GCI Review 2024

Awards

- Best Forex Broker Europe 2015 - ForexExpo

- Best Forex Customer Service 2015 - IFM

- Best Forex Broker Europe 2014 - ForexExpo

- Most Innovative Forex Broker Europe 2013 - International Finance

- Best Forex Broker Europe 2012 - Global Banking & Finance Review

GCI Review

GCI Financial Ltd is an award-winning forex and CFD broker offering the MetaTrader 4 (MT4) and ActTrader platforms. Our review of the broker’s services covers the software downloads, available markets, demo accounts, and customer support. Find out if you should login and start trading with GCI.

GCI Financial Company Details

Founded in 2002, GCI Financial Ltd offers over 300 tradable financial assets and educational tools for both beginners and experienced traders. The company has clients from all over the world, including Europe, India, and Australia.

However, despite receiving multiple awards over the years, the broker is unregulated and it isn’t clear where its head office is based.

Trading Platforms

MetaTrader 4

GCI offers the MetaTrader 4 (MT4) trading platform – the leading system among traders of all levels. All of the broker’s tradable financial assets are available on MT4 along with multiple features:

- 30+ built-in technical charting indicators

- Expert Advisors (EAs) supported

- NDD & ECN order processing

- Instant market execution

- Instant fills in forex

- One-click trading

- Nine time frames

The MT4 64-bit download is available from the broker’s website.

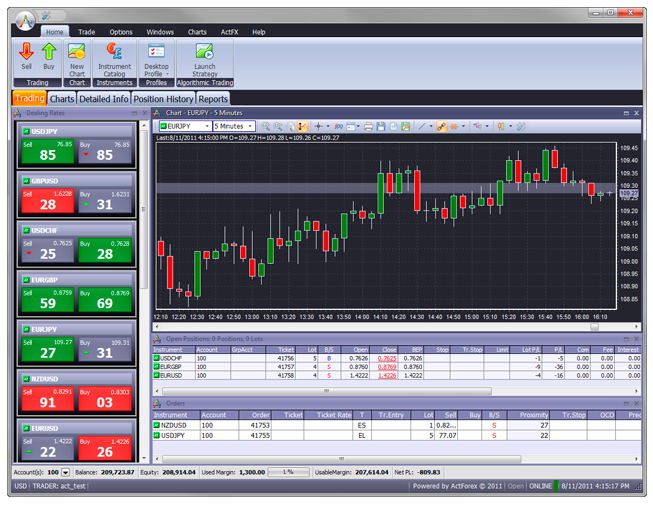

ActTrader

ActTrader is sophisticated forex software that offers trading across all available products. The platform comes with a range of tools:

- Back-testing on historical financial data

- Dozens of technical indicators

- Real-time account statements

- Customisable interface

- One-click trading

- Price alerts

- Instant fills

ActTrader is available as a free download from the broker’s website.

Markets

GCI Financial offers over 300 instruments across several asset classes:

- Forex – Trade 40 major, minor, and exotic currency pairs including EUR/USD, EUR/GBP, and AUD/USD

- Indices – Trade 17 world stock market indices including the FTSE 100, Dow Jones, and S&P 500

- Metals – Trade on gold, silver, platinum, palladium, and copper

- Commodities – Trade on oil and natural gas, as well as commodity-backed bonds

- Shares – Trade on a range of global shares including Facebook, Deutsche Bank, and Sony

Spreads & Commission

Spreads start at 1 pip for the EUR/USD and around 2 pips for the GBP/USD and EUR/GBP. Typical spreads on major indices, such as the FTSE and Dax, start at 3 points. Spreads on gold and silver are 45 and 5 respectively.

Accounts are commission-free, so it’s just the spread to take into account. Overall, trading fees are around the industry norm.

Leverage

Across both MT4 and ActTrader, maximum leverage on currencies is 1:400 while on shares, it’s 1:20. Note, ESMA regulations limit leverage rates to 1:30 for residents from Europe.

Mobile Apps

GCI offers both the ActTrader and MetaTrader 4 platforms in mobile app versions, allowing traders to access the markets and manage their accounts from portable devices. Users have access to many of the same features as the desktop platforms.

The apps are compatible with both iOS and Android devices and can be downloaded for free from the Apple App Store or the Google Play Store. There is also a mobile website for ActTrader users, meaning clients can carry out trades from a mobile browser without having to download additional software.

Payment Methods

Deposits

Traders can fund their account using several fee-free methods:

- Wire transfer – 1 – 3 business days

- Perfect Money – 1 business day

- Neteller – 1 business day

- Skrill – 1 business day

The minimum deposit is $500 and there is no maximum deposit limit. Note some methods may charge their own commission fees.

