IMMFX Review 2024

Pros

- The 15+ commission-free deposit methods make it easy and cheap for global traders to deposit funds. I was able to access Western Union, Payeer, PayPal, crypto deposits and more

- Alongside the powerful MT5 desktop terminal and mobile app, I found that IMMFX offers daily technical analysis and signals on popular assets like WTI crude oil and EUR/USD

- I found a good selection of online educational content with integrated videos and courses for those looking to gain basic knowledge and advanced strategies

Cons

- I find the broker's asset line-up is quite limited compared to top brands and not sufficient for experienced traders to build a diversified portfolio

- I think the withdrawal fees are quite expensive for some payment methods including a 6% charge for credit/debit cards

- It's unfortunate that IMMFX is regulated offshore with no guarantee of top-tier financial protection for clients

IMMFX Review

IMMFX is an online broker offering forex, stocks, and commodity CFDs through the MetaTrader 4 (MT4) platform. In this review, we cover the login process, spreads, leverage, regulation, and more. Read on to find out whether you should open a trading account with IMMFX.

IMMFX Headlines

IMMFX is a veteran online broker, having opened its virtual doors in 2006. The parent company – IMM Group Ltd, is registered offshore in the Marshall Islands and regulated by the Financial Services Authority (GLOFSA). The brokerage has offices in 15 locations across the globe, with registered addresses in London, New York, Toronto, Frankfurt, and Vanuatu (as well as St. Vincent). The company accepts both retail and corporate customers.

IMMFX is an STP (straight-through-processing) forex broker, meaning clients’ orders are placed through a third-party liquidity provider, such as a major bank or other institution. This is often the preferred model for traders, as there is no conflict of interest when brokers take the other side of a trade.

Trading Platforms

MT4

IMMFX uses the MetaTrader 4 platform, which is highly regarded by forex traders for its reliability, speed, and range of features. It can be accessed on both Windows and Mac PCs, with a mobile version available for iOS and Android users.

MT4 has been particularly praised for offering a wide range of timeframes, a large number of technical indicators, and interactive charting. Through the platform, users can access robots for automated trading strategies, known as Expert Advisors. These can be created from scratch by traders with coding know-how or bought off-the-shelf. Other benefits of MT4 include:

- One-click trading

- Rich historical data

- EAs and additional indicators

- Range of analytical objects

- Advanced charting

MT4 Web Trader

MT4 also has a web-based version, known as Web Trader. This allows IMMFX clients to execute orders from any computer with a browser and internet connection. The platform is considered highly reliable and safe to use. MT4 Web Trader has almost identical features to the downloadable desktop app, though some trading tools may not be available.

Mobile App

MT4 can be downloaded on both iOS and Android tablets or smartphone devices. The app features interactive charts, hundreds of financial instruments, and a full set of trade orders. This allows customers to execute positions on the go, from any location.

While feature-rich, most traders prefer to complete their analysis on the desktop terminal, since the small screen size can be difficult for analysing markets effectively.

Products

IMMFX specialises in forex and CFD trading, offering a decent product range. There are over 60 currency pairs on its platform, including majors, crosses, and exotics. This is a fairly typical range size compared to competitors. CFD trading is supported on indices, cryptocurrencies and stocks, as well as commodities like oil and raw metals.

In total, IMMFX offers around 200 financial instruments:

- 5 precious metals, including gold and silver

- 3 energies, including oil and gas

- 60+ forex currency pairs

- 30+ crypto pairs

- 70+ stocks

- 12 indices

However, not all asset types are available. IMMFX does not support trading on ETFs or options. Some strategies are also not supported For example, hedging with zero margin is permitted, but scalping is not.

Fees

IMMFX advertises tight spreads starting at an average of 0.1 pips for the EUR/USD pair. Other major currency pairs have average spreads of less than 1 pip, such as 0.4 and 0.6 pips for the GBP/USD and USD/CAD pairs, respectively. Crosses tend to have wider average spreads, at around 1 pip or higher, from 0.5 pips for EUR/GBP to 1.8 pips for GPB/NZD.

Average spreads for stock market index CFDs vary from 2 points (for AUS200) to 13 points (NGAS), generally sitting around the 5 points mark. Individual stocks vary depending on market conditions.

