Finotrade Review 2024

Finotrade Review

Finotrade offers popular forex and CFD assets on the MT4 desktop, web and mobile trading platforms. This broker review explores the trading product specifications, plus payments, withdrawals, and demo accounts. We’ll also look at trust and regulation, to help you decide if it’s safe to sign up with Finotrade.

Finotrade Details

Finotrade is a trading name of Finotec UK Limited, a broker based in London and regulated by the Financial Conduct Authority (FCA). The company was established in 2007 and has since gained 10,000 clients who have invested $100 million.

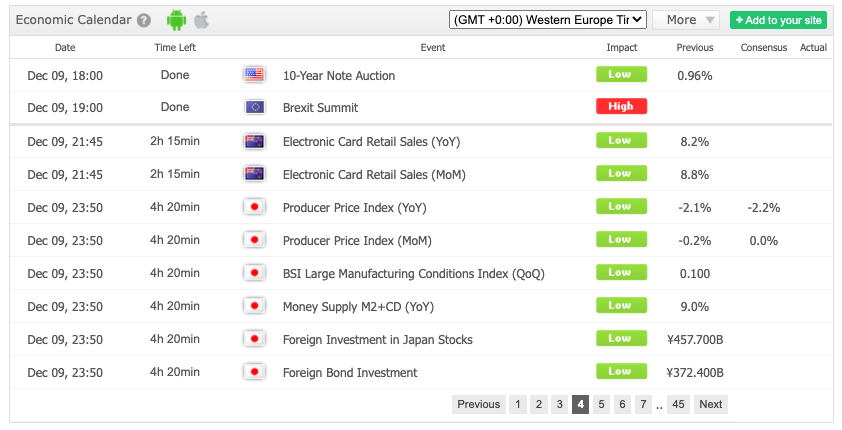

The company offers forex and CFDs on indices and commodities on the MetaTrader 4 platform. The broker also provides some additional tools, such as an economic calendar, calculators and a forex training academy.

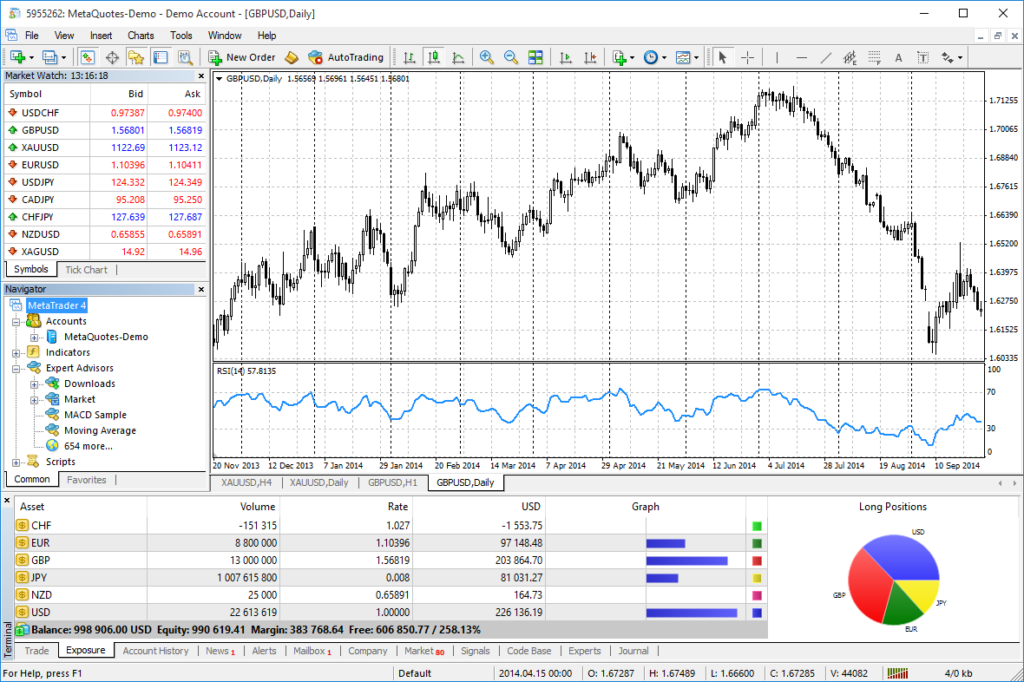

MetaTrader 4 Platform

Clients get access to the MetaTrader 4 platform, which has been trusted by brokers and traders alike for 15 years. The platform is highly customisable and intuitive, boasting a suite of technical and fundamental analysis tools, as well as automated trading capabilities. Features include:

- 30 technical indicators and 24 graphical objects

- 9 time intervals, from one minute to one month

- One-click trading directly from the chart

- Access to Expert Advisors (EAs)

- Live quotes in Market Watch

- Financial news feed

- Trading history

The platform is available for download once you have registered for an account. You can also access the web version directly from an internet browser, which offers the same features and functionality as the native application.

Markets

Finotrade offers 34 major, minor and exotic currency pairs, such as EUR/GBP and USD/TRY, 11 CFD indices such as NASDAQ and FTSE 100, plus popular commodities including gold and oil. Whilst a reasonable selection, our review did note there wasn’t any cryptocurrencies or shares.

