SynergyFX Review 2024

Awards

- Best Forex Broker 2018 - International Business Summit Malaysia

- Australian Best Forex Broker 2015 - Global Financial Market Review

- Best Currency Management Fund 2015 - GFMR

SynergyFX Review

SynergyFX is a forex broker, offering ECN accounts on the downloadable MT4 and MT5 trading platforms. If you’re deciding whether to register and login to SynergyFX, take a look at this review for the pros and cons.

SynergyFX Details

Founded in 2011, SynergyFX is an Australian provider of forex and derivative products. In 2018, the company merged with the ACY Capital Group to provide online trading with low commissions.

The broker claims to be registered with the US SEC and CFTC, but we could not verify its credentials on the regulator’s databases, raising concerns.

Trading Platforms

MetaTrader 4

SynergyFX offers MT4 to active traders. With access to forex, indices, and commodities, the platform offers a customisable dashboard and fast execution speeds. Traders also get access to instant live quotes, 40 technical indicators, and several time frames. The platform is also a good option for those looking to build and use automated trading robots.

Windows users can download MT4 from the broker’s website after registering for an account.

MetaTrader 5

MT5 offers more advanced order options, hedging abilities, 21 timeframes, and Level II market depth. As a result, the platform offers a faster and more powerful experience than its predecessor. MT5 works with Windows PCs and can be downloaded once an account has been created.

MetaTrader WebTrader

SynergyFX also offers the web-based versions of both the MT4 and MT5 platforms – ideal for MacOS users, or those who don’t want to download any applications. The WebTrader solution offers seamless trading with just as much power and speed as the desktop platforms, plus all the technical and analysis features.

SynergyFX Markets

SynergyFX offers a range of assets, including 40+ currencies, 10+ commodities and precious metals, 20 global indices, and over 600 of the world’s largest share CFDs. You can also now trade Chinese offshore Yuan (CNH) on the MT4 platform.

Trading Fees

Spreads at SynergyFX are fairly competitive, with major FX pairs around 0.8 pips with the stpECN account and 0.2 pips with the zeroECN account. Major indices such as the FTSE 100 are around 1.4 pips, and crude oil is around 0.030 with stpECN pricing.

There are no commission charges with the stpECN account, but you can expect $6 and $5 per lot charges with the zeroECN and pureECN accounts respectively.

SynergyFX Leverage

Leverage is available up to a maximum of 1:500 across all accounts. Details of margin requirements are provided in the broker’s terms and conditions, or from within the client portal.

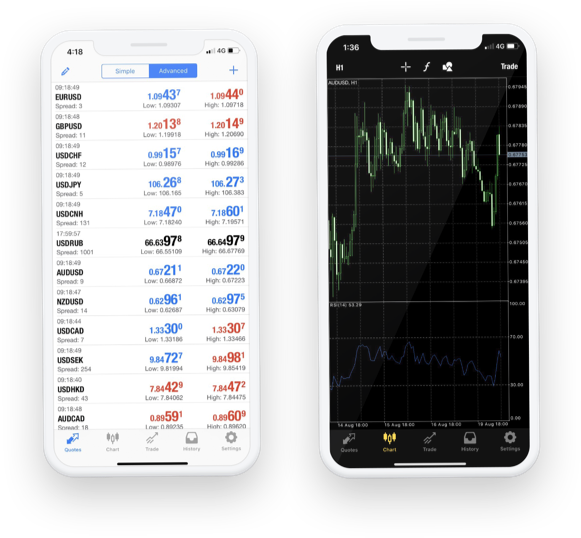

Mobile Apps

Both MT4 and MT5 are available for mobiles or tablets, via the App Store or Google Play store. Traders can access ultra-tight spreads 24 hours a day from their smart devices, with access to advanced charting functions, live pricing data, and full trading history. Traders can also set mobile alerts to stay on top of their orders whilst on the go.

Payment Methods

Deposits

Account funding is available via bank wire transfer (local and international), credit/debit cards, Skrill, Doku Wallet, China Union Pay, and other e-wallets. SynergyFX does not charge for funding by bank transfer, though international payments may incur a bank fee. Received and cleared funds for bank transfers may take 2 – 3 business days.

Withdrawals

The same options are available for withdrawals, however, you can only withdraw via bank wire if you originally deposited by credit card. There is a $25 service charge per withdrawal for international bank transfers and a 3% merchant fee for payments via Skrill. Australian local bank transfers are free three times per month, after which there is a $25 charge per additional withdrawal. In most cases, withdrawals are processed in 1 – 2 business days.

Demo Account

A demo account is available in 17 different languages and can be opened within minutes. Demo accounts are helpful for beginners who wish to try out the trading platforms before signing up for a live account. With a default virtual account balance of $50,000, SynergyFX users can place demo trades free from financial risk for 30 days.

Regulation

Synergy FX was acquired by ACY Securities Pty Ltd which is regulated by the Australian Securities and Investments Commission (ASIC) under license number 403863. ACY Capital Australia Limited is regulated by the Vanuatu Financial Services Commission (VFSC) under license number 012868.

