Switch Markets Review 2025

See the Top 3 Alternatives in your location.

Pros

- I am impressed by the complimentary access to the HowToTrade education resources, community chatroom and market analysis without the need for any deposit

- Switch Markets offers access to a decent range trading tools including a market sentiment heatmap, an economic calendar and a VPS. I particularly appreciate the diverse range of forex calculators

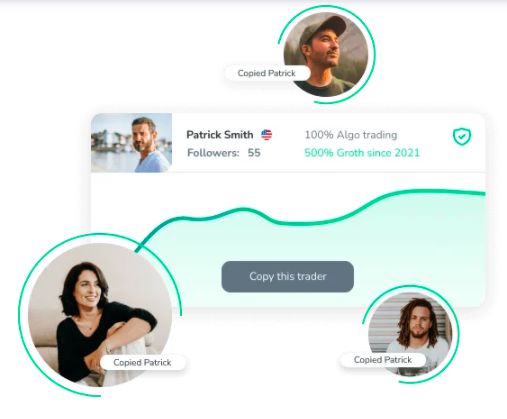

- Traders can access copy trading solutions via the MetaTrader Trading Signals tools and duplicate positions of experienced traders in real-time

Cons

- Spreads are not the most competitive for Standard account holders in my opinion, averaging 1.5 pips on EUR/USD

- I'm a little concerned that the global entity is regulated offshore by the SVGFSA, a low-tier watchdog with very limited financial protection for clients

Switch Markets Review

Switch Markets is a fast-evolving broker that is trusted by traders worldwide. The firm offers a wide range of assets, including forex, indices, CFD shares and commodities. This review covers everything there is to know about Switch Markets, including regulation details, the trading platforms available, plus minimum deposit and withdrawal requirements.

Switch Markets Headlines

Switch Markets is a relatively new broker on the scene, having been established in 2019. It is located in Australia but operates internationally. The Australian arm is regulated by the Australian Securities and Investments Commission (ASIC), a globally respected financial regulator.

Switch Markets International PTE Ltd is an authorised representative of its parent company, Royal ETP LLC, which is based in St Vincent and the Grenadines.

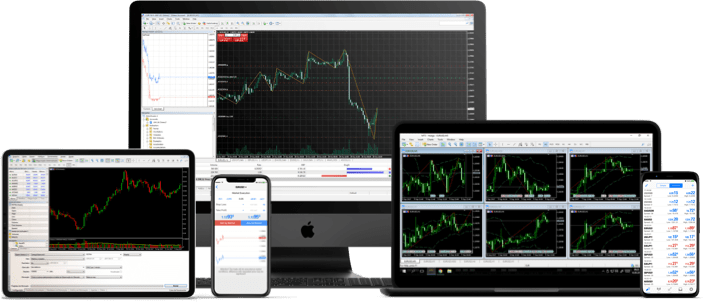

Trading Platform

Traders can use the industry-renowned MetaTrader 4 (MT4 or MetaTrader 5 platforms. It is available as both a browser-based WebTrader and a desktop application that can be downloaded to Windows or Mac. Since being released in 2005, MT4 has become one of the most popular platforms among traders and brokers.

Despite being slightly dated from a UX perspective, the platform is still easy to use and navigate. Opening and closing trades is simple and intuitive, and on top of this, it is packed with additional features to improve the overall trading experience.

There is a range of technical tools and charts to assist with market analysis. Plus, you have the option of setting up price alerts to notify you when assets hit a value of your choosing.

Assets

Switch Markets offers a great range of assets, including forex, CFDs and more:

- Forex – Over 60 currency pairs, including a range of majors, minors and exotics

- Indices – 21 indices, including the FTSE 100, Nasdaq 100 and Nikkei 225

- CFD Shares – Over 80 CFD shares, including popular stocks like Twitter, Facebook and Amazon

- Commodities – 8 commodity CFDs, including gold, silver and energies like crude oil and natural gas

- Cryptocurrency CFDs – Four cryptocurrency CFDs: Bitcoin, Litecoin, Ethereum and Ripple

Live Accounts

With Switch Markets, traders can open a regular account or an institutional account, with a minimum deposit of $50 and $25,000, respectively. Within each of these, users can choose between a standard or pro account.

