Intertrader Review 2024

Awards

- Best Spread Betting Provider 2019 - COLWMA

- Spread Betting Provider of the Year 2018 - MoneyAge

- Value for Money 2018 - UK Leverage Trading Report

- Spread Betting Provider of the Year 2017 - MoneyAge

- Best CFD Provider 2016 - FX Empire

Intertrader Review

Intertrader is a forex and CFD broker that also offers spread betting and a service for professional clients called Intertrader Black. Our review focuses on the key aspects of trading with this firm, including demo accounts, the login process, broker fees, and minimum deposit requirements.

Intertrader Details

Intertrader Limited was founded in 2009 and is owned by GVC Holdings PLC. The company is regulated by the Gibraltar Financial Services Commission (GFSC) and is also on the UK’s Financial Conduct Authority (FCA) register. This firm has offices in London and Gibraltar and accepts clients from Australia to Paraguay.

Intertrader recently acquired Sigma Trading, a specialist broker that gave the company the necessary credentials to launch its professional client service.

Trading Platforms

Intertrader Web Platform

To access the platform, clients must sign in directly from the website with their standard login credentials. The No Dealing Desk (NDD) platform carries out trades with market-neutral execution and no requotes. A wide range of order types are available, including stop-loss, limit, and trailing stop.

The platform interface is highly customisable and clients can execute orders in a single click using a Quick Trading ticket. It also offers several free trading tools:

- Charts from IT-Finance with over 70 technical indicators

- Automated pattern analysis from Autochartist

- Market news from RANSquawk for research

Intertrader Advanced Platform

The broker also offers a downloadable platform, which is available on Mac OS and Windows. The trading solution will appeal to clients who value the speed and stability of a software solution. The advanced version has the following features:

- Same suite of trading tools as the web-based platform

- Access to market analytics and Bloomberg Live TV

- Alerts using price targets or trendlines to monitor the market

MetaTrader 4 (MT4)

Clients can utilise MT4, a widely popular trading platform, to deal in forex, indices, and commodities. The platform is available for download to PC and offers a market-leading array of trading and analysis tools:

- Quick and easy portal launch

- Expert Advisors (EAs) for automated analysis or trading

- 30 technical indicators that can be applied to live or historic data

- Line studies and charting templates plus direct trading from the chart

Intertrader has a direct MT4 terminal that clients can use instead of the default platform interface. The broker also offers the FIX API on MT4 to create automated order systems, though potential users must deposit a minimum of £100,000.

ZuluTrade

This company offers the ZuluTrade auto-trading platform, which allows clients to copy the orders of professionals using a signals service. Users access the same market-neutral execution and all orders are completed via Intertrader.

Markets

Intertrade offers a range of products, including forex, CFDs and spread betting. Indices and commodities are also offered as future contracts. Prospective clients should note that spread betting is only available to UK customers, and that the asset offering varies with the trading platform:

Web Platform

- Forex – 45 currency pairs

- Indices – 14 global stock indices

- Commodities – 18 contracts including energy, metals, and softs

- Shares – top 250 UK firms plus US and global shares

- Rates/bonds – four markets including Euro-Bund

MT4

- Forex – 36 currency pairs

- Indices – 13 global stock indices

- Commodities – gold, UK and US crude oil

Intertrader previously offered cryptocurrency trading, including Bitcoin, however cryptos are no longer available.

Spreads & Commission

Intertrader offers competitive spreads on both platform types. For example, EURUSD starts from 0.6 pips on the web platform and 1 pip on MT4.

The brokerage charges swap fees, and rates depend on several factors including closing price, unit exposure, and risk per pip. Intertrader also charges £/$3 per lot per side for MT4 forex trades plus 0.1% per side for UK and European share CFDs, and ¢2.95 per side for US shares.

Leverage Review

Retail

Leverage is available to retail clients at Intertrader. Major forex pairs are set at 1:30, minor forex pairs, gold and major indices at 1:20, minor indices and commodities other than gold at 1:10, and equities at 1:5.

Professional

Professional traders can access higher leverage rates, translating into lower capital requirements. Forex, gold, and indices are offered at 1:200, commodities other than gold at 1:100, and equities at 1:20.

See the brokerage’s website for further details on the margin levels required.

Mobile Apps

Intertrader App

The Intertrader platform is available as a mobile app on both Android and iPhone. Developed in collaboration with NetDania, the app is fully-featured and provides a complete trading experience for the user:

- Breadth of order types

- Rapid order execution

- Direct chart trading

- Price alerts

MT4 App

The MT4 platform is also offered on the App Store and Google Play. The app incorporates the full suite of orders, interactive charts, and technical analysis plus financial market news.

Payments

At Intertrader the minimum initial deposit is $500, and subsequent deposits must be at least $50. Clients can fund their account by bank transfer or via the platform using Skrill. Our review was disappointed to see this relatively high minimum deposit, as many large brokers now allow investments of $100 or less.

