IIFL Review 2024

IIFL Review

IIFL is an Indian stockbroker offering a wide range of financial services, including Demat accounts. Customers can login and conduct online trading across a variety of assets and markets, including stocks and shares, mutual funds, bonds and indices. This review will tell you everything you need to know about IIFL, from the trading platforms offered to the brokerage charges and more.

IIFL Headlines

IIFL, meaning India Infoline, was established in 1995 and is one of the most well-known stockbrokers in India. Formerly known as India Infoline Limited, owner Nirmal Bhanwarlal Jain and director R Venkataraman rebranded to the IIFL Group. This encompasses IIFL Securities (the brokerage), Finance, Wealth, Insurance and Home Loan, each of which has an individual share price that can be found on websites such as Yahoo Finance.

IIFL Securities is regulated by the Securities and Exchange Board of India (SEBI). It is listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE).

While the head office is located in Mumbai, it is a large company with over 4000 branches across 900 cities in India. It also has offices abroad in Hong Kong, Dubai, New York, London and Singapore.

Trading Platforms

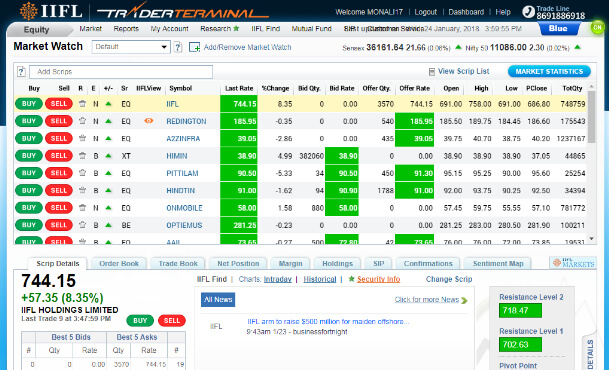

Opening a Demat and trading account with IIFL gives customers access to the Trader Terminal (TT) web trading platform. Trader Terminal 4.1 and 4.0 is also available to download for free on Windows and Mac via the broker’s website, providing even faster order execution.

The user interface is intuitive; positions can be opened and closed with single clicks, and the market analyser provides trading recommendations. This includes real-time market updates, price alerts and information relating to upcoming initial public offerings (IPOs). The platform portal also features two-factor authentication (2FA) to ensure a secure login process.

Assets

Customers can trade a range of products through IIFL:

- Shares – clients have access to a variety of shares listed on the NSE and BSE stock exchanges

- Indices – customers can trade indices based on the NSE and BSE exchanges

- Commodities – including gold, silver and crude oil

- Mutual Funds

- Futures

- Options

- Forex

- IPOs

IIFL provides a varied range of assets vs competitors such as 5paisa, Upstox, Motilal Oswal, Angel Broking and Zerodha, with access to more markets than its rivals.

Spreads & Commission

Customers are charged a flat rate per order. Equity delivery is free, while equity intraday, equity futures and equity options are charged at 20 Rs (Rupees) per order. Currency and commodity futures options are also charged at 20 Rs per order. There is no fixed monthly fee associated with these.

Whether you are a non-resident Indian (NRI) customer or a regular customer, you will need to open a Demat account to trade assets through IIFL, as with any Indian stockbroker. There are no charges when opening a 2-in-1 account (but 3-in-1 accounts are not available). The Demat account has an annual maintenance charge (AMC) of Rs 250, however the first yearly charge is waived.

Leverage

IIFL clients receive different margin rates for different assets. When trading the NIFTY 50 Stocks index, traders can trade at a maximum leverage of 1:15. Futures and options (F&O) can be traded at a maximum leverage of 1:25.

There are margin calculators available online to help users figure out rates and charges. For example, leverage of 1:15 means a client can put down 100 Rs and trade with 1500 Rs. Customers should be aware that while trading with leverage can increase wins, it will also multiply losses.

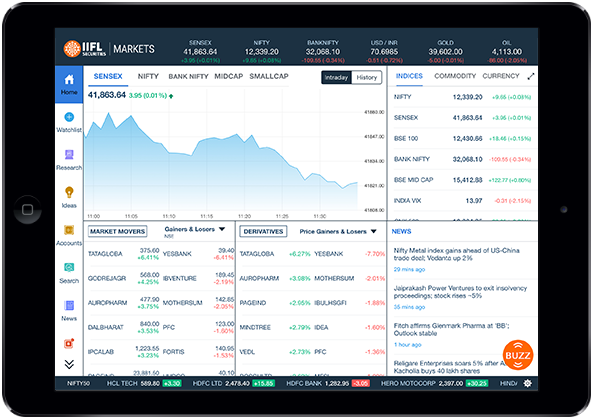

Mobile Trading

The brokerage offers two different mobile trading apps: the IIFL Markets App and the IIFL Mutual Funds App. Both apps are available to download on Apple (iOS) and Android (APK) devices. The markets app provides users with the ability to open and close trades and carry out market analysis. There is also the option to set up price alerts and receive free research reports and trading tips.

The mutual funds app allows clients to buy, sell and monitor mutual funds. They can view mutual fund scheme performance and receive advice from fund managers. The app is free to download to all live account holders.

Deposits & Withdrawals

There is no minimum deposit for IIFL Securities, but customers must have a minimum margin of Rs 1,000 to trade. Deposits made via an IIFL linked bank account are processed almost instantly. Other e-payment methods take up to three working days, while cheques at an outstation can take around 15-20 days.

