TeleTrade Review 2024

Awards

- Best Forex Broker Europe 2017 - Capital Finance International

- Best CFD Broker Europe 2015 - Global Banking & Finance Review

- Best Forex Customer Service Broker Europe 2015 - Global Banking & Finance Review

- Best Trading Education Provider Europe 2014 - International Finance Magazine

- Best Forex Broker in Europe 2014 - Global Financial Market Review

- Best Trading Platform Southern Europe 2014 - Global Banking & Finance Review

TeleTrade Review

TeleTrade offers forex and CFD trading through ECN and NDD accounts. This broker review explores the minimum deposit requirements and the registration process, as well as additional features including economic calendars, news and bonuses. Find out whether to log in and start trading.

TeleTrade Details

Established in 1994, TeleTrade is an EU-licensed CFD and forex broker, regulated by the Cyprus Securities and Exchange Commission (CySEC). Over the years TeleTrade has picked up multiple international awards while building a substantial client base.

The multi-asset broker caters to retail and professional clients offering the award-winning MetaTrader platforms as well as the group’s own copy-trading solution – TeleTrade Invest.

TeleTrade’s forex and other trading products are available to clients worldwide, from Ukraine and Russia to Greece, Romania Malaysia, the Philippines, Qatar, Vietnam and Egypt.

MetaTrader Platforms

This review was pleased to see TeleTrade offers both MetaTrader 4 and MetaTrader 5 platforms, which can be downloaded onto desktop PCs, or accessed straight from an internet browser. The MetaTrader suite offers powerful multi-asset trading, suited to different investment styles and experience levels.

Seasoned traders may prefer MT5, which offers a wider range of technical indicators, as well as other advanced features such as Depth of Market view, an economic calendar, and an embedded community chat.

The MT4 MultiTerminal desktop app is also available for investors or traders who work with multiple accounts simultaneously from Mac or Windows computers.

Markets

Traders can access over 60 major, minor, and exotic currency pairs at TeleTrade, as well as 19 cryptocurrency coins. There’s also a wide range of CFDs available, including agricultural commodities, precious metals and energies, plus dozens of global indices and stocks.

Price List

TeleTrade offers tight ECN spreads with the MT5 account, starting from 0.2 pips for EUR/USD. However, with the Standard MT4 account, spreads are around 1.6 pips for the same pair.

Commission-free trading is available with the Standard MT4 account, but there is a 0.007% and 0.008% commission with the NDD and ECN accounts respectively.

Other fees include swap charges on overnight positions and a €50 inactivity fee on accounts left inactive for 3 months.

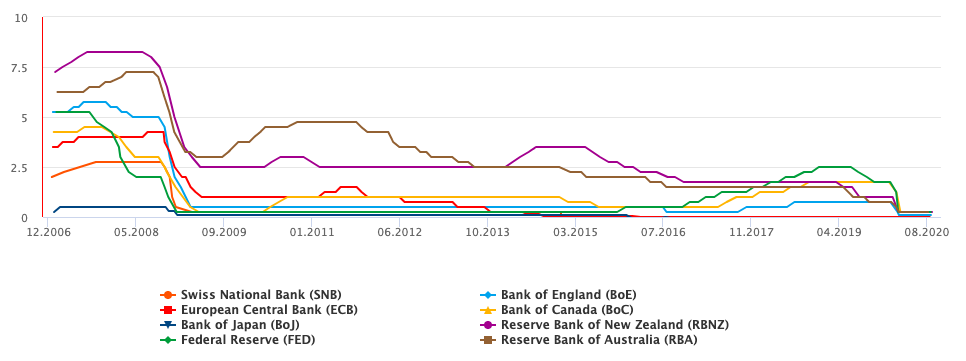

Leverage

Maximum leverage of 1:500 is available for professional clients. Otherwise, leverage limits for retail clients range between 1:2 and 1:30 depending on the asset traded. Margin requirements are provided on the website.

Mobile Apps

TeleTrade offers a proprietary mobile app, TeleTrade Analytics, which provides detailed market analysis, an economic calendar, news, videos, and more. The app can be installed from the App Store or Google Play.

MT5 for mobile is also available for iPhone and Android users, offering real-time quotes on both live and demo accounts. Users can trade directly from the interactive charts and view complete trade history. There’s also a good range of custom indicators and advanced order types available.

Payment Methods

Deposits

Funding in EUR or USD is available via bank wire transfer, credit/debit cards, and e-wallets including Skrill, Neteller, and Fasapay. Most methods are processed within minutes, except wire transfer which can take 2 – 3 working days. Some fees also apply:

- Neteller – 3.9% + $0.29 transaction fee (min $1)

- Wire transfer – according to bank fees

- Fasapay – 0.5% (max $5)

- Visa/Mastercard – 3.5%

- Skrill – 2.9%

Withdrawals

All withdrawal methods generally take 1 – 2 business days to process. The following fees apply:

- Non-SEPA wire transfer – 0.1% (min $55 – max $200) + intermediary bank fees

- SEPA EUR wire transfer – €1 + bank commission

- Visa/Mastercard – 2.35% + €1/$1.30

- Fasapay – 0.5%

- Neteller – 2%

- Skrill – 1%

Upon login, head to your personal account page to make deposits and withdrawals.

