FundedNext Review 2026

FundedNext is a prop trading firm with headquarters in the United Arab Emirates. They offer funded trading accounts with starting values of up to $300,000 and traders can reach up to $4,000,000 in funding through a scaling plan.

Reward share, or profit split, generally starts at 80% on funded accounts and can increase up to 90% via Scale-Up and up to 95% with Add-Ons. There’s a one-time challenge fee refundable after passing, subject to the rules of that plan.

But while the conditions look attractive, should traders sign up with FundedNext? In this review, we cover how FundedNext works, the account types and evaluation challenges they offer, what their rules are, how to get funded, whether they are legit, and how they compare to alternatives.

Key Takeaways

- FundedNext operates its trading programs via its own platform licenses and direct integrations with top-tier liquidity providers

- Replaced older Evaluation/Express sales with the Stellar lineup (1-Step, 2-Step, Lite, Instant), with optional Add-Ons for higher reward share

- FundedNext offers more funding than most prop trading firms we’ve tested, with profiles up to $4 million

- If you don’t pass, you typically don’t get the fee refunded and may need to repurchase depending on the plan

- The firm has some tight rules for certain funded accounts which may limit trading strategies used

What Is FundedNext?

FundedNext is an international proprietary trading firm headquartered in the UAE and founded in 2022. The firm is part of NEXT Ventures.

FundedNext aims to appeal to a range of traders and investment styles. They offer multiple Stellar account options (1-Step, 2-Step, Lite, Instant) to secure live funded trading accounts and up to 95% profit sharing.

Some account types offer a challenge-phase reward (e.g., 15%), but it doesn’t apply to every challenge (e.g., Stellar Lite).

Free retakes are available under specific conditions, notably trading-cycle retakes, though reset feature limitations may apply on some account-size combinations.

How Does FundedNext Work?

FundedNext works like other prop firms, with traders completing an assessment to prove their trading skills before being able to open a pre-funded live account.

Profits made on this funded account are then split between the trader and FundedNext, following a predetermined percentage share.

FundedNext offers an updated evaluation model:

Stellar Account Options

FundedNext no longer sells the older Evaluation and Express plans to new customers. Instead, its CFD offering is organised around the Stellar lineup, which gives you a choice between passing a challenge (one-step or two-step), choosing a lighter-risk challenge, or starting with an instant funded-style account.

- Stellar 2-Step Challenge: A traditional two-phase route: you aim to hit an 8% target in Phase 1 and 5% in Phase 2, while respecting a 5% daily loss cap and 10% overall loss cap.

- Stellar 1-Step Challenge: A faster, single-phase route: you target 10% once, with tighter risk limits – 3% daily and 6% overall maximum loss.

- Stellar Lite Challenge: A more conservative challenge structure that reduces the drawdown limits to 4% daily and 8% overall, and typically includes extra rule constraints compared with the main Stellar challenges.

- Stellar Instant Account: An “instant” style option designed for traders who want to skip the multi-phase target path. FundedNext describes it as having no consistency rule, so you’re not required to keep daily results or position sizes within a specific pattern. Instant has no daily loss limit but has a 6% maximum loss using a trailing method.

App

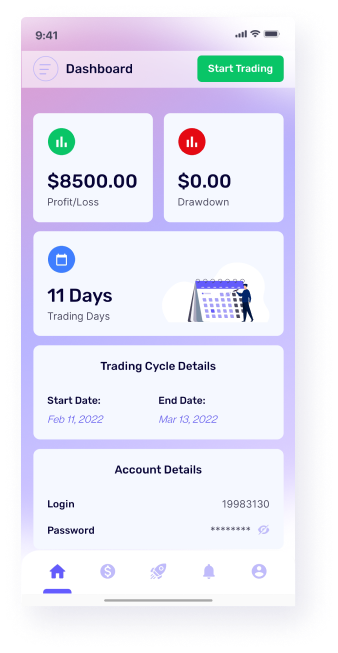

Our experts found that the FundedNext app is designed to let traders stay up-to-date with their trading performance, account growth and other details.

This is a notable advantage over other prop trading firms, which do not always offer a bespoke trading application for their users.

The app is available on both the Apple iOS App Store and Android Google Play Store or from the FundedNext website.

Platform Details

FundedNext provides access to MT4, MT5, cTrader and Match-Trader via its own platform licenses and liquidity-provider integrations, catering to different software preferences.

