Tradeview Review 2024

Pros

- The main thing that stands out for me is the wide range of platforms available at Tradeview, including the MetaTrader terminals, cTrader and Currenex, plus several software options for the broker’s real stocks trading service

- Through STP/ECN execution, the broker is able to achieve raw pricing on popular assets. Tradeview also charges very low commissions from $2.50 per lot per side

- My tests uncovered a strong range of 60+ currency pairs, which is above the industry average and should allow serious forex traders to explore plenty of opportunities

Cons

- I was a little disappointed to find a $35 fee for bank wire withdrawals and a 1-1.5% fee for Skrill and Neteller

- A key drawback for me is the lack of top-tier regulatory oversight. The broker’s offshore regulation with CIMA may mean that traders won’t receive robust fund protection measures. They are however, looking to bolster this area in the near future.

Tradeview Review

Tradeview is an online broker with over 5000+ instruments across forex, stocks, commodities, indices and cryptocurrencies. Our review covers the account types offered, spreads, leverage, platforms and more. Find out whether Tradeview is the right broker for you.

Tradeview Details

Tradeview is an established online STP ECN broker based in the Cayman Islands. Founded in 2004, the company has offered its services to over 100,000 accounts, including institutional and professional traders from around the world.

Tradeview is regulated by CIMA and MFSA and offers over 5000+ financial instruments across 5 platforms, including MT4 and MT5. However, the broker prohibits clients from the US and from countries where FX and CFDs are restricted by local laws or regulation.

In 2021, the brokerage also invested in its European trading operations, opening an office in Malta and securing a license from the local regulator. The move has allowed the company to leverage local regulatory conditions and infrastructure to offer market-leading trading conditions to clients in the region.

Trading Platforms

Tradeview offers a choice of 5 platforms, suited to traders of all levels; MT4, MT5, cTrader, Sterling trader and CurreneX.

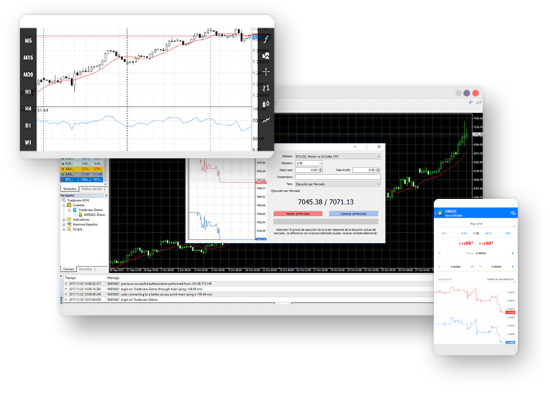

MetaTrader 4

Clients can trade with the popular MT4 platform, which covers forex and CFD markets. The platform offers 30 technical indicators for market analysis and a comprehensive charting package, with a wide range of analytic instruments.

The user-friendly terminal allows for extensive customisation so traders can find a set-up that works them. MT4 does an excellent job of balancing functionality with ease of use.

The Tradeview MAM plugin is a simple, fast, effective and reliable addition to the MetaTrader4 System. The drawdown tool allows the trader to determine a maximum loss. The popular forex trading platform, Metatrader4, is available on Android and iOS devices – free of charge at Tradeview.

MetaTrader 4 is available on Windows, Mac, Web, iOS and Android.

