financial)

- CFD cryptocurrencies (Bitcoin, Ethereum, Litecoin and Ripple)

Spreads & Fees

The typical spread for the EUR/USD and EUR/GBP currencies pairs is 0.6 pips. For the GBP/USD currency pair, it is 0.7 pips. As XE Prime does not charge commission, these spreads are competitive.

Other charges also apply, such as swap rates of up to 0.5% for positions kept open overnight. These fees will not be a concern for day traders. Inactivity fees may also be charged when an account has been dormant for three consecutive months. In addition, charges may be imposed in the case of an account being closed due to the actions of the customer.

Leverage

The default leverage for forex transactions at XE Prime is 1:200 per asset. As an offshore broker with less stringent regulations, this leverage is much higher than the maximum leverage many European brokers offer, which tends to be around 1:30.

Leverage means that traders can gain more exposure relative to the amount they invest. It can mean larger profits, but also magnified losses if the market moves in the wrong direction.

Mobile App

XE Prime’s trading platform is available on Google Play and the App Store. This means traders can open, monitor and close positions from wherever they are in the world. Many of the desktop analysis and account management features are also available.

Payment Methods

Deposits

XE Prime does not charge for deposits, although third-party fees may apply. The minimum deposit is typically $50 and the maximum is $15,000. The deposit options and processing times for each are as follows:

- Volt (instant)

- Jeton (instant)

- Visa (instant)

- Interac (instant)

- Klarna (instant)

- eftPay (instant)

- CASHU (instant)

- iDEAL (instant)

- Giropay (instant)

- Neteller (instant)

- PayRedeem (instant)

- Wire transfer (3-5 days)

- Avo Payments (instant)

- Perfect Money (instant)

- Skrill (usually a few minutes to half an hour)

- Crypto such as BTC and XRP (up to a few hours)

Withdrawals

XE Prime does not charge withdrawal fees, although customers may face third-party fees from their own bank. While there are slightly fewer withdrawal options than there are deposit options, popular solutions such as credit cards and wire transfers are still available.

Note that processing times for withdrawals can be longer. For example, it will take 3-5 business days for credit card withdrawals.

Demo Account

For beginners and those wanting to test a new strategy, XE Prime has a demo account. This comes with a balance of $10,000 and allows unlimited balance refills. However, unlike many other brokers that provide demo accounts, XE Prime limits customer access time to one month only.

Deals & Promotions

XE Prime offers referral bonuses. Customers can receive a reward of up to 10% for successfully referring a friend. A separate promotion that customers can apply for is the Safe Mode Program, which grants users three risk-free trades. This latter promotion is a good option for beginners and those new to online trading.

Regulation & Licensing

XE Prime is regulated by the Vanuatu Financial Services Commission (VFSC). As is the case with some other offshore regulators such as those based in the Caribbean, the process for getting regulated by these bodies is often simplified. There is minimal legal supervision over broker activities, which can mean that brokerages are less trustworthy than other strictly-regulated platforms.

Importantly, traders using these brokers may be at increased risk of fraud, and regulatory bodies may not require negative balance protection and insurance to be in place for customers.

Additional Features

XE Prime provides free trading ideas which show the “quality” and direction of market movement for a particular asset. For example, it may show that the CAD/JPY currency pair has strong positive price movement, which could indicate that you should take a long position.

XE Prime also offers a Trading Academy, which has a selection of videos covering various topics on trading as well as how to navigate the platform itself. Although other brokers have a broader education section, the videos that XE Prime has uploaded provide a simple way for traders to learn the fundamentals of trading. For example, one basic topic covered is “What is Forex?”. A glossary is also available on the website that explains different technical trading terms.

Account Types

Unlike some brokers that have several account types with varying spreads and commissions, XE Prime keeps things simple with one “real” trading account alongside their demo solution. With that said, traders can change to an Islamic account if they wish to comply with Sharia law. The other downside of a single account is limited perks for active customers.

Benefits

- No commission and tight spreads

- A large number of assets available to trade

- The in-house trading platform keeps things straightforward and has the usual features

Drawbacks

- Limited customer reviews

- No MetaTrader platform available

- Not available to customers in the US

- No legitimate social media presence

- Offshore broker with limited regulatory oversight

- Website errors and mistakes raise questions about the professionalism of this broker

Trading Hours

Trading hours will vary depending on the market in question. For example, the forex market is open 24 hours a day between 5 pm EST on Sunday and 4 pm EST on Friday. This makes it accessible to XE Prime traders in all time zones. However, other markets may have different opening hours. See the broker’s official website for a breakdown by product.

Customer Support

Customers can get in touch via several support channels:

- Telephone – +41 -225013125

- Email – support@xeprime.com

- Live chat – online contact form on the website

Note that company opening hours are Monday-Friday (08:00-00:00 GMT+3) so traders will not be able to access customer support outside of these times. This is particularly important to note for those trading weekend markets.

Security

XE Prime has Know-Your-Customer (KYC) verification processes in place, so customers registering for an account will need to submit proof of identity, residence and payment.

Segregated accounts are also used by XE Prime to ensure that client funds are kept separate from the funds of the company. This helps to protect client capital should the firm get into financial difficulties. The brokerage also states that user funds are insured and that their trading system is fire-walled, helping to protect against malicious attacks.

XE Prime Verdict

XE Prime gives its customers access to a wide range of markets, with zero commission and tight spreads on many assets. The in-house trading platform also gives investors an integrated and seamless experience. However, there are risks associated with XE Prime being an offshore broker with less stringent regulatory monitoring and supervision. The fact that the brand is a relatively new broker with little verifiable history also means that caution should be exercised when choosing to trust this broker with capital.

FAQs

XE Prime: Is It Good?

XE Prime is a broker that offers useful services such as zero commissions and low spreads. It also has a range of markets available and good customer support options. However, because it is an offshore broker it is subject to less stringent legal requirements. This means that customers should be careful when deciding to trade with XE Prime.

Does XE Prime Accept Customers From The US?

No, XE Prime does not accept customers from the United States. However, it does accept customers from Europe, including the UK. New clients can register for an account on the official website.

Does XE Prime Have An Islamic Account Available?

Yes, XE Prime does offer an Islamic account that complies with Sharia law. That means no interest, bonuses or usury. Users in Muslim countries will have their account automatically registered as an Islamic account. Other interested customers will need to contact the customer support team.

Can You Use XE Prime’s Demo Account Indefinitely?

There is a time limit of one month when using the demo account. However, users can replenish funds in the account within that period. Prospective traders can sign up for the paper trading account on the brokerage’s website.

Top 3 Alternatives to XE Prime

Compare XE Prime with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

XE Prime Comparison Table

| XE Prime | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | VFSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | 3 Risk-Free Trades | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:200 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 10 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by XE Prime and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| XE Prime | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

XE Prime vs Other Brokers

Compare XE Prime with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of XE Prime yet, will you be the first to help fellow traders decide if they should trade with XE Prime or not?