Which option you choose depends on your preferred fee structure. The standard regular account has no commission and competitive spreads that start from 1.4 pips, while the pro regular account offers spreads as low as 0 pips, with commission charged at $7.

On the other hand, the standard institutional account has razor-sharp spreads as low as 0.6 pips but crucially, is commission-free.

The pro institutional account has zero spreads on many assets but costs $5.50 in commission.

Switch Markets also offers an Islamic account. The swap-free account is Sharia-compliant.

Spreads & Commission

As mentioned, the spreads and commission charged vary depending on the account opened. Standard accounts are commission-free, while pro accounts have the lowest spreads.

Stocks and shares CFDs work slightly differently on Switch Markets. For regular accounts, there is a commission of 2% of the share price. For either institutional account, this drops to 1% of the share price.

For the standard regular trading account, typical spreads are:

- AUD/NZD – 2.1 pips

- EUR/USD – 1.5 pips

- GBP/USD – 1.9 pips

- EUR/GBP – 2 pips

- WTI (Crude) – 4.0

- BTC CFD – 52.5

- FTSE 100 – 2.2

For the standard institutional trading account, typical spreads are:

- AUD/NZD – 1.3 pips

- EUR/USD – 0.7 pips

- GBP/USD – 1.1 pips

- EUR/GBP – 1.2 pips

- WTI (Crude) – 3.0

- BTC CFD – 44.5

- FTSE 100 – 1.6

For either pro trading account, typical spreads are:

- AUD/NZD – 0.7 pips

- EUR/USD – 0.1 pips

- GBP/USD – 0.5 pips

- EUR/GBP – 0.6 pips

- WTI (Crude) – 2.0

- BTC CFD – 38.5

- FTSE 100 – 1.2

Leverage

The leverage offered varies depending on the market. Customers can trade forex with leverage up to 1:500. Indices are offered up to 1:200, commodities up to 1:50, and share CFDs up to 1:20.

Leverage allows you to trade positions that are much larger than your deposit would usually allow. For example, 1:500 means you can put down $50 and receive market exposure up to $25,000. While this can increase winnings, it can also magnify losses, so risk management strategies must be implemented.

Mobile Trading

Switch Markets offers the MetaTrader 4 mobile app to clients who want to trade on the go. This is available for download on iOS and Android, with all the same benefits as the desktop service. It is easy to navigate and intuitive to use.

Placing orders and closing them is simple, even for novices. Additionally, many of the same features, such as technical analysis tools and charts, are available in the app.

This allows users to research and analyse financial markets while on the move.

While all the services are replicated across devices, most traders prefer the browser or desktop app for research, preferring just to monitor their portfolios on the mobile app.

Deposits & Withdrawals

Switch Markets requires a minimum deposit of $50. This increases to $25,000 on the institutional account. For most deposit methods, there are no charges. However, if you transfer cryptocurrency to your account, there is a 0.8% charge.

Processing speeds vary between payment types. Visa and Mastercard are processed within the nearest working day, while bank transfers take 3-5 working days and most other methods are processed almost instantly. Deposits can be made using the following methods:

- E-wallet transfer

- Perfect Money

- NganLuong.vn

- Bank Transfer

- Mastercard

- UnionPay

- Globepay

- PayTrust

- Neteller

- Fasapay

- Interac

- Skrill

- VISA

There are no minimum or maximum withdrawals. The average processing time is three days, though, for many methods, this can be as quick as 24 hours. For most payment options, there is a 2% fee. In particular, for bank transfers, the fee is $20, for crypto, it is 0.8% and for Fasapay and PayTrust, it is 0.5%. Withdrawals must be made using the same method as deposits to comply with anti-money laundering policies.

Demo Account

Switch Markets offers a demo account for clients that open an account and deposit funds. There are no time limits or restrictions on the amount of trading you can do.

However, if the demo account is left inactive for 45 days, it will be deactivated. Demo accounts are often called ‘paper money accounts’ as they allow traders to practise new strategies that have not yet been refined.

