Wahed Invest Review 2024

Pros

- The broker's fee covers all custodian fees and transaction fees and traders are never charged for account balances of zero

- Strong regulation by the SEC in the US and the FCA in the UK, plus membership with the Shariah Review Bureau

- Commitment to ethical investing with rigorous screenings, plus Waqf practices to ensure income generated from assets is donated

Cons

- Platform is not as advanced as other competitors

- Higher fees than other investment firms

- Bank card funding not available

Wahed Invest Review

Wahed Invest is a Muslim-friendly trading platform that helps clients build portfolios in halal equity funds, Sukuk (Islamic bonds), and gold. In this 2024 review, we explain how Wahed Invest works, from trading fees and minimum deposits to potential returns and sign-up tips. We also list popular alternatives to Wahed.

About Wahed Invest

Wahed is an online investment platform founded in 2015 by CEO Junaid Wahendna. It is one of the first globally accessible robo-advisors, also known as digital investment managers. The firm launched in the UK and US in 2018.

Designed for those who want to invest, but do not have the time or the experience to do so manually, a robo-advisor can be viewed as a hands-off portfolio management tool. Users sign up and answer questions about how much they would like to invest, their time horizons, and other financial goals. Then clients can make a deposit and let Wahed’s trading system do the rest.

Wahed is not entirely novel in the assets that it provides to traders, but it is pioneering in several respects. For example, Wahed offers a trading platform and products that are compliant with Sharia laws, while also having an ISA tax-efficient wrapper.

Wahed Invest also has comparatively low fees compared to many online brokers and lets traders get started with as little as $100. Clients can withdraw and deposit at no additional fee at any time and access assets that aren’t easy to obtain normally, such as Sukuk (an Islamic financial certificate, similar to a bond in Western finance, that complies with Islamic religious laws), as well as emerging markets.

All of this is packaged into one user-friendly interface, and while not every aspect is unique, finding all of these components together and accessible in one place is rare for Muslim traders.

How Wahed Invest Works

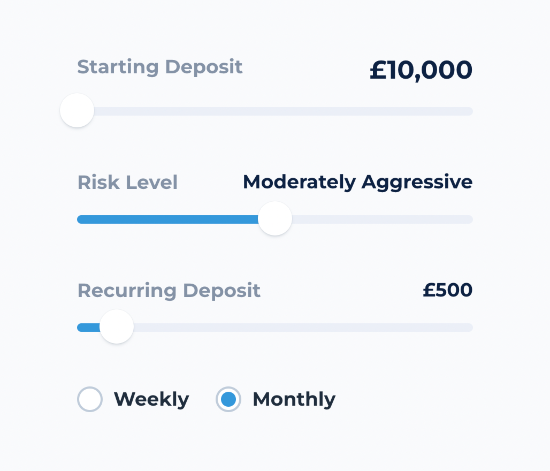

As outlined above, as an investor approaching the platform, you will be asked to answer questions relating to your financial goals and risk level. Wahed then optimizes your portfolio using only Shariah-compliant investments, potentially providing healthy returns with upfront risk.

The firm’s investment categories include global equity, emerging markets equity, US equity, REITs, commodities, and fixed income. Using these categories of investments, Wahed generates a percentage in different assets, designed to tell the investor how much risk is associated with each one. Each investment option will also be placed into one of the following categories:

- Very conservative

- Conservative

- Moderate

- Moderately aggressive

- Aggressive

- Very aggressive

For example, the company’s very conservative portfolio is made up of 90% Sukuk and 10% cash, whereas its very aggressive solution is 86.5% in HLAL and UMMA, 12.5% in VP-DJ Shariah China A-Shares 100 ETF, and 1% cash.

These portfolios are highly diversified and HLAL, meaning they track a principles-selected, market-cap-weighted index of US equities that conform to Shariah standards, and conform to UMMA, meaning a whole community of Muslims bound together by ties of religion.

Alternatively, investors can choose a thematic portfolio based on the type of securities that are included. For example, the money market portfolio which is made up of 97.5% Affin Hwang Aiiman Money Market Fund, or the emerging markets portfolio which is made up of 97.5% iShares MSCI EM Islamic UCITA ETF and 2.5% cash. This means that clients can also choose a portfolio that is entirely made up of one security.

In addition, Wahed Invest offers a rebalancing service, which occurs based on your goals and risk tolerance. So, if you decide you are ready to take on more risk, the portfolio will be rebalanced whenever funds are added or withdrawn. Rebalancing can also happen when the market goes through a major change in terms of volatility.

Assets & Markets

There are a number of instruments that can be bought and sold on Wahed:

- Global Equities – iShares MSCI EM Islamic UCITS ETF USD, HSBC Islamic Global Equity Index GPB IC

- Emerging Markets – iShares MSCI EM Islamic UCITS ETF USD

- Sukuk – Franklin Global Sukuk Fund W

- Gold – ETFs Physical Gold (GBP)

Money is essentially invested into a variety of stocks and shares, Sukuk, and gold, and the funds are pooled. This gives users the advantages of a diversified portfolio whilst not having to invest huge amounts of capital. Without this approach, it would cost more to purchase all of the underlying assets in each fund. Therefore, when you invest using Wahed you will hold several kinds of stocks, shares, Sukuk, and gold for a lower overall investment price. This makes the platform more cost-effective for many traders, especially beginners.

Fees

In terms of other robo-advisors, Wahed Invest is one of the more expensive options.