MetaTrader 5

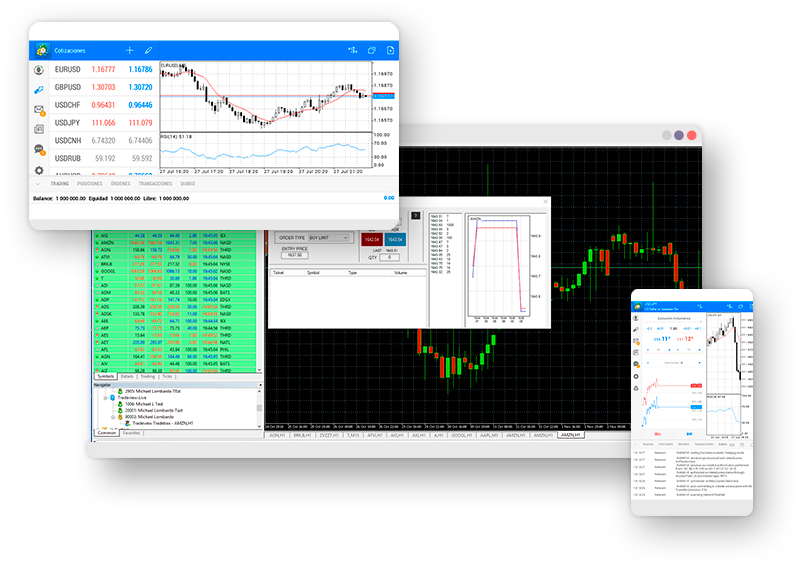

Members also have access to MT5, a more updated platform to its MT4 predecessor. Along with advanced analytics, the platform’s dashboard comes with an intuitive interface that is fully customisable.

Users benefit from:

- 30 built-in key performance indicators

- Run up to 10 charts simultaneously

- Easy-to-access control panels

- 2,000 custom indicators

- Instant execution

- 21 timeframes

- Watch lists

- Access to over 50,000 real US Stocks and option

- Ability to trade on exchange equities

MetaTrader 5 is available on Windows, Web, iOS and Android.

cTrader

cTrader is a leading multi-asset ECN platform. It provides full STP technology for instant entry and execution. The platform offers a suite of 70 indicators, 26 chart time frames and level II pricing, making it suitable for more advanced traders.

Specifically, cTrader connects with Tradeview’s Innovative Liquidity Connector, which grants access to over 50 banks and prime liquidity providers.

Available in 14 different languages and spread from 0 pips. The cTrader platform also supports Copy, formerly known as cMirror. Here you can copy or mirror the strategies of professional money managers.

cTrader is available on Windows, Android, iOS.

Sterling Pro

Sterling Pro is widely used professional trading platform in the industry for trading equities, options.

It provides the powerful options trading tools required by professional options traders worldwide, including both single-leg and complex options order functionality. Sterling Trader Pro’s combination of powerful performance and configurability gives traders complete control over their trading in the American equity markets.

- Single platform to trade equities, single and multi-leg options, and futures

- Highly configurable charting package with over 60 studies and indicators

- High performance, real-time Level I and Level II market data

- Broker and Clearing firm neutral with deep brokerage and clearing firm network

- Fully customizable and configurable hotkeys and hot buttons

- Portfolio management – real time position and P&L

- Customizable ticker watchlist with over 60 data points

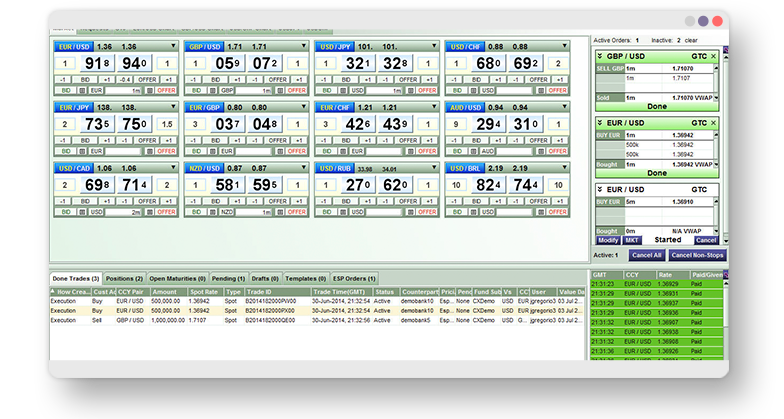

CurreneX

CurreneX is a fully integrated forex trading software designed for clients who require advanced charting tools. The platform offers 31 additional technical analysis tools and is known for its high-speed, low-latency FX trading technology. For investors focussed on forex, the dedicated CurreneX platform is a good option.

CurreneX is only available on Windows.