Bonuses & Promotions

Switch Markets offers a 100% credit bonus for first-time deposits – just add as little as $100 to your account and the broker will match your deposit up to a value of $5,000. However, those looking to make a profit should be aware, this bonus can only be used for trading and cannot be withdrawn.

Note, Switch Markets does not offer a no deposit bonus.

Regulation

Both Switch Markets and its parent company – Royal ETP LLC, are regulated by the Australian Securities and Investments Commission (ASIC). ASIC is the top regulatory body in Australia and is a well-respected and trusted body globally. The organisation aims to protect traders from undue harm by ensuring brokers implement certain practices. In particular, ASIC limits the leverage available to retail traders and ensures customer funds are kept segregated from those of the broker.

Additional Features

All Switch Markets live account holders are offered a free virtual private server (VPS) – the best system for automated trading using algorithms and robots. Trades are executed at a 1 millisecond latency time, making the likelihood of slippage low – a crucial requirement for automated trading.

Social trading is also available, allowing you to copy the positions of successful traders so that you can replicate their success. This is provided through the MetaTrader 4 platform.

Furthermore, Switch Markets offers a wide range of educational resources. There are seminars, webinars, trading guides and more, all designed to help investors improve and learn.

On top of this, the brokerage provides an economic calendar that lists key upcoming global events which could have an impact on financial markets.

Trading Hours

The trading hours at Switch Markets vary between different markets. Forex instruments trade during standard forex sessions, which are available all week and closed on weekends. Cryptocurrencies are available 24/7, making them great for those who enjoy weekend trading.

Customer Support

Switch Markets aims to provide a polite and prompt support team. Whether you have encountered an issue when trading or have simply forgotten your login details, they are on-hand to help. Customer support is available 24/7 and can be reached via the following methods:

- Email: support@switchmarkets.com

- Live chat

Security

Switch Markets’ strapline is ‘Not just another broker, but a broker you can count on’, and they work hard to ensure traders feel safe. In line with ASIC regulation, all funds are held in segregated accounts with tier one banks. Plus, ASIC regulation means traders have an extra level of trust in the firm.

Switch Markets Verdict

Switch Markets is a popular broker, not just in Australia but around the world too. The brand offers a great range of assets, including over 60 forex pairs, plus tight spreads and low commissions. Deposits and withdrawals can be made easily via several different methods and it is regulated by the ASIC. If you want to start trading today, Switch Markets is a good option.

FAQs

Is Switch Markets Legit?

Yes, Switch Markets is a legitimate forex and CFD trading broker. It is regulated by the Australian Securities and Exchange Commission and has many positive reviews on Trustpilot.

How Much Capital Do I Need To Trade With Switch Markets?

The minimum deposit at Switch Markets is $50. Clients simply need to fill in a short registration form and deposit funds to get started.

Where Is Switch Markets Regulated?

Switch Markets is regulated by the Australian Securities and Investments Commission (ASIC). This is a top tier regulatory body that aims to protect retail traders by ensuring the broker has implemented certain practices, including limits on leverage, mandatory risk disclosures and segregated accounts.

Does Switch Markets Offer A Demo Account?

Yes, Switch Markets offers a demo account. The account can be used free of charge and is a great place to practise trading without risking capital.

Can I Trade With Switch Markets In The US?

No, clients in the US, Yemen, Iran and North Korea are all unable to trade with Switch Markets.

Best Alternatives to Switch Markets

Compare Switch Markets with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Switch Markets Comparison Table

| Switch Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 3.8 | 4.3 | 3.6 |

| Markets | CFDs, Forex, Stocks, ETFs, Cryptos, Futures, Commodities | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | 100% Deposit Bonus | – | 10% Equity Bonus |

| Platforms | MT4 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:200 |

| Payment Methods | 9 | 6 | 11 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Switch Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Switch Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

Switch Markets vs Other Brokers

Compare Switch Markets with any other broker by selecting the other broker below.

The most popular Switch Markets comparisons:

Customer Reviews

There are no customer reviews of Switch Markets yet, will you be the first to help fellow traders decide if they should trade with Switch Markets or not?