Optimus Futures Review 2025

Optimus Futures Review

Optimus Futures is a regulated introducing broker that works with several futures clearing merchants (FCMs) to provide access to the futures market. This review will cover minimum deposits, withdrawals, trading platforms, fees and more. Find out whether you should open a live account today.

Optimus Futures Headlines

Optimus Prime is based in Florida, USA and was founded in 2005 by Matt Zimberg. It has four other offices in Iowa, Chicago, Akron and New York. As an independent entity that partners with some of the biggest FCMs, Optimus Futures offers a number of trading platforms, services and solutions.

The brokerage focuses on maintaining relationships with clients while trade execution, back office and exchange floor operations are handled by FCM partners. There are six FCM partners in total: AMP, Ironbeam, ADM Investor, Gain Capital, TradeStation and Wedbush. However, depending on your jurisdiction, only a few may be available. For example, retail traders in Canada can only access AMP Global Clearing, Wedbush Futures and TradeStation Securities.

Optimus Futures, its FCM partners and clearing firms are all registered with the National Futures Association (NFA).

Trading Platforms

Optimus Futures works with 17 firms to offer a wide selection of 44 trading platforms. Some interfaces require a monthly payment while others can be accessed with no additional fee. Free access platforms include the following:

MetaTrader 5

MT5 is a top-rated all-in-one platform for trading multiple assets. It is hailed as one of the most customisable on the market, with various tools and charts for technical analysis, indicators and all types of execution orders. Other features include:

- Copy trading

- 21 timeframes

- Unlimited charts

- 80 technical indicators

- Flexible trading orders

- Financial news & economic calendar

TradingView

TradingView is a trusted cloud and web-based trading platform for forex and futures. It offers charting, organisational tools and social trading features. Users can also benefit from:

- HTML5 charts from your browser

- 50+ intelligent drawing tools

- Built-in technical analysis

- Advanced price scaling

- Economic calendar

TradeStation

TradeStation’s radar screen allows users to find new market opportunities in real-time. Traders can follow live trends and chart patterns across the entire market using built-in, customisable indicators. Other features include:

