JP Markets Review 2026

See the Top 3 Alternatives in your location.

Awards

- South Africa’s Best Broker 2019 - Global Business Outlook

- South Africa’s Fastest Growing Broker 2019 - International Finance

- The Most Transparent Broker 2019 - The European

- Forex CEO of the year South Africa 2020 - International Business Magazine

Pros

- Same-day deposits and withdrawals

- Free forex courses and webinars

- WhatsApp customer support

Cons

- Lack of transparency on the website

- Some customer complaints

- Higher trading fees than many brokers with wide spreads and a $10 commission per lot

JP Markets Review

JP Markets is an online forex and CFD broker based in Johannesburg. After opening a demo or live account, users can sign in and start trading on the award-winning MetaTrader 4 (MT4) platform. This review will detail JP Markets’ welcome bonus, the login process, how to contact the chat help desk, and more.

Company Details

JP Markets was founded in 2016. Its owner and CEO, Justin Paulsen, aims to become Africa’s leading forex broker, and has made strides towards doing so. The company now has offices in South Africa’s Johannesburg, Polokwane, Bloemfontein, Cape Town, and Pretoria, in addition to operations in Swaziland, Kenya, Pakistan, and Bangladesh.

JP Markets is regulated in its home country of South Africa, holding a license with the Financial Services Board (FSB). Regulatory oversight from the FSB helps prevent scams and many fraudulent forex brokers operating in Africa have been exposed by the FSB.

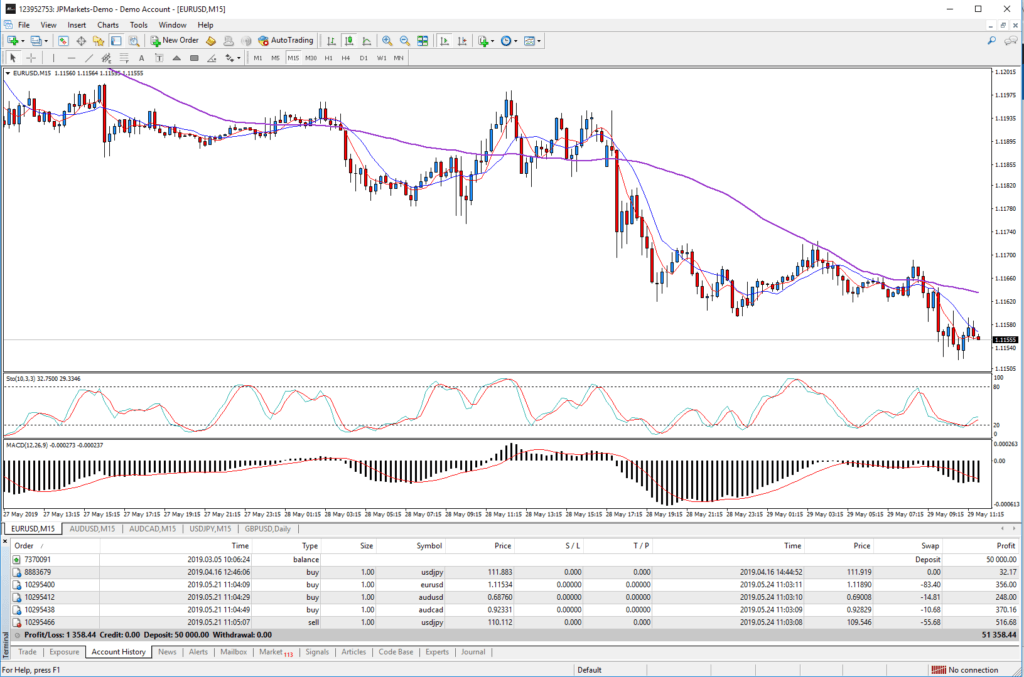

Trading Platforms

JP Markets offers the downloadable MetaTrader 4 (MT4) platform. Considered the gold standard for retail forex trading, MT4 can be downloaded to Windows and Mac devices. The MT4 terminal is responsive while the setup and interface is customisable.

Once you’ve signed in, you’ll find a wealth of trading tools at your fingertips. There are nine standard chart timeframes, 30 built-in technical indicators, plus thousands of additional price indicators available from the Market. Multiple order types are available, as well as risk management features.

JP Markets MT4 platform facilitates trading in multiple currencies, including GBP, EUR, USD, SGD, and PLN, and is available in 30 different languages.

Note, MetaTrader’s MT5 and Web Trader platforms are not available with JP Markets real trading accounts.

Recommended Alternatives To JP Markets

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Products

JP Markets offers forex and CFD trading across 5,000 global markets, including:

- Stocks & shares on major global companies

- Forex, including majors, minors & exotics

- Indices, such as Nasdaq 100 (NAS100)

- Commodities, such as gold and silver

- Cryptocurrencies, including Bitcoin

Spreads & Commissions

Spreads at JP Markets start from 0.7 pips with average spreads on the likes of EUR/USD 2 pips. This, coupled with a $10 commission per lot on the broker’s ECN and STP accounts makes them expensive to trade with. If you take JP Markets vs Pepperstone, IB, or XM, for example, spreads and commissions are relatively high.

