TIO Markets Review 2024

Pros

- The company's 24/7 customer service availability is in line with some of the top brokerages that I have reviewed

- Another major advantage for me is the free access to Trading Central, an excellent charting and analysis tool

- I have found fees to be pretty competitive with TIO Markets, averaging as low as 0.2 pips for GBP/USD on the VIP account

Cons

- Leverage rates with the UK branch are limited to a maximum of 1:30, which may feel restricting for experienced traders

- Compared to major competitors, TIO Markets' educational resources are notably limited

- Most traders will be registering with the global branch, which is regulated offshore and will not offer any robust fund safeguarding measures

TIO Markets Review

TIO Markets offers subscription-based accounts on the MT4 and MT5 desktop platforms and mobile apps, as well as PAMM solutions for investors. Before you register and login, take a look at this broker review for minimum deposits, withdrawals, bonus deals, and more. Find out if TIO Markets is a safe choice.

TIO Markets Overview

TIO Markets Limited is an online brokerage registered in Saint Vincent and the Grenadines. TIO Markets UK Ltd is registered in the UK and regulated by the Financial Conduct Authority (FCA).

With over 40 years of experience, the broker provides a range of CFDs and FX instruments across the MetaTrader platforms. TIO Markets offers commission-based trading as well as unique subscription accounts and educational tools for beginners.

Platforms & Tools

4 / 5MetaTrader 4

TIO Markets offers the MT4 trading platform as the standard option for clients. There’s plenty on offer for traders who use automated trading with Experts Advisors, as well as a host of charting tools and analysis features. Buy, Sell, Stop Limit, and Sell Stop orders are also available on a customisable interface, which includes 30 pre-loaded indicators and 9 timeframes.

MT4 is only available to download on Windows PCs, so those using MacOS operating systems may wish to use MT5 or WebTrader.

MetaTrader 5

MT5 offers endless possibilities for professional trading, with advanced analysis features and access to superior tools, including Level II pricing and a multi-thread strategy tester. MT5 also comes with a wider range of indicators, graphical objects, and timeframes than MT4.

MT5 is suitable for both Windows and Mac PCs.

WebTrader

MetaTrader’s WebTrader is ideal for quick and convenient access to trading markets without any software installation. Although the WebTrader has limited features compared to the desktop versions, users still get the same powerful experience with enough tools to support automated trading.

Assets & Markets

2 / 5You can trade 120+ instruments at TIO Markets, including over 45 currency pairs, 3 cryptocurrency pairs, a selection of precious metals and energies, 10 renowned stock indices, and a wide range of global stocks. This review was impressed with the breadth of trading assets available.

Fees & Costs

4 / 5Floating spreads at TIO Markets are fairly competitive, with major pairs like EUR/USD around 0.4 pips.

Commissions are charged with the VIP, Standard, and Signature accounts, starting from $0.02 round turn per 0.01 lots. The VIP Black account is commission-free, but there is a monthly subscription charge of $49.95 per month.

There’s also a $30 dormancy fee following three months of inactivity.

TIO Markets Leverage

The maximum leverage available for all accounts is 1:200. Higher leverage is also available upon request. A breakdown of margin requirements for all the assets is listed on the trading specifications page on the website.

Mobile Apps

The MetaTrader platforms are both available as apps on iPhone and Android devices. Traders can manage and place trades easily whilst on the move. Charting features are slightly limited in the mobile apps, however as far as mobile trading goes, the MetaTrader apps are superior to most mobile platforms.

Deposits & Withdrawals

Deposits are free and can be made via bank wire transfer, credit card, cryptocurrencies, and e-wallets. The minimum deposit is $50 for all methods apart from cryptos. All methods are processed within 1 working day, apart from bank wire which can take up to 5 working days.

The same methods are available for withdrawals and are processed within 1 working day for cards, cryptos, and e-wallets, and 5 working days for bank wire. In most cases, withdrawing over $50 is free, but there are some charges for transactions below $50:

- Crypto – ETH 0.003, BTC 0.0004, TIOx 50, USDT 1.5

- Bank wire – $25

- Credit card – 5%

- E-wallet – 5%

Demo Account

You can create a demo MT4 or MT5 account from within the client portal. Demo accounts are particularly useful for beginners who want to familiarise themselves with the platform and trading features before creating a live account. Demo accounts at TIO Markets only expire following 30 days of inactivity.

