Vietcombank Transfer Brokers 2026

Vietcombank Transfer is a popular payment solution in Asia that offers straightforward deposits and withdrawals to and from trading accounts. In this guide, discover the best brokers with Vietcombank Transfer. Every broker has been evaluated by our experts.

Best Vietcombank Transfer Brokers

After exhaustive tests, we've found these are the 1 top brokers that accept Vietcombank Transfer:

Here is a short overview of each broker's pros and cons

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

Compare The Best Vietcombank Transfer Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| RoboForex | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 |

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- RoboForex offers over 12,000 instruments, providing more short-term trading opportunities than the vast majority of online brokers, with forex, stocks, indices, ETFs, commodities, and futures.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

Cons

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

How Did We Choose The Best Vietcombank Transfer Brokers?

To uncover the top Vietcombank Transfer brokers, we:

- Searched our database of 500 online brokers, prioritizing all those that accept Vietcombank Transfer payments

- Ensured that they support deposits and withdrawals via Vietcombank Transfer for online trading

- Listed them by their overall ranking, using 100+ data points and findings from our extensive tests

Comparing Vietcombank Transfer Brokers

We’ve selected our top Vietcombank Transfer brokers by evaluating all the available options according to several criteria. These are the most important considerations:

Trust

Trust is our top priority when we review brokers. Knowing your trading funds are secure is more important than any other consideration when choosing a broker.

That’s why we mostly recommend brokers that have oversight from top-tier regulators like the UK’s Financial Conduct Authority (FCA) which ensure that licensees adhere to fair business practices.

- There are also some offshore Vietcombank Transfer brokers like RoboForex which have proven themselves as reliable brokers through a strong track record and by providing reliable safeguards such as negative balance protection.

Minimum Deposit

Vietcombank Transfer brokers with a low minimum deposit are the most accessible to traders who don’t have access to large amounts of capital, such as beginners.

We prioritize brokers that offer traders access to their full range of features without needing to deposit more than $500.

- Traders can access binary options with IQ Option for an initial deposit of as little as $10, and the broker accepts transfers from Vietcombank.

Markets

We like Vietcombank Transfer brokers that provide a large selection of instruments, as this means you can take advantage of opportunities as they arise across many markets. This will appeal to active day traders in particular.

Ideally, a broker will allow traders to dip into multiple asset classes such as forex, stocks, commodities, indices and crypto.

- With more than 12,000 instruments across six asset classes to trade, RoboForex is our top Vietcombank Transfer broker for market access.

Fees

Vietcombank Transfer can be a low-cost payment method, but to take full advantage you’ll need a broker with low or no deposit and withdrawal charges on its end.

We review each broker’s trading fees, including spreads and commissions, as well as non-trading fees to give a full run-down of the costs involved in day trading.

- With tight spreads, a fee-free withdrawal program, and a policy of reimbursing traders for their deposit fees, RoboForex is up there with the best-value Vietcombank Transfer brokers.

Customer Service

Payment methods like Vietcombank Transfer serve regions that are often far from the large Western markets that brokers focus on, so we highly value brokers that offer multilingual support around the clock.

Since it is important to ensure that this service is professional and useful, we test each customer support channel and rate brokers according to the speed and quality of responses.

- IQ Option is a Vietcombank Transfer broker that rates highly for customer service with 24/7 support in multiple languages and fast, helpful responses via live chat or telephone.

What Is Vietcombank Transfer?

Vietcombank is one of Vietnam’s biggest commercial banks, established in 1963, that today provides customers with a wide range of financial amenities, including card services, e-banking, remittance payment support and credit.

Primarily aimed at Vietnamese customers, Vietcombank Transfer is a payment service that can be made for both domestic and overseas transactions with relatively low fees, making it a suitable account funding method for traders.

Fees

A Vietcombank Transfer incurs no fees to or from other Vietcombank accounts. Fees and commissions only apply for bank transfers to alternative banks, card payments and cheques.

