GKFX Review 2024

Pros

- I was pleased to see some excellent additional tools on offer alongside the MT4 platform, including Trading Central analysis and Autochartist. There’s also a VPS service for experienced traders

- There’s a decent range of payment methods available, from bank wire to e-wallets like Neteller and Skrill. Most methods are also processed instantly

- I found GKFX’s trading conditions were relatively competitive compared to other brands. Minimum spreads are low, starting from 0.6 pips for EUR/USD, plus there are zero commissions in the Standard account

Cons

- I’m disappointed that most deposit methods come with fees starting from 1%. Most brokers will offer free deposits

- I think the broker’s range of assets isn’t as wide as many competitors and it would have been good to see more global stocks on offer

- Whilst MT4 is an excellent platform, some traders may feel restricted by the lack of choice. Many brokers will offer at least one other third-party platform or even a proprietary solution

GKFX Review

GKFX is an ECN broker offering forex and CFD trading services. The broker has a large presence in Europe and multiple countries around the world. This review looks at their MetaTrader 4 trading platform, account options, spreads, and more. Find out if you should start trading online with GKFX.

GKFX Company Details

Established in 2013, GKFX is based in Malta, operating under AKFX Financial Services Ltd. AKFX is a Category II Investment Services company and is regulated by the Malta Financial Services Authority (MFSA).

AKFX is part of the Global Kapital Group (GKG), a multi-national company operating in 28 offices across 18 countries. Also within the GKG group is GKFX Prime and GKFX Financial Services Asia Limited, which have multiple offices across the Middle East, as well as in China, Vietnam, Thailand, Malaysia, Cambodia, and Indonesia. GKFX Prime is regulated in the British Virgin Islands (BVI).

GK Pro, a London-based subsidiary specialising in spread betting, also forms part of the company’s portfolio.

GKFX has grown rapidly with its number of employees worldwide now exceeding 1,000. The new CEO recently signed a deal that saw Arsenal Football Club become its official partner. In the past the owner has also teamed up with AC Milan.

Trading Platforms

MetaTrader 4

GKFX offers MetaTrader 4 (MT4), a favourite among traders for its advanced features and accessibility. Once you have your login credentials, you can trade FX, metals, shares, indices, energies, and futures. Other key features include:

- 3 different chart types, 9 timeframes

- 50+ pre-installed technical indicators

- Access to Expert Advisors (EAs)

- Fully customisable interface

- Available in 30 languages

- Back-testing available

- Micro-lots available

- One-click trading

- No partial fills

WebTrader

The MT4 platform is also available as a web-based online terminal, allowing live account holders to trade from any supported browser with no additional software or download required. The platform is regularly updated so users have access to the same features as the desktop platform.

To access the platform, users will need to login to MYGKFX, which is accessible from the top of the website page. WebTrader is accessible on Windows, Mac and other devices.

Markets

GKFX offers a diverse range of tradeable instruments:

- Cryptocurrency – Trade five popular cryptocurrencies against the US Dollar, including Bitcoin, Ethereum & Litecoin

- Forex – Trade over 50 global currency pairs including the EUR/USD, GBP/USD, and USD/JPY

- Equities – Trade on over 100 CFD stocks and shares including Apple, Walt Disney, and Bank of America

- Indices – Trade on major indices in spot and futures markets, including the FTSE 100, CAC 40, Germany’s DAX 40, & the Dow Jones

- Commodities – Trade on hard and soft commodities including gold, oil, and natural gas

Spreads & Fees

Spreads start at around 0.6 pips for EUR/USD, 0.7 for GBP/USD, and 1.4 for EUR/GBP. Target spreads for major indices such as the FTSE 100 are around 1 and go as low as 0.4 points for the SP500. Spot gold spreads are 0.3 pips and 0.026 for silver. Crude oil spreads start from 0.03 pips. For cryptocurrencies, target spreads for Ripple vs USD start from 0.1. These spreads are competitive and easily comparable to the likes of Admiral Markets, IG, and eToro.

Other fees to be aware of include swap rates on overnight positions as well as an inactivity fee charged on dormant accounts. Details can be found in the broker’s terms and conditions.

Leverage

GKFX offers leverage from 1:2 for cryptocurrencies, up to 1:30 for FX, and up to 1:20 on major indices and commodities. Spot equities are offered up to 1:5.

The broker provides margin requirements on their Market Information Sheet (MIS). Cryptocurrencies require a 50% margin, whilst forex margins are set between 3.33% up to 8%, depending on the currency pair. Major indices require a 5% margin, as does gold. Equities are set at 20%.

A margin calculator is also available on the broker’s website.

Mobile Apps

The MetaTrader 4 platform is also available in a mobile app version, where users have access to all the standard features. With over 30 pre-installed technical indicators, rapid trade execution, and a user-friendly mobile interface, clients can trade with ease from their smart device.

The MT4 mobile app is compatible with Android and iOS devices and can be downloaded from the respective App Store or Play Store.

Payment Methods

Deposits

Clients can fund their accounts using:

- Bank wire transfer – Swift transfer cost. 2-5 days

- Debit/credit cards – 2.5% fee. Instant

- Neteller – 1% fee. Instant

- Skrill – 1% fee. Instant

- Bitcoin – 1.5% fee. Up to one hour

- WebMoney – 3%. Instant

- QIWI Wallet – 5%. Instant

- Russian Post – free. Up to 72 hours

Withdrawals

Clients can withdraw profits using:

- Bank wire transfer – 0.5% fee (minimum $30). Up to 10 days

- Debit/credit cards – 2.5% + $7.5. Up to 6 days

- Neteller – 1.5% fee. Up to one day

- Skrill – 1% fee. Up to one day

- Bitcoin – 1.5% fee. Up to one day

- WebMoney – 1.5%. Up to one day

- QIWI Wallet – 1.5%. Instant. Up to one day

Demo Account

GKFX offers a free demo account where users can practice trading on MT4 with zero risks. Once you have your login details, you can trade in USD, GBP, or EUR, and access virtual funds up to 100,000.