Clients can withdraw their funds once per day fee-free, but there is a minimum limit of $100. Traders can request another withdrawal in the same 24 hour period but will be subject to a $5 fee if less than $1,000. Users should contact customer support if they encounter a problem during this process.

Demo Account

Users can opt to open a web or MT4 demo account, depending on the platform they would like to trade with. This account also works with the mobile app and allows clients to familiarise themselves with the platforms before investing.

Bonuses & Promo Codes

Intertrader runs a rebate scheme called TradeBack for professional users. This programme compensates clients with between 5 and 10% of their execution costs, based on the total amount they have paid to open trades. This rebate can be withdrawn, but is only available to clients using the web platform – see terms and conditions for full details.

Regulation Status

Intertrader Limited is authorised by the Gibraltar Financial Services Commission, where clients can direct complaints if they are not resolved by the firm. The broker also has limited regulation from the Financial Conduct Authority (FCA). The company guarantees the safety of their client funds through the Gibraltar Investor Compensation Scheme (GICS), which entitles traders to up to €20,000 if the firm goes bankrupt. Importantly, online customer reviews of Intertrader suggest it is trustworthy.

Additional Features

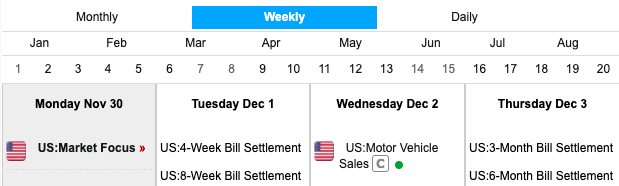

The Intertrader website has a market news and insights section that publishes educational articles and an economic calendar. The broker also hosts informational content on trading forex, spread betting, and CFDs and has an active YouTube channel.

Professional Services

This broker offers other programs for consistent investors. Intertrader Pro takes applications for professional clients, including asset managers and family offices. Successful applicants can utilise level 2 market data on the premium professional platform. Intertrader Black is also available to professionals, providing bespoke investment strategies along with phone trading on equities. Intertrader Prime is geared towards high net worth individuals and the service is supplied by the category 1 investment dealer Argon Financial.

Account Types

Clients can either open a web trading account or an MT4 account. The former gives traders access to the web-based platform, the advanced platform, and the mobile app. The MT4 account allows clients to use the MetaTrader 4 platform and the associated app. Intertrader also offers separate accounts for spread betting and CFD trading.

Benefits

Signing up for an account with Intertrader vs IG has several benefits:

- flexible spread betting

- Low minimum bet size

- Fully-featured mobile app

- Own-brand platform with tight spreads

- Comprehensive professional services programme

Drawbacks

- Wider spreads and fewer asset classes with MT4 account

- High $500 minimum deposit

Trading Hours

Opening hours depend on the market of interest and are listed next to each asset on the broker’s website. As a general rule, most markets are open for trading during weekday hours.

Customer Support

Clients can contact customer support 24/5 using the following channels:

- Contact us form on the broker’s website

- Phone – +44 203 364 5189

- London office address – City Tower, 40 Basinghall St, London EC2V 5DE

Security

Intertrader ensures that personal data is kept secure, and is situated in a password-protected database within a secure network safeguarded by advanced firewall software. They use SSL version 3 and TLS 1.2 with 128 and 256-bit encryption respectively.

Intertrader Verdict

Intertrader is a forex and CFD broker that also offers spread betting in the UK. This broker has a range of professional services including Intertrader Black, plus demo accounts and an own-brand platform with a fully-featured mobile app. This brokerage offers competitive spreads and could prove a good option for experienced clients seeking a professional trading experience.

Top 3 Alternatives to Intertrader

Compare Intertrader with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Intertrader Comparison Table

| Intertrader | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, futures | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $500 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | Gibraltar Financial Services Commission & Limited Regulation under the FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | Up to 10% rebate scheme | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (Retail), 1:200 (Pro) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 2 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Intertrader and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Intertrader | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Intertrader vs Other Brokers

Compare Intertrader with any other broker by selecting the other broker below.

FAQ

Who owns Intertrader?

Intertrader Limited is owned by GVC Holdings PLC. The CEO of Intertrader is Shai Heffetz.

Is Intertrader legit and trustworthy?

Reviews online indicate that Intertrader is a good firm with a legitimate offering. The firm also has oversight from two financial bodies.

Is Intertrader regulated?

This broker is regulated by the Gibraltar Financial Services Commission and has limited regulation from the Financial Conduct Authority (FCA).

What platforms does Intertrader offer?

Intertrader has two own-brand platforms: a ‘web-based’ solution and an ‘advanced’ download alongside a mobile app. The broker also offers MT4 integration in a separate account.

Does Intertrader offer a demo account?

The broker offers two demo accounts – the web-based platform and MT4 accounts. Prospective clients can use these to practice trading before they make a deposit.

Customer Reviews

There are no customer reviews of Intertrader yet, will you be the first to help fellow traders decide if they should trade with Intertrader or not?