Trader's Way Review 2025

Pros

- Decent range of 40+ currency pairs

- Low deposit of $10 for beginners

- Good selection of trading platforms including MT4

Cons

- Limited non-FX instruments

- No US or UK clients accepted

- Lack of educational materials

Trader's Way Review

Trader’s Way is an online ECN broker based in Dominica. The brokerage offers 50 instruments across the MT4, MT5 and cTrader platforms. This review covers, spreads, commissions, the login process and demo accounts. Find out whether you should open an account with Trader’s Way.

Trader’s Way Headlines

The brokerage was established in 2011 and is headquartered in Dominica. TradersWay offers an ECN and VAR model on its accounts and clients can trade with three leading desktop and mobile platforms.

Currently, the brokerage is not regulated but is registered as TW Corp. under the Commonwealth of Dominica. Accounts can be opened from multiple countries like India, China and Canada, but US and UK clients are not accepted.

Trading Platforms

TradersWay clients can download the MT4, MT5 and cTrader platforms.

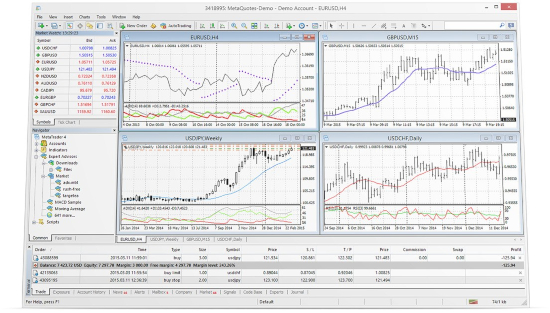

MetaTrader 4

MT4 is an industry-leading platform that allows users to trade in markets with impressive analytical tools. The terminal comes with 9 timeframes, 50 built-in technical indicators, one-click trading, among other features. Once traders have opened an account, they can access the MT4 portal with their login details.

Trader’s Way have added ECN trading to the platform that allows clients to connect directly to the interbank market.

MT4 is available on Windows, MetaTrader Web Terminal, iOS and Android. A macOS version is available using compatibility layer tools i.e. Wine.

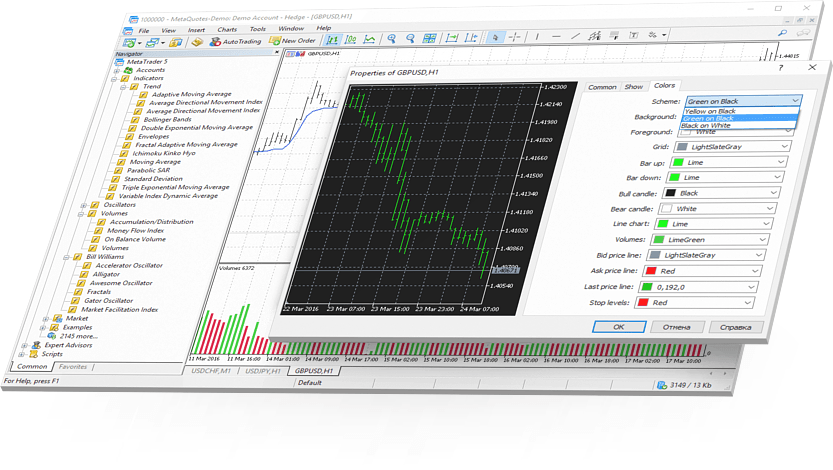

MetaTrader 5

MT5 is a multi-asset platform that offers advanced financial trading functions. The multi-lingual platform offers 80 built-in indicators, up to 100 charts, 21 time-frames, advanced Market Depth feature, and one-click trading. Stop-loss and take-profit orders can also be used to secure profits and minimise losses. In addition, the platform allows for signal trading and hedging.

MT5 is available on Windows, MetaTrader Web Terminal, iOS and Android. A macOS version is available using compatibility layer tools i.e. Wine.

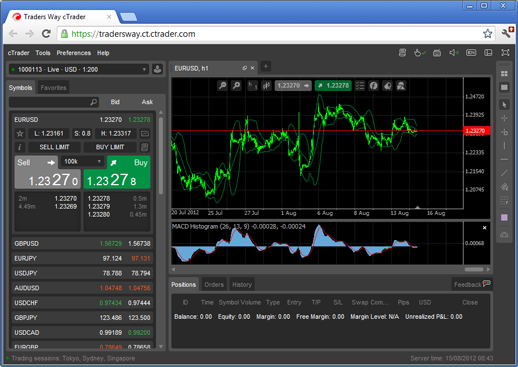

cTrader

TradersWay clients can experience the full power of ECN trading, which cTrader is specifically designed for. The platform takes advantage of fast entry and execution, level II pricing, direct access to liquidity providers, enhanced charting and one-click functionality. cTrader takes away any dealing desk intervention to guarantee a level trading field.

cTrader is available on Windows, Mac, Android and iOS.