The MetaTrader 4 (MT4) platform is one of the most popular platforms for online trading. We’ve used it extensively – it is a versatile, customizable solution, with a host of features, including over 30 technical indicators, 9 timeframes and Expert Advisors (EAs) for automated trading.

MT4 also has a mobile app, allowing traders to trade wherever they may be. The mobile platform offers most of the same features as the base desktop platform and is available on the Android Google Play Store.

Education

FundedNext offers a good selection of educational resources for traders, including a news calendar covering important economic updates relevant to the tradable assets.

The firm also has a blog that covers a wide range of articles, including Q&As with traders, weekly economic updates, market analysis, a risk calculator, forex trading guides and important announcements.

Pros Of FundedNext

- Retry for free unlike some funded account providers

- Maximum capital of $4 million is more than many prop firms

- Up to 95% reward share available via Add-Ons (default funded share is lower)

- Competitive spreads and fees for active traders through liquidity providers

Cons Of FundedNext

- No guarantee you’ll make money

- Fail and you lose the sign-up fee

- Some reports of slow execution leading to slippage

- No phone number customer service contact

- Educational resources are more research-based

Security & Reputation

FundedNext is not a broker and positions its offering as a simulated trading and education-style service – it isn’t regulated like a broker-dealer.

Still, FundedNext has a strong reputation, with a Trustpilot score of over 4.5 with tens of thousands of reviews.

Customer Service

FundedNext offers a reliable customer service team which traders can contact 24/7:

- Email Address – support@fundednext.com

- LiveChat – Available at the bottom of their website

- Online Form – Available on their “Contact” page: https://fundednext.com/contact

- Address – Office no. 7, AI Robotics HUB, C1 Building, AFZ, Ajman, United Arab Emirates

- Facebook Messenger – @FundedNext

You can also interact with FundedNext through their social media accounts: Facebook, X, Instagram, YouTube, Discord and Telegram – Under the @FundedNext handle or similiar.

Verdict

FundedNext offers high levels of funded capital, with successful traders quickly getting access to $300,000 (up from the previous $200,000), and being able to raise that to $4 million through the scale-up plan.

The firm makes accessing funded accounts simple, requiring a one-time fee and passing a Stellar route (1-Step/2-Step/Lite), or choosing the Stellar Instant option.

Traders will also be able to trade using popular platforms, such as MetaTrader 4, and can speculate on a range of assets.

If you can follow the rules and successfully trade, then FundedNext could provide you with an opportunity to get funded.

FAQ

Is FundedNext A Good Prop Trading Firm?

FundedNext is a good pick for traders looking for a funded account. The company offers high profit splits up to 95%, accounts up to $4 million, plus a competitive scaling plan. The one-time entrance fee is also refundable if you secure a funded account.

Is FundedNext Trustworthy?

FundedNext is classed as an education firm, not a broker-dealer or any other type of financial institution, and therefore is not regulated by a financial regulatory body. It does have mainly positive reviews on third-party sites like Trustpilot though.

Still, we are always skeptical about prop firms business model, as they effectively make money from some traders who lose money applying to take part.

Does FundedNext Offer A Demo Mode?

FundedNext does not offer a demo account. FundedNext sells challenge accounts – they also offer a Free Trial product with its own rules.

Does FundedNext Offer A Good Profit Split?

On most Stellar funded accounts, the trader typically starts on an 80% reward share, with the potential to increase to 90% through the firm’s scale-up plan. FundedNext also sells optional add-ons that can increase the reward share further (up to 95%), depending on the plan you purchase.

If you’re trading a Stellar Instant account, the advertised maximum reward share is lower (up to 80%) rather than the higher splits offered on challenge-to-funded routes.

Overall, the top-end splits can be very competitive versus other prop firms – but the headline percentage usually assumes either scaling progress and/or paid add-ons, so it’s worth checking the exact terms for the specific account you’re buying.

Does FundedNext Offer A Reliable Trading Platform?

Through FundedNext, you can use the MT4, MT5, cTrader and Match Trader platforms. They are all versatile, customizable and offer traders plenty of tools and features to apply their strategy.

Some software, such as MetaTrader and cTrader, also come with additional features like automated trading bots.

What Assets Can You Trade With FundedNext?

This can change, check the symbols list as availability varies by platform and server. That said, forex, indices and commodities are typically available.