In terms of additional costs, the broker charges an inactivity fee as well as a rollover fee for positions held overnight. Fortunately, JP Markets reduce costs in other areas. For example, there are no deposit or withdrawal fees, which is a useful bonus.

Leverage

Flexible leverage up to 1:500 is available. With that said, maximum leverage is usually extended to professional traders with retail customers able to access leverage up to 1:200. Leverage levels do also vary between instruments.

Overall though, JP Markets offers generous leverage, in part due to the relatively relaxed regulatory requirements in South Africa. For traders, this means the ability to take much bigger positions than would usually be allowed in Europe, for example. And while it does increase the risk of potential losses, it also increases the potential for large returns.

Margin requirements and the margin call process can be discussed with a member of the JP Markets team. The contact details for which are listed further below.

JP Markets Mobile App

The JP Markets mobile app promises total account control while on the move. From the mobile dashboard, users can make deposits and withdrawals, open real live accounts, and browse educational resources. The mobile app can be downloaded to both Android (APK) and iOS (Apple) devices.

Note, the broker’s app is regularly updated to improve the user experience.

Payment Methods

A decent range of deposit and withdrawal options are available to JP Markets clients.

Deposits

Funding your account is possible through:

- Debit/credit cards (Mastercard & Visa)

- Bank transfer (details on website)

- Skrill

Deposits usually appear in your trading account the same day but can take up to 24 hours. Clients can fund their account using local currencies. JP Markets has bank accounts with Absa, FNB, Standard Bank and Nedbank, details of which are available on their website. For ECN and STP accounts, there is no minimum initial deposit, so traders can choose an amount they’re comfortable with.

In terms of how to deposit funds, from your account area, select ‘deposit’, then choose your currency and payment method, and follow the instructions. There are no fees for deposits or withdrawals.

Withdrawals

Withdrawals are processed Monday to Friday from 9 am to 5 pm, GMT +2 (South African Standard Time). Unfortunately, there are a few security hurdles to jump through as part of the withdrawal process:

- Log into your secure members’ area to request an internal transfer from your trading account to your landing account.

- Select ‘Transfers’ and then ‘Internal Transfers’.

- Enter the amount you would like to withdraw, noting the ‘from’ account is your trading account while the ‘to’ account is your landing account.

- Upload relevant documents to ensure prompt account validation and payment processing, including ID, proof of address, and banking details, including account number.

Once the Finance department has processed the payment request, withdrawals are processed within four hours.

Overall, if you take JP Markets vs popular providers in Africa, such as Exness and Globex360, the broker offers a decent range of payment options, minimal fees, plus prompt processing times.

Demo Account

JP Markets does offer a demo account. The practice account simulates live trading conditions, using real market data and leverage. The only difference is virtual cash is used.

To open a new demo account:

- Navigate to the Dashboard

- Select ‘Open Account’ underneath ‘My Trading Account’ section

- Hit ‘Open New Trading Account’

- Select your base currency

- Choose between account types (ECN or STP)

- Enter secure login credentials and select ‘Submit’

Welcome Bonus

JP Markets offers a 200% free deposit welcome bonus up to R280,000 or USD equivalent. The 2020 bonus is applied automatically and is compatible with mobile and desktop deposits. However, withdrawal terms and conditions state that you cannot withdraw the bonus credit.

Licensing

JP Markets is regulated by South Africa’s Financial Services Board (FSB), license number – 46855. The broker is currently under investigation concerning customer complaints, and as a result, their license has been suspended. We recommend waiting until JP Markets has resolved their regulatory issues before registering for a new account.

JP Markets client funds are segregated from company capital and monitored daily by a third-party auditor. Indemnity insurance is also in place along with negative balance protection.

