Global Prime Review 2026

See the best Global Prime alternatives in your location.

Pros

- 24/7 customer support

- Wide range of deposit options with zero fees

- Low latency with execution speeds from 10ms

Cons

- Narrow range of account options

- Clients from US and Canada are not accepted

- No MetaTrader 5 integration

Global Prime Review

Global Prime is an online ECN broker, offering trading in forex, CFDs and commodities. The company specializes in low-latency connectivity to tier-1 bank liquidity. Our 2026 review explores its spreads, commissions, leverage, opening a live account and more. Find out whether to register for an account with Global Prime.

Company Details

Global Prime was founded in 2010. It is based in Australia and caters to retail and institutional traders around the world. It offers popular platforms including MT4, TraderEvolution and FIX API, as well as multiple asset classes such as forex, CFDs and commodities. The broker offers straight-through processing and fast execution with their ECN facilitating direct access to 26+ liquidity providers.

The Global Prime Group is comprised of a network across Australia (Global Prime PTY Ltd), Vanuatu (Gleneagle Securities PTY Limited), and Seychelles (Global Prime FX Ltd). They are regulated by the ASIC, VFSC and FSA.

The company’s leadership team has a combined experience of 80+ years within financial trading and related markets. Their investing services are used by traders globally and are available in 196 countries, including the UK, though traders from United States are prohibited from opening an account.

Global Prime’s head office is located in Australia.

Ethical Dealing Model

Global Prime adopts an ethical dealing model. This means that instead of trading against their clients, they focus on connecting clients to markets.

It is estimated that 95% of forex and CFD brokers operate B-books models, allowing them to generate profits at the expense of their clients.

Trading Platforms

Global Prime offers three trading platforms: MetaTrader 4, TraderEvolution and FIX API.

MetaTrader 4

Clients can trade with the well-known MT4 platform, popular amongst forex traders. MT4 offers advanced charting functionality, 30 built-in indicators, one-click trading, and automated investing through APIs, among other features.

The MT4 platform is suitable for clients looking to enjoy institutional style trading or scalping strategies. The platform is also suited to both new and more advanced traders.

Key features include:

- Automated trading

- Backtesting capabilities

- Options for customization

- Compatible with 1000s of plugins

MetaTrader 4 is available on Windows, Mac, Web, iOS and Android.

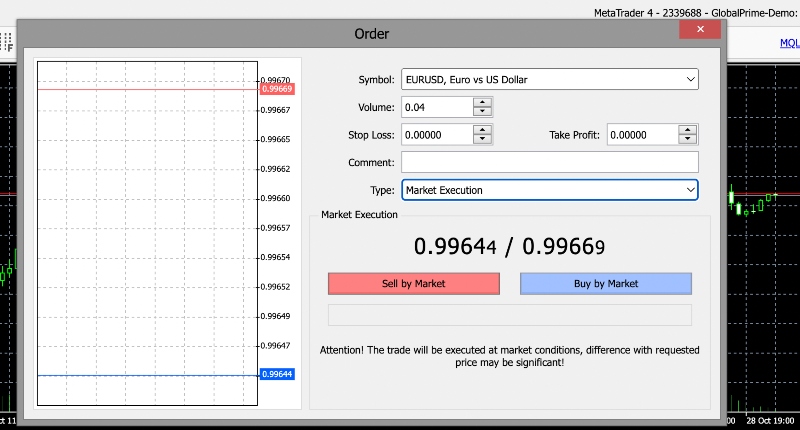

How To Place An Order

- Download MT4 and login to the software or open the webtrader terminal

- Select file, new chart and then choose an asset from the list

- Select the new order icon in the top left of the chart

- Enter your trade requirements, including market execution or pending order, take profit and stop loss, volume

- Select sell or buy to confirm the order

TraderEvolution

The TraderEvolution platform caters to professional traders who seek more advanced functionality for order entry, analysis and algorithmic trading. It comes with 10+ fully customizable chart types, multiple time frames, ability to view market depth and one-click trading.

It is equipped with the same pricing and execution as the MT4 platform but offers greater transparency over liquidity, level 2 pricing, DoM trading and volume analysis.

TraderEvolution is available on Windows, iOS and Android.

FIX API

The FIX API solution is also designed for professional traders who are looking to deploy proprietary algorithmic trading solutions with the lowest possible latency. The platform is best suited to experienced traders who want the flexibility to use any programming language.

What is particularly useful is the ability to connect directly with trading servers in real-time, as opposed to going through third-party programs such as MT4. For easy account management and access, trades are drop copied to either an MT4 or TraderEvolution account.

The solution requires a minimum deposit of USD $10,000 and comes with a USD $2,000 monthly commission. With that said, fees may be negotiable with Global Prime customer support services.

