TradeDirect365 Review 2026

See the Top 3 Alternatives in your location.

Pros

- Access to the MT4 desktop, web and mobile platform

- Free demo account

- Full range of investments with a particularly strong suite of Australian stocks

Cons

- No copy trading service

- CloudTrader has an outdated interface

- Market research trails the best brokers

TradeDirect365 Review

TradeDirect365 is an ASIC-regulated CFD trading broker. To help you decide whether to make an account with TD365, this review will cover the platforms and apps available, trading instruments, demo accounts, minimum deposits, and fees. Read on for our verdict on TradeDirect365.

Company Details

Founded in 2014 by professional trader Davin Clarke, TradeDirect365 offers fixed but tight spreads on a range of assets including forex, indices, and commodities. There is also no minimum deposit, making it a good option for traders looking for low-cost CFD trading.

The company is registered with the Australian Securities and Investment Commission (ASIC) and holds an Australian Financial Services Licensee (AFSL). The global entity is also authorized by the Securities Commission of the Bahamas (SCB).

Client funds are held in segregated accounts and the broker offers negative balance protection.

Assets & Markets

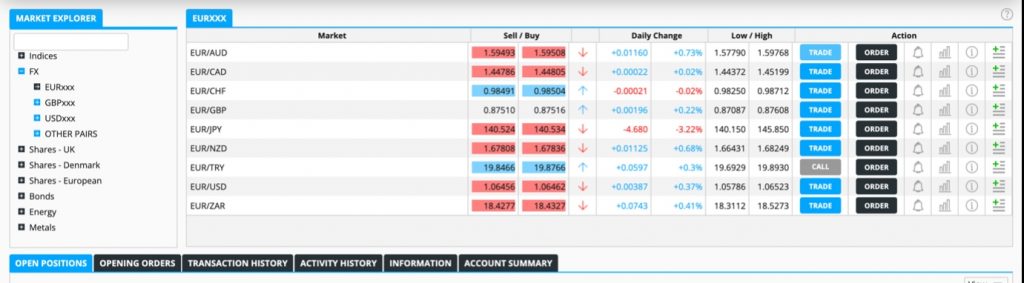

Trade365 offers 500+ instruments, available to trade as CFDs:

- Cryptocurrencies – Trade 10 cryptos including Bitcoin and Ethereum

- Commodities – Speculate on the price of Gold, Silver, US Crude Oil, and UK Brent Crude Oil

- Indices – Trade six global indices including Australia 200, Wall Street 30, UK 100, and Germany 30

- Forex Pairs – Trade 30+ major, minor and exotic currency pairs such as the EUR/USD, USD/JPY, and AUD/USD

- Stocks – Access 400+ Australian stocks, 200+ UK and US stocks and 100+ European stocks. Companies include Amazon, Deutsche Bank, and CommBank

Note, access to instruments varies by platform. Day traders cannot trade cryptocurrencies or stocks on the MT4 terminal.

Platforms

TradeDirect365 offers MetaTrader 4 and a proprietary web and app-based CFD trading platform called CloudTrader. Both platforms are available to use or download directly from the TD365 website.

MT4 was created by MetaQuotes Software in 2005. Beginner investors can get started with the easy-to-use interface with popular technical indicators, nine time frames, and access to a community of other users. Experienced traders can take advantage of the Expert Advisor feature to program trading bots.

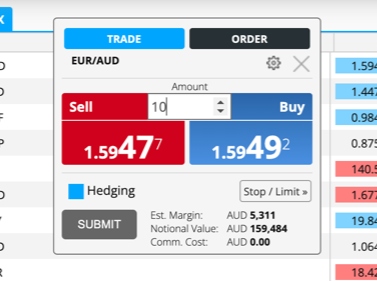

The CloudTrader terminal is simple to use with one-click trading and guaranteed stop-loss orders. The broker offers more competitive trading conditions on this platform, including fixed spreads, lower commission fees, and a smaller minimum order requirement. Additionally, day traders can access stock and crypto opportunities, which are not available on MT4.

How To Place A Trade On CloudTrader

- Log in to your TradeDirect365 account

- Select the asset you wish to trade

- Input the position parameters. This includes the size of the order and any stop loss orders

- Press ‘submit’ to open the position

- Monitor the activity of your open trade using the bottom widget

- When you are ready to close the position, press the X under the ‘close’ column, and then ‘submit’ in the window that pops up

Spreads & Fees

Spreads and fees differ between MT4 and CloudTrader. The broker’s CloudTrader terminal follows a fixed spread model, which makes it easier for day traders to monitor costs and profits during periods of significant market volatility. The MT4 platform uses a floating spread system, which may suit experienced traders.