IMMFX uses a variable spread system, meaning the actual figure may be higher than that quoted. However, the brokerage promises competitive prices, with forex spreads generally lower than the industry average of 1.5 pips.

One major downside of IMMFX is the commission charge on withdrawals. The exact rate depends on the transfer method, but fees generally sit at around 5% or below (for instance, 3% for bitcoin transfers and 5.8% for ePay). However, some withdrawal methods can be more expensive, for example, an 8.8% fee is charged for Western Union. Customers can also be charged up to $80 for wire transfers. The amount of commission charged by IMMFX is generally higher than most brokers.

Leverage

IMMFX offers leverages from 1:2 up to 1:200. Traders should be aware that highly leveraged trades are risky, so we advise caution when trading at the higher end of this scale. Leverage on currencies and precious metals are optional, and can be set by the trader in the IMMFX Back Office.

Note, oil, gas, and stock market indices have fixed leverage rates available.

Deposits & Withdrawals

IMMFX offers a wide range of deposit and withdrawal options. The payment methods are listed below, together with the minimum deposit amount, and withdrawal fee:

- ePay – Minimum Deposit 50 USD, Withdrawal Fee 5.8%

- FasaPay – Minimum Deposit 50 USD, Withdrawal Fee 4.2%

- PaySafe – Minimum Deposit 50 USD, Withdrawal Fee 4.2%

- PerfectMoney – Minimum Deposit 50 USD, Withdrawal Fee 2%

- SticPay – Minimum Deposit 50 USD, Withdrawal Fee 4.2%

- UnionPay – Minimum Deposit 50 USD, Withdrawal Fee 4.2%

- WireTransfer – Minimum Deposit 50 USD, Withdrawal Fee 20-80 USD

- Universal Money Transfer – Minimum Deposit 50 USD, Withdrawal Fee 4.2%

- Western Union – Minimum Deposit 100 USD, Withdrawal Fee 8.8%

- MoneyGram – Minimum Deposit 100 USD, Withdrawal Fee 8.8%

- PayCo – Minimum Deposit 10 USD, Withdrawal Fee 4.2%

- PAYEER – Minimum Deposit 50 USD, Withdrawal Fee 4.2%

- Bitcoin/Litecoin/Ethereum/Bitcoin Gold – Minimum Deposit 50 USD, Withdrawal Fee 4.2%

- Khdamati –Minimum Deposit 50 USD, Withdrawal Fee 2%

Deposits can be processed instantly using all methods except UAE Exchange and wire transfer, which may take up to 5 working days. 1% commission is charged on Khdamti and Advcash deposits, all other payment methods are free. Withdrawals take 1-5 banking days, regardless of the transfer method.

Promotions

IMMFX offers a 20% deposit bonus to new or existing customers. Clients can access this bonus upon login by emailing bonus@immfx.com. It should be noted that this promotion is not a free gift, as customers cannot actually withdraw the bonus. Traders should consider whether the bonus is in line with their trading strategy, as it may prevent you from withdrawing your profits on your deposited funds.

IMMFX also reserves the right to cancel the bonus if certain activity criteria are not met. Several reviews online allege that the broker refused to provide the bonus without giving a reason, which is disappointing.

Live Accounts

Apart from the demo account, IMMFX offers only one account type: the Prime Account. Spreads on this account start at 0.2 pips and leverage is offered up to 1:200. The minimum deposit for the Prime Account is $100. Most trading strategies are permitted, including automated trading using expert advisors. The minimum lot size is 0.01 lot on most instruments, with a standard lot being 100,000 units of the base currency.

Demo Account

IMMFX offers a demo account with up to $100,000 in virtual capital. There is no time limit on its usage, providing a platform for new traders to learn the basics or experienced traders to test new strategies. However, note that while the demo account closely simulates real-life trading conditions, there are claims that the demo account is more profitable than live trading.

