Personal Capital Review 2024

Awards

- Best for Portfolio Management 2020

Pros

- Segregated client funds with a top-tier custodian bank

- FDIC-insured cash account with no minimum balance requirement

- A wealth of free financial analysis and planning tools

Cons

- An annual advisory fee of 0.89%

- Wealth management services only for customers with $100,000+ in invested assets

- No forex, futures or cryptocurrencies

Personal Capital Review

Personal Capital is now Empower. Please go to our review of Empower for our latest findings and expert verdict.

Personal Capital offers free investment tools and wealth management services. The broker-dealer aims to help US individuals transform their financial lives through technology and advisory solutions. This review will cover the products available to retail customers, fees, brokerage accounts, and more. Find out if you should sign up with Personal Capital.

Company Details

Personal Capital is an online financial advisory and personal wealth management company founded in 2009 by Bill Harris, Rob Foregger, Louie Gasparini, and Paul Bergholm. The organization is headquartered in Redwood City, California with additional offices in San Francisco and Denver.

Previously known as SafeCorp Financial Corp, the firm provides a selection of free and paid products for retail investors of all experience levels. The company was also acquired by Empower Retirement in 2020 for $1 billion. It is now referred to as Personal Capital, by Empower.

The company has 3.4 million active users with $20.5 billion in assets under management. It also has accolades from established firms and media groups, including a quote from The New York Times that it is “the tool to beat”.

Personal Capital is registered with the U.S. Securities and Exchange Commission (SEC) as an investment advisor.

Trading Platform

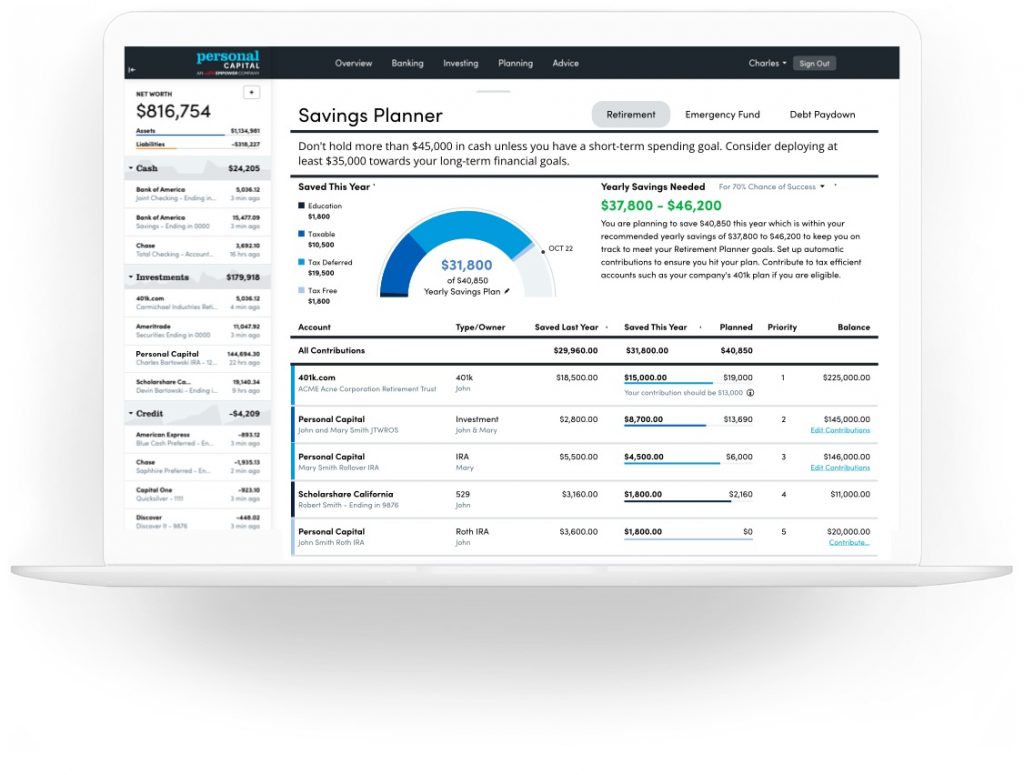

Personal Capital offers an intuitive financial dashboard. It uses state-of-the-art technology to provide investors with a 360 view of their finances. It is available on desktop devices or can be downloaded as a mobile-compatible app for iOS and Android mobiles and tablets.