Demo Account

TeleTrade offers a demo account with a default $50,000 virtual balance, providing access to real-time trading on over 200 instruments. Demo accounts allow new traders to get acquainted with platform features and test trading strategies in a simulated environment.

Unfortunately, demo accounts at TeleTrade are archived after 14 days, which is a little disappointing given that most other brokers offer a minimum 30 day trial period.

TeleTrade Welcome Bonus

Aside from the VIP program which offers spread discounts and other perks, TeleTrade does not offer any other bonus deals, promotional codes, or contests. This is not uncommon for CySEC-regulated brokers.

If TeleTrade does change tack and introduce no deposit bonuses, make sure to check the terms and conditions before you sign up and start trading.

Regulation

TeleTrade-DJ International Consulting is registered as a Cyprus Investment Firm (CIF) and licensed by the Cyprus Securities and Exchange Commission (CySEC), under license number 158/11. TeleTrade also operates under the Markets in Financial Instruments Directive (MiFID) which regulates financial services in the EU. In addition, the broker operates in Asia and beyond, including Armenia and Ghana.

TeleTrade ensures the safety of client funds in several ways, including segregated client accounts, negative balance protection, and protection through the Investor Compensation Fund. Traders should feel safe when depositing their funds at TeleTrade.

This review is comfortable that the TeleTrade group of companies are trustworthy.

Additional Features

Additional educational resources include free forex webinars from investment experts, tutorials for beginners, and daily market video briefings. A useful interactive chart and economic calendar also allow you to keep track of current prices and global news. There are some useful forex calculators available as well, including margin and pip calculators.

TeleTrade also offers its own copy trading platform, TeleTrade Invest, which allows investors to mirror the positions of experienced traders.

Accounts

TeleTrade offers 3 account types that determine access to the MetaTrader platforms: Standard (MT4), NDD (MT4), and Real ECN (MT5). All accounts require a minimum deposit of 100 USD/EUR and a minimum contract size of 0.01 lots. Hedging is also allowed in all three accounts.

The Standard MT4 offers the highest spreads starting from 1.1 pips but is commission-free (apart from 0.1% on CFDs on US stocks). The other two commission-based accounts offer tighter spreads.

Benefits

Trading with TeleTrade comes with multiple benefits:

- Copy trading platform and analytics app

- Commission-free trading available

- Decent product list

- CySEC-regulated

Drawbacks

TeleTrade could improve its rating in the following areas:

- US clients not allowed

- No bonuses or promotions

- 14-day expiry for demo accounts

Trading Hours

Session times for precious metals are 00:05 – 22:55 (Monday to Friday) UTC+2. For cryptocurrencies, trading times are 00:00 – 24:00 (Monday to Thursday) and 00:00 – 22:59 (Friday) UTC+2. All other asset opening times vary and are provided in the trading conditions.

Customer Support

The best way to reach customer support is via the live chat service; the chat logo at the top of the website will take you through to the online assistant service, which is fast and helpful. Alternatively, you can contact the broker via their email or telephone number: support@teletrade.eu or (+357) 22314160. There are also additional EU support offices located in Portugal, Hungary, Italy, and Poland.

Safety

The MetaTrader platforms are guarded with 128-bit encryption technology as well as two-factor authentication. Communication between client computers and the servers is also fully encrypted upon login to the Personal Area.

TeleTrade Verdict

TeleTrade is a longstanding EU-regulated broker offering competitive No Dealing Desk and ECN accounts on the MT4 and MT5 platforms. Traders can access hundreds of diverse assets with a $100 minimum deposit. Investment opportunities are also available with the copy trading platform, making this broker a good all-round option.

Top 3 Alternatives to TeleTrade

Compare TeleTrade with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

TeleTrade Comparison Table

| TeleTrade | IG | World Forex | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4 | 4.3 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $1 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Regulators | CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA |

| Bonus | – | – | 100% Deposit Bonus | – |

| Education | No | Yes | No | Yes |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:250 (Pro) | 1:1000 | 1:50 |

| Payment Methods | 7 | 6 | 10 | 6 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

World Forex Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by TeleTrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TeleTrade | IG | World Forex | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

TeleTrade vs Other Brokers

Compare TeleTrade with any other broker by selecting the other broker below.

FAQ

Does TeleTrade offer any no deposit bonuses?

Due to CySEC restrictions, TeleTrade does not currently offer any deals or promotions, which include no deposit bonuses, welcome deals, or contests.

Does TeleTrade offer demo accounts?

Yes, you can open demo accounts in any of the three accounts: Standard MT4, NDD MT4, or Real ECN MT5.

How do I sign up for a TeleTrade demo account?

Registration for a demo account can be done in minutes by clicking on the homepage’s drop-down menu and filling in the short online form.

Does TeleTrade accept clients outside the EU?

TeleTrade mostly accepts clients within the EEA, including the UK, Greece, Romania, Italy, among others. The broker also provides its services on a cross-border basis to other areas, including Asia and Africa. This includes Indonesia, Vietnam, Ukraine, Russia, China, and Kenya.

Is TeleTrade a good broker?

TeleTrade is an award-winning broker with a strong track record and decent customer ratings online. The broker also holds EU regulatory licenses and provides a strong level of fund safety for its clients.

Customer Reviews

There are no customer reviews of TeleTrade yet, will you be the first to help fellow traders decide if they should trade with TeleTrade or not?