Assets

Tradeview clients have a choice of over 100 assets:

- Forex – 60 major, minor and exotic pairs i.e. EURUSD, GBPUSD and EURJPY

- Cryptocurrencies – 4 cryptocurrencies i.e. BTCUSD, ETHUSD

- Stocks – 5000+ real US stocks and options, and 9 indices including NASDAQ and AMEX

- Commodities – 3 metals and 3 energies, i.e. gold, silver and oil

Overall, the broker offers a moderate range of financial instruments, though more extensive portfolios of products can be found elsewhere.

Spreads & Commission

Tradeview offer floating spreads with variable commissions. Spreads and commissions differ across two of its forex accounts; Innovative Liquidity Connector® (ILC) and the X Leverage account.

Spreads start from 0 pips on the ILC account and are competitive on the X Leverage account. A $5 round turn commission is charged per lot traded on the ILC account, while X Leverage account holders aren’t charged. Typical spreads on leading pairs GBPUSD are 0.6 and 0.2 or EURUSD.

A comprehensive list of the broker’s swap rates can be found on their website under ‘Rollover rates’.

Leverage

As with spreads and commission conditions, leverage also differs for each account. For ILC accounts, maximum leverage is 1:100 while on X Leverage accounts, it’s 1:400. The minimum trade size is 0.1 lots on the ILC account and 0.01 lots on the X leverage account.

Mobile Apps

Tradeview does not offer a proprietary mobile app. However, the forex broker offers mobile trading using the MT4, MT5 and cTrader platforms. Mobile versions of MT4 and MT5 have the same functionality as desktop versions, such as the ability to control accounts and access 30 technical indicators for market analysis, among other features.

cTrader mobile features fluid charting functionalities, symbol information and in-app notifications.

MT4, MT5 and cTrader apps are available to download on the App Store and Google Play.

Deposits & Withdrawals

Deposits on Tradeview don’t come with any charges. The broker offers a wide range of deposit methods with varying processing times:

- Credit Card – (Same day) Mastercard/Visa

- Bank Wire – (approx. 1-2 business days) Scotiabank, Fidelity, BCP

- Alternative – (Same day) Uphold, Bitpay, PayR, Sticpay, Fasapay, TransferMate, Advcash, Interac e-Transfer, Bitwallet, Neteller, Skrill, Tronipay

Withdrawals are only released via the same method in which the payment was originally submitted. Tradeview does not charge fees for withdrawals. However, a hefty $35 is charged with the bank wire option and a 1%-1.5% fee for Skrill and Neteller. To submit a request for withdrawals, users have to complete a form on the website with supporting documentation.

Demo Account

Tradeview offers a free live demo account where users can trade across MT4, MT5, cTrader and CurreneX platforms. Users can learn to trade in real-time, practice trading strategies with technical indicators while avoiding monetary risk.

Signing up for a demo account is easy on the website. Simply input your details, choose a platform and select an account type to get started.

Tradeview Bonuses

From time to time Tradeview may offer promotional bonuses. Full details can be found on the website.

Regulation

Tradeview Forex is regulated by the Cayman Islands Monetary Authority (CIMA) under license number 585163. CIMA is the main regulator of financial services in the Cayman Islands.

In addition, the broker’s European trading hub holds a license from the Malta Financial Services Authority (MFSA). They recently opened a new office in Malta regulated byt the Malta Financial Services Authority (MFSA) License Number IS/93990.

MFSA is a fully autonomous public institution and reports to Parliament on an annual basis. The MFSA is a member of the European Banking Authority (EBA),and the European Securities and Markets Authority (ESMA).

However, most expert traders and institutional clients are likely to be more cautious of offshore regulated brokers. This review would have liked to see regulation from more reputable bodies like the FCS, CySEC and ASIC.

Additional Features

- Education: Tradeview offers some educational materials in the form of a glossary list. They also have a website called Surf’s Up!, which is dedicated to educating about the FX market. The website is updated with daily news and regular financial blogs.

- Social trading: The broker also offers its own social trading website called Trade Gate Hub. Members can learn from other professional traders in real time. Social and copy trading may suit beginners or those with limited time.

Trading Accounts

Tradeview offers Individual, Corporate and Joint account types. The main differences are in the aforementioned forex account types; Innovative Liquidity Connector and X Leverage, which are available on all three accounts.