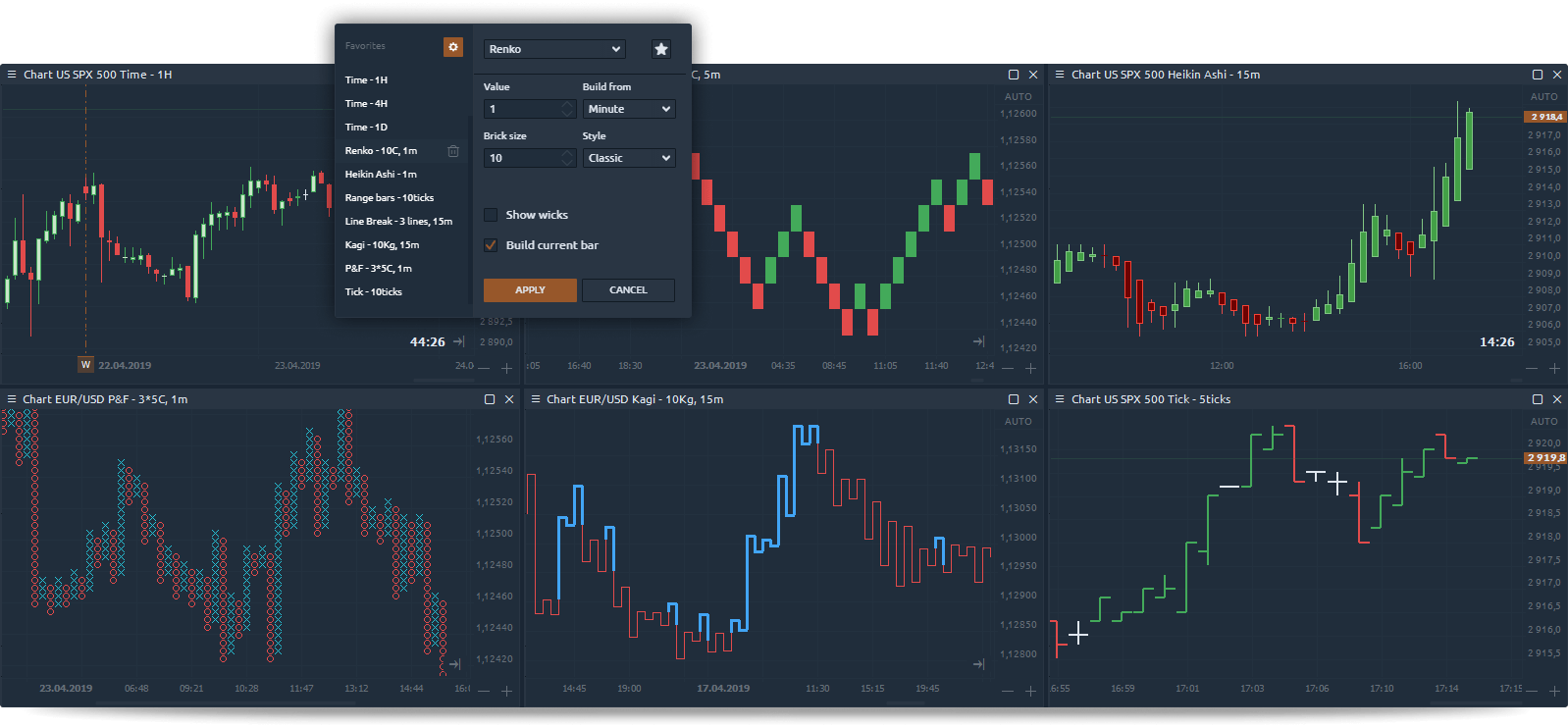

- Exotic chart types, everything from candlesticks to Renko bars

- Up to 27+ years of intraday data

- Up to 90+ years of daily data

- Multiple time-frame analysis

- 10 different chart types

- 150+ indicators

OptimusTrader

OptimusTrader is a user-friendly and functional futures platform specifically designed to provide fast executions. This platform is for users who prioritise speed over value-add extras. It is ideal for beginners, but professionals will still find the crucial indicators and trading tools they require, including:

- Customisable trading screen with widgets

- Rithmic data feed API

- Flexible order tickets

- Interactive charts

- Depth of Market

OptimusFlow

Optimus Flow is the broker’s signature order flow trading platform. Analytical panels on its interface make for an improved visual display and faster order execution while still allowing for technical analysis. This platform is only available for funded Optimus Futures customers through the AMP clearing firm. Users benefit from:

- Market depth

- Chart drawing tools

- Strategy backtesting

- 40+ technical indicators

- Standard and custom timeframes

- Live market data and quotes (including level 2 data)

Products

Optimus Prime clients can only trade futures and options. Nevertheless, the broker offers an impressive 13 exchanges, which sell derivatives on forex, energies, grains, indices, meats, metals and soft commodities.

Futures:

- Singapore Exchange (SGX)

- Cboe Futures Exchange (CFE)

- London Metal Exchange (LME)

- Intercontinental Exchange (ICE)

- Chicago Board of Trade (CBOT)

- Kansas City Board of Trade (KCBT)

- Commodity Exchange Inc. (COMEX)

- Minneapolis Grain Exchange (MGEX)

- Chicago Mercantile Exchange (CME)

- Australian Securities Exchange (ASX)

- New York Mercantile Exchange (NYMEX)

- European Derivatives Exchange (EUREX)

- NYSE London International Financial Futures Exchange (LIFFE)

Options:

- Singapore Exchange (SGX)

- Minneapolis Grain Exchange (MGEX)

- Australian Securities Exchange (ASX)

- Kansas City Board of Trade (KCBT): commodities

- Commodity Exchange Inc. (COMEX): precious metals

- Cboe Futures Exchange (CFE): volatility index and bitcoin futures

- New York Mercantile Exchange (NYMEX): energy and soft commodities

- Intercontinental Exchange (ICE): forex, soft commodities, equity indices, energies

- European Derivatives Exchange (EUREX): European interest rates and equity indices

- NYSE London International Financial Futures Exchange (LIFFE): metals and equity indices

- Chicago Mercantile Exchange (CME): equity indices, bitcoin, interest rates, commodities, forex

- Chicago Board of Trade (CBOT): financial, treasury, micro e-mini and mini index, mini agricultural

- London International Financial Futures Exchange (LIFFE): equity indices, commodities, interest rates, fixed income

Note, UK retail traders are banned from trading crypto-derivatives under FCA regulation as of 6 January 2021.