Bonuses & Promotions

At the time of writing, GKFX Prime does not offer any no deposit welcome bonus deals or promotions. With that said, check the broker’s website before you register for an account in case of new rebate offers and free revenue credit.

Regulation & Reputation

AKFX Financial Services Ltd (GKFX) is a Category II Investment Services company and is regulated by the Malta Financial Services Authority (MFSA). The broker is EU-regulated under MiFID. The group is also fully compliant with ESMA regulations. As a result, the broker receives a high trust rating among customer reviews.

Note, GKFX is no longer regulated in the UK by the FCA.

Additional Features

GKFX also offers some useful additional features, including a glossary of trading terms and economic indicators, video seminar courses, and webinars as part of the learning academy. Users can also access an economic calendar plus margin, profit, and currency calculators.

A technical market insight and news tool, Trading Central, as well as Autochartist, are also available as downloadable plugins. A VPS (Virtual Private Server) is also available for users, although this does come with a monthly fee.

Account Types

GKFX offers three different account options: Standard, Premium, and Corporate. Most traders will be drawn to the Standard account given that the minimum deposit amount is €100. Users would need at least €20,000 to open a Premium or Corporate account.

Traders have access to the same instruments across all three accounts, as well as leverage up to 1:30, variable spreads from 0.6, and a maximum trade size of 100. There are no commissions with the Standard account and commission is charged at €6 per lot with the Premium account.

GKFX also offers Islamic swap-free accounts.

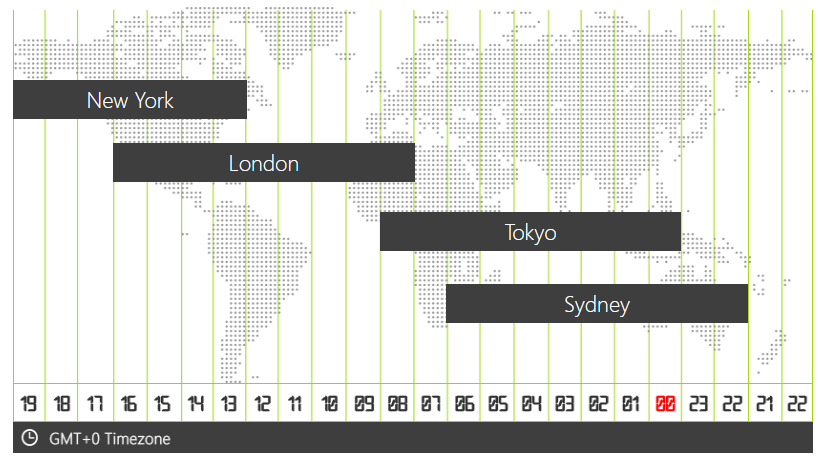

Trading Hours

Online forex trading sessions vary and some time zones will overlap, attracting the highest volume of traders. GKFX’s opening hours for forex, commodities, and indices run from Sunday at 10:02 pm to Friday at 09:58 pm UK time. For equities, the market opens on Monday at 16:35 and closes on Friday at 22:50.

Details of specific markets trading hours can be found on the broker’s Market Information Sheet (MIS).

Customer Support

GKFX customer support is contactable via:

- Online contact form

- Email – support@gkfx.eu

- Telephone hotline – +356 2778 0848

- Live chat – live chat logo located on the right-hand side of the page

Support is available 24 hours a day, from 10 pm Sunday – 10 pm Friday. The website is available in English, German, Spanish, Italian, and Arabic.

Keep up to date with the latest news on GKFX’s social media pages:

Security

MetaTrader 4 complies with industry-standard security requirements including 128-bit Secure Sockets Layer (SSL) encryption as well as two-factor authentication upon login.

AKFX Financial Services Ltd is part of the Investor Compensation Scheme, a client protection program, designed to safeguard against financial failure or insolvency. As per MiFID and MFSA regulations, the brokerage also segregates client funds into separate bank accounts.

GKFX Verdict

GKFX is a global broker with clients in multiple jurisdictions. With access to hundreds of instruments across five markets, as well as competitive fees and decent trading conditions, GKFX is a good choice for beginners and experts.

Top 3 Alternatives to GKFX

Compare GKFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

GKFX Comparison Table

| GKFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | €100 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | MFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, AutoChartist, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:5 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 6 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by GKFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| GKFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

GKFX vs Other Brokers

Compare GKFX with any other broker by selecting the other broker below.

FAQ

Is a deposit bonus offered at GKFX?

At the time of writing, GKFX does not offer any deposit bonuses or welcome promotions. See the broker’s website or social media pages for the latest promotional news.

What trading platforms are available at GKFX?

Clients can trade on the MetaTrader 4 mobile, web, or desktop platform. GKFX does not offer MetaTrader 5 (MT5) or a proprietary program.

How do I open an account with GKFX?

You can open a live or demo account from the broker’s website. For a live account, after registering your personal and login details, you will be asked to verify your identity.

What leverage is offered at GKFX?

Maximum leverage is offered at 1:30 depending on the asset traded. This cap is in line with ESMA regulations that limit the risk clients can take on.

Is GKFX regulated?

Yes, GKFX is regulated by the Malta Financial Services Authority (MFSA). The broker also complies with MiFID.

Customer Reviews

There are no customer reviews of GKFX yet, will you be the first to help fellow traders decide if they should trade with GKFX or not?