TIO Markets Bonuses

TIO Markets does not currently offer any welcome no deposit bonus deals or promotions. With that said, check out the broker’s website or social media pages for any upcoming deals and competitions.

Regulation & Trust

3 / 5TIO Markets Ltd is registered in Saint Vincent and the Grenadines. TIO Markets UK Limited is regulated in the UK by the Financial Conduct Authority (FCA), under license number 488900.

The strict UK regulations ensure that TIOMarkets provides a strong level of fund safety for clients. This includes negative balance protection and segregated bank accounts for client money. That said, it is unlikely that this level of protection is provided for clients registering with the offshore entity.

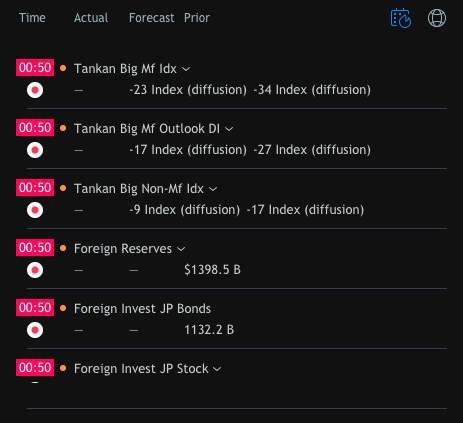

Additional Features

TIO Markets has a decent education centre containing an economic calendar, blogs, webinars, and a forex glossary. The blog is particularly comprehensive and is regularly updated with CEO newsletters, daily market analysis, and educational forex articles.

Account Types

TIO Markets offers four accounts, which use a commission or subscription-based structure. Standard features across all accounts include a minimum trading volume of 0.01 lots, access to over 120 instruments, and negative balance protection.

- Standard – $6 commission per lot, free sign-up

- Signature – $4 commission per lot, free sign-up

- VIP – $2 commission per lot, $24.95 per month, raw spreads

- VIP Black – $0 commission per lot, $49.95 per month, raw spreads, advanced education, TioShield (refunds on losing trades)

Trading Hours

Forex is a 24-hour global market, but server times for specific instruments vary. These can be found on the MT4 and MT5 platforms once you have registered for an account.

Customer Support

3.5 / 5Enquiries can be made using the online contact form, by emailing support@tiomarkets.com, or by clicking on the live chat logo. The live chat service was fairly responsive when tested. There’s also a number of active social media pages that you could follow for the latest news, including LinkedIn and YouTube.

Safety

Client data on the MetaTrader platforms is kept safe in encrypted servers, with additional digital ID protocols in place. The website could do with a little more transparency around security within the client portal.

TIO Markets Verdict

The subscription accounts on offer at TIO Markets offer something different while the raw spreads and zero commissions may entice experienced traders. For a low minimum deposit, VIP Black users also get access to TioShield insurance, among other attractive features. Overall, TIO Markets offers an interesting alternative to the standard offering found at most online trading brokers.

Top 3 Alternatives to TIO Markets

Compare TIO Markets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

TIO Markets Comparison Table

| TIO Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.9 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:200 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by TIO Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TIO Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

TIO Markets vs Other Brokers

Compare TIO Markets with any other broker by selecting the other broker below.

The most popular TIO Markets comparisons:

FAQ

Is TIO Markets safe or a scam?

TIO Markets Ltd is registered in Saint Vincent and the Grenadines. TIO Markets UK Ltd is registered in the UK and regulated by the FCA, a highly recognised financial regulator. The broker therefore appears to be legitimate, but traders should always be mindful of any entities that are registered offshore.

How can I contact TIO Markets?

TIO Markets does not have a telephone number, however, they can be reached via email – support@tiomarkets.com, or live chat.

Is TIO Markets regulated in Cyprus?

TIO Markets is not currently regulated in Cyprus, but it is regulated in the UK by the FCA.

Does TIO Markets accept UK clients?

Yes, TIO Markets provides its services to residents of the United Kingdom.

Does TIO Markets offer a welcome no deposit bonus?

At the time of writing, TIO Markets does not offer any welcome bonuses, including no deposit bonus deals, competitions, and promo codes.

Customer Reviews

There are no customer reviews of TIO Markets yet, will you be the first to help fellow traders decide if they should trade with TIO Markets or not?