TradeFW Review 2024

Awards

- Best Forex/CFD Provider - Global Banking & Finance Review

- Best Performing CFD Provider - Global Banking & Finance Review

TradeFW Review

TradeFW is an online broker specialising in forex and CFD trading. In this review, we’ll cover all aspects of its services, from customer support to leverage. Plus, we’ll review its mobile trading app, test account, and more. Read on to find out whether TradeFW is the right broker for you.

TradeFW Headlines

TradeFW is an online forex and CFD brokerage that has been operating since 2018, previously trading under the name BO360. The platform markets itself primarily towards European clients based in Italy, Spain, and the UK. Its parent company, iTrade Global, is registered in Cyprus.

TradeFW has received a number of industry awards, including “Best Forex/CFD Provider” and “Best Performing CFD Provider” by Global Banking & Finance Review. The company operates as an ECN and STP broker, serving both retail and professional clients.

As an EU-based firm, the broker is regulated by the Cyprus Securities and Exchange Commission (CySEC). CySEC imposes stringent rules on brokers with the aim of protecting traders. Among other safeguards, it ensures compensation schemes are available to clients.

Trading Platform

MetaTrader 4

TradeFW provides clients with MetaTrader 4 (MT4), the most popular platform for forex and CFD trading. MT4 is renowned for its wide range of features and quick, reliable service. The platform suits traders of all abilities as it is intuitive, easy to use, and comes with a solid variety of technical tools.

It is available as a desktop app (for Windows and Mac PCs), a web-based service, and a mobile app on iOS and Android smartphones.

With TradeFW, users have access to 85 pre-installed trading indicators. Plus, customers can purchase additional indicators and Expert Advisors (automated trading robots) through the MetaTrader market. Other features of the MT4 trading app include:

- One-click trading

- Interactive charts

- Multiple timeframes

- Detailed historical data

- Customisable Indicators

TradeFW does not impose any trading restrictions, allowing clients to hedge, scalp, and use automated trading strategies.

WebTrader

In addition to the desktop service, TradeFW customers can use the web-based platform: WebTrader. This can be accessed from any PC with a browser and internet connection. MT Webtrader is known for being safe to use and dependable, featuring all the same tools available on the desktop platform.

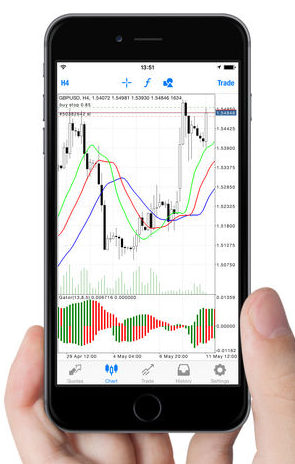

Mobile App

MT4 is available on both iOS and Android tablets or smartphone devices. The mobile app is equipped with interactive charts, hundreds of financial instruments, and a full set of trade orders. This allows TradeFW customers to trade from anywhere in the world.

Products

TradeFW offers over 170 currency pairs and CFDs, as well as some indices, metals, commodities, and stocks:

- 10+ ETFs

- 120+ CFDs

- 10+ Indices

- 2 precious metals

- 30+ currency pairs, including majors, crosses, and exotics

TradeFW’s range of currency pairs and CFDs is fairly typical for an online forex broker and will be suitable for most traders. However, the platform does not support cryptocurrencies like Bitcoin.

Spreads & Fees

TradeFW’s spreads are generally higher than other brokers. The standard account starts at 2.7 pips, larger than the industry average of around 1.5 pips. Plus, spreads on the popular EURUSD currency pair start as high as 3.2 pips. The TradeFW Gold and VIP accounts have spreads starting at 2 pips and 1.7 pips respectively.

Spread data is not listed clearly on TradeFW’s website – clients have to calculate it themselves. This lack of transparency isn’t particularly encouraging. The large spreads possibly imply that TradeFW has liquidity issues (or, as an STP broker, works with individual providers with a significant markup). Larger brokers, like Pepperstone, can offer tighter spreads because of their strong partnerships with liquidity providers.

TradeFW does not take a commission on forex, indices, or commodities. However, for CFDs on stocks, the platform charges a fee of 0.1% (or a minimum of 10 units of the base currency).

The broker’s commission rates and high spreads mean that it is not the most cost-effective broker. However, TradeFW does not charge commission on deposits or withdrawals, unlike some of its competitors.

Leverage

Leverage up to 1:30 is available depending on the asset being traded. While other brokers do offer larger leverages, which could be attractive to some, highly leveraged positions are riskier. Generally, limits of 1:30 are considered sensible, in line with many global regulators’ recommendations.

- Forex – Up to 1:20 or 1:30, depending on the pair

- Commodities – Up to 1:10

- Indices – Up to 1:20

- CFDs – Up to 1:5

- ETFs – Up to 1:5

Payments

Deposits

TradeFW accepts deposits made by credit card, wire transfer, or using an e-Wallet. The broker advertises zero fees on deposits, but upon further reading of their legal documentation it appears that they charge a 3% handling fee “at their discretion”. Clients can make payments via:

- Visa, Mastercard, or Maestro – Instant

- Bank wire transfer – 3 – 5 business days

- Trustly – 1-2 business days

- Sofort – 1-2 business days

- Neteller – Instant

- Skrill – Instant

The minimum deposit is 250 currency units (EUR/USD/GPB/AUD/CAD/SGD) for the Standard account. This is a larger deposit than most other online forex brokers require. Accounts can have base currencies of EUR or USD only, so deposits made in GBP/AUD/CAD/SGD will be converted using the standard conversion rate on the day of deposit. There may be conversion charges.

