Spread Co Review 2024

Spread Co Review

Spread Co is an online spread betting and CFD broker specialising in forex, commodities, equities and indices. Our review covers live accounts, payment methods, the proprietary trading platform, regulation, and more. Find out whether Spread Co is a trustworthy spread betting broker.

Spread Co Headlines

Spread Co Ltd was established in 2005, offering global services from a head office in London. The broker is authorised by the Financial Conduct Authority (FCA), a highly respectable regulator. Today, there are over 10,000 live traders using the broker’s services. Spread Co offers spread betting on major markets, stocks and shares, plus CFDs and forex.

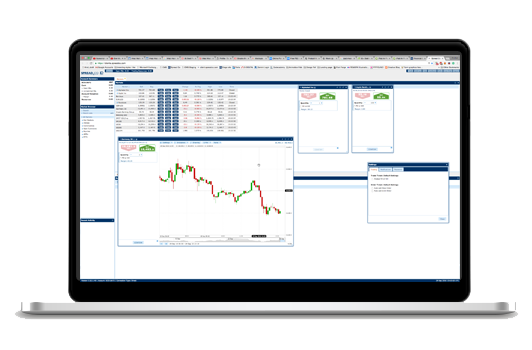

Trading Platform

The broker offers its proprietary trading platform to meet the needs of all clients, powered by TradingView. Spread Co recommends trading through major web browsers, with no software download requirements. Alternatively, clients can access the free mobile application or iPad app.

Features of the online platform include:

- Expert financial analysis

- Trade directly from charts

- Fully customisable interface

- Wide range of technical indicators

- Set market movement alerts and watch lists

- Create custom charts using live industry data

- Access risk management tools including stop losses and limit orders

Assets

Spread Co offers clients trading opportunities in the following global markets:

- Forex – 38 currency pairs

- Equities – 1,000 global equities

- Commodities – precious metals and energies

- ETFs – 100+ including technology and commodities

- ADRs – trade shares in companies in over 20 countries

- Indices – trade on the largest stock exchanges including UK100, US30 and NDQ100

The broker also offers the opportunity to trade Mini Markets which offer smaller stake sizes from just 10p. These markets are the most liquid and a popular way for traders to get familiar with spread betting. Spread betting lets traders go short in falling markets and provides 24 hour access, margin trading and zero hidden fees.

Spreads & Commission

Spreads are fixed and as low as 0.8 pips during liquid hours. Spreads differ between spread betting and CFD accounts. The broker offers the tightest spreads up to a maximum of £50 a point before this increases on a sliding scale. Spreads on majors are 0.8 pips on EUR/USD and 1.0 pip on GBP/USD and EUR/GBP. Spreads on leading indices, such as the FTSE 100, start at 0.8 pips.

Commissions are only charged for equities trading, starting at 0.05% for UK trades. The broker does charge swap rates for positions held overnight, further details of which can be found on the company website.

Leverage

Leverage varies by instrument:

- Indices – 5%

- Equities – 20%

- Forex pairs – 3.33% or 5%

- Commodities – 5% or 10%

- Mini Markets – 3.33% or 5%

As an FCA-regulated broker, Spread Co complies with ESMA’s retail leverage limits.

Mobile Apps

The broker offers a mobile app with full desktop platform features. This is available for free download and is compatible with iOS and Android devices. The app allows for complete trading management while on the go. Features include:

- One-click trading

- 50 technical indicators

- Event notification option

- Interactive charting tools

- Easily switch between accounts

Deposits

Minimum deposits vary by account type; £200 for spread betting accounts and £250 for CFD accounts. After this, the deposit requirement for both accounts is £100. Spread Co offers limited payment methods for live account deposits in GBP, EUR, USD, or JPY:

- Skrill

- Bank transfer

- Credit/debit cards

Withdrawals

To request a withdrawal, select the payment option within the trading platform or contact client services. Withdrawals to credit/debit cards and UK bank accounts are free. International bank transfer payments are subject to a £15 charge + local bank fees. Skrill withdrawals incur a 1% fee. Same-day processing requests must be received by 12:30 pm GMT.

Note, the minimum withdrawal amount is £50.