Deposits can be made via the following online payment methods:

- RTGS (Real Time Gross Settlement) transfer

- IIFL linked bank account through TT web

- DD / pay order

- IMPS transfer

- NEFT transfer

- Cheque

The minimum withdrawal amount is Rs 999. A balance of Rs 1000 must be always maintained in the account. Typically, withdrawals are processed within 24 hours, with cheques being dispatched to local branches in 24 hours. Proof of identity and address must be provided before withdrawals can be made.

Withdrawals can be made using the following methods:

- Bank transfer

- NEFT transfer

- RTGS transfer

- Cheque

Bonuses

IIFL Securities runs one deal for new customers. It allows them to open a Demat and trading account for free, with no account opening charge. This saves customers a one-time fee of Rs 250. There are also refer and earn bonus schemes available via the broker’s homepage.

Regulation

IIFL is regulated by the Securities and Exchange Board of India (SEBI), a top tier regulatory body that holds brokerages to a high standard. This was proven in 2019 when six individuals linked to IIFL Securities were fined and banned by the SEBI.

Additional Features

India Infoline provides a wealth of additional trading features including its own news site. The dashboard links to a variety of sources, with news provided for mutual funds, IPOs, forex and more.

Customers also have the opportunity to purchase non-convertible debentures (NCDs) in the company. Upcoming NCDs are regular and were recently issued to the public in September 2021 for IIFL Finance.

Once signed in through the web login and customer portal, clients also have access to the e-learning knowledge centre. Here, clients can learn about Demat eaccounts, trading accounts and stock markets, and even access resources regarding know-your-customer (KYC) updates.

Live Account

Customers are offered a 2-in-1 account. This provides broking and depository services via a trading and Demat account. The brokerage does not provide banking services (as a 3-in-1 account would) since it does not have a banking licence. The account is available for Indian residents, as well as non-resident Indians (NRIs).

There are no levels or tiers to the account, but know-your-customer (KYC) information must be provided to open the account. Futures and options (F&O) clients must complete a further activation form stating proof of income to be allowed to trade.

Benefits

These are several advantages to trading with IIFL:

- Free account opening

- No AMC charges for the first year

- Open to resident Indians and NRIs

- Range of assets and markets available

- Access to the Trader Terminal (TT) platform

- Wide network of branches across India and abroad

Drawbacks

There are also some disadvantages of trading with IIFL:

- No demo account offering

- 3-in-1 accounts are not available

- No intraday tick chart functionality

- Clients do not have access to the popular MetaTrader platforms

Trading Hours

Stock, index, commodity and derivative assets on India Infoline are open for trading during the hours of their respective stock markets (BSE, NSE etc.). Forex currency pairs trade during the standard 24/5 forex trading session. The broker’s trading platforms and account portal are available 24/7.

Customer Support

Customer care and assistance are taken seriously at IIFL Securities. Whether support is required for a Demat account, or a number to call regarding lost trade login details is needed, the customer service team is on hand.

The team can be contacted via the following methods:

- Customer care contact number: 022-40071000

- Email: customergrievances@indiainfoline.com

- WhatsApp number: 022-61502000

- Toll-free number: 9015457868

- Email ID: cs@indiainfoline.com

- Customer service chat

- Online full form

Security

Customers are encouraged to set up two-factor authentication. This requires either an email or text confirmation to access accounts, adding an extra layer of security that ensures no one else can login. The brokerage also uses industry-standard encryption protocols to protect client data.

IIFL Verdict

IIFL Securities is a popular Indian stockbroker. Part of the IIFL Group, it provides services including online Demat and trading accounts. Customers can start investing across multiple assets including shares, mutual funds and bonds. The Trader Terminal platform is intuitive and a range of online payment methods are available. Overall IIFL is a great choice for Indians who want to start trading.

FAQs

Is IIFL A Discount Broker?

IIFL Securities is a full-service broker. 5paisa is a discount broker owned by the IIFL group, but acts as its own entity. See our review of 5pasia for more details.

Is IIFL A Good Company?

India Infoline is a well-recognised brand. It has positive reviews on YouTube regarding its good quality of service and customer support. The company also offers an impressive list of trading products and competitive account fees and charges.

Is IIFL A Government Company?

IIFL is not a government company. It is owned by Indian billionaire Nirmal Jain. Details of the company’s finances, history and management team can be found on the broker’s website.

Is IIFL A Bank?

The broker is not a bank as it does not have a banking license. It provides 2-in-1 accounts for customers as opposed to 3-in-1 accounts that provide banking services.

Is IIFL A NBFC?

Yes, IIFL is an NBFC. A NBFC is a non-banking financial company. Further details on the setup of the various entities under the company umbrella are available on the broker’s website.

Top 3 Alternatives to IIFL

Compare IIFL with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

IIFL Comparison Table

| IIFL | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4.5 |

| Markets | Forex, Stocks, Futures, Options, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | 1000 Rs | $0 | $0 | $100 |

| Minimum Trade | – | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | SEBI | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | NFA, CFTC |

| Bonus | Gift vouchers worth up to ₹5000 | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | – | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:50 |

| Payment Methods | 2 | 6 | 6 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by IIFL and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| IIFL | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

IIFL vs Other Brokers

Compare IIFL with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of IIFL yet, will you be the first to help fellow traders decide if they should trade with IIFL or not?