Fees

The Optimus Futures commission structure favours higher trading volumes. It also depends on the markets you trade, your trading platform and the order routing connection used. With that said, commission rates do not exceed $0.50 per side no matter how low you trade. Clients who meet daily trading volume thresholds can qualify for discounted commissions as low as $0.10 per side.

Average Daily Contracts vs Commission Per Side

- 0-20 contracts = $0.50

- 20-100 contracts = $0.40

- 101-500 contracts = $0.30

- 501-1000 contracts = $0.20

- 1000+ contracts = $0.10

Leverage

Optimus Futures does not offer any leverage on futures and options products. However, it does offer low day-trading margins which are determined by clearing firm partners. These are provided as a percentage of the initial margin or as a nominal amount. Day trading margins are calculated by market volatility, open interest, customer credit profile and funds in the account. For a detailed list of margin requirements, visit the broker’s website.

Mobile Trading

Optimus Futures has a number of free platforms suited for mobile trading. These include Optimus Trader, Optimus News, MT5, TradeStation Mobile, Firetip, iBroker and CQG Mobile Trader. These are available for downloaded on iOS or Android devices. Prospective users can find reviews from customers on the respective app stores, but many have good ratings.

Payments

The method and costs of funding and withdrawing from your account will depend on the FCM you choose. In general, deposit methods include bank wire transfer, bank ACH deposit or physical cheques. However, the latter options are only open to U.S. traders. The only base currencies accepted are USD, GBP and EUR which may be a downside for international clients who have to pay currency conversion fees.

For withdrawals, users generally have to send a request to accounts@optimusfutures.com. Withdrawal options include a check, wire transfer or ACH transfer (domestic only). Some methods require a high withdrawal fee of $20 for domestic traders and $30 for international traders.

The minimum deposit requirement varies by FCM. These range from $500 to $10,000. However, the account minimum for short options sellers starts at a $100,000 – a high threshold for retail traders.

- AMP: $500

- Ironbeam: $500

- ADMIS: $10,000

- Wedbush: $5,000

- Gain Capital: $5,000

- TradeStation: $5,000

- Phillip Capital: $5,000

Demo Account

Optimus Futures offer a demo account on a number of their trading platforms. By selecting the simulated trading feature, you can view market prices and test out strategies with virtual funds. To access a trial account, simply fill out the form on the website.

Promotions

At the time of writing, Optimus Futures does not offer any welcome or no deposit bonuses. The only discounts offered are on commission rates for high volume traders. However, it is worth regularly checking the website for any offers. Make sure to read bonus terms and conditions before accepting the offer.

Regulation

Optimus Futures LLC is a member of the US National Futures Association (NFA) and is registered with the Commodity Futures Trading Commission (CFTC). The FCMs on Optimus Futures are either regulated by the CFTC, the NFA or the UK’s Financial Conduct Authority (FCA), which are highly reputable bodies.

Additional Features

Optimus Futures offer a decent number of additional educational resources. The broker has a comprehensive list of free guides, for example, futures trading for beginners, golden rules of trading, managed futures and more. There are also multiple scheduled webinars that benefit traders of all levels. The broker also has an established YouTube account that covers a number of topics. Further additional features include a podcast, a blog about trading tips and a futures trading community forum where users can share ideas.

Accounts

Optimus Futures offers a number of account options to suit various traders’ needs:

- LLC

- Joint

- Individual

- Corporate

- Partnership

- Pension Plan Accounts

- Trust/Individual Retirement Account (IRA)

To get started, you will need to pick an FCM to start your online application. Each FCM has varying costs and minimum account requirements. Generally, opening an individual account takes approximately 10 to 15 minutes. Once the trader has completed the application and funded their account, it takes around 24 to 48 hours before it’s live. On corporate accounts, it can take between 3 to 4 business days, however, this may depend on the complexity of the account.

