Key To Markets Review 2024

Pros

- I like that all clients can freely access MetaTrader 4 and MetaTrader 5, two of the industry's top platforms with impressive analysis tools and intuitive automation capability

- I'm glad to see that one of Key To Markets' regulatory licenses is from the UK's Financial Conduct Authority (FCA), a highly respected authority with top-tier safeguarding measures

- I was impressed by the inclusion of social trading options and access to a free virtual private server (VPS), providing a more extensive range of services than the average online broker

Cons

- Any deposits or withdrawals not made via wire transfer will incur costly transaction fees

- I think the lack of commission-free, STP account types will restrict the broker's accessibility to beginners and less experienced traders

- I would prefer to see a wider range of product classes to allow for greater diversification opportunities

Key To Markets Review

Key To Markets is a regulated ECN broker offering forex and CFD trading on the MT4 platform. The broker offers two live accounts as well as social PAMMS, with commission-free trading and fast deposits. This review explores leverage, the login process and the secure client area.

Key To Markets Overview

Key To Markets (UK) Limited was established in 2010 in London. Additional entities are based in New Zealand and Mauritius (Key To Markets International Ltd and Key To Markets NZ Ltd), as well as an intermediary in the UAE, operating under Key To Markets DMCC.

The company is regulated by the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Commission (FSC) in Mauritius.

Key To Markets considers itself a true ECN broker, offering fast execution, transparent pricing, and a good selection of products for margin trading. The broker caters to both private traders as well as institutional investors and companies.

Platforms & Tools

2 / 5MetaTrader 4

MT4 boasts an intuitive interface with advanced and automated trading capabilities. The platform offers dozens of custom indicators, real-time pricing, nine timeframes, and a historical data feed. The easy-to-use dashboard and customisable charts are also newbie-friendly, making this a great platform for beginners and experts alike.

You can download MT4 from inside the secure client area once you have registered for an account.

FIX API

Designed for more sophisticated trading, FIX API allows users to connect to the broker’s data feed for super-fast order routing. This means traders can bypass the MT4 terminal and connect directly with the broker’s liquidity pools. The platform is suitable for advanced traders who already use their own proprietary algorithms and black box strategies.

Note that users must have at least €5,000 in their trading account and execute a minimum of 500 lots per month to use the FIX API.

Assets & Markets

1 / 5Key To Markets supports ECN trading on a wide range of assets, including over 65 currency pairs, consisting of 8 major and 11 exotic base currencies. There are 14 index CFDs as well as over 60 global company shares on 4 large stock exchanges. You can trade 5 of the most popular cryptocurrencies plus metals, energies, and soft commodities. 1 bond is also available for trading.

Fees & Costs

3 / 5Spreads depend on which of the two accounts you choose. The Standard account is commission-free but charges a 1 pip mark-up on top of the raw spread. The Pro account uses raw spreads but does charge a commission of $0.08 per micro lot. Raw spreads are around 0.4 pips for major pairs like EUR/USD and around 2.8 pips for gold.

There are also swap rates for holding overnight positions.

Leverage

There is a high leverage limit available up to 1:500 across both account types. Leverage can be a powerful tool to magnify profits and speculate on market movements, however, it can also increase losses if risks aren’t managed effectively.

Mobile App

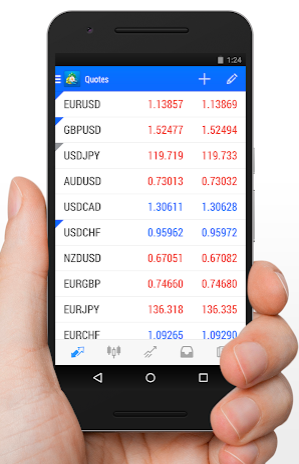

MT4 can be accessed from a mobile phone, giving you the freedom to trade on the go and through several devices simultaneously. Traders can view full trading history and access all order types and execution modes. The app supports most of the same features as the desktop version but with fewer custom tools and indicators.

You can download MT4 onto iOS and Android devices using their respective app stores.

Deposits & Withdrawals

Key To Markets offers 10 funding options, including bank wire, SEPA transfers (EUR), card payments, e-wallets, UnionPay, and AliPay. Most methods are instant, except bank wire which take 2 – 4 days, and SEPA transfers which take 1 – 2 days.

There is a 2.5% commission on e-wallets, UnionPay, AliPay, and Visa/Maestro cards. Bank wire, SEPA transfers, and Mastercard payments are free.

There are 4 withdrawal methods available which all take 1 business day to process: bank wire, Skrill, Neteller, and Sticpay. Bank wire transfers are fee-free but there is a 1% commission for the other methods.