The ASX200 can be traded with a fixed spread of 0.9 pips on CloudTrader and from 1 pip on MT4. The EUR/USD currency pair is offered at 0.6 pips on CloudTrader and from 0.3 pips on MT4. These spreads are competitive and lower than most online brokers.

There is also a commission fee of $5 or 0.07% on stocks valued above $7,150 when using CloudTrader and $1.50 per lot with MT4. There is a monthly fee (AUD$27.50) to access Australian share CFDs, though this is waived when 2 round turn trades are executed within a month.

Swap fees apply for overnight positions. These are calculated using the interbank interest rate + a 2.5% finance fee.

A full trading fee schedule is available on the broker’s website by instrument/platform.

TradeDirect365 Leverage

Day traders can access leverage up to 1:30 with the Australian-based TradeDirect365. This includes a maximum 1:30 leverage on major currency pairs and 1:20 on global indices. This is in line with the regulations set out by the ASIC.

Professional traders can access leverage up to 1:200. Investors signed up with the SCB-registered entity can also access leverage up to 1:200.

Mobile Apps

Both platforms are available as mobile apps. Day traders can access all the features of the desktop terminals optimized for smaller screens.

The applications have intuitive dashboards and stable order executions. The TradeDirect365 bespoke application is the most clutter-free option, making it the best fit for beginners.

Prospective traders can also spend time in the demo environment to see which app they prefer.

Payment Methods

Deposits

There is no minimum deposit requirement to open an account with TradeDirect365, making it accessible to all investors.

Deposit methods include bank wire transfers, credit/debit cards, POLi, and TransferWise.

On the downside, all payments must be in AUD. Bank transfers are the only deposit method available to international customers, so currency conversion fees may apply. International bank transfers have a maximum fee of 20 AUD.

Deposits can take 3 to 5 working days for non-Australian residents and 1 working day for traders in Australia. This is significantly longer than many brokers, which typically offer near-instant account funding.

Day traders can open an account in AUD, USD, EUR, or GBP.

How To Make A Deposit Using Bank Wire Transfer

Traders can send funds directly through mobile banking for the quickest transaction times. TradeDirect365 clients must include their unique account number as the reference for correct allocation.

- BSB Number: 034-008

- Bank Account Number: 188015

- Bank Name: Westpac Banking Corporation

- Account Name: Finsa Pty – Trade Direct 365 Client AUD

- Bank Address: 115 Queen Street, Brisbane, QLD 4000, Australia

Withdrawals

The only method of withdrawal is bank wire transfers. There is a fee of 15 AUD, which is a significant disadvantage to alternative brokers.

Withdrawals can take up to one working day.

TD365 Demo Account

Demo accounts are available on both the CloudTrader and MetaTrader 4 platforms. Simply create an account with TradeDirect365 to get login details for each terminal.

The CloudTrader demo account provides users with $10,000 in virtual funds. The MT4 paper trading profile provides $50,000 in virtual funds.

Deals & Promotions

TD365 does not offer any financial rewards or bonus incentives to new or existing retail investors. This is aligned with ASIC regulations so not something that will be introduced soon.

Regulation & Licensing

TradeDirect365 is regulated by the Australian Securities and Investment Commission and has been since 2016. The ASIC is a trusted regulatory body that enforces strict rules on its licensees to ensure traders are protected. This includes keeping clients’ funds separate from company capital, having an anti-money laundering policy, and offering negative balance protection to retail investors. The ASIC also handles complaints regarding the broker.

TD365.com, a registered name of Trade Nation Ltd, is also authorized by the Securities Commission of the Bahamas (SCB), SIA-F216. This entity serves global traders, and while not as well-regarded as the ASIC, it is a promising sign that the brokerage is trustworthy.

Note, clients from the USA are not accepted.

Additional Features

TradeDirect365 uploads informative blog posts under the title ‘The Secrets Of CFD Trading’. These cover specific indexes, how to use certain indicators, information and tips on trading commodities and metals, and much more. There are currently 20 blog posts covering a range of topics.

The broker also provides eight videos on its YouTube channel and links on the website. These are helpful videos providing tips on how to trade CFDs. Examples of videos include ‘how to customize your trading charts’ and ‘how to place a stop-loss order’.