Markets

Clients can trade with up to 50 assets across forex, metals and oil and cryptocurrencies. However, indices and stocks, such as the US30, are not available.

- Forex – up to 42 pairs available across major, minor and exotic currency pairs i.e. GBPEUR and USDZAR

- Cryptocurrency – Trade in up to 9 cryptocurrencies i.e. BTCUSD, ETHUSD and LTCUSD

- Commodities – 2 metals and 2 oils available i.e. gold, silver and crude oil

Note instruments vary across each account type. To see the specific assets available on each account, visit the trading conditions page.

Trading Fees

Spreads are variable across all four account types. Spreads start from 0 pips, apart from MT4.VAR, which starts at 0.7 pips. Typical spreads on EURUSD and GBPUSD are 0.5.

The MT4.VAR account is commission-free as it’s already included in the spread, whilst other ECN accounts charge a small commission. MT4.ECN & MT5.ECN require $25 per $1 million turnover and $3 per $100,000 turnover on CT.ECN. Trader’s Way offers cashback on commissions depending on monthly trading volumes.

Users can see swap rates on the MetaTrader trading terminal by visiting Market Watch > Specifications. Swap rates on CT.ECN accounts can be viewed on the broker’s website.

TradersWay Leverage

Maximum leverage of up to 1:1000 is available for clients on the MT4.ECN, MT4.VAR and MT5.ECN accounts. CT.ECN clients are offered 1:500. The margin is 0.1% of the volume of opened positions. Note margin calls can occur quickly even if there are sufficient funds in accounts. A useful margin calculator is accessible on the company website.

Mobile App

Traders Way does not offer a proprietary mobile app. However, MetaTrader mobile apps still offer the same functionalities, forex technical analysis tools and they also come with excellent customer reviews. Thus, you can easily access financial markets and trade from anywhere.

MetaTrader mobile apps, APK and iOS, can be downloaded on the App Store or Google Play.

Deposits & Withdrawals

In order to make a transaction, TradersWay members have to log in to the Private Office and choose the preferred payment method. Deposits can be made in USD, EUR, CAD and GBP and processing times vary:

- Perfect Money – Instant

- Credit/Debit Cards via VLoad – Instant

- Bank Transfer via Abra – 1 to 2 business days

- USD Coin, True USD, Skrill, Neteller, Fasapay – Same day

- Cryptocurrencies Bitcoin, Litecoin, Ether, Ripple, Tether – Same day

Depending on the payment method, clients are subject to variable fees. Payment requests are processed within 48 hours. All withdrawals up to the total deposited amount must be made using the same payment option. The rest can be withdrawn using any payment method.

Demo Account Review

Traders Way offers a free demo account, which offers similar trading conditions to real accounts. Users simply have to visit the registration page, and once you choose an account type, log in to the demo portal. Trial accounts come with fixed or floating spread options. No real-money deposits are needed to open a demo account.

TradersWay Bonuses

Trader’s Way offers a 100% deposit bonus scheme. Members simply need to make a deposit in Private Office and choose the bonus amount, which will automatically be credited into the account on a daily trading volume basis. The deposit bonus is limited to $5,000 per account and is only available on MT4.VAR and MT4. ECN accounts.

The bonus cannot be withdrawn, and simply acts as a cashback or rebate on a portion of commissions. Please be aware of the terms and conditions before claiming any bonuses.

Regulation

TradersWay is unregulated which is a concern as the legal protections afforded to clients will be limited. With that said, the broker is legally registered with the Commonwealth of Dominica as TW Corp. under company number 15690.

Note the broker did receive a cease and desist order by the US State of Missouri in 2016. The broker was alleged to be conducting unlawful business by offering the unregistered purchases of binary options to Missouri residents. Their website made deceptive claims that didn’t disclose its ability to sell binary option contracts. Currently, Missouri investors are prohibited from accessing TradersWay services.

Additional Features

- Webinars – Traders Way offers online webinars on forex strategy, conducted by their Chief FX strategist. Hundreds of YouTube videos can also be accessed on their channel. Unfortunately the broker hasn’t uploaded any webinars for some time.

- Market outlook – A weekly forex market outlook is available on the Trader’s Way website.

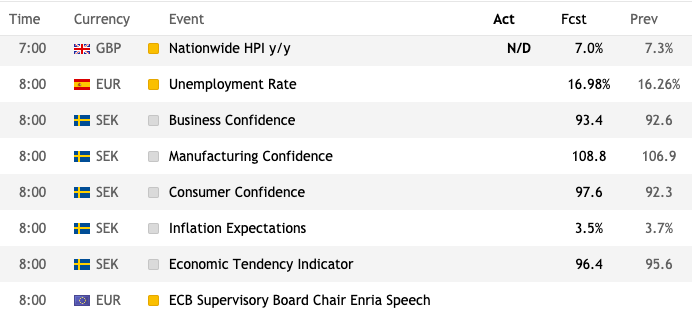

- Economic calendar – Found under Resources, the economic calendar can be useful for forecasting price dynamics. The calendar is updated weekly.

