JFD Bank Review 2026

See the Top 3 Alternatives in your location.

Awards

- Fastest Growing Forex Broker Europe 2020 - Global Banking & Finance Review

- Best OTC Brokerage Western Europe 2020 - International Business Magazine

- Fastest Growing Financial service company Western Europe 2020 - International Business Magazine

Pros

- Excellent range of products with 1500+ assets

- Free demo account for new users

- Powerful MetaTrader software will meet the needs of experienced traders

Cons

- $500 minimum deposit is high for beginners

- Wide spreads on some forex pairs

- Customer support is not available on the weekend

JFD Bank Review

JFD Bank is an established online broker that is multi-regulated. The broker offers a DMA/STP model and trading in 1,500+ instruments over 8 asset classes. This review covers JFD’s unique MT4+ and MT5+ platforms, spreads, commissions, and login process. Find out whether you should open an account.

JFD Bank Details

The JFD Group was founded in 2011 by professional traders looking to address the lack of transparency in the market. The award-winning company is headquartered in Cyprus, with office branches in (Ludwigsburg) Germany, (Madrid) Spain, Bulgaria and Vanuatu. JFD Group Ltd is regulated under the CySEC, VFSC and BaFin. It is also a member of numerous stock exchanges in Germany. The broker offers over 1500+ instruments across three platforms to institutional and retail clients.

Trading Platforms

JFD offers three trading platforms; MetaTrader 4+, MetaTrader 5+ and third-party platform, Guidants.

MetaTrader 4+

JFD offers superior platform additions to the well known MT4 experience. They’ve added more than 500 instruments from 8 assets. Clients can access their DMA/STP agency model called JFD’s Pure Agency model, which has the ability to connect to 20+ liquidity providers. The ‘+’ indicates exclusive package of add-ons.

Add-ons include:

- Excel RTD – Clients can build their own analytical trading dashboard

- Mini terminal – Depth of Market

- Mini terminal – Chart trader

- Trade terminal

MT4+ is available on Windows, web, iOS and Android.

MetaTrader 5+

On top of the standard features offered by MT5, the platform offers the broker’s DMA/STP Pure Agency Model. Clients can also request post-trade execution reports. MT5+’s exclusive JFD add-ons are a slight upgrade to the package offered by MT4+:

- Trading directly from real-time charts. See at a glance the full information on actual spreads and price movements

- Full market depth, which allows traders to see bid and ask prices that are as close to the market as possible

- Full access to all trading instruments offered by JFD

- Complete range of order types

MT5+ is available on Windows, web, iOS and Android.

Guidants

Guidants is a popular CFD and FX trading platform hosted in Germany. It offers an interactive and intuitive interface. Clients can trade over 1,000 instruments and can create their own technical and fundamental approach. Uses also get access to an extensive choice of free widgets like the JFD Depot, as well as heat maps, price alerts, and an integrated economic calendar.

Guidants is only available in German and can be downloaded on web browser, iOS and Android.

Markets

Trade in 1500+ markets:

- Stocks – Trade 400 shares from US / UK / Germany / France / Netherlands / Spain

- Indices – 15 indices including the US Dow Jones, DAX & UK FTSE 100

- Cryptocurrencies – 5 available i.e. BTCUSD, ETHUSD, LTCUSD

- Forex – 66 major, minor and exotic currency pairs i.e. GBPUSD

- Commodities – Trade in Brent Crude Oil and WTI Crude Oil

- Metals – 4 metals i.e. gold and Silver

- ETFs – 21 ETFs & 4 ETNs

Spreads & Commission

JFD Bank offers variable spreads and low to zero commission fees depending on order size and asset. Typical spreads on GBPUSD are 3.5 and 1.8 on EURUSD. FTSE spreads are typically 6 pips and 3.5 on US Dow Jones, which aren’t as competitive as other brokers.

Commissions on forex and metals are $3 per lot per side but gold and silver vary depending on contract specifications. Zero-fee CFD trading is available on physical stocks and cryptocurrencies, while commissions on other CFDs vary. Reduced commissions are also available for high volume traders.

If forex positions are held during a rollover, swap fees may be charged.

