OneUp Trader Review 2025

OneUp Trader is proprietary futures trading firm. It offers funded trading accounts with a value between $25,000 and $250,000, in return for a monthly fee. This review will cover how OneUp Trader’s funded accounts works. We also explain key features and eligibility requirements, plus the pros and cons of OneUp Trader vs alternatives.

About OneUp Trader

OneUp Trader is a prop trading firm that offers funded accounts to individuals who pass the eligibility criteria. This means you can trade with capital provided by the OneUp team, with zero risk to your personal funds.

The brand’s mission is to enable driven individuals to become fully funded traders. The one-stop solution integrates transparency, community and simplicity to create an exciting funded profile environment.

The company has its headquarters in Philadelphia, USA.

How OneUp Trader Works

OneUp Trader offers just one product for a monthly fee; funded trading accounts.

To open an account with the firm, follow the steps below.

Step 1: Choose Profit Split & Account Size

The prop trading firm offers accounts ranging from $25,000 to $250,000 with either an 90% profit split or a 50% profit split. A monthly subscription fee applies to all account types. Details such as targets, daily loss limits and trailing drawdowns vary between profiles:

- $25,000: Either $125/month for a 90% profit split, or $105/month for a 50% profit split. The rules and benefits for this account size include:

- Max 3 contracts

- $100 balance reset

- $1,500 profit target

- $500 daily loss limit

- $1,500 trailing drawdown

- First $10,000 at 100% profit

- $50,000: Either $150/month for a 90% split or a $120/month for a 50% split. The rules and benefits for this account size include:

- Max 6 contracts

- $100 balance reset

- $3,000 profit target

- $1,250 daily loss limit

- $2,500 trailing drawdown

- First $10,000 at 100% profit

- $100,000: Either $300/month for a 90% profit split or $240/month for a 50% profit split. The rules and benefits for this account size include:

- Max 12 contracts

- $100 balance reset

- $6,000 profit target

- $2,500 daily loss limit

- $3,500 trailing drawdown

- First $10,000 at 100% profit split

- $150,000: Either $350/month for a 90% profit split or $300/month for a 50% profit split. The rules and benefits for this account size include:

- Max 15 contracts

- $100 balance reset

- $9,000 profit target

- $4,000 daily loss limit

- $5,000 trailing drawdown

- First $10,000 at 100% profit split

- $250,000: Either $650/month for a 90% profit split or $500/month for a 50% profit split. The rules and benefits for this account size include:

- Max 25 contracts

- $100 balance reset

- $15,000 profit target

- $5,000 daily loss limit

- $5,500 trailing drawdown

- First $10,000 at 100% profit split

Step 2: The Evaluation

You must pass an evaluation step before you can access OneUp Trader’s capital. The minimum 15-day, online assessment (excluding weekends and holidays) is designed for users to demonstrate their skills. Exact target values and trailing drawdown balance differ between account sizes, however, for all account types, the following rules need to be adhered to be in with a chance of funding:

- Only invest during permitted trading hours

- You must adhere to and follow the Dynamic Scaling Targets

- You must not allow your account balance to hit or exceed the trailing drawdown

- Consistency requirements must be met (the aggregate of three other days’ profits earned must be 80% or more of the profits earned on your best trading day)

- All positions must be closed at least one minute before any major economic releases, during releases, and one minute after major economic releases. Definitions and direct links to calendars are published on the firm’s website

If you are successful and pass the evaluation, a questionnaire must be completed and a binding contract acknowledged before the firm will provide funding.

Note, you can open multiple accounts during the evaluation stage in the hopes of being successful, but only one funded profile will be provided.

Step 3: Choose A Platform

Once you have passed the evaluation stage, it will take a few days for your account to be approved and opened. OneUp Trader has a selection of platforms, including NinjaTrader, Sierra Chart, QuanTower, R Trader, and R Trader Pro. During your evaluation, you get access to free market data provided by Rithmic.

There are different ways to go about getting access to your chosen trading platform. You can either buy access to the platform via a monthly fee, or some platforms and brokerages, such as NinjaTrader, allow you free access if you open an account (subject to any minimum deposit requirements).

Note, funded traders are responsible for all fees related to using the execution platform.

Step 4: Get Funded

Once the steps above have been completed, you will be given login credentials to your activated funded account.

There are, however, ongoing requirements to keep your account live. This includes meeting a minimum weekly trading volume, typically no less than 50% of the average trading executions passed in the evaluation period. Additionally, from day one of trading with your funded account, you will be subject to further rules for a 90-day probationary period. This includes your account being positive every 15 days during the provisional period.

