SolidusX Review 2024

Please see the list of similar brokers or the Best Brokers List for alternatives.

Pros

- Full range of investments

Cons

- No copy trading

- No demo account

- No MT4 integration

SolidusX Review

SolidusX offers 5000+ instruments on a user-friendly trading platform. The relatively new brokerage aims to provide a secure and intuitive trading environment alongside professional guidance and support. This review of SolidusX will cover login security, trading fees, account types, payment methods, mobile app features, and more. Find out whether to start trading with SolidusX.

Company Details

SolidusX is a subsidiary of Solidus Capital, a UK-based asset management firm. The company has over 2,300 clients worldwide with over $1.5 billion of assets under management.

The brokerage’s tier 1 liquidity providers use real-time order books to facilitate immediate access to popular markets with instant executions. New traders can get started with a $500 minimum deposit with various account options to suit clients’ needs.

SolidusX is registered in Saint Vincent and the Grenadines and is regulated by the local Financial Services Authority (SVGFSA).

Trading Platform

SolidusX offers a bespoke trading platform. The web-based terminal provides beginner traders with straightforward navigation, alongside high-performance tools.

Features include:

- Trading Journal – Log orders, add notes and tags

- Hedging Allowed – Hedge existing assets and profit from market movers

- Advanced Order Execution – Trailing and guaranteed stop-loss and take-profit plus pending orders

- Interface – Drag and drop capabilities, fully customizable dashboard, multiple trader workspaces, and optimize layouts with in-built widgets

- ©Solidifyre – A proprietary algorithmic tool which analyzes 140+ technical indicators, performs back-testing and reviews the news

- Watchlists – Create multiple watchlists with list or tile view plus embedded instrument details. View pre-configured stop-loss and take-profit suggestions

- Intuitive Charting – Access multi-chart views and intuitive module linking. Day traders can benefit from customizable graphs, advanced drawing tools and 60+ technical indicators

- Dashboard – Track activity and analyze performance and behavior on a specific instrument, account, or asset class. This includes win rates, risk and reward ratios, and intraday performance

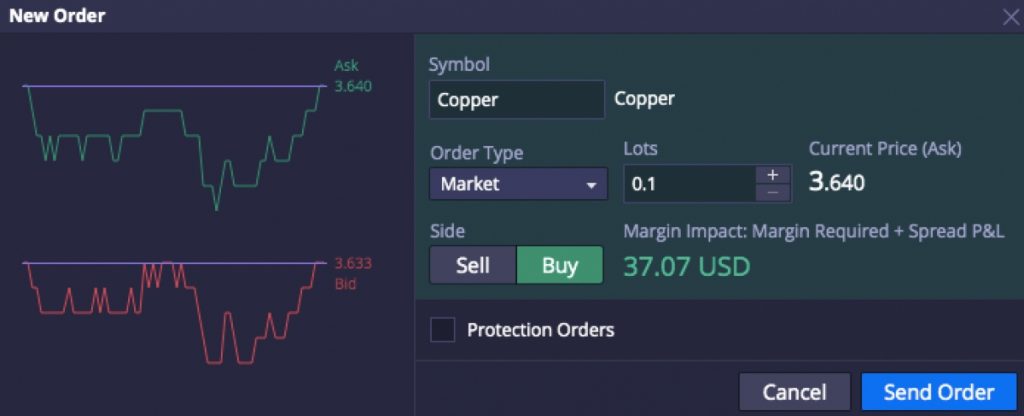

How To Place A Trade

- Login to your SolidusX client portal

- Open the WebTrader platform

- Choose an asset using the drop-down menu on the left. You can also search your watchlists or select from the public lists which are organized by asset class

- Select the ‘bid’ or ‘ask’ price

- A new order screen will then pop out. Alternatively, you can authorize one-click trading to invest directly from a graph/chart

- Choose the order type (market, limit, stop, or OCO)

- Increase or decrease the lot size

- Select the order duration (GTC, DAY, or GTD)

- Review the margin impact and spread P&L

- Select ‘Send Order’

Assets & Markets

SolidusX offers over 5000 instruments:

- Speculate on major and minor currency pairs including EUR/GBP, USD/GBP, and AUD/CAD

- Trade on some of the world’s largest stock exchanges including NASDAQ 100, S&P 500, and FTSE 100

- Speculate on commodity CFDs without unit limitations. This includes the opportunity to trade an ounce of gold or a barrel of oil

- Trade 1200+ global stocks including Tesla, Boeing, Amazon, and Facebook. This includes access to fractional shares

- Invest in exchange-traded funds (ETFs) including SPDR S&P 500 ETF TRUST and Invesco DWA Technology Momentum ETF

- Take positions on popular digital currency assets and crypto crosses including Bitcoin, Ethereum, and Litecoin

Note, access to assets varies between account types.

Spreads & Fees

Trading fees vary by account type and instrument. However, our experts were disappointed by the lack of transparency around spreads and commissions. The Tyro account for example offers fixed spreads alongside a small commission, but the broker does not publish details of average spreads and fees.

The broker does not charge for deposits and withdrawals, account management, or performance fees.