In addition, there is a glossary page for some of the most popular investing phrases, such as ‘gapping’ and ‘increment size’. There are also some useful tools available to day traders such as dividend projections, upcoming market expiry times, and changes to trading hours.

The only major absence offered by an increasing number of brokers is copy trading, which is a particularly useful tool for beginners.

TradeDirect365 Account

There is just one CFD trading account available for all TradeDirect365 retail traders. However, the key differentiator is the choice of platform; MT4 or CloudTrader, which provides a different trading experience.

MetaTrader 4

- CFD and FX trading

- 24/5 customer support

- Variable spread pricing model

- Minimum order size 0.01 lots

CloudTrader

- CFD trading

- 24/5 customer support

- Minimum order size $0.10

- Fixed spread pricing model

Single Currency CFD Account

A unique feature offered by TradeDirect 365 is the single currency CFD profile. This account uses a money denomination of the CFD ’stake’ rather than reflecting the market being traded. For example, CFD contracts on the S&P 500 would traditionally be traded in USD regardless of a user’s account currency.

For day traders, this means there are no costly, currency conversion fees, or admin required to convert a P&L back to an account denomination. Additionally, users can benefit from easier account management based on a home currency rather than needing to work in foreign monetary values.

Note, a professional account is also available upon request. This offers higher leverage, no negative balance protection, and competitive fees.

Trading Hours

Daily trading hours differ on the market and asset being traded. Forex pairs are typically available from 23:00-21:00 (GMT), whereas stocks and indexes are open in line with their local market.

Each month the TradeDirect365 website is updated to inform clients of market expiries and closures. To keep positions open after the stated expiry, contact the broker’s customer support team.

Customer Support

Customer support is available 24/5, Monday 7 AM to Saturday 7 AM (GMT). This includes via email and phone:

- Email – support@TradeDirect365.com.au

- Phone – 1 800 886 514 (AU residents) or 61 2 8310 4713 (international)

- Office Address – Level 17, 123 Pitt Street, Sydney, NSW 2000

There is also a live chat service, available on the broker’s website and via the platform. When we tested the live chat feature, we received a response within two minutes, which is competitive vs alternative brokers.

Security & Safety

Retail investors can trade with a guaranteed stop, meaning risks are minimized. The MT4 terminal also encrypts all data transmissions so transactions cannot be hacked.

It is also worth implementing additional security protection measures such as two-factor authentication or one-time passwords on the MT4 platform.

TradeDirect365 Verdict

TradeDirect365 has built a strong reputation. It offers a range of financial instruments with tight and fixed spreads. But while the broker accepts clients from many countries, it is the best fit for Australian traders due to the local payment methods available. The most competitive fees are also found on Australian trading assets.

FAQs

Is TradeDirect365 A Good Broker For Day Trading?

TradeDirect365 is a fairly good broker for day trading. It offers tight spreads and fast order executions, both of which can help protect a trader’s profit margin.

Is TradeDirect365 A Trusted Broker?

Yes, as TradeDirect365 is regulated by the ASIC and has been since 2016, it is a trusted broker. Many customer reviews, alongside our experts’ experience, are also positive.

Does TradeDirect365 Offer Halal Trading?

TradeDirect365 does not offer a halal account. This is a downside to many competitors which cater to Muslim traders.

Can I Use Bitcoin To Make Deposits To My TD365 Account?

You can only make deposits to your TradeDirect365 account in AUD. This is a notable drawback as many brokers now accept Bitcoin payments.

Does TradeDirect365 Have A Mobile App?

TD365 has a mobile app available on Android and Apple devices. MT4 is not currently available on the Apple App store, so traders using an Apple device should consider the CloudTrader platform.

Does TradeDirect365 Have A Web Platform?

Yes – CloudTrader and MT4 are available via all major web browsers. There is no download requirement.

Best Alternatives to TradeDirect365

Compare TradeDirect365 with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

TradeDirect365 Comparison Table

| TradeDirect365 | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 3 | 4.3 | 3.6 |

| Markets | CFDs, Stocks, Indices, Forex, Commodities, Cryptocurrencies | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | ASIC, SCB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Anniversary Bonus |

| Platforms | MT4 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:200 | 1:50 | 1:200 |

| Payment Methods | 5 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by TradeDirect365 and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TradeDirect365 | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

TradeDirect365 vs Other Brokers

Compare TradeDirect365 with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of TradeDirect365 yet, will you be the first to help fellow traders decide if they should trade with TradeDirect365 or not?