Users can switch between major groupings on the main navigation bar; Investing, Planning, Banking, and Wealth Management. The dashboard updates in real-time and categorizes your financial information into digestible and visual displays.

Although the platform is suitable for beginners, the terminal also provides enough analytical features and planning tools for experienced traders to dig deep into investment opportunities.

Features include:

- Net Worth – Make smart investment decisions using the Net Worth calculator. Pinpoint what you owe vs what you own and track your liabilities and assets over the long-term

- Investment CheckUp Tool – Review the performance of your current investment holdings and view rebalancing suggestions. Compare your portfolio allocation vs the ideal target allocation to minimize risks

- Fee Analyzer – Expose hidden fees within your external investment accounts. Gain insight into the performance and expenses of your mutual fund trades and protect your money from costly charges

- Budgeting – Organize your investments, everyday spending, and savings by category, date, and institution. Set budgets to keep track of your annual trading balances and ensure funds are available when opportunities arise

- Savings Planner – Create annual savings goals with insights and countdowns to help you achieve your ambitions. Whether it’s retirement savings, debt pay downs, or emergency fund building, the service provides a clear breakdown of fund requirements by period

How To Get Started

- Register for a Personal Capital account

- Verify your identity by SMS or phone call

- Link your existing financial accounts by searching bank name or URL, e.g. Bank of America

- Enter your credentials for the US bank account or financial institution

- Select ‘Continue’

- Repeat until all your financial account details have been entered

- Once verified you can view all your linked accounts within one dashboard

Products & Assets

Personal Capital investment accounts and trade plans are made up of stocks, mutual funds, fixed-income products, and ETFs. Access to instruments will vary between portfolio suggestions based on your financial goals.

The broker-dealer uses their Smart Weighting indexing technology to create a diverse portfolio. This involves equally weighting an asset’s style, size, and economic sector. The aim is to achieve risk-averse returns while not missing opportunities. Personal Capital creates a sample of 70+ individual US stocks to construct an index. With this comes increased tax management opportunities, the elimination of fund costs, and the avoidance of ‘sector’ bubbles.

When we used Personal Capital, we were particularly pleased to see the option to invest in socially responsible portfolios made up of firms that align with environmental, social, and governance (ESG) factors.

Fees & Costs

The Personal Capital fee schedule is simple. Customers can access all the financial tools and analysis dashboard free of charge. There are no commissions, meaning you can use the tools as often as required to support investment decisions.

An annual fee does apply for advisory services and wealth management support. The firm uses a percentage-based cost method according to your assets under wealth management.

Fees by asset balance:

- Up to $1 million – 0.89%

- $1 million to $3 million – 0.79%

- $3 million to $5 million – 0.69%

- $5 million to $10 million – 0.59%

- $10 million+ – 0.49%

Leverage

Personal Capital does not provide margin trading opportunities. All investment portfolio suggestions are designed to be executed through cash accounts.

Payment Methods

Deposits

Deposits and withdrawals can be requested directly through your Personal Capital dashboard. You can transfer funds via domestic and international bank wire transfers (USD currency only) or transfer between Personal Capital accounts. This includes setting up automated direct deposits on a daily, weekly, or monthly recurrence. The broker does not charge any fees.

For new accounts, users are required to deposit at least $1 to a cash account. A 60-day waiting period is activated from this deposit, meaning funds can only be withdrawn to the amount of the deposit made via the linked account. Deposits made from newly linked accounts may incur a processing time of five working days.

How To Transfer Funds Through The Personal Capital Mobile App

- Log in to the Personal Capital mobile app with your registered credentials

- Select your cash account

- Click on the three dots found on the top right of the interface

- Select ‘Transfer Funds’

- Choose the account to transfer funds from

- Choose the account to transfer funds to

- Add the transfer value

- Select the regularity of transfer e.g. one-off, weekly, monthly, etc

- Select ‘Next’

- Review the transfer and select ‘Confirm Transfer’

The maximum deposit limit is $250,000 per transaction although there is no limit on the number of individual transactions per day.