Swap fees apply for positions held overnight.

Leverage Review

When we used SolidusX, we were offered leverage up to 1:200. This is fairly high, meaning greater profit potential for users. Of course, risks will also be amplified so make sure you take a careful approach to money and risk management.

SolidusX Mobile App

SolidusX introduced its mobile trading app in April 2022. It is available for free download to iOS and Android devices.

The application offers a fully-customizable dashboard, mobile-optimized charting, real-time pricing, and a notification center for the latest market trends. For added security, the app enables biometric login features and two-factor authentication.

SolidusX Managing Director, James Fisher, commented that the mobile application is an “added layer that helps you centralize and control all your trading activity, enjoy full functionality, and control every other aspect of your account. With it, users can access markets around-the-clock so they never miss out on opportunities”.

Payment Methods

Deposit

SolidusX accepts several payment methods, including bank wire transfers, credit/debit cards, and cryptocurrencies. The broker does not apply any account funding fees though third-party charges may apply.

Processing times vary by payment method. SolidusX requires investors to notify them of a deposit being made for improved tracking times.

The minimum deposit requirement is $500.

Withdrawals

Day traders can withdraw funds via bank wire transfer or Bitcoin wallet.

The broker processes all pending withdrawals once per day, between 12:00 and 14:00 UTC. Any requests made after noon will be processed the following day.

The time taken for funds to be received back to the original payment method will vary. Bank wire transfers can take between two to four working days. Crypto transfers typically take up to 30 minutes, though this is blockchain-dependent.

Note, account verification must be completed before you can submit a withdrawal request.

Demo Account

SolidusX does not offer a free demo account. This is disappointing as this is standard among the top brokers.

With that said, once you have signed up with SolidusX, you can access the client portal and trading dashboard without having to deposit money.

We were able to view all features, including economic calendars, trading charts, assets, and watchlist functions. You can also apply technical indicators and custom graphic tools to an asset of your choice. So although you cannot practice investing, it is still a good way to get a feel for the terminal before depositing.

Deals & Promotions

As an offshore broker, SolidusX is not restricted from offering bonus deals and financial incentives. When we registered for a new account, we were offered a $100 deposit bonus on a transfer of $1000.

The broker also runs a referral program. Investors are encouraged to introduce friends and family to the brokerage with unique rewards available. A certain percentage of the referral’s initial deposit balance will be shared once account verification is complete.

Regulation & Licensing

SolidusX is owned and operated by Digital Genius Group Ltd. The broker is regulated by Saint Vincent and the Grenadines Financial Services Authority, registration number 26130. The brokerage is also currently seeking regulatory approval in the EEA and Australia.

Although the firm is registered with an offshore regulator, SolidusX does offer negative balance protection and segregates client funds. SolidusX is also signed up to a third-party insurance fund with up to $85,000 available per investor in the event of bankruptcy.

Still, it’s worth pointing out that SolidusX is not regulated by a top-tier watchdog, such as the UK Financial Conduct Authority (FCA) or the Cyprus Securities & Exchange Commission (CySEC). Traders should be careful investing with brokers that are subjected to limited regulatory oversight.

Additional Features

Education

While using SolidusX, we were disappointed by the lack of educational content and resources. Having said that, a trader blog was introduced in 2022, with step-by-step guides, tips, and advice for making investment decisions. Topics include how to trade in volatile markets, tips for trading cryptocurrency, and how to choose an investment platform.

SolidusX also looks to be expanding its education offering, with an ‘Academy’ logo earmarked as coming soon on the website. This could be a useful ideal resource for beginners.

All accounts have access to live news streams within the trading platform. An economic calendar is also provided in the client dashboard.

Personal Guidance

One of the core pillars of the broker is to provide wealth guidance and financial support to investors of all experience levels. So, upon initial registration, the broker will conduct a personal financial assessment to analyze goals and investment opportunities.

SolidusX customers also get regular access to financial experts. The specialists are available to traders through live chat, telephone or email.

Account Types

SolidusX offers five account types for retail traders; Tyro, Optio, Primus, Centurion, and Legatus.

All accounts offer three currency denominations; GBP, EUR, or USD. All profiles also offer access to hedging and scalping, instant execution, and a minimum trade size of 0.01 lots.

Tyro

- Fixed spreads

- Low commissions

- Access to entry-level leverage

- An initial platform walkthrough

- $500 minimum investment required

Optio

- Variable spreads

- Access to market analysis

- Lower commissions vs Tyro

- Dedicated investment specialist

- Increased leverage opportunities

- $2,500 minimum investment required

- Unlimited access to webinars and the training academy (once launched)

Primus

- Premium asset access

- Market-grade spreads

- Access to market analysis

- Dedicated investment specialist

- Customizable commission structure

- $25,000 minimum investment required

- Unlimited access to webinars and the training academy (once launched)

- Access to premier events including earnings reports and initial public offerings

Centurion

- Full asset access

- Commission-free

- Access to market analysis

- Institutional-grade spreads

- ©Solidifyre algorithmic analysis

- Dedicated investment specialist

- $100,000 minimum investment required

- Unlimited access to webinars and the training academy (once launched)

- Access to premier events including earnings reports and initial public offerings

Legatus

- Full asset access

- Commission-free

- Priority transactions

- Access to market analysis

- Loyalty package available

- Institutional-grade spreads

- Dedicated investment specialist

- ©Solidifyre algorithmic analysis

- $100,000 minimum investment required

- Unlimited access to webinars and the training academy (once launched)

High-net-worth traders looking to invest more than $500,000 can also access an exclusive club. The elite program offers access to a full team of dedicated experts who can provide bespoke investment advice and financial solutions.