Global Prime Assets

Clients can trade 150+ markets across forex, CFDs and commodities:

- Forex – major, minor and exotic currency pairs including GBPUSD and EURUSD

- Cryptocurrencies – popular cryptocurrencies i.e. BCHUSD, ETHUSD and LTCUSD

- Commodities – hard and soft commodities including gold, silver and platinum

- Indices – global indices such as Nasdaq 100, Nikkei 225 and FTSE 100

- Bonds – relatively stable government bonds

Spreads & Commission

Spreads at Global Prime are variable starting from 0.0 pips. Typical spreads on leading pairs EUR/USD are 0.16 and 0.75 on GBP/USD. Typical spreads on the FTSE 100 are 0.84 and 1 on the Nasdaq 100.

Global Prime only charges commissions on forex and metal trades with the ECN account. Commission charges per standard lot are as follows: 7 AUD, 7 USD, 6.2 EUR, 5.4 GBP, 9.5 SGD, 9 CAD.

The company also offers competitive overnight swap rates, which are taken directly from the interbank market.

Leverage Review

Global Prime leverage ranges from 1:1 to 1:100. The company asserts that these are the maximum rates traders can utilize without it being detrimental to their profitability or success. 1:100 standard leverage has a 1% margin requirement. Leverage limits do vary by asset class.

Global Prime does offer negative balance protection for clients registered with Global Prime Pty Ltd (Australia) regulated by ASIC. There are also protocols in place to try to mitigate the possibility of a negative balance including a 120% margin call level. More details can be found on the brokerage’s website. Should your account head into negative balance, the user simply has to deposit the amount required to bring the balance back to zero.

Mobile Apps

Clients have access to the TraderEvolution platform on the go via the recently launched, TraderEvolution mobile app. The app is available to download from the Google Play Store and iOS store. Multiple languages are supported and it is free to download.

Traders can also access the MT4 app on iOS and Android devices. Free to download from the App Store and Google Play, the MT4 Android and iOS apps offer most of the functionality of the web version, with some limitations in charting and viewing options. Overall though, customer reviews and rankings of the mobile solution are excellent.

Payment Methods

Deposit and withdrawal funding requests are actionable through Global Prime’s client portal. The brokerage offers a wide range of deposit methods. Deposit requirements range from AUD $1 to AUD $200. While all are fee-free, processing times do vary:

- Credit/debit cards (MasterCard & Visa) – Instant

- POLi – Instant

- Skrill – Instant

- Gate8 – Instant

- VNPay – Instant

- PayPal – Instant

- Neteller – Instant

- FasaPay – Instant

- Dragonpay – Instant

- PromptPay – Instant

- Thai QR payment – Instant

- BPAY – Approximately 24 – 48 hours

- Pagsmile – Within 24 hours (during business days)

- Bank wire – 1-2 business days (Australia), 3-5 business days (Intl.)

Users are able to deposit funds in six base currencies: USD, AUD, GBP, EUR, CAD & SGD.

Withdrawals are available through Mastercard and Visa, bank wire and Neteller. With card payments, processing times range from 1-10 days. Bank wire takes 1-2 business days (AU) and 3-5 business days (Int.). Neteller withdrawals are instant once actioned.

Global Prime does not charge any finance or withdrawal fees but will pass on any bank charges to the client.

Demo Account

Global Prime offers a free demo account across its MT4 and TraderEvolution platforms. Traders can explore platform functionalities and practice strategies, risk-free. Demo accounts are credited with $5,000 in virtual funds.

Demo accounts are recommended for all, irrespective of experience level.

When ready, clients are able to upgrade to a live account with real capital.

Global Prime Bonuses

Our experts found that apart from its referral program, Global Prime does not offer any bonus deals or promotions at the time of writing. However, you can check its website and social media pages for news of future promos and competitions.

Regulation Review

Global Prime is fully licensed and regulated as a group of contracting entities across Australia, Vanuatu and Seychelles. Global Prime PTY Ltd is regulated by the Australian Securities and Investments Commission (ASIC) under license number 385620. Gleneagle Securities PTY Limited trading as Global Prime FX is regulated by the Vanuatu Financial Services Commission (VFSC) under license number 40256 and Global Prime FX Ltd is regulated by the Seychelles Financial Services Authority (FSA) under license number 8426189-1.

More experienced traders are likely to take caution with the VFSC and FSA regulatory bodies. The VFSC, for example, allows for the quick and easy setup of companies and offers limited client protection. Fortunately, ASIC is considered a top-tier regulator.

Global Prime conducts regular independent external audits of its financial and compliance arrangements and has no adverse record from any financial regulator, government body, or court of law.

Additional Features

- Margin calculator – Global Prime offers an FX pip calculator that works out the required position size based on your currency pair, risk level and stop loss.

- YouTube channel – Global Prime has an established YouTube channel with over 300+ videos. Content includes educational short-form videos and podcast videos featuring founders and the leadership team.

- Trading academy – Traders of all skill levels can benefit from Global Prime’s comprehensive and structured training program that features various mentors.

- Trading community – Members can communicate with each other and industry mentors on their Discord hangout.

- VPS offers – The broker’s VPS services improve the quality and speed of trade execution. The VPS is also free for clients who trade more than 20 lots a month.

- Autochartist alerts – A range of features, including fundamental and technical analysis, educational resources, news and market updates and detailed charts and analysis.