Withdrawals

Cash is available for withdrawal within a one to three-day settlement period after investment positions are closed. There is a $25,000 withdrawal limit per day unless you are exempt, including if your account was opened before December 1st, 2019. If so, the withdrawal limit is $100,000 per day.

External withdrawal requests from a Personal Capital cash account are typically received within one to two working days. There are no withdrawal fees, but third-party charges may apply.

International wire transfer withdrawals are not permitted. Domestic withdrawal wire transfers over $10,000 are processed Monday to Friday between 9:30 AM and 2:00 PM each day (Pacific Time).

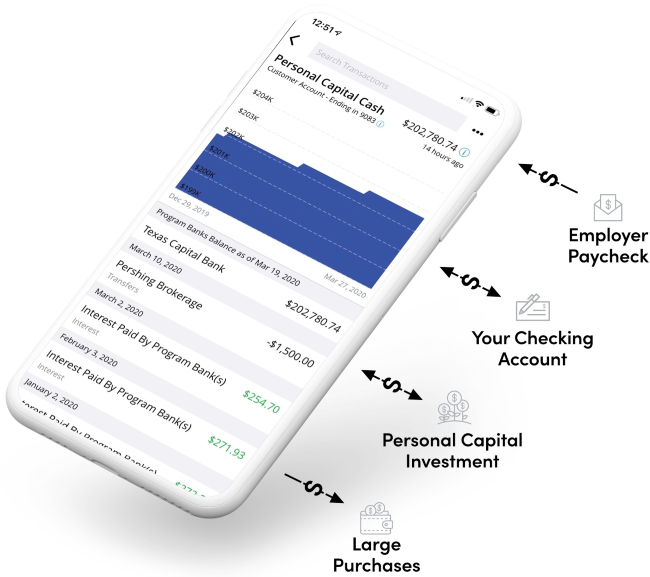

Personal Capital Mobile App

The majority of Personal Capital tools can be accessed via the iOS and Android mobile applications. You can download the apps from the relevant app store.

While using Personal Capital’s mobile application, we could access our investments and real-time financial status 24/7. Customers can also use interactive cash flow tools from portable devices. This includes compatibility with Apple watches. You can set spending and investment targets and check spending status by date.

The brokerage’s app is highly rated, with a 4.7/5 ranking on the Apple App Store. Additionally, quotes from recognized media outlets, such as CNBC, have called it “the best app for investors”.

Demo Account

The broker-dealer does not provide a demo account service. This is disappointing, particularly given the high minimum investment required to access wealth management services.

Nonetheless, potential users can access a wealth of educational resources and guides. Investors can also use all financial tools free of charge. Additionally, new users can speak to a wealth advisor to understand potential investment plans and portfolio options.

Deals & Promotions

Existing Personal Capital customers can receive bonuses and financial rewards through the broker-dealer’s referral scheme. Rewards vary, but historically, they have included six months of waived advisory fees, free access to live events, and gift cards.

The referred ‘friend’ must link a new investment account with a minimum balance of $1000 within 30 days of receiving the unique link.

Regulation & Licensing

Personal Capital Corporation is a wholly owned subsidiary of Empower Holdings LLC and operates through two subsidiaries;

- Personal Capital Advisors Corporation (PCAC) – Registered as an investment advisor, regulated by the Securities and Exchange Commission (SEC)

- Personal Capital Services Corporation (PCSC) – Manages the Personal Capital Cash Program. All funds held in a Personal Capital Cash account are FDIC insured to an aggregate of $2,000,000

Client funds are also segregated from Personal Capital’s business funds and held with Pershing Advisor Solutions, one of the USA’s largest custodian banks.

Remember, no investment advisor can guarantee profits. Past performance is not indicative of future returns. Never invest more than you can afford to lose.

Additional Features

Education

Personal Capital offers a variety of educational resources and information suitable for both experienced traders and complete beginners. The brand operates an educational blog named Daily Capital which hosts hundreds of articles, forum-style posts, and guides. Key categories include company news, financial planning, investing & markets, guides & reports, and key-term glossaries.