Fees that traders may encounter include:

- Foreign currency account deposit – 0.03% charge (minimum $1, maximum $70)

- Swift – 0.2% charge (minimum $5, maximum $200) plus a fee from an overseas bank ($10 for USD, $40 for JPY and EUR and $20 for other currencies)

How To Deposit Using Vietcombank Transfer

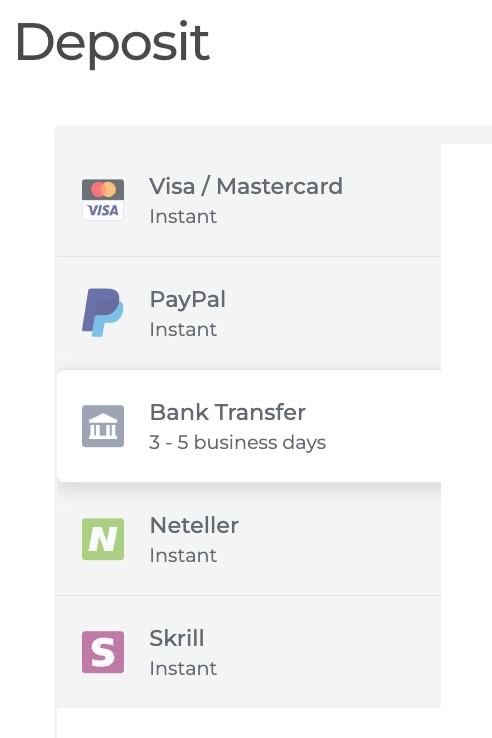

Although I’ve found the deposit process can vary between brokers, the steps are generally the same. At RoboForex, for example:

- Sign into the client portal and navigate to the ‘Deposit Funds’ page

- Choose the account you wish to deposit to

- Locate the bank’s logo or name in the list of deposit options

- Click to open the Vietcombank payment tab

- Enter your details and the amount to deposit

- Follow any on-screen instructions and hit ‘Confirm’ or similiar to finalize the transaction

Minimum and maximum payment limits, daily transfer amounts and processing times may differ from broker to broker.

The process to withdraw from your trading account should be similar to deposits, and available receiving currencies to a Vietcombank account include EUR, USD, JPY and VND, reducing the chance of high exchange rate charges.

Pros & Cons Of Funding Your Trading Account With Vietcombank Transfer

Pros

- You can make a Vietcombank transfer through the internet or a fully serviced mobile app, with transaction status and live exchange rate information provided so you can fund your trading account on the move.

- The Vietcombank transfer system comes with tools like an exchange rate calculator and interest rate details, helping you understand the impact on your trading profits.

- Vietcombank can be contacted 24/7 via a telephone number, great for issues with online broker deposits or transfer limits. I also found a comprehensive FAQ section on the payment provider’s website.

Cons

- The payment solution is primarily available to Vietnamese individuals and traders. This rules out global traders being able to use the method. With that said, international brokerages can still accept a Vietcombank transfer.

- Although a relatively low-cost payment method, you may be charged for both deposits and withdrawals. Charges will vary from broker to broker but these can cut into profits. See details on the international and domestic wire Vietcombank transfer fee structure for more information.

- Maximum payment rules apply, including a 100,000,000 VND monthly transaction limit per customer. This may constrain high-volume day traders.

Is Vietcombank Transfer Good For Day Trading?

Vietcombank offers a fast and secure payment solution that is especially good for traders in Vietnam who want to fund supported brokerage accounts cheaply. The mobile app, 24-hour customer service and credit and debit cards make this a viable option for your trading account requirements.

On the downside, services are limited to Vietnamese residents and traders only, and transfer fees to international brokers might be hefty, especially if the broker also charges.

Use our list of top-rated Vietcombank Transfer brokers to get started.

FAQ

Are Vietcombank Payments Safe For Traders?

All Vietcombank transfers are made through a reliable banking service and payments require one-time password encryption with industry-standard SSL certification. This makes it a secure option for traders to make transfers to trusted brokers.

What Is The Vietcombank Transfer Rate For Deposits To A Trading Account?

Vietcombank transfer rates vary by broker. Some established platforms may cover applicable charges associated with the payment method.

Check the terms and conditions before depositing into a live trading account.

Are Deposits To Trading Accounts Using Vietcombank Transfer Fast?

You can generally execute a Vietcombank Transfer 24 hours a day, 7 days a week. These will be processed almost instantly, though funds may not reach their destination until the next day, depending on request time and beneficiaries being inside or outside the Vietcombank system.

We’ve also found that brokers that accept a Vietcombank Transfer through wire transfers or credit/debit cards may have their own processing timelines. This can cause delays in funds reaching or leaving trading accounts.

That said, IQ Option processes Vietcombank withdrawals within the same day if the request is received within working hours.