Withdrawals

Withdrawals can be made via the same methods listed above. Traders will need to complete a withdrawal form (online or PDF) available from the client portal, and email it back to the broker. There are no withdrawal fees and most payment requests are processed within 24 hours.

Demo Account

GCI Financial offers demo accounts with both the MT4 and ActTrader platform downloads. Users can practice trading with $50,000 in virtual funds, with no financial risk. If you’re unsure whether to open an account after reading this review, the simulator account is a great way to test the broker’s financial services for yourself.

Bonuses & Promotions

GCI offers an exclusive promotion of 50% bonus margin on deposits over 10,000 USD or EUR. Deposits less than this will be subject to the regular 25% bonus margin.

The broker also offers 4% interest on your average daily balance which is credited at the end of each month. Traders should check the broker’s website for any changes or further revenue promotions.

Regulation

Despite winning multiple awards, GCI LLC is not regulated. This is a concern. Unregulated providers do not provide the same degree of security as fully licensed brokers. It also raises questions about whether GCI Financial is a scam. Customer reviews don’t suggest that is the case, but readers should be wary given the group’s lack of legitimate regulatory oversight.

Additional Features

GCI offers an education and resources centre, containing various trading tools to assist both beginner and expert traders. This includes daily news, e-learning resources, a currency calculator, forex charts, trading signals, and an economic calendar. The only problem is that much of the educational content and trading signals haven’t been updated in years.

Account Types

GCI’s account offering is based on the two platforms available: MetaTrader 4 and ActTrader. Both accounts require a $500 initial deposit and offer trading in forex, indices, metals, crude oil, individual shares, and commodities.

The ActTrader account requires 10,000 currency units per lot, whilst the MetaTrader account requires 100,000 currency units per lot. The MetaTrader account also gives you a choice of ECN or traditional execution, no requotes or delays, and NDD instant execution in major currencies.

Benefits

Benefits of trading with GCI include:

- Two trading platforms, including MT4

- 300+ tradable financial assets

- Award-winning online broker

Drawbacks

Downsides to creating a GCI trading account include:

- Unregulated broker

- Long live chat wait times

- Outdated education centre

Trading Hours

Forex can be traded 24 hours a day, however for other assets, trading times vary:

- North American shares – 9:30 am – 4:00 pm EST

- European shares – 3:00 am – 11:30 am EST

- Asia-Pacific shares – 8:00 pm – 2:00 am EST, or 8:00 pm – 10:00 pm and 12:30 am – 2:00 am EST, depending on the share.

- Commodities – Sunday 6:00 pm – Friday 4:00 pm EST

- Forex futures – Sunday 5:00 pm – Friday 4:00 pm EST

- Indices – varies by index, see the broker’s website for details

Customer Support

GCI offers a customer support help desk in eight different languages, including English, German, Russian, and Japanese.

The broker can be contacted via:

- Email – info@gcitrading.com

- Telephone number – +1 800 604 2457 (24/5 GMT)

- Live chat – located in the bottom right-hand corner of the website

Unfortunately, it can take a while to get through to live chat support.

Security

The MetaTrader platform is protected with industry-standard Secure Sockets Layer (SSL) encryption. It is not clear from the website what levels of security the ActTrader platform has. GCI does, however, have a privacy policy on the website detailing their data collection processes.

GCI Verdict

GCI offers a decent breadth of tradeable financial assets on the MetaTrader 4 and ActTrader platforms. The broker also offers commission-free accounts as well as a fully-featured demo account. However, the outdated education centre and the lack of regulatory oversight may deter some traders.

Top 3 Alternatives to GCI

Compare GCI with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

GCI Comparison Table

| GCI | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.3 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $500 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | 4% interest on account balance | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, ActTrader | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:400 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 2 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by GCI and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| GCI | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

GCI vs Other Brokers

Compare GCI with any other broker by selecting the other broker below.

FAQ

Is GCI Financial a scam?

GCI Financial Ltd is currently unregulated. With that said, online customer reviews don’t suggest that the broker is a scam. Still, we always recommend opening an account with a licensed provider first.

What assets does GCI offer?

GCI offers over 300 tradeable instruments in forex, indices, shares, metals, commodities, and CFDs.

How can I make a deposit at GCI?

Deposits can be made via wire transfer, Perfect Money, Skrill, or Neteller. You can deposit funds from within your account portal and the minimum payment accepted is $500.

Does GCI offer a demo account?

Yes, GCI offers a demo account with both the MetaTrader 4 and ActTrader platforms. Users have access to $50,000 in virtual funds to practice trading.

What is the maximum leverage offered at GCI?

GCI offers maximum leverage of 1:400 with live accounts. For trading in online shares, leverage is capped at 1:20.

Customer Reviews

There are no customer reviews of GCI yet, will you be the first to help fellow traders decide if they should trade with GCI or not?