Personal Strategy

The Personal Strategy® tool combines innovative technology with the brand’s financial advisors to create a personalized investment portfolio. This is available to paying, wealth management customers. The product creates a unique collection created with stocks and ETFs, designed and managed specifically for you.

Retail clients can benefit from a dedicated wealth management advisor, daily portfolio rebalancing, and tax optimization. The suggested strategy utilizes your personal financial goals, risk appetite, and timelines to provide a well-rounded, long-term trading solution.

The automated tool is monitored by Personal Capital’s wealth managers, and auto-adjustments are made by the team based on external market movements. The asset allocations can also be amended as your financial situation or goals change over time.

Financial Roadmap

The Financial Roadmap tool was launched in 2020. It was developed to boost financial outcomes through personalized and timely guidance. Based on your personal data, the product suggests major topics to focus such as mortgage/real estate, education, or retirement cash flow. It can recommend an allocation of funds to invest, save or create an emergency fund.

The ‘timeline’ can be found running alongside the bottom of the dashboard interface. It uses a checklist-based roadmap so you can understand which topics you have visited and what needs attention.

Account Types

Once you have registered for a Personal Capital account and synced your existing investment and banking accounts, users gain access to the free financial tools offered by the firm.

Accounts are available to US residents only.

Cash Management Services

The Personal Capital Cash account is a high-interest savings account that can be used alongside investment tools and financial planning services. The account is available for no fee, with no minimum account balance requirement, unlike the wealth management profiles. Customers benefit from a 3.35% APY interest rate (3.45% APY for customers with a wealth management profile).

Features include:

- No minimum balance

- Set up direct deposits for paychecks

- Individual or joint accounts available

- Pay bills by linking your checking account

Wealth Management Services

Retail clients must have a minimum of $100,000 in investments to qualify for Personal Capital investment management profiles. There are different wealth management tiers:

Investment Services Account

- Access to all free financial tools

- $100,000 to $200,000 in investment assets

- A managed ETF portfolio and investment review upon request

- Unlimited financial and retirement guidance from Personal Capital advisors

Wealth Management Account

- Access to all free financial tools

- $200,000 to $1,000,000 in investment assets

- Two dedicated financial advisors and specialist support

- Access to experts in real estate, stock options, and more

- A fully customized ETF and stock portfolio with regular performance reviews

Private Client Account

- Access to all free financial tools

- Fully customizable investment plans

- Over $1,000,000 in investment assets

- Two dedicated financial advisors and specialist support

- Stocks, ETFs, and individual bonds portfolio implementation

- Private equity investment options (available to clients with $5m+ invested assets)

- Priority access to experts in real estate, stock options, and more plus specialist support for retirement and wealth planning

New Account Requirements

To get started with Personal Capital, you will need to register for an account.

Select the ‘Get Started’ logo found on the top right of the website’s navigation bar. You will need to provide detailed financial information if you are looking for a managed profile. Here is how it works:

- Complete the financial evaluation questions

- Personal Capital’s wealth management team will develop a personalized money strategy

- A Pershing account (Personal Capital’s third-party custodian) will be opened once you are happy with the trade plan

- Fund your account with cash or transfer securities

- The financial strategy is implemented

Customer Service

Personal Capital does not offer a live chat function.

Our experts were impressed with the FAQ section, however, more detail can be found within the online Support Center. The link can be found on the ‘Contact Us’ webpage. Topics include how to deposit/withdraw to an investment account, login queries, and brokerage fees.

Additionally, there are plenty of guides, blog posts, and articles so you can resolve issues or find answers yourself.