Leverage

Professional clients are provided with leverage up to 1:400. However, due to leverage ratios set by ESMA, retail traders can only access leverage between 1:2 to 1:30. This is to minimise the size of losses and is standard among EU-regulated brokers.

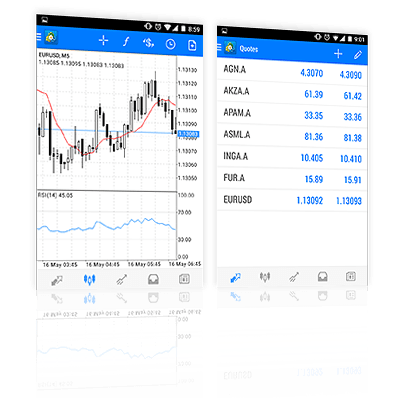

Mobile Apps

MT4+ and MT5+ are available as Android and iOS mobile apps. They come complete with desktop functionalities such as DMA/STP execution and more advanced features. Moreover, they have full access to exclusive JFD add-ons so you can execute complex trading orders, access market depth and have full control of your account wherever you are and at any time.

MT4+ and MT5+ mobile apps are available to download on the App Store and Google Play.

Deposits & Withdrawals

Members can deposit and withdraw funds securely by logging into My JFD. Here, funds can be transferred from one JFD account to another without any charges. All deposits are credited into live accounts within 24 hours on business days.

- Credit/debit cards – No fees via SEPA Transfer. International transfers have varying fees depending on the country of origin

- SafeCharge – 1.95% – 2.95% fee + 0.29 EUR transaction charge

- Neteller & Skrill – 2.90% fee + 0.29 EUR transaction charge

- SOFORT – 1.8% fee + 0.25 EUR transaction charge

Depending on the country of your bank, withdrawals are usually credited within 2-7 working days. Withdrawals come with varying fees and processing times:

- SOFORT – 1 – 3 days

- SafeCharge – 2 – 3 days + 2 EUR transaction charge

- Skrill – 24h + 1% fee but charges don’t exceed 10 EUR

- Neteller – 24h + 2% fee but charges don’t exceed 30 USD

Demo Account

Users can open a free demo trading account while receiving the same JFD experience offered with live realtime accounts. Simply sign up and input your details on the broker’s website. A free demo account is useful for new or professional traders who want to test strategies without risking cash.

JFD Bank Bonuses

There are no official bonuses offered by JFD Bank, which is due to regulatory rules. While there are other no deposit bonuses and promo codes offered on other unofficial websites, users must be aware of the terms and conditions before claiming.

Regulation

JFD Group Ltd is authorised and regulated by CySEC under license no. 150/11. With this regulation, the broker is authorised and regulated to conduct portfolio management, investment advice and execution activities. JFD Overseas Ltd is authorised and regulated by VFSC (Licence no. 17933). The company is authorised and regulated to conduct dealing in securities, portfolio management, investment advice and order execution. JFD Bank AG is licensed and regulated by BaFin (Licence no. 120056) and is licensed to provide investment and banking services.

The company is registered in multiple countries across Western Europe including the UK, France, Ireland, Greece and Spain. JFD Bank AG is also a capital markets partner in the Frankfurt, Munich, Düsseldorf and Vienna stock exchanges. Therefore, clients should feel assured that the broker is not a scam.

Additional Features

- Market news & analysis – Expert analysts provide daily insightful articles along with exclusive subscription-based content for free.

- Webinars, live events, seminars – Users get access to regularly organised webinars, live events and seminars. Sessions are available in multiple languages and are either free or paid. Check upcoming sessions on the JFD event calendar.

- YouTube – The broker has a YouTube channel called JFD. Webinars and other educational videos are available to view on the channel.

Trading Accounts

JFD keeps things simple with one retail account. Depending on the platform chosen, members can trade up to 1500+ instruments across 8 assets. To open a live account, users needs to provide ID verification and complete a questionnaire on trading knowledge and experience. The minimum deposit required is $500.

Trading Hours

Each market is subject to specific trading hours. Opening hours on forex, indices and commodities markets are open 24/5. ETFs and cryptocurrencies are available 24/7. JFD provides a table for specific trading times based on each country, which can be viewed on their website under Contract Specifications.

Customer Support

Customer support can be contacted 24 hours, 5 days a week. Users can contact them via telephone on +49 (0) 69175374271, email via support@jfdbank.com or live chat.