Benefits

- Low commissions for high volume traders

- Vast choice of free educational resources

- Wide range of trading platforms

- CTFC and NFA regulation

- Good customer support

- Segregated accounts

- Mobile trading

Drawbacks

When comparing Optimus Futures vs competitors, such as AMP futures, NinjaTrader or Interactive Brokers, the broker has some drawbacks:

- Limited payment methods for international traders

- High commissions for low volume trades

- High minimum account requirements

- Only USD offered as a base currency

- No Islamic swap-free accounts

- Limited instruments offered

- High withdrawal fees

- No leverage offered

Trading Hours

Optimus Futures follows standard market trading hours. Specific opening and closing hours depend on the instrument being traded. For example, forex and commodities open from Monday to Friday but vary by exchange. The website offers a detailed table on trading times for each asset.

Customer Support

The Optimus Prime customer support team can be contacted through the following methods:

- Telephone: 1-800-771-6748

- Local telephone: 561-367-8686

- Live Chat: Bottom of homepage

- Email: general@optimusfutures.com

- Feedback form: ‘Contact Us’ link on the bottom of the help centre

- Address: Optimus Futures, 4160 NW 1st Avenue, Suite 17, Boca Raton, FL 33431

The broker’s website also offers a comprehensive FAQ section to help you self-serve simple queries.

Security

Optimus Futures has good security and safety processes. Under the CFTC, client funds are held in segregated accounts, which cannot be used by the broker for operational financing. Optimus Futures’ privacy policy also protects client’s personal account information. However, the broker does not guarantee complete protection against malicious third parties, such as hackers or fraudsters. Nonetheless, the broker regularly sets procedural safeguards to protect data. Clients should do their own due diligence and implement two-factor authentication where possible.

Optimus Futures Verdict

Optimus Futures offers a solid service for futures and options traders. It provides a wide range of trading platforms to suit beginners and professionals, a number of educational resources and partners with regulated FCMs and clearing firms. However, there are some downsides. These include the high minimum deposits, no option to leverage trades and expensive commissions on low trading volumes. Therefore, Optimus Futures is generally preferred by professional traders based in the US.

FAQs

What Trading Platforms Can I Use On Optimus Futures?

Optimus Futures offers a choice of 44 trading platforms across mobile, desktop and web-based devices. Some interfaces require a monthly fee while others can be accessed at no cost. The free services include MT5, TradingView, Optimus Flow and TradeStation.

What Is The Minimum Account Requirement To Trade On Optimus Futures?

The minimum account requirement depends on the FCM you choose. This ranges from $500 to $10,000. Generally, this threshold is too high for beginners, who are likely starting out with less capital.

Is Optimus Futures Regulated?

Optimus Futures is a member of the National Futures Association (NFA) and is regulated by the Commodity Futures Trading Commission (CFTC). Its FCM partners are also registered with the CFTC.

Does Optimus Futures Offer A Demo Account?

Optimus Futures users can access a free demo account on selected trading platforms. You just need to provide a few basic details such as your name and email address to open an account. A demo account allows you to try out the platform in a simulated environment with virtual funds at no risk.

Top 3 Alternatives to Optimus Futures

Compare Optimus Futures with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Optimus Futures Comparison Table

| Optimus Futures | Interactive Brokers | FOREX.com | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.3 | 4.4 | 4 |

| Markets | Futures, options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stock CFDs, Futures, Futures Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $500 | $0 | $100 | $1 |

| Minimum Trade | Variable | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | CFTC, NFA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | SVGFSA |

| Bonus | – | – | VIP status with up to 10k+ in rebates – T&Cs apply. | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView | MT4, MT5 |

| Leverage | – | 1:50 | 1:50 | 1:1000 |

| Payment Methods | 3 | 6 | 8 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Optimus Futures and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Optimus Futures | Interactive Brokers | FOREX.com | World Forex | |

|---|---|---|---|---|

| CFD | No | Yes | No | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | No | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | No | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Optimus Futures vs Other Brokers

Compare Optimus Futures with any other broker by selecting the other broker below.

The most popular Optimus Futures comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Optimus Futures yet, will you be the first to help fellow traders decide if they should trade with Optimus Futures or not?