Questrade Review 2025

Awards

- #1 Investor Satisfaction 2020 - J.D. Power's Self Directed Investor Satisfaction Study

- Seal of Service Excellence 2019 - DALBAR

Pros

- Comprehensive learning centre with goal-tracking advice, platform tutorials and investment webinars

- Excellent mobile trading app for active equity or options traders, with advanced charting and order types, plus a strategy builder tool

- Easy account opening with no set-up fees and a choice of flexible portfolio types, depending on risk appetite

Cons

- No youth investment accounts

- $1000 minimum deposit is high for beginners

- Canadian citizens accepted only

Questrade Review

Questrade is a Canada-based online brokerage offering managed investment portfolios as well as self-directed trading with a range of account options. The broker also provides practice accounts and promo codes for new users. Our review includes everything you need to know, from pricing to trading platforms.

Questrade Company Details

Founded in 1999, Questrade Inc. is an established online brokerage, regulated by the Canadian Investment Regulatory Organization (CIRO). The financial group initially offered investment in Canadian and North American Stocks as well as ETFs, but now also provides access to options, FX, CFDs and more.

With 21 years in the Canadian market, the award-winning broker has accumulated $15 billion in assets and has featured in several online publications, including Yahoo Finance. Questrade ensures that all client needs are catered for with several different account types, from short-term to retirement-friendly.

Trading Platforms

Questrade Web Platform

The standard Questrade Trading platform is designed for all levels and the most popular choice for Questrade clients. No download is required; simply sign up for a live or demo account to receive your login details.

The all-in-one trading platform offers a smart design coupled with intuitive features, including historical data, customisable watchlists, and charting tools. Users can choose between 3 chart types (Candlestick, Mountain, or Bar) and view data in 10 time-frames. There are also 30 technical indicators ready to use, including Bollinger Bands and Moving Averages.

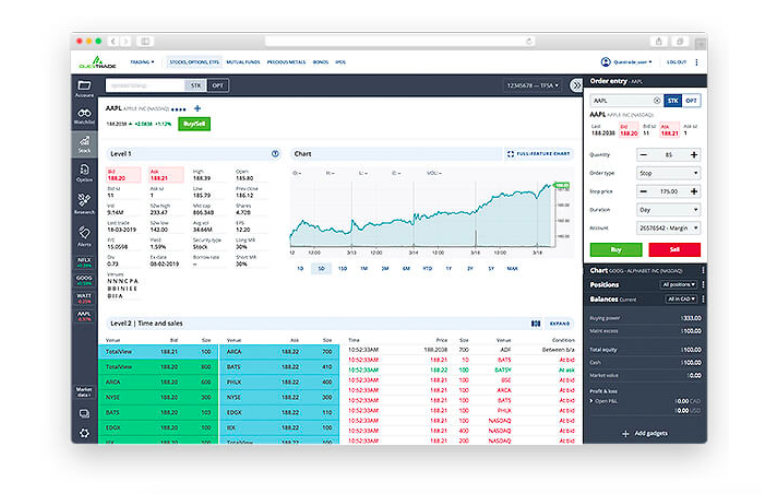

Questrade IQ Edge

For the more professional and active trader, Questrade IQ Edge is the superior option. Open multiple platform windows at once with the smart interface and utilise market filters to track movements quickly. Advanced trading order types are also available, including bracket, conditional, and multi-leg options.

The trading platform is desktop-based and a download is required for either Windows or Mac users.

Questrade Global

The Questrade Global web-based platform is ideal for those who want to trade on international FX and CFD markets. The built-in smart features include custom indicators and charting tools, economic releases, and personalised watchlists. Clients can open 4 chart windows simultaneously in customisable time ranges and access 9 chart types and plenty of technical indicators and drawing tools.

Once you have set up an account, access to the trading platform is quick and easy straight from your internet browser.

Note, MetaTrader 4 and MetaTrader 5 are not available to download at Questrade.