Phone and live chat support hours are Sunday 23:00 CET to Friday 23:00 CET. JFD also provides a list of worldwide helplines and offers a multilingual customer service.

JFD Group Ltd is headquartered in Cyprus at:

Kakos Premier Tower

Kyrillou Loukareos 70

4156 Limassol, Cyprus

The broker also has subsidiaries in Germany and Vanuatu and branches in Madrid, Spain and Bulgaria.

Security

Client funds are fully segregated and kept in licensed financial institutions. Furthermore, JFD abides by international regulatory standards. The company is also a member of the Investor Compensation Fund (ICF), which guarantees the safety of funds. Despite Wirecard’s insolvency in 2020, JFD acted swiftly to make sure client funds were not affected.

The group offers negative balance protection and ensures a lower leverage set-up, which is designed to reduce the risk of depleting accounts. Comprehensive audits are also conducted by internal and external auditors. With the vast client protection measures and good company practices in place, we are confident that JFD is a safe and secure broker.

JFD Bank Verdict

This review was impressed with JFD Bank’s trader-centric approach with a focus on fair and direct investing. On top of that, it’s an established and multi-regulated broker with processes to protect client funds. It also offers a large range of trading instruments with advanced platforms. The only major downsides are the high spreads on leading forex pairs and indices, plus the $500 minimum deposit requirement. Despite this, we are comfortable recommending JFD Bank.

Best Alternatives to JFD Bank

Compare JFD Bank with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

JFD Bank Comparison Table

| JFD Bank | Interactive Brokers | World Forex | |

|---|---|---|---|

| Rating | 2.3 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $500 | $0 | $1 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFDs) |

| Regulators | CySEC, VFSC, BaFin | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | – | – | 100% Deposit Bonus |

| Platforms | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:400 | 1:50 | 1:1000 |

| Payment Methods | 7 | 6 | 7 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by JFD Bank and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| JFD Bank | Interactive Brokers | World Forex | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | No | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

JFD Bank vs Other Brokers

Compare JFD Bank with any other broker by selecting the other broker below.

Customer Reviews

1 / 5This average customer rating is based on 1 JFD Bank customer reviews submitted by our visitors.

If you have traded with JFD Bank we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of JFD Bank

FAQ

Is JFD Bank Regulated?

Yes. The broker is multi-regulated under CySEC (license no.150/11 ), VFSC (license no.17933 ), and BaFin (license no.120056). As a result, we’re not worried that JFD is a scam.

Does JFD Bank offer a demo account?

Yes, JFD Bank offers a free demo account. Simply sign up and start practicing trading strategies via the broker’s suite of trading platforms.

How much capital do I need to trade with JFD Bank?

A minimum deposit of $500 is required to open an account. This is relatively high compared to many online trading brokers.

Is JFD Bank a good broker?

JFD Bank is a good all-round broker, offering a wide range of instruments on powerful platforms. However, this broker’s spreads on leading instruments are not the most competitive.

Is JFD Bank a trustworthy broker?

We believe that JFD Bank is a trustworthy broker with positive reviews. On top of being regulated by several trusted bodies and keeping funds separate, it conducts regular audits and provides annual financial reports.

Warning: JFD Brokers Arbitrarily Cancelled My Trading Account and Deducted My Profits!

I must share my recent extremely unpleasant experience with JFD Brokers. As a brokerage that claims to be professional and reputable, their actions are shocking and completely unacceptable.

I initially deposited only $15,000 into my trading account with JFD Brokers and successfully withdrew $21,583.37 during my trading activities. However, when my account had accumulated approximately $40,000 in profits, JFD Brokers arbitrarily cancelled my account and deducted all my profits! This behavior is clearly unjustified, raising serious suspicions that they acted simply because I earned “too much” profit from my trading.

As a brokerage claiming professionalism and credibility, such actions not only violate the principles of fair trading but also betray the trust of their clients. I have already filed an official complaint with the Cyprus Securities and Exchange Commission (CySEC), urging the regulatory authority to investigate and take appropriate actions. I strongly condemn this irresponsible behavior and urge all traders to exercise caution when choosing a trading platform, always ensuring they protect their capital and profits.