Demo Account

Spread Co Limited offers a demo account on their trading platform, accessible for 2 weeks. Demo accounts are a great way to become familiar with the platform and to test spread betting or CFD strategies risk-free. The demo account is available in GBP, EUR, or USD and comes with £25,000 or equivalent in virtual funds. A client services platform tour is also offered by the broker to demonstrate user features.

Spread Co Bonuses

At the time of writing, Spread Co Ltd does not offer any deals or promotions to new or existing clients, this includes no deposit bonuses. This is in line with FCA regulations.

Regulation Review

Spread Co UK Limited is licensed under the Financial Conduct Authority (FCA), meaning the broker follows established regulatory standards. The FCA is a highly prestigious agency in the financial markets. Client funds are segregated in top-tier banks and protected by the FSCS, covering up to £85,000 should the broker become insolvent.

Additional Features

The broker’s website offers multiple trading support features. This includes a financial trading blog, an economic calendar and Market Watch live news bulletins. The website also supports several training guides and education topics including the basics of spread betting and CFD trading, using technical indicators and strategies, with a glossary and extensive FAQ page.

Spread Co Accounts

Spread Co offers two different account types; spread betting or CFD. Both accounts are available in EUR, USD, and GBP.

- Spread Betting Account – minimum stake £1, initial deposit requirements are £200, no dealing spread, earn 2% cash interest on cash balances over £10,000. The broker offers the Spread Free Basic solution for entry level traders and the Spread Free Bronze for more active traders.

- CFD Account – no commissions, 0% financing on short index positions, access to a wide range of financial markets with straightforward buy and sell propositions plus a suite of risk management tools.

To open an account, clients need to complete a simple online form and send identity documents with proof of residence. The broker assures applications are processed within 1 working day.

Benefits

- FCA regulated

- Hedging allowed

- Good user reviews

- Mini Markets access

- Mobile trading solution

- Extensive educational guides

Drawbacks

- Not available to US residents

- No MetaTrader platforms

Trading Hours

The broker follows standard office hours and provides 24-hour trading from Sunday 10 pm to Friday 10 pm GMT. Note, spreads fluctuate depending on the trading window as liquidity and volatility changes.

Customer Support

Spread Co offers a range of customer support options:

- Email – cs@spreadco.com

- WhatsApp – +44 7575 674341

- Live chat engine – located at the bottom of the contact page

- Telephone – +44 (0)1923832682 (customer service, Monday to Friday 8 am-6 pm)

Security

Personal information is protected by SSL encryption on both PC and mobile applications. Account access is fully password protected. The Spread Co trading platform also assures industry-standard encryptions with secure logins.

Spread Co Verdict

Spread Co offers opportunities for traders of all abilities to invest in forex, CFDs and spread betting. Small stake requirements and low minimum deposits make it a good choice for new traders. Prospective clients should also feel assured of the FCA regulation, security protocols and customer service.

Top 3 Alternatives to Spread Co

Compare Spread Co with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Spread Co Comparison Table

| Spread Co | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Spread betting, CFDs, forex, indices, shares, commodities, ETFs, ADRs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | £200 | $0 | $0 | $1 |

| Minimum Trade | £0.10 | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:20 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Spread Co and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Spread Co | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Spread Co vs Other Brokers

Compare Spread Co with any other broker by selecting the other broker below.

FAQ

Does the Spread Co trading platform allow hedging?

Hedging is possible on the Spread Co platform. Head to the broker’s demo account terminal to practice hedging strategies before investing funds.

Does Spread Co offer stock trading?

Yes, Spread Co Ltd allows trading on many of the world’s most popular stock indices. The UK100 for example includes companies such as HSBC and Tesco.

What is spread betting?

Spread betting is a straightforward way to speculate on the price of shares, currencies and more without owning the underlying asset. A profit or loss is based on the price of the asset when the trade was opened vs its price when the trade was closed.

Is Spread Co regulated?

Yes, Spread Co is authorised by the Financial Conduct Authority (FCA), register number 446677. This is a reputable regulator and a good sign that the company can be trusted.

What is the minimum deposit at Spread Co?

The initial deposit requirement for a spread betting account is £200 while CFD accounts require a £250 minimum payment.

Customer Reviews

There are no customer reviews of Spread Co yet, will you be the first to help fellow traders decide if they should trade with Spread Co or not?