- MyFxBook Autotrade – Replicate the positions and strategies of other traders with the broker’s copy trading tool

Account Types

Global Prime only offers one account type – The ECN Account. Global Prime’s ECN comes as Individual, Joint, Corporate and Trust solutions.

ECN account features include:

- AUD $7 commission per lot round turn on FX and metals only

- Best execution with 26+ liquidity providers

- Variable and tight spreads from 0.0 pips

- Execution speeds as low as 1ms

- Automated trade receipts

Opening an account is straightforward and simply requires proof of identity and address. Members can also sign in and manage their accounts through the client portal.

Clients can choose between two fee models: commission-free or spreads + commission.

Account holders can trade using AUD, USD, GBP, EUR, SGD, or CAD.

Note that the minimum first-time deposit for a live account is AUD $200 or equivalent.

Trading Hours

When we used Global Prime, we found trading hours on forex, indices and commodities markets are open 24/5 from Monday to Friday. Specific trading hours for each market can also be viewed on the Global Prime website or on the MT4 and TraderEvolution platforms.

Customer Support

The broker’s customer support team is available 24/5, Monday to Friday. They can be reached via email at support@globalprime.com, via phone at +61 (2) 8379 3622 or directly through live chat.

While using Global Prime, the customer support team were knowledgeable and responsive.

Security & Safety

Global Prime is a transparent and legitimate online broker, providing automated trade receipts that detail fill speed, slippage, spread and liquidity provider. The company is also transparent about how they generate income via commissions, swaps and interest. In addition, the MT4 platform provides high-tech encryptions, secure logins, and industry-standard data privacy.

While using Global Prime’s platform we did not have any security concerns.

Global Prime Verdict

Our experts found that Global Prime offers a promising trading environment for traders of all experience levels. While the broker doesn’t offer the widest variety of instruments, it provides competitive spreads on leading pairs and indices. The broker is also regulated and transparent regarding the security measures in place to protect clients and operates an ethical trading model. Overall, we’re comfortable recommending Global Prime to our traders, particularly experienced investors looking for advanced trading tools.

FAQs

Is Global Prime Regulated?

Yes, Global Prime is licensed and regulated by the Australian Securities and Investments Commission (ASIC) under license number 385620, the Vanuatu Financial Services Commission (VFSC) under license number 40256, and the Seychelles Financial Services Authority (FSA) under license number 8426189-1.

Does Global FX Offer A Demo Account?

Yes, Global Prime offers a demo account where you can place simulated trades, explore platform features and test strategies without risking real money.

How Much Capital Do I Need To Trade With Global Prime?

The minimum first-time deposit for an ECN Global Prime account is $200. There is a minimum deposit of USD $10,000 required to get FIX API access and it comes with a USD $2,000 monthly commission.

Is Global Prime A Good Broker?

Global Prime is a legitimate brokerage that abides by regulations and practices good financial governance. The company also offers competitive spreads and reputable trading platforms. Its educational tools, coupled with over a decade of industry experience make it a good option for prospective traders.

Is Global Prime A Trustworthy Broker?

Global Prime is a regulated and trusted broker with positive user reviews. Client funds are held in segregated tier-1 accounts. The broker also promises transparency and operates an ethical dealing model, meaning that it doesn’t profit from client losses.

Best Alternatives to Global Prime

Compare Global Prime with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Global Prime Comparison Table

| Global Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Rating | 3.8 | 4.3 | 4.5 |

| Markets | Forex, indices, commodities, cryptocurrencies, shares, bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | A$200 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, VFSC, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | – | – | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Platforms | MT4, TradingView, AutoChartist | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:200 | 1:50 | 1:50 |

| Payment Methods | 13 | 6 | 9 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Global Prime and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Global Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| CFD | Yes | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | No |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | No |

| Futures | No | Yes | Yes |

| Options | No | Yes | Yes |

| ETFs | No | Yes | No |

| Bonds | Yes | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Global Prime vs Other Brokers

Compare Global Prime with any other broker by selecting the other broker below.

The most popular Global Prime comparisons:

Customer Reviews

3.7 / 5This average customer rating is based on 3 Global Prime customer reviews submitted by our visitors.

If you have traded with Global Prime we would really like to know about your experience - please submit your own review. Thank you.

I’m a retail trader that runs HFT setups and Global Prime is without doubt the best firm I’ve used. I regularly get around 10ms execution speeds, super tight spreads nearing zero. Its FIX API has also been a game changer. I know I can rely on their tech and infrastructure to punch my trades through at substanial volumes.

Hello. I’was trading for the first and I didn’t have a good experience with the persona who was helping me. Can someone please check for me if i have an account with you? Please!

I can attest to Global Prime being a decent broker for day traders. I chose it because I wanted a firm that provides volatility analysis and fast order execution (I’ve been burned before by slow platforms so my setups just aren’t profitable enough). You get Autochartist if you open a Global Prime account and it’s terrific. For example today it showed me in charts, numbers and the like that the CHFSGD was experiencing high volatility, along with expected price ranges over the next hour, 4 hours and 24 hours, suggesting big short term price fluctuations.