Withdrawals

TradeFW has a strong service when it comes to withdrawals. In contrast with other brokers in the market, TradeFW does not charge commission. It also aims to process customer funds within one working day, which is faster than most brokers. However, traders should be aware that, in line with anti money laundering regulations, withdrawals must be made via the same method as deposits.

Test Account

Unlike many of its competitors, TradeFW does not offer a demo account. These can be a great way for new and experienced traders to test strategies. Particularly if you’re new to the trading platform, it’s important to trial executing positions before using real funds. It’s disappointing that TradeFW lacks this service.

Additional Features

TradeFW has a fairly minimal range of educational tools available, with a few web pages explaining the basics of CFD and forex trading, as well as a glossary of trading terms. It also provides a blog that can be accessed via the company homepage.

The broker claims to run a series of trading webinars, although none are currently scheduled on their calendar. Unusually for a broker, TradeFW does not have any technical tools available, such as a pip calculator or trading calendar, but some of these features can be found on the MT4 platform.

Account Types

TradeFW’s retail clients have access to three tiers of account:

- Standard Account – This type of account has a minimum deposit of $250. Spreads start at 2.7 pips, with a maximum leverage of 1:30. The minimum contract size is 0.01.

- Gold Account – The most popular account for retail traders. Clients can trade with tighter spreads than the Standard Account, starting at 2 pips. There is a minimum contract size of 0.05.

- VIP Account – This account offers spreads as low as 1.7 pips. The minimum contract size is 0.1.

TradeFW also offers a professional account with lower spreads and high leverages. The broker uses the STP model on this service and does not act as a market maker.

Security

As a CySEC-licensed broker, TradeFW has a legal duty to keep its clients and their investment capital safe. This means that all funds are housed in top-tier EU banks (such as the Bank of Cyprus), and client money is segregated from that of the business’. The broker is also a member of the ICF (Investor Compensation Fund), which means capital is insured in the case of an extraordinary event, such as broker liquidation.

Furthermore, TradeFW complies with risk disclosure guidelines, adequately displaying this across their homepage.

Customer Support

TradeFW’s customer service team is contactable 24 hours a day, 5 days a week (Monday – Friday). Support is available in English, Italian, or German.

The support team can be reached by:

- Contact Number – UK (+44) 203 097 21 49, Italy (+39) 023 057 90 40, Germany (+49) 302 099 447 07

- Email – support@tradefw.com, backoffice@tradefw.com (Head Office)

- Online feedback form – can be found on the ‘Contact Us’ page

- Head office contact number – (+357) 25 262 043

- Live chat

Trading Hours

TradeFW follows standard trading hours. These vary by asset but are 24 hours a day, Monday – Friday for forex. The company website lists information about trading holidays when hours may be reduced.

Benefits

- CySEC-regulated broker, meaning client funds are secure

- No trading restrictions, clients can hedge and scalp

- Automated trading enabled

- Negative balance protection

- Good customer reviews

- Fast withdrawals

- Secure login

Drawbacks

- High spreads & fees

- No cryptocurrency trading

- Limited educational resources

- No test/demo account

TradeFW Verdict

TradeFW is a solid forex and CFD broker, with a good range of products across stocks, currency pairs, and ETFs. The broker provides access to the MT4 platform, complete with the iOS/Android app for mobile trading. As a legitimate CySEC-regulated broker, TradeFW is not considered a scam, though the platform’s leverage limits, high spreads, and lack of a demo account may put some traders off.

FAQs

Does TradeFW Have A Mobile App?

Customers can use the mobile version of the MT4 trading platform, which allows traders to check in on their account and execute orders. The app is available on iOS and Android devices.

Is TradeFW A Regulated Broker?

TradeFW is licensed by CySEC, the regulatory body of Cyprus. This ensures that client funds are well protected by providing investor insurance and segregated accounts.

What Leverages Does TradeFW Offer?

TradeFW has leverage limits of 1:2 to 1:30 on most currency pairs. Leverage up to 1:5 is available for CFDs and ETFs. With that said, trading on margin is risky, so novice traders should consider whether this strategy is right for them.

Can I Trade Bitcoin With TradeFW?

TradeFW does not support cryptocurrency trading on its platform, including for Bitcoin.

How Can I Contact TradeFW’s Customer Support Team?

The contact number of TradeFW’s head office in Cyprus is (+357) 25 262 126. Otherwise, they can be reached via email at support@tradefw.com. A live chat facility can also be accessed via the broker’s homepage.

Top 3 Alternatives to TradeFW

Compare TradeFW with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

TradeFW Comparison Table

| TradeFW | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, ETFs, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | None | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 9 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by TradeFW and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TradeFW | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

TradeFW vs Other Brokers

Compare TradeFW with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of TradeFW yet, will you be the first to help fellow traders decide if they should trade with TradeFW or not?