Additional Features

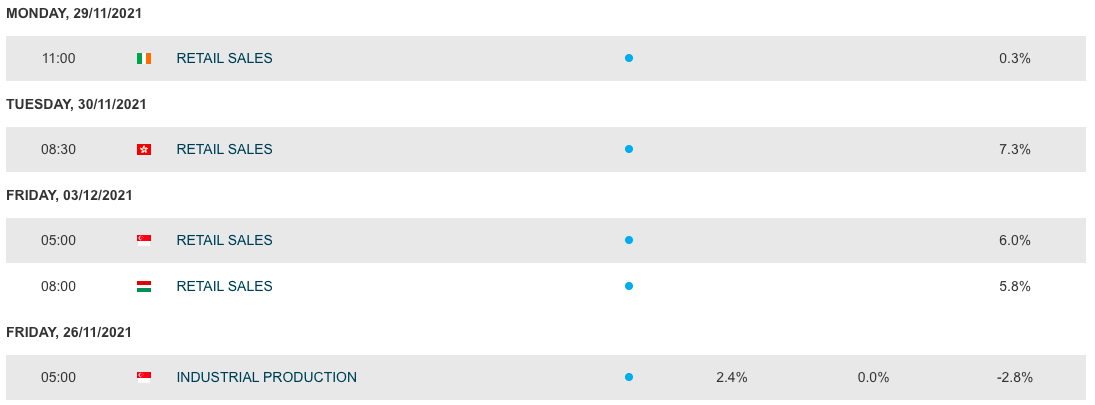

IMMFX offers a strong range of educational and tools, including a currency converter and trading calculator (covering pips, margins, pivot points, CFD profit loss, and stop-loss limits). The platform also has regularly-updated signals, trading charts, and an economic calendar.

The educational offering consists of webinars, video libraries, and a financial news section. However, the VPS (Virtual Private Server) service is currently unavailable.

Customer Support

IMMFX’s customer support team can be contacted via the following channels:

- Feedback Form – Available on the “Customer Support” tab

- Phone (International) – (+44) 20 3695 0059

- Email (General Enquiries) – info@immfx.com

- WhatsApp – (+44) 7723 855 091

- Skype – IMMFX.SUPPORT

- Live chat

The company’s offices are open 24 hours from 19:00 Sunday – 20:00 Friday (GMT).

Security

As an offshore broker, IMMFX is not subject to strict regulation and therefore your funds do not have the same level of protection as other brokers offer. Despite this, the company promises client funds are segregated from its operational cash. The firm also uses international auditors, though there is no further detail about the company used.

Trading Hours

The trading hours for each asset vary depending on the market opening times. For forex, markets are open 24 hours Monday – Friday. For other instruments, such as oil, gas and gold, times vary. Check the IMMFX website for details.

The broker also maintains an economic calendar with information about trading holidays.

IMMFX Verdict

IMMFX is an offshore forex broker with a decent range of currency pairs and competitively low spreads. The brokerage provides access to the MT4 platform, which is highly regarded in the trading community. However, we’d always suggest that you opt for a regulated broker where possible. Some IMMFX clients have been unhappy with the service provided and dispute resolution opportunities are limited with offshore providers.

FAQs

Does IMMFX Use The MT4 Trading Platform?

Yes, IMMFX clients can access the desktop and web versions of the MT4 trading system. There is also a mobile app for iOS and Android devices.

Is IMMFX A Safe Broker?

IMMFX is based offshore, so your recourse options are limited if you’re unhappy with the service. Several reviews online allege unfair trading practices. However, the company does use segregated accounts and offers negative balance protection, practices that should provide traders with some peace of mind.

What Leverages Does IMMFX Offer?

IMMFX offers leverages up to 1:200 on its Prime Account. Inexperienced traders should be cautious when trading with leverage as it increases the likelihood of losses.

What Is IMMFX’s Minimum Deposit?

The IMMFX Prime account requires a minimum deposit of $100 USD. The minimum trade size on most assets is 0.01 lots.

Does IMMFX Offer Swap-Free Accounts?

Yes, IMMFX offers swap-free accounts for Muslim and non-Muslim traders. You can sign up for an Islamic-friendly account on the broker’s homepage.

Top 3 Alternatives to IMMFX

Compare IMMFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

IMMFX Comparison Table

| IMMFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | GLOFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | 20% Deposit Bonus | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:200 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 9 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by IMMFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| IMMFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

IMMFX vs Other Brokers

Compare IMMFX with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of IMMFX yet, will you be the first to help fellow traders decide if they should trade with IMMFX or not?