Markets

Questrade primarily offers a wide range of investment choices to suit all types of goals and risk-levels, including stocks, indices such as the S&P 500, ETFs (Exchange Traded Funds), options, and over 110 FX pairs. There are also other asset classes available including precious metals, such as gold, CFDs, bonds, futures, warrants and GICs ($5000 minimum).

Overall, this review was impressed with the excellent breadth of online financial markets.

Fees

Self-Directed Investing Pricing

The pricing structure for self-directed investing depends on whether you are a novice or an active trader. All accounts come with the Basic pricing package, which is $0.01/share with a minimum of $4.95 and a maximum of $9.95 per stock. ETFs are free to buy but selling will include commissions.

The Enhanced pricing package costs $19.95 USD/CAD per month and comes with enhanced Level 1 live streaming data, plus a full rebate if you spend more than $48.95 in trading commissions.

You can also utilise Active Trader pricing by purchasing one of the Advanced data packages for $89.95 USD/CAD per month. These include extra perks like Level 1 and Level 2 live streaming data, full and partial rebates, plus other data add-ons.

Once you unlock Active Trader pricing, you can benefit from either fixed or variable commission plans, as indicated below. CFD pricing for commodities and indices is derived from spreads. Stocks are priced with a commission plus a minimum payment.

There are some other fees to bear in mind. These include rollover fees for expiring and non-expiring CFDs, ECN and ATS exchange fees on US and Canadian securities, plus other admin fees. There is also a quarterly inactivity fee of $24.95 which applies to accounts with less than $1,000.

Questwealth Portfolio Pricing

If you opt for a Questwealth Portfolio, there is a 0.25% commission on balances between $1,000 – $99,999, which reduces to 0.20% with balances over $100,000. Other fees include Management Expense Ratio fees (MER) on ETFs, currency exchange fees, and administrative fees.

The costs may appear complex, but the broker is fully transparent and makes it clear that there are no hidden fees. Note, GIC and borrow rates for short selling can be found on the Questrade website.

Leverage Review

Leveraged products are only available with the margin accounts at Questrade, and are capped at 1:3.33.

Margin trading requirements (i.e. maintenance excess) for stocks, options, and precious metals can be found in the pricing section of the website, as well as interest rates. Note that Questrade has 4 approval levels for options trading which are based on minimum balances before placing a trade; this ranges from no minimum for Level 1, to 25,000 CAD for level 4.

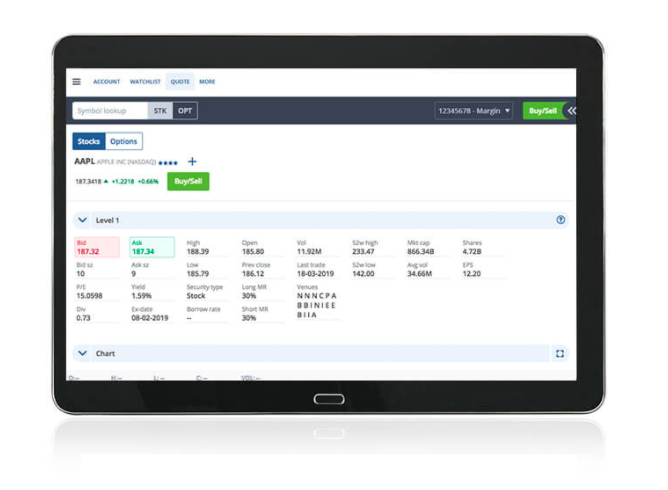

Mobile Apps

The Questrade Trading platform comes also as a mobile app, offering the same all-in-one functionality as the web-based version. Users can access watchlists, built-in research, and real-time market data whilst on the go, as well as customise charts and manage accounts with ease.

The app is available for iOS and Android smartphone and tablet devices, though due to some negative customer reviews online, some improvements may be needed in regards to technical faults and customer service issues.