ILC accounts require a minimum deposit of $1000, while the X Leverage account requires a $100 deposit. All accounts over $2,500 get a dedicated account manager, 24/7. Once the account is created, users can log in on the ‘Client Cabinet’.

The broker also offers swap-free accounts for Islamic traders.

Benefits

- MT4, MT5, cTrader, CurreneX, Sterling Trader platforms

- Social & copy trading

- Crypto trading

Drawbacks

- High withdrawal fees on bank transfers

- Limited educational materials

- US clients not accepted

- Offshore regulation

Trading Hours

Tradeview opens on Sunday at 5 pm EST and closes on Friday at 4:55 EST. Each market is subject to specific trading hours. Forex, indices and commodities markets are open 24/5 from Monday to Friday. Trading hours for each market can also be viewed on MT4 and MT5 platforms.

Customer Support

The broker can be contacted via the live chat box on their website, via email at tradeview@tradeviewforex.com or on their telephone hotline:

- Main Office – +1 345 945 6271

- Direct Phone – +1 345 946 4532

The company’s headquarters are based in the Cayman Islands – Tradeview LTD, Grand Cayman, KY1-1002; 5th Floor Anderson Square, 64 Shedden Rd, PO Box 1105.

Security

Tradeview ensures safety and security by keeping client funds in segregated bank accounts. Furthermore, the company only works with tier 1 banks.

The brokerage also protects its clients from trading and leveraging risks through an automated risk management system, which is available on their trading platforms. These measures ensure that account balances don’t go negative. Moreover, its platforms provide high-tech encryptions, secure logins, and industry-standard data privacy. The broker also conducts regular internal and external company audits, which can be viewed on their website.

Tradeview Verdict

Tradeview offers competitive spreads with low commission and generous leverage across trusted trading platforms. While its CIMA regulation is good, analysts and experts usually advise not to trade with offshore regulated brokers. The limited educational materials may also fail to meet the needs of new traders. Therefore, while Tradeview is a decent broker, we also recommend exploring other forex and CFD providers.

Top 3 Alternatives to Tradeview

Compare Tradeview with the top 3 similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Tradeview Comparison Table

| Tradeview | World Forex | IG | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 3.8 | 4 | 4.4 | 4.3 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $1 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Regulators | CIMA, MFSA | SVGFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA |

| Bonus | Promotional Offer vary. Contact Tradeview for details | 100% Deposit Bonus | – | – |

| Education | Yes | No | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Leverage | 1:400 (CIMA), 1:30 (MFSA) | 1:1000 | 1:30 (Retail), 1:250 (Pro) | 1:50 |

| Payment Methods | 12 | 10 | 6 | 6 |

| Visit | – | Visit | Visit | Visit |

| Review | – | World Forex Review |

IG Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by Tradeview and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Tradeview | World Forex | IG | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | Yes |

| Options | No | No | Yes | Yes |

| ETFs | No | No | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | Yes |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Tradeview vs Other Brokers

Compare Tradeview with any other broker by selecting the other broker below.

The most popular Tradeview comparisons:

FAQ

Is Tradeview regulated?

Yes. Tradeview is licensed and regulated by CIMA under license number 585163. However, CIMA is an offshore regulator.

Tradeview are also regulated by MFSA

Does Tradeview offer a demo account?

Tradeview does offer a free demo account, with access to all its platforms. Users have to input some personal details on the broker’s website to get started.

How much capital do I need trade with Tradeview?

A minimum deposit of $100 is required on the X Leverage account and $25,000 on the Innovative Liquidity Connector.

Is Tradeview a good broker?

Tradeview offers competitive spreads and little to no commission with high leverage across all account types. However, besides offering 60 currency pairs, they offer a relatively limited set of tradable assets.

Is Tradeview a trustworthy broker?

Tradeview maintains good governance under CIMA regulation and conducts regular audits. Client funds are also secured in segregated tier 1 banks. Thus, Tradeview is unlikely a scam and is trustworthy.

Customer Reviews

There are no customer reviews of Tradeview yet, will you be the first to help fellow traders decide if they should trade with Tradeview or not?