Additional Information

OneUp Trader has safeguarding measures in place to ensure you only fail the evaluation process if you are not ready for a funded account. It enforces the scaling plan structure, meaning you cannot trade more lots than are available, so this cannot cause you to fail the evaluation. Additionally, the probationary period is designed to develop individuals as investors. If within 30 days your yield does not match profit targets, you will receive an email notifying you of the fact, and you will have some time to bring this up.

The company does not allow funded accounts to be run by bots or algorithmic trading systems, meaning strategies that work best with robot accounts (such as arbitrage trading) may not prove your abilities as a trader.

It is also highly recommended that you use strategies that have proven to be profitable for you in the past, as OneUp Trader puts a lot of emphasis on consistency.

OneUp Trader deals with futures contracts only. This includes metal futures (gold, platinum, etc.), e-mini futures and forex futures – if the trading platform you choose supports this. Some key features to look for when deciding on a platform include subscription fees, minimum deposit requirements, peer-to-peer trading (P2P) and access to customer service (via phone number or email).

The company is private about the owner(s) – not disclosing this information anywhere. In fact, details about how/when the company and trading platform were founded are limited. And while the firm is not required to be regulated, it would be reassuring to see published details of company/trader successes and security liabilities.

Fees

The OneUp Trader monthly subscription fee, as well as total commissions (depending on your volume of trading, your profits, and your account size) are the only fees applied to your funded account. There are no hidden fees.

Information on what OneUp Trader charges per side or round trip (R/T) on each asset can be found on their website. Nonetheless, we were offered a $2.04 fee per side when trading the e-mini S&P 500 and a $2.06 commission charge for all currency futures.

It is good to see there are no withdrawal fees, though a minimum limit of $1000 applies. To request a profit withdrawal, users must send an email to the provider with the amount they wish to withdraw. Funds will be processed on the same day if the withdrawal threshold has been met. Withdrawals can only be sent via bank wire transfer.

Pros Of OneUp Trader

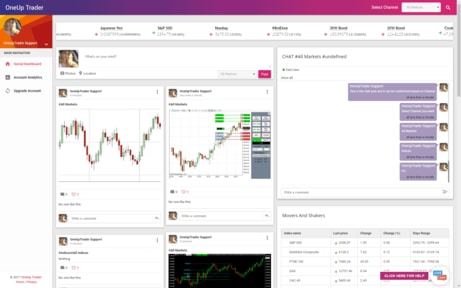

- Access to live trading information in your feed

- No monthly data fee vs alternatives, such as TopStepTrader

- 100% money back guarantee if OneUp Trader cannot fulfil their funding

- The prop firm is suited to day trading as you cannot hold contracts open overnight, whereas Earn2Trade do allow overnight holdings

- OneUp Trader offers a 7-day free trial and promo codes for new customers which applies a discount on their first payment. Occasionally, a coupon code is released to extend the timings to a 14-day free trial

- Chat pages that are available on your dashboard allow you to interact with other funded investors, helping you to network and share tips and knowledge with traders around the world, including the UK, France, and Japan

Cons Of OneUp Trader

- Minimum profit withdrawal of $1,000

- You need to pay for a trading platform or software once your account is funded

- Customer service is only available via email, which means potentially longer response times

- For the evaluation, you may need to pay for your software (only NinjaTrader is available for free)

- No automatic trading software, which can be a negative for traders who adopt strategies like arbitrage trading

OneUp Trader Verdict

OneUp Trader provides a straightforward sign-up process and access to $250,000 in trading capital. With a one-step evaluation process, no monthly data fees, and an intuitive dashboard, it has all you need to make funded day trading enjoyable. As long as you follow the rules to keep your funded account open, you have plenty of control over what you trade, how much you trade and whom you trade with.

FAQs

Is OneUp Trader Legit?

OneUp Trader LLC is tried and tested by thousands of individuals, many of whom leave positive reviews. If you have any queries, the company provides customer support via email, as well as being active on Facebook, Twitter, and Instagram.

Is OneUp Trader Restricted By Location?

Unfortunately, OneUp Trader is not accessible to all retail clients. To find out if its services are available in your country, follow the sign-up procedure.

Where Can I Learn More About OneUp Trader?

YouTube has several videos of traders using the firm’s services. The website also offers detailed information about the joining process and account types.

What Happens If I Do Not Meet A Target On My OneUp Trader Account?

OneUp Trader will not automatically close your account if you fail to meet a target or drop below a loss limit. Instead, your account will be locked for the day or you will receive an email notifying you of your trading patterns, advising you to improve your performance.

What If I Want To Increase Or Decrease My Account Size With OneUp Trader?

To upgrade your account to access more funds, you will need to go through the evaluation process again. This is not necessary when you downgrade your account to a smaller size.