How To Open An Account

Our experts registered for a new SolidusX profile in just three minutes. Simply select the ‘Sign up’ logo found in the main menu. Complete the basic information requirements including email, phone number, and country of residency. An email confirmation will need to be verified to gain access to the client dashboard.

The broker complies with KYC and AML protocols meaning you will need to provide ID verification before you can get started. This includes proof of residency, proof of identity, and a copy of your debit/credit card (you can blank out some information) as a source of deposit verification.

SolidusX aims to process all new account requests within 48 hours.

Benefits

Our experts found several advantages to trading with SolidusX:

- 1:200 leverage

- Fractional stocks

- Five account tiers

- 5000+ instruments

- Access to financial experts

- iOS and Android mobile app

- Negative balance protection

Drawbacks

- No demo account

- High minimum deposit

- Limited regulatory oversight

- Unreliable customer support

- No transparent pricing schedule

Trading Hours

Trading hours vary by instrument. For example, you can invest in the cryptocurrency market 24 hours per day, 7 days a week.

You can view the latest trading hours within the platform interface. Be aware of upcoming events that may cause price volatility.

Customer Support

SolidusX offers various customer support options, including telephone, email, and an online contact form. The broker also offers a live chat service, though when we tested the tool response times were slow.

Contact details:

- Email – support@solidusx.com

- Live Chat – Bottom right of each webpage

- Online Contact Form – Found on the support webpage

- Telephone – +(44) 2081543483 (UK) or +(61) 282058232 (international)

A basic FAQ section can also be found on the ‘Support’ page. Information is sorted by category including getting started, transferring funds, trading, and reporting.

Security & Safety

SolidusX uses SSL technology, meaning personal information and transactions are secured by encryption technology.

The broker also states that the trading terminal is un-hackable due to a secured cloud-based system and two-factor authentication (2FA). Other cyber security protocols include:

- Cryptographically hashed passwords

- Amazon Web Services (AWS) security controls

- Digital asset cold storage with multi-signature technology

- Cloudflare mitigation against distributed denial of service (DDoS) attacks

- Regular IT security assessments to stay up to date with potential vulnerabilities

SolidusX Verdict

SolidusX is a fairly new broker that offers an extensive list of instruments, from forex to cryptos. Its intuitive trading platform and on-call financial experts also make it an appealing option.

However, the high minimum deposit of $500, the unreliable customer support, and the lack of regulatory oversight or demo account may deter potential investors. The absence of a well-known platform like MetaTrader 4 is also a drawback.

As a result, SolidusX may not be a good fit for most beginners.

FAQs

What Assets Does SolidusX Offer?

SolidusX offers thousand of assets, including cryptocurrencies, currency pairs, ETFs, commodities, indices, and global stocks. Fractional shares are also available.

Does SolidusX Have A Mobile App?

Yes – the SolidusX mobile app is available as a free download to iOS and Android devices. It offers the full functionality of the desktop terminal, alongside mobile-optimized charting and a convenient notification center for the latest alerts and market movements.

What Is The Minimum Deposit To Get Started With SolidusX?

The lowest starting deposit is $500, available with the Tyro account. Higher account tiers come with large investment requirements, from $2,500 with the Optio account up to $100,000 with the Legatus profile. Premium accounts offer lower fees, priority support, and more advanced tools and market insights.

Who Owns SolidusX?

SolidusX is owned and operated by Digital Genius Group Ltd. It is a subsidiary of Solidus Capital, a UK-based asset management firm with decades of experience. Day traders enjoy a stable platform with guidance from a team of market experts.

Is SolidusX Legit?

SolidusX is a legitimate brokerage registered in Saint Vincent & the Grenadines. And whilst not offering strong regulatory oversight, the brand does have good user reviews and offers more than 5000 instruments on its web-based platform.

Top 3 Alternatives to SolidusX

Compare SolidusX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

SolidusX Comparison Table

| SolidusX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 1.3 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, ETFs, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $500 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | SVGFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | Deposit Joining Bonus | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | TradingView | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:200 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 6 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by SolidusX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| SolidusX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

SolidusX vs Other Brokers

Compare SolidusX with any other broker by selecting the other broker below.

Customer Reviews

1 / 5This average customer rating is based on 1 SolidusX customer reviews submitted by our visitors.

If you have traded with SolidusX we would really like to know about your experience - please submit your own review. Thank you.

Available in United States

Available in United States

SolidusX defrauded me out of A$320,00 claiming crypto currency had lost it’s value but an online search proved this to be a scam. Beware. !