Spreads & Commission

Finotrade is not transparent with spreads or commission, which is concerning for an FCA-regulated broker. We would warn traders to exercise caution around any brokers that do not provide any indication of pricing to new clients. In such cases, traders will be expected to sign up straight away without knowing what costs are involved, which is a red flag.

Leverage Review

The maximum retail leverage permitted at FCA-regulated brokers is 1:30 on major forex pairs. Again, it’s surprising to see that this broker has not provided any transparency around leverage or margin rates to potential new traders.

Mobile Apps

The MetaTrader 4 platform is available as a convenient mobile app, available in over 20 languages for Android and iPhone users.

Easy trading on-the-go is supported by the platform’s powerful tools, which enable users to manage trades and analyse the markets in just a few taps. The app includes an array of charting tools, indicators and timeframes, plus a live news feed and the ability to set mobile price alerts.

Payments

Finotrade accepts deposits and withdrawals via local wire transfers, SafeCharge and UnionPay. Processing fees start from 2.95% for SafeCharge deposits up to $500,000 and 3.5% plus $0.35 for Union Pay. Local bank charges may apply if you’re using wire transfers.

Processing times may vary depending on the payment method; details of these can be provided by the customer support team.

Demo Account

Finotrade offers a practice account where you can test out your skills within the MT4 platform using virtual money. Demo accounts are usually available for a set period of time, so it’s worth checking the terms with the broker before signing up.

Finotrader Bonuses

Unsurprisingly, deals and promotions are not offered at Finotrade, as the FCA strictly prohibits incentivised trading schemes.

Regulation

Finotec Trading UK Limited (Finotrade) is licensed and regulated by the Financial Conduct Authority (FCA) in the United Kingdom, with license number 470392. The broker must provide high standards of fund safety by using segregated client accounts, as well as participating in the Financial Services Compensation Scheme (FSCS).

Additional Features

Finotrade offers an Academy section which includes forex and CFD basics, as well as an ebook. There is a section on video tutorials, though the link only leads to a blank page. There is also a small choice of trading tools, including an economic calendar, however the overall selection is underwhelming compared to other brands.

Accounts

There are 4 account types available at Finotrade: Classic, Gold, Platinum and VIP. The Classic starter account requires a minimum deposit of $1,000, which is high in comparison to other brokers.

The Gold account requires a $10,000 minimum deposit, the Platinum, $25,000 and the VIP, $100,000. These accounts include competitive spreads and additional benefits, such as webinars, an account manager and premium customer care.

The broker also offers a Multi-Account Manager (MAM) account for fund managers, as well as Islamic swap-free accounts.

Benefits

Reasons to sign up with Finotrade include:

- Desktop, web and mobile trading

- Regulated broker

- Demo accounts

- MAM account

Drawbacks

Drawbacks of trading with this broker include:

- Limited educational resources

- No transparency with pricing

- $1,000 minimum deposit

- Limited funding methods

- Poor online reviews

Trading Hours

Trading sessions for forex and commodities are open 21:05 – 00:00 GMT and are closed from 00:00 – 20:55 GMT. For indices, trading sessions run from 00:00 to 20:55 GMT. You can also check opening times for a specific product within the MT4 platform.

Customer Support

The customer support team is available via telephone, email or live chat. Note that the live chat service is managed by a chatbot which, when tested, was not able to answer many of our queries.

- Telephone – +44 2033 187 716

- Email – support@finotrade.com

- Address – Finotrade UK, 1-4 Bury Street, Holland House, London EC3A 5AW, United Kingdom

Security

MT4 is a safe trading platform which uses Secure Sockets Layer encryption codes to ensure that data transmitted between servers is protected. Traders can also add extra layers of security login features.

Finotrade Verdict

Whilst Finotrade does offer some popular assets, a practice account and a safe trading platform, our review has revealed some notable concerns. If they are to earn the trust of any new traders, the broker should be more transparent around their prices and improve their customer support.

Top 3 Alternatives to Finotrade

Compare Finotrade with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Finotrade Comparison Table

| Finotrade | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $1000 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 3 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Finotrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Finotrade | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Finotrade vs Other Brokers

Compare Finotrade with any other broker by selecting the other broker below.

FAQ

Is Finotrade legit?

Finotrade is a legitimate company registered and licensed in the UK. Nonetheless, it’s always recommended to compare with other brokers or check out customer reviews online before making a decision.

What accounts are available at Finotrade?

Finotrade offers four account types: Classic, Gold, Platinum and VIP. The classic account requires a $1,000 minimum deposit. There are also MAM accounts and Islamic accounts.

What funding methods are available at Finotrade?

Finotrade accepts payments via local bank transfer, SafeCharge and UnionPay. Note that funding fees will apply and processing times may vary.

Does Finotrade offer a demo account?

Yes, there is a practice account where you can browse the trading platform and test out your strategies. The account will include a sum of virtual money and may expire after a certain period.

What leverage is available at Finotrade?

The maximum leverage you can trade at FCA-regulated brokers is 1:30 for major currency pairs. Professional traders may be eligible for higher ratios and will need to contact customer support for details.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Finotrade yet, will you be the first to help fellow traders decide if they should trade with Finotrade or not?