To begin with, investors must deposit a minimum amount of $100 to open an account. While this is not entirely out of reach of many investors, it does take away some of the accessibility of the service.

Furthermore, the monthly percentage fee for the management of the account is comparatively high. The management fee is 0.49%-0.99%, which is higher than most competitor platforms. It also does not offer tax-loss harvesting.

It’s important to note that the management fee shifts depending on the balance of your portfolio, so if your portfolio is larger, you can get that rate down to 0.49%, comfortably within the realm of what many other investment services offer.

- If your portfolio balance is between $100 and $249,999, then your management fee will be 0.99%

- If your portfolio balance is more than $250,000, you will qualify for the 0.49% management fee

Rebalancing with Wahed does not cost anything extra, and there are no transaction charges for buying or selling securities. There are no hidden fees either, only the comparatively higher costs which they advertise.

Regulation

It’s always wise to be cautious when dealing with a newer company, and since Wahed only launched in 2015, you may naturally feel less certain about how safe your funds will be with the brand.

However, importantly, Wahed is registered with the US Securities and Exchange Commission (SEC), which bodes well for the standard of the company.

Furthermore, Wahed is also insured by the Securities Investor Protector Corporation (SIPC), so all user funds are protected and insured up to the value of $500,000, should the company declare bankruptcy.

Wahed Invest is one of seven licensed robo-advisory platforms operating in Malaysia, and the only one that is Sharia-compliant.

It offers investments and returns in compliance with Islamic law, is certified by the Shariyah Review Bureau, and is also a member of the Accounting and Auditing Organization for Islamic Institutions (AAOIFI).

Regulation does not guarantee that you are going to profit from using a platform, it only means that the company is more likely to be legitimate than an unregulated provider. It also means that if the company were to do anything illegitimate, any loss may be covered by insurance and the regulatory body would investigate it and potentially remove the license from the platform.

Profits still depend on market conditions, and this doesn’t hinge on the legitimacy of the platform.

Wahed Invest & Shariah Law

Wahed claims to be the first automatic Islamic investment platform governed by Shariah law. This law dictates religious practice and the aspects with which many Muslims live their lives – and this includes financial decisions such as investing.

This also means that Wahed has to comply with ethical guidelines. For example, they have no financial ties to industries such as tobacco, alcohol, firearms, or adult entertainment. All investments are monitored by an Islamic committee and decisions are made regarding whether a certain investment type would appeal to most Muslims around the world.

Shariah-compliant investing, also known as halal trading, has a focus on welfare and Islamic beliefs as well as the more traditional goals of western investing, which is to maximize one’s returns.

This also means that Wahed does not invest in any companies which provide financial services which aren’t Islamic, and that they don’t invest in companies which generate interest income larger than around 5% of total revenue, unless the excess of 5% is donated to a charity.

Customer Support

Wahed Invest is available for contact to discuss customer queries and offers support via two channels:

- Phone – they can be reached on the contact number 855-976-4747, from Sunday to Thursday during the hours of 9am to 5pm ET

- Email – customers can email info@wahedinvest.com to get in touch with its support team

There is also a wealth of information available via its website blog, including details on how to delete an account.

Wahed Invest Verdict

Wahed is a reputable and reliable trading platform offering socially responsible investment opportunities, particularly for beginners or those who prefer a more hands-off approach. Of course, Wahed is not offering access to assets that investors can’t get from a traditional online broker, but this would take more time to accumulate compared to Wahed’s convenient solution.

FAQs

Should I Invest In Wahed?

Wahed Invest is perfect for traders who haven’t yet acquired the experience and expertise to manage their own investments. Similarly, if you do not have time to do so, then it could be a good option.

Is Wahed Invest Legitimate?

Wahed Invest is compliant with Sharia law. It is certified by the Shariyah Review Bureau and is also a member of the Accounting and Auditing Organization for Islamic Institutions (AAOIFI). Given that this is a legitimate regulatory body, Wahed is a reliable and trustworthy brand.

Can I Buy The Wahed Securities Via A Standard Broker?

It is possible to purchase the same securities in the Wahed portfolio yourself through a traditional brokerage, but not necessarily in such a convenient and cost-effective way. This has made the investing app popular with aspiring traders and those tight on time.

What Is Wahed Invest’s Minimum Investment Amount?

Investors must make an initial investment of $100 to open an account with Wahed.

What Is Shariah Compliant Investing?

Shariah investing, also known as halal trading, is a sub-sector of socially responsible and ethical investing that complies with the principles of Islam. This means that Wahed seeks to focus on social welfare with their investments as well as profits, and also affects the industries in which they invest.

Is Wahed Invest Really Halal?

Yes, Wahed Invest offers entirely halal investing. It is trusted by thousands of active Muslim traders in the UK and US.

Top 3 Alternatives to Wahed Invest

Compare Wahed Invest with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Wahed Invest Comparison Table

| Wahed Invest | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| Rating | 3.1 | 4.4 | 4.3 | 4.5 |

| Markets | Stocks, Sukuk, Gold | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $100 |

| Minimum Trade | Variable | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | SEC, SRB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | NFA, CFTC |

| Bonus | – | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | – | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:50 |

| Payment Methods | 1 | 6 | 6 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Wahed Invest and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Wahed Invest | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Wahed Invest vs Other Brokers

Compare Wahed Invest with any other broker by selecting the other broker below.

The most popular Wahed Invest comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Wahed Invest yet, will you be the first to help fellow traders decide if they should trade with Wahed Invest or not?