Live Account Types

To sign up with Trader’s Way, you can simply open a live account under the menu bar on the website. The verification process requires you to provide supporting ID documentation. All accounts require a minimum deposit of $10. The broker offers 3 ECN accounts and 1 standard MT4 account:

- MT4.ECN and MT5.ECN – Trade in all markets offered with tight variable spreads. This account provides direct access to the interbank market using the MT4 and MT5 platform.

- MT4.VAR – This is a swap-free account and is the only commission-free option. This account is designed for those who prefer to trade in real market conditions before taking the next step to a professional ECN/STP account. MT4.VAR is perfect for those learning to trade under real interbank market conditions with minimum risk.

- CT.ECN – Only forex and metals are available on this account. It is designed especially for STP/ECN trading. CT.ECN offers Level II market depth and automatic trading with a proprietary algorithmic platform, cAlgo. This account promises minimum slippage, the tightest possible spreads and low latency.

Trading Hours

Trading hours coincide with many of the global financial markets, which are dependent on time zones. Opening hours on forex and commodities markets are 24/5 from Monday to Friday. Trading hours on cryptocurrencies are 24/7. Specific trading hours for each market can also be viewed under Trading Sessions on the broker’s website.

Customer Support

The broker’s back office customer support team are on-hand via the following channels should you encounter any issues with the trading platform not working i.e. the server being down or any off quotes error messages.

The team can be contacted via the “Let’s Chat” box. Alternatively, you can contact customer service on the telephone at +1 849 9370815. A variety of emails regarding specific queries are also available:

- New accounts – sales@tradersway.com

- Customer service – helpdesk@tradersway.com

- Technical support – support@tradersway.com

All inquiries are processed within 24 hours on business days. Customer support can help if you want to delete an account or deposit funds. Note the team cannot advise on trading taxes.

Trader’s Way is registered at TW Corp., 8 Copthall, Roseau Valley 00152, Commonwealth of Dominica.

Security

As Trader’s Way is unregulated, the broker is not subject to strict standards by regulatory bodies. The broker claims to employ AML and KYC policies to prevent money laundering and inappropriate use of funds. Client funds and company money are also said to be segregated.

Trader’s Way does not offer negative balance protection. Customers are not protected from any losses bigger than their original investments.

Trader’s Way Verdict

The forex broker offers competitive spreads with generous leverage and account options that will suit varying skill levels. Unfortunately some negative online reviews do flag scam warnings and the lack of regulatory oversight is a concern. With that in mind, we’d recommend looking at other brokers before opening an account.

Top 3 Alternatives to Trader’s Way

Compare Trader’s Way with the top 3 similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

Trader’s Way Comparison Table

| Trader’s Way | World Forex | Interactive Brokers | xChief | |

|---|---|---|---|---|

| Rating | 1.3 | 4 | 4.3 | 3.9 |

| Markets | Forex, cryptocurrencies, commodities | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $1 | $0 | $10 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | – | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | 100% deposit bonus up to $5,000 | 100% Deposit Bonus | – | $100 No Deposit Bonus |

| Education | No | No | Yes | No |

| Platforms | MT4, MT5, cTrader | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:1000 | 1:1000 | 1:50 | 1:1000 |

| Payment Methods | 11 | 10 | 6 | 12 |

| Visit | – | Visit | Visit | Visit |

| Review | – | World Forex Review |

Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by Trader’s Way and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Trader’s Way | World Forex | Interactive Brokers | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | No | Yes | No |

| Bonds | No | No | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Trader’s Way vs Other Brokers

Compare Trader’s Way with any other broker by selecting the other broker below.

FAQ

Is Trader’s Way regulated?

Trader’s Way is unregulated but registered as TW Corp with the Commonwealth of Dominica under company number 15690.

Does Trader’s Way offer a demo account?

Yes, users can open a free demo account and practice trading strategies without risking real money. Sign up on the broker’s homepage.

How much capital do I need to trade with Trader’s Way?

A small minimum deposit of $10 is required on all accounts. This is a low entry requirement and good news for beginners.

Is Trader’s Way a good broker?

Trader’s Way offers competitive spreads on leading pairs. However, withdrawal reviews from customers have warned against trading with this broker.

Is Trader’s Way a trustworthy broker?

As an unregulated broker, Trader’s Way is not subject to strict standards under regulatory bodies. However, it claims that client funds and company money are kept separately and that it abides by AML and KYC policies. Despite this, we do not deem the broker to be trustworthy given the poor customer reviews.

Customer Reviews

There are no customer reviews of Trader's Way yet, will you be the first to help fellow traders decide if they should trade with Trader's Way or not?