InterForex Review 2024

InterForex Review

InterForex is a regulated online trading broker. Users can trade 50+ currency pairs, stocks, indices, and commodities on two exclusive platforms; InterForex Pro and OmniTrader+. Our review covers the account options, trading platforms and more.

InterForex Details

InterForex was founded in 2009 and is based in Honduras. InterForex SA is regulated by, and registered with the Financial Services Authority in Honduras. The company stands out for its hefty 1:200 leverage rates and bespoke trading platforms.

Note the broker has no affiliation with InterForex General Trading LLC.

Platforms

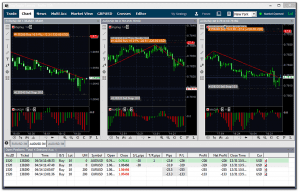

The firm offers two platforms: the InterForex Pro platform which offers all assets and OmniTrader+ which exclusively trades options.

InterForex Pro

InterForex Pro features include:

- Tradable charts

- One-click order execution

- Multilingual interface support

- Strategy and indicator builder

- Extensive charting and analytical tools

- Live market view and real-time detailed reports

- Multiple products dealing windows; spot FX and CFDs

- Built-in calendars for streaming news and financial indicators

OmniTrader+

OmniTrader+ features include:

- Live chat

- Secure login

- Options strategy builder

- Fully customisable trader interface

- Symbol finder to manage many products

- Extensive and drill-down reporting concepts

- Real-time unrealised P&L and account analysis

- Access to specialised information from the dealing desk

Both platforms are available for download to desktop devices or you can trade through major web browsers.

Markets

Users can trade 50+ FX pairs as well as CFD instruments on global stocks, indices, and commodities such as oil and precious metals. Almost 50 options instruments are available to trade through the exclusive InterForex OmniTrader+ platform.

Trading Fees

The broker takes its cut from floating spreads:

- Forex – InterForex generally offers fair dealing spreads with 1-3 pips on major currencies such as EUR/USD and GBP/USD, plus 3-15 pips on others

- CFDs – The broker charges reasonable variable spreads plus overnight charges for any share CFD positions held past 5 PM (EST). Rates vary by product, more details can be found within platform trading windows.

Leverage

Leverage varies by account type, the Premium account option offers the maximum at 1:200. As this broker is not regulated within the EU, leverage is not subject to ESMA’s 1:30 forex and CFD trading cap. But while high leverage rates may increase returns they can also magnify losses.

Mobile Trading

Our review was disappointed to see mobile trading apps are not offered. This makes tracking positions while on the go challenging. Instead, clients will have to rely on trading through web browsers, which will impact user-ability and features.

Payments

Minimum deposits vary by account type. The Classic account offers the lowest deposit of just $500.

New accounts require initial funding via bank wire transfer. Existing users can deposit money into their accounts through:

- Moneybookers

- WebMoney

- Credit Card

- OKPAY

- Neteller

- PayPal

InterForex charges a bank wire transfer rate, varying by account type, up to a maximum of $50 per transfer.

Demo Account

Both trading platforms offer a free demo account option, requiring online registration ahead of use. The demo accounts offer the same features as live accounts including streaming market rates, all chart builders and reporting. The demo accounts are funded with $100,000 of virtual equity to allow users to test strategies and familiarise themselves with the trading platforms.

InterForex Bonuses

At the time of writing, InterForex is offering the following promotions for new clients:

- Interest-free account credit up to $10,000

- 5% free cash bonus upon deposit into a new Classic account. Terms and conditions apply

Regulation Review

InterForex SA is regulated by, and registered with the Financial Services Authority of Honduras. This is not a well-regarded regulator so the level of client protection is likely to be limited.

InterForex Inc is not registered by any US, Canadian, Australian, or EU regulator.

Additional Features

The broker’s website offers an extensive online academy; a free education platform providing training materials across 3 major topics; introduction to forex, trading CFDs, and understanding options. This is a great tool for both new clients and experienced traders looking to increase their knowledge.

Trading Accounts

InterForex offers many account options all of which require compliance documents ahead of opening (passport/picture ID and a utility bill or bank statement):

- Classic – access the lowest minimum deposit of $500 with a small number of currency pairs

- Professional – best suited to investors experienced in managing the risks associated with leveraged trading

- Active Trader – designed for traders who perform high volume trades

- Premium – access to exclusive trading rates to meet individual preferences

All accounts share similar features such as minimum contract size, margin requirements, and base currency (USD), however maximum trade size differs by account. Customer support also varies, though the Premium account has a 24/5 dedicated helpline and personal account manager.

Benefits

There are several benefits of trading with InterForex:

- 24/5 customer support

- Negative balance protection

- Extensive education academy

- Large selection of instruments

- Bonuses and promotions for new clients

- Different account options suited to varying experience and trading styles

Drawbacks

Downsides of trading with the broker include:

- High minimum deposit

- No mobile trading apps

- Fees for wire transfer deposits

- Not available to residents of the US, Canada, or Australia

- No offering of industry established MT4 or MT5 platforms

Trading Hours

InterForex trading hours for all account options are Sunday 5 PM (ET) – Friday 5 PM (ET), however trading hours for different instruments may vary, consult the broker’s website.

Customer Support

InterForex offers very limited customer support. Live chat isn’t accessible for non-account holders and there isn’t a telephone contact number.

- Mail address – InterForex SA, Primera Planta del edificio Sutrasfco, Ave. La Republica, La Ceiba, Atlantida, Honduras

- Email – Complete an online form to submit a message or contact info@interforex.net

Security

There is no information regarding the safe-holding of funds or segregated accounts on the broker’s website, therefore a degree of caution would be recommended before signing up. All accounts are fully password protected.

InterForex Verdict

InterForex offers online trading in major financial markets. The range of account types means traders of all abilities are catered for, however initial deposit requirements are relatively high. The website’s education section offers a decent resource pool for traders of all levels. But unfortunately, the limited information on the company’s history and failure to mention the security of funds may make traders think twice.

Top 3 Alternatives to InterForex

Compare InterForex with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

InterForex Comparison Table

| InterForex | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 1.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, options | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $500 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | Financial Services authority of Honduras (FSA) | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | 5% free cash bonus | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:200 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 6 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by InterForex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| InterForex | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

InterForex vs Other Brokers

Compare InterForex with any other broker by selecting the other broker below.

FAQ

How do I open an account with InterForex?

All account types require users to complete an online application form and then upload identity documentation (passport/picture ID and a utility bill or bank statement). Once the broker has reviewed and verified the application, users will receive initial bank wire transfer details to fund their account.

Are there any deals or promotions for new InterForex clients?

At the time of writing, new client promotions included a 5% cash-free bonus when opening a Classic account and interest-free account credit up to $10,000.

Does InterForex offer a demo account?

Yes, both trading platforms offer demo accounts, funded with $100,000 in virtual cash.

Is InterForex regulated?

The broker is regulated by the Financial Services Authority of Honduras. Unfortunately this isn’t a highly regarded financial regulator.

What is the minimum deposit to open an InterForex account?

The Classic account requires a $500 minimum deposit. Deposit requirements then vary depending on the account type with the Premium solution requiring a $100,000 payment.

Customer Reviews

There are no customer reviews of InterForex yet, will you be the first to help fellow traders decide if they should trade with InterForex or not?