Payment Methods

Funding a Questrade account can be done from within the trading platform via several methods including online bank payments, wire transfers, money orders, and cheques. Electronic methods are free but all other methods incur transfer and withdrawal fees. For example, CAD and USD wire transfers cost $20 and $30 respectively. An international wire transfer costs $40.

Processing times are 1 – 2 business days for most methods but receipt of funds may vary depending on the chosen bank or payment processor.

Demo Account

Questrade offers practice accounts for all of its trading platforms. Demo accounts allow you to test out the platform features and capabilities as well as your own trading skills, in a completely risk-free simulator environment.

Both the standard Questrade Trading web-platform and IQ Edge desktop platform allow you to practice with 500,000 USD or CAD virtual cash, for 90 days. Demo users in the Questrade Global trading platform will receive 100,000 CAD in virtual funds for 30 days.

Questrade Bonuses

Questrade currently offers two promo codes in 2025; the first is for 5 zero commission trades upon account opening. Note that you will need to open an account with at least 1000 CAD minimum to qualify. The other promotion requires funding of at least $25,000 within 30 days of account opening and users will receive one month of free trades, plus level 2 market data.

Questrade also offers rebates on transfer fees when you switch your existing account to Questrade. The maximum rebate is $150 per account and there’s no limit to the number of accounts you can bring over. Check the Questrade website for news of trading competitions.

Regulation

Questrade Inc. is regulated by the the Canadian Investment Regulatory Organization (CIRO). As a member of CIRO, Questrade agrees to a number of regulatory rules, including regular reviews, employee screening, adhering to minimum capital requirements, and undertaking any necessary investigations relating to misconduct.

Questrade is also a member of the Canadian Investor Protection Fund (CIPF), so traders should feel safe investing with the broker.

Additional Features

Questrade offers an education section with beginner and advanced resources, including a blog, how-to articles within the knowledge base, and on-demand webinars to help improve investing skills. There are also retirement planning tools, including a retirement calculator and retirement-specific blog articles. You’ll also find guidance on premarket, after hours, and extended hours trading. In addition, tutorials advise on risk management tools, including bracket orders, limit orders and trailing stop limits, plus dividends yields.

For self-directed investors, Questrade also offers the Market Intelligence tool, a fundamental research platform powered by Morningstar. Users with either the Questrade Trading or IQ Edge platforms can access this service free of charge.

Traders can also subscribe to the IPO Bulletin, which provides a full list of the latest Initial Public Offerings for sale.

Questrade Accounts Review

Whether you opt for self-directed investing, or a Questwealth Portfolio, there is a range of account types to choose from. What’s more, you can add and open as many as you’d like and there are no yearly fees. An overview of account categories is provided below.

Traders should note that any account requires a $1,000 minimum balance before you can start investing. This is quite hefty compared with other competitors such as QTrade and Wealthsimple.

Self-Directed Investing

Self-directed investors can boost their buying power with margin trading, or invest in ETFs for free without commissions. Traders can also benefit from mutual fund rebates and set up a Dividend Reinvestment Plan (DRIP) which automatically reinvests dividend income.

- Registered Retirement Savings Accounts & Plans (RRSA & RRSP) – Offers tax deductions with yearly contributions. Spousal account also available.

- Locked-in Retirement Accounts (LIRA) – Convert your employer-sponsored pension and enjoy tax-deferred income.

- Income Funds – Rollover your savings from Registered Retirement accounts into retirement-friendly accounts.

- Registered Education Savings Plans (RESP) – Set up post-secondary education for a child (or beneficiary) and enjoy government incentives and grants.

- Entity & Trust Accounts – Invest on behalf of your business or someone else.

- Individual and Joint Margin Accounts – Start buying US stocks, options, ETFs, and more.

- Forex & CFD Accounts – Trade on global markets including FX, commodities, global stocks, and index funds.