However, it’s not clear that ACY are maintaining the SynergyFX brand with broken links on the website, plus statements about it being regulated in the US despite our experts unable to verify this on the regulator’s register.

Note that the broker doesn’t provide negative balance protection.

Additional Features

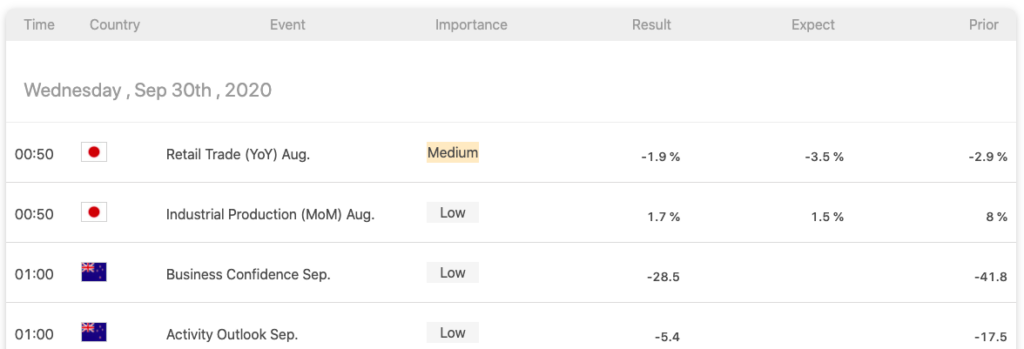

New and experienced traders can benefit from the resources and educational content on offer, which includes market analysis courses and webinars, a free trading e-book, forex articles, a news blog, and an economic calendar.

Though there is nothing particularly unique, the educational offering is sufficient for beginners. To compete with other brokers, SynergyFX could include forex calculators and other trading tools.

SynergyFX Accounts

Depending on your trading style, there are three main accounts on offer at SynergyFX, in 7 different currencies: stpECN, zeroECN, and pureECN. All accounts require a minimum trading volume of 0.01 lots.

stpECN

The stpECN account offers competitive market pricing, with no commissions and a minimum deposit of $50. Swap-free trading is also available with this account.

zeroECN

The ZeroECN account offers direct access to tier-1 liquidity providers for tighter spreads, commissions from $6 per round turn lot, and a minimum deposit of $2,000. The minimum deposit thereafter is $100.

pureECN

The pureECN account also offers direct access to tier-1 liquidity, with tight spreads, commissions from $5 per round turn lot, and an initial minimum deposit of $20,000. The minimum deposit thereafter is $100.

Traders can also get exclusive access to hundreds of share CFDs via the commission-based MT5 Xchange account.

Trading Hours

Trading hours for currency pairs are 00:00 – 24:00 GMT+2 / GMT+3 (DST) Monday to Friday. Server times for indices and commodities vary depending on the market and are provided in the product specifications page on the website.

Customer Support

SynergyFX have multilingual support offices based in Sydney, Taiwan, China, and Malaysia, which provide assistance 24/5 via:

- Email – support@acy.com

- Online contact form – Contact us page

- Live chat – responses received within 2 minutes when tested

- Telephone – +61 2 9188 2999 (international) / +02 5594 4927 (Taiwan)

Security

SynergyFX keeps to industry-standard security measures to safeguard data between servers. Platforms are secured with 128-bit encryption systems and transactions are safely carried out within the client portal, CloudHub.

SynergyFX Verdict

SynergyFX’s core offering includes tight ECN spreads on forex, indices, and commodities. The broker also provides some additional education and the MT4 and MT5 platforms, suitable for those with limited experience as well as those using advanced trading strategies.

However, it seriously trails the best brokers in terms of trust, support and trading resources.

Top 3 Alternatives to SynergyFX

Compare SynergyFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

SynergyFX Comparison Table

| SynergyFX | IG | World Forex | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 1.3 | 4.4 | 4 | 4.3 |

| Markets | Forex, CFDs, indices, shares, commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $1 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA |

| Bonus | Spin & Win Draw | – | 100% Deposit Bonus | – |

| Education | No | Yes | No | Yes |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:1000 | 1:50 |

| Payment Methods | 7 | 6 | 10 | 6 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

World Forex Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by SynergyFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| SynergyFX | IG | World Forex | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

SynergyFX vs Other Brokers

Compare SynergyFX with any other broker by selecting the other broker below.

FAQ

Where is SynergyFX based?

The broker’s global head office is at Level 18, ACY Tower, 799 Pacific Hwy, Chatswood, NSW 2067, Australia.

Who owns SynergyFX?

SynergyFX is owned by ACY Securities, a private limited company that is not listed on a stock exchange. The owners and management team have over 10 years of experience working in the financial markets.

Does SynergyFX accept UK clients?

Yes, this broker accepts clients from the United Kingdom.

Does MetaTrader 4 have trailing stop orders?

Yes, you can set trailing stop orders in MT4, along with a number of other stops and limits.

How do I open a SynergyFX account?

You will need to fill in a short form to apply for an account. SynergyFX will then email you a link to download the trading platform, along with your login details.

Customer Reviews

There are no customer reviews of SynergyFX yet, will you be the first to help fellow traders decide if they should trade with SynergyFX or not?