- Online Contact Form – Available on the broker’s website

- Phone – 855.855.8005 (Available 9 AM to 5 PM Monday to Friday)

- Address – Personal Capital, 8 Lagoon Drive, Suite 200, Redwood City, CA 94065

Security & Safety

When using the Personal Capital platform and financial tools, you can be assured of top-tier security protocols and safety standards. Client login details are encrypted and unavailable to company employees. Other features include:

- Biometric authentication, FaceID and fingerprint sign-in requirements on mobile devices

- Multi-factor authentication (MFA) enables one-time passwords (OTPs) each time a login attempt is made from an unrecognized device

- Personal Capital operates a year-round Bug Bounty program which deploys dozens of ‘hackers’ to exploit any potential threats or security risks

- Users can enable daily transaction alerts or email reports which notify them of any suspicious payments made within one of your linked bank accounts

- Your personal data is protected with AES-256 encryption, the same rigorous standards used by the U.S. military. This includes multi-layer key management

- The company has partnered with industry-leading authentication brands including Norton and Verisign for additional layers of security when logging in to your account or withdrawing funds

Personal Capital Verdict

Personal Capital is a good solution for high-net-worth individuals seeking wealth management support and dedicated financial planning. The range of free tools creates a one-stop platform for financial and investment analysis. Although the high advisory fees and minimum account balances may be unsuitable for many, the free Personal Money Cash Account with high-yield interest rates is a good starting point.

FAQs

Is Personal Capital Really Free?

Personal Capital offers free tools to all customers and the Personal Capital Cash savings account can be opened with no minimum balance requirement. There is, however, an annual advisory fee for wealth management services, which is based on your assets under management. There are no confusing commission charges or hidden fees. You must have at least $100,000 in investable assets to be eligible.

Is Personal Capital Safe And Legitimate?

Yes, our Personal Capital review confirms that the company is a safe and secure financial services provider. The firm operates with top-tier security protocols, SEC regulations, and segregated client funds.

Does Personal Capital Sell Your Data?

No, Personal Capital does not sell or permit customers’ personal information to be shared with any third-party institutions.

Is Personal Capital A Good Company?

Personal Capital is a legitimate financial services provider. The Personal Capital Advisors Corporation is regulated by the Securities and Exchange Commission (SEC). The firm provides a range of free financial tools, investment guidance, and support for both experienced and novice traders looking for planning advice.

Is Personal Capital A Broker Dealer?

Personal Capital is an online financial advisor and personal wealth management firm. It offers brokerage accounts via its personalized wealth management solution. Investors can trade through managed or flexible asset portfolios.

Can I Link My Existing Broker Account To My Personal Capital Dashboard?

Yes, you can link third-party brokerage profiles to your Personal Capital dashboard. This includes profiles from Interactive Brokers and eTrade, for example. Additionally, Personal Capital integrates with Zillow to retrieve the value of your home so you can include this within your financial reporting.

Is Personal Capital Online Only?

Personal Capital is a web and mobile-based platform. Customers can access financial tools, planning, and investment portfolios online and on portable devices. Alternatively, retail traders can use services on Apple watches.

Top 3 Alternatives to Personal Capital

Compare Personal Capital with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Empower – Empower, previously Personal Capital, is a US-based and SEC-regulated trading platform and advisory firm. Clients can access pensions, robo-advisors and do-it-yourself investing in stocks, mutual funds, fixed-income products and ETFs. Millions of clients trust Empower with their long-term investments, attracted by the suite of free financial planning tools and excellent reputation.

Personal Capital Comparison Table

| Personal Capital | Interactive Brokers | IG | Empower | |

|---|---|---|---|---|

| Rating | 3.3 | 4.3 | 4.4 | 2.8 |

| Markets | Stocks, ETFs, Mutual Funds, Fixed Income | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, ETFs, Mutual Funds, Fixed Income |

| Demo Account | No | Yes | Yes | No |

| Minimum Deposit | $1 (Cash), $100,000 (Robo Advisor) | $0 | $0 | $1 (Cash), $100,000 (Robo Advisor) |

| Minimum Trade | Variable | $100 | 0.01 Lots | Variable |

| Regulators | SEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SEC, FINRA |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Own |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | – |

| Payment Methods | 1 | 6 | 6 | 1 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

Empower Review |

Compare Trading Instruments

Compare the markets and instruments offered by Personal Capital and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Personal Capital | Interactive Brokers | IG | Empower | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Personal Capital vs Other Brokers

Compare Personal Capital with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Personal Capital yet, will you be the first to help fellow traders decide if they should trade with Personal Capital or not?