Financial Spreads Review 2024

Financial Spreads Review

Financial Spreads offers over 1,000 spread betting and CFD assets on desktop and mobile trading platforms. This review covers the broker’s key features, including deposits, withdrawals and demo accounts. Find out if you can trust Financial Spreads and start trading today.

Financial Spreads Details

Financial Spreads is a trading name of Finsa Europe Ltd, which launched in 2007 as a CFD trading and spread betting brokerage. The company is based in the UK and regulated by the Financial Conduct Authority (FCA).

Financial Spreads offers an array of instruments with tight spreads on a proprietary trading app. The broker also provides some educational content and guidance for traders of all levels.

Financial Spreads Platform

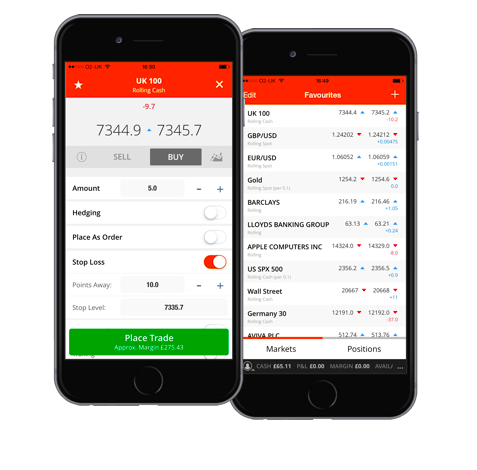

The broker’s platform supports spread betting and CFD trading across multiple devices. The platform includes a live price feed, risk management tools, watchlists, plus P&L and account management tools. There’s also a broad range of time intervals, drawing options including Fibonacci Arcs, plus overlays and indicators such as MACD and Bollinger Bands.

The broker’s platform is available as a web trader, which can be accessed from most major internet browsers.

Markets

Financial Spreads offers CFD and spread betting products across 30 forex pairs, 3 cryptocurrencies, 17 stock market indices on future and rolling cash contracts, 5 commodities, plus a variety of UK, US and European shares.

Trading Fees

Spreads are around 0.7 pips for EUR/USD and 0.8 pips for EUR/GBP and USD/JPY. Crude oil spreads are 3 points, whilst major indices such as FTSE 100 are around 4 points.

Commissions are incorporated into spreads, but there is a cost to holding equity CFDs overnight, known as an overnight financing charges.

FinancialSpreads Leverage

The maximum leverage available is 1:30 on major currency pairs, 1:20 for minor currencies and 1:10 for commodities. The margin requirements for each instrument are provided in the market information sheets on the website.

Mobile Apps

The broker’s platform is offered primarily as a mobile app, which delivers convenient and powerful trading features to suit the modern trader. The app comes with essential technical analysis tools, trading from the charts and full account management. The app is compatible with both Android and iOS devices.

Deposits & Withdrawals

Financial Spreads offers deposits and withdrawals via bank transfer, credit/debit cards and online payments. The minimum deposit is £250. Unfortunately the broker isn’t transparent around funding fees or processing times, which our review was concerned to see.

Demo Account

Traders can practice their spread betting and CFD trading skills without risking real funds on the demo account. The free practice account lasts for 30 days and includes £10,000 in virtual funds, plus access to live prices and charts.

Welcome Bonuses

Financial Spreads complies with regulatory restrictions imposed by the Financial Conduct Authority (FCA) and therefore does not offer any bonuses.

Regulation Review

Finsa Europe Ltd (Financial Spreads) holds a license with the Financial Conduct Authority (FCA) in the United Kingdom, under license number 525164. The FCA is one of the most highly