Additional Features

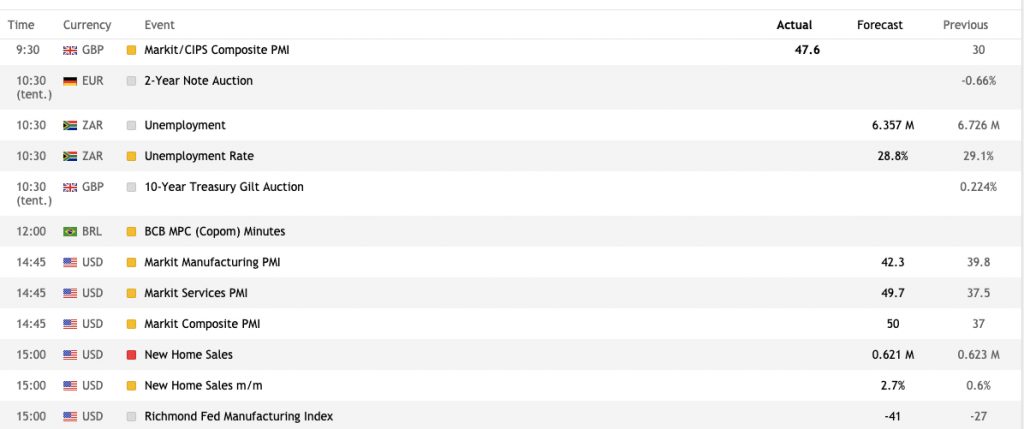

JP Markets stands out for its beginner trading courses. Forex novices can sign up for free lessons and online webinars. There are video tutorials on a breadth of topics, including pattern analysis, the VIX 75, and trading strategies. Also available on the broker’s website is an economic calendar, trading workshops, how-to documents, plus JP Markets Telegram – an online forex trading community.

Copy-trading and automated trading capabilities would be a welcome addition to the broker’s current offering. So too would a signals service, although the broker does send optional market information via SMS, sometimes several times a day.

Account Types

There are several types of JP Markets accounts. When you open a real live account, you can choose between ZAR, USD, and GBP based options. Also, you can choose between an ECN or STP model. The ECN zero spread account comes with a commission charge per trade while with the STP model, the broker takes its fee from the spread.

When it comes to account registration, you will need to supply FICA documents, which include proof of ID and address. Each investor account type promises a secure login process and a members’ area to navigate resources and account features.

Trading Hours

Trading hours at JP Markets depend on the instrument but tend to follow normal market operating hours. As a result, trading forex and stocks is predominantly a weekday activity while cryptocurrency trading takes place in decent volumes over the weekend.

JP Markets Customer Support

Support is available to customers through several channels:

- Live chat – chat logo found in the bottom right-hand corner of the broker’s website

- Telephone contact number – 082 828 0576

- WhatsApp number – 0715599457

- Email address – support@jpmarkets.co.za

The website also has a fairly extensive FAQ section and an online query form. Customer service agents are pretty knowledgable and able to help with login issues, account verification, plus client area server issues. They can also advise what to do if an internal payment transfer is declined.

Our only constructive criticism would be that support times could be improved. It can be several minutes before you get through to anyone on live chat or using the telephone helpline.

For the latest JP Markets news, follow the broker on social media:

Specific contact details and zip codes for the Johannesburg headquarters address and the broker’s other offices can be found on the JP Markets website.

Safety & Security

Website encryption is used to create a secure trading environment at JP Markets. The MetaTrader 4 platform also comes with a one-time-password (OTP) for an additional layer of security.

Is JP Markets A Good Broker?

JP Markets is one of the best-known forex brokers in South Africa. It’s particularly good for beginners with free training courses and online webinars. The mobile app and reliable MT4 platform also ensure a high-quality trading experience. With that said, we would like to see tighter spreads, automated trading, and better customer support. And until the broker’s license is fully operational, we’d recommend holding off registering for a new account.

Popular Alternatives To JP Markets

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Best Alternatives to JP Markets

Compare JP Markets with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

JP Markets Comparison Table

| JP Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 1.5 | 4.3 | 3.6 |

| Markets | Forex CFDs, indices, stocks, commodities, cryptocurrencies | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | FSB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | 200% deposit bonus up to R280,000 | – | 100% Anniversary Bonus |

| Platforms | MT4 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:400 | 1:50 | 1:200 |

| Payment Methods | 2 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by JP Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| JP Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | No | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

JP Markets vs Other Brokers

Compare JP Markets with any other broker by selecting the other broker below.

Customer Reviews

1 / 5This average customer rating is based on 1 JP Markets customer reviews submitted by our visitors.

If you have traded with JP Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of JP Markets

FAQ

What is JP Markets?

JP Markets is one of Africa’s top-rated forex trading brokers. Their website invites retail traders from around the world to create an account and trade their forex and CFD products.

How do I deposit money into my JP Markets trading account?

To deposit funds into your JP Markets account, select ‘Deposit’ from your account area, choose your currency, and select your preferred payment method. Then follow the on-screen instructions. Note, you may need to use your MT4 account number as the payment reference.

What is the minimum deposit for JP Markets?

JP Markets does not have a rigid minimum deposit policy. Traders are free to deposit however much they are comfortable with. However, the broker does recommend depositing approximately R3 000.

Does JP Markets have KWD?

Yes – you can fund your account with Kuwaiti Diner (KWD). And as with all JP Markets accounts, you can earn interest on the balance of your trading account.

Does JP Markets support scalping?

No – JP Markets does not allow scalping. Hedging and automated trading also aren’t possible on the online trading platform.

i think i was scammed by one of your agents with the name of Varilynn Cemone MC CREANOR ID 8809300062086

Bussy trading with her now for almost 3weeks now ans still did not get payed out me as i tryed to stop it but nothing is happening.

i please need help with tracing this Laydyand know if she is reel