This review was pleased with the multiple prompt payment options available.

Demo Account

Key To Markets offers a demo MT4 account where you can access real market data with simulated money. If you’re looking to try a broker’s services, a new strategy or the MT4 download, the demo account is an excellent place to start. You can register for a demo account on the broker’s homepage.

Bonuses & Promos

Due to regulatory restrictions, Key To Markets does not offer any bonus deals or promotions. The broker does, however, offer a free VPS service to customers who meet requirements, as well as a 25% discount on all other VPS services provided by New York City Servers.

Regulation & Trust

3 / 5Key To Markets (UK) Ltd is registered in the United Kingdom and regulated by the Financial Conduct Authority (FCA), with registration number 527809. The company holds a MiFID passport which allows it to carry out its services in Europe.

Key To Markets International Limited is registered in Port Louis, Mauritius, and is regulated by the Financial Services Commission (FSC), with license number GB19024503.

Unfortunately, the broker does not provide negative balance protection for CFD positions, however, it does hold client funds in segregated accounts at top-rated banks.

Additional Features

Within the Blog section, you can find educational content and market research, though it is limited compared to other brokers.

The broker also offers the social copy-trading platform, Myfxbook Autotrade, as well as the VPS service discussed earlier. Myfxbook allows traders to mirror the strategies and behaviours of other successful traders within an automated environment. The VPS allows experienced traders to run automated trading strategies on a fast and secure network.

Account Types

Key To Markets offers two types of live account: the Standard and the PRO. The only difference between the two accounts is the commission structure, with no commission with the Standard account and a €6 or $8 commission per lot with the PRO account.

Both accounts allow true ECN execution and require the same 100 EUR/USD minimum deposit, as well as a 0.01 lot minimum trade size. There is no maximum trade size, and the margin call and stop out are set at 120% and 100% respectively.

The broker also offers social PAMMs for investors and money managers who wish to build their portfolio.

Trading Hours

Trading hours for precious metals and natural gas are Monday to Friday from 01:00 to 23:59 GMT+2. Crude oil opens at 03:00 and closes at 24:00 GMT+2. Cryptocurrencies run from 00:01 – 23:59 Monday to Thursday and 00:01 to 23:55 on Fridays. Trading hours are 16:30 – 23:00 GMT+2 for US stocks and are 11:00 – 19:30 GMT+2 for European stocks.

Trading hours for soft commodities and indices vary depending on the stock exchanges.

Customer Support

2 / 5A major downside with Key To Markets is the lack of live chat support. Most other brokers offer this as a standard service. Instead, Key To Markets recommends making contact via their email address – info@keytomarkets.com, though even this method was slow when tested.

Alternatively, you can try one of the other support options:

- UK office telephone – +44 20 3384 6738 (9am – 6pm UK time)

- NZ office telephone- +64 9955 1907

- Online contact form – Contact us page

Security

Key To Markets uses standard security protocols to keep client data safe. MT4 is protected by encryption-based security as well as two-factor authentication. Personal information is also stored in secure electronic facilities, which are protected with firewalls.

Key To Markets Verdict

Key To Markets is a good broker for forex and CFD trading, offering the MT4 platform plus social and investing PAMMs. The dual-regulation, including the FCA oversight, is promising; however, the lack of educational research and live chat support is not ideal for beginners.

Top 3 Alternatives to Key To Markets

Compare Key To Markets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Key To Markets Comparison Table

| Key To Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.8 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, FSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Key To Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Key To Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Key To Markets vs Other Brokers

Compare Key To Markets with any other broker by selecting the other broker below.

FAQ

Is Key To Markets a regulated trading broker?

Yes, Key To Markets is regulated by the United Kingdom Financial Conduct Authority (FCA) and the Mauritian Financial Services Commission (FSC).

What trading platform does Key To Markets use?

The broker uses the downloadable MetaTrader 4 (MT4) platform for mobile and desktop trading. The broker does not offer access to the MT4 WebTrader at this time.

How do I open an account with Key To Markets?

Click ‘Open a Real Account’ or ‘Open a Demo Account’ at the top of the broker’s homepage and follow the registration instructions. Once you have completed the account submission, you will then be able to sign in to the secure client area.

Is there a demo account available at Key To Markets?

Yes, Key To Markets offers a practice account where you can test out trading strategies in a risk-free environment. Sign up for a demo account from the broker’s website.

What is the maximum leverage at Key To Markets?

The maximum leverage offered across both account types is 1:500. These are decent rates and will help traders increase position sizes with a small initial deposit.

Customer Reviews

There are no customer reviews of Key To Markets yet, will you be the first to help fellow traders decide if they should trade with Key To Markets or not?