Questwealth Portfolios

Questwealth Portfolios are accounts managed by a team of experts, offering lower fees. As with self-directed investing, traders can also choose between the retirement and education accounts, as well as short term options such as individual and corporate Cash Accounts and Tax-Free Savings Accounts (TFSA). Users can also choose to invest in a range of low-risk and high-risk Socially Responsible Investing portfolios (SRI), from Conservative Portfolios to Aggressive Growth Portfolios.

Trading Hours

For most markets, trading hours are from 9:30 am – 4:30 pm EST, Monday to Friday. Specific times may vary depending on the market, and these can be found within trading platforms.

Questrade Support

Support is available via an online contact form, telephone number (1-888-783-7866), or by selecting the live chat logo in the bottom corner. Questrade’s head office address is 5700 Yonge Street, North York, ON M2N 5M9, Canada.

The support team can help with a host of queries, from limit order duration and issues with the platform not working and loading to setting up and starting a Questrade account, plus negative cash balances. They can also assist with closing a Questrade account, hotkeys guides and queued order questions.

Client Security

Questrade ensures full security on all transactions and accounts. Email and phone 2-step verification are required for all clients and trading platforms boast a 256-bit SSL digital certificate, which encrypts incoming and outgoing transactions through a secure connection. Questrade can also enable automated alerts, which provide the last login attempts on client accounts.

Questrade Verdict

Questrade offers investment plans on stocks, options, ETFs, and more, with practice accounts on three trading platforms. The broker also offers promo codes and multiple live accounts, including margin options for leveraged trading. The online brokerage may be particularly attractive to experienced investors who can maintain a high minimum balance.

Top 3 Alternatives to Questrade

Compare Questrade with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Questrade Comparison Table

| Questrade | Interactive Brokers | World Forex | Dukascopy | |

|---|---|---|---|---|

| Rating | 3 | 4.3 | 4 | 3.6 |

| Markets | Forex, CFDs, indices, shares, precious metals, mutual bonds, options, warrants, GICs, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $1000 | $0 | $1 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | CIRO | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA | FINMA, JFSA, FCMC |

| Bonus | 5 commission-free trades | – | 100% Deposit Bonus | 10% Equity Bonus |

| Education | No | Yes | No | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 | JForex, MT4, MT5 |

| Leverage | 1:3.33 | 1:50 | 1:1000 | 1:200 |

| Payment Methods | 1 | 6 | 10 | 11 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Questrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Questrade | Interactive Brokers | World Forex | Dukascopy | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | No | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | Yes | Yes | No | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

Questrade vs Other Brokers

Compare Questrade with any other broker by selecting the other broker below.

The most popular Questrade comparisons:

FAQ

How do I open a Questrade account?

Setting up a Questrade account is quick once you know which account(s) you wish to open. Click Open An Account at the top of the page and select from the options available. The next stages involve creating your sign-in credentials, building your profile, and setting up your account requirements. You’ll then receive your 10 digit account number and can get started.

How secure is Questrade?

The Questrade platforms use 256-bit Secure Sockets Layer (SSL) encryption protocols as well as 2 Factor Authentication (2FA). Traders should feel safe when investing at Questrade.

Can I trade Bitcoin at Questrade?

No, Questrade does not currently offer trading on Bitcoin or other cryptocurrencies.

What is a Questrade Margin Account?

A Questrade non registered margin account will allow you to invest in North American markets using leverage. You also have the option to borrow US Dollars and keep the Canadian Dollar equivalent in your account, or you can exchange your Canadian Dollar funds to US funds.

How do I convert CAD to USD at Questrade?

For those who want to invest in US securities without paying substantial currency conversion fees, it is possible to use Norbert’s Gambit method to exchange CAD to USD at an attractive price. This essentially involves buying, journaling, and selling shares in the Horizons US Dollar Currency ETF (ticker symbol DLR). Customer support can guide you through this process.

Is Questrade a public company?

No, Questrade is not a publicly listed company. It is a member of the privately owned Questrade Financial Group.

Customer Reviews

There are no customer reviews of Questrade yet, will you be the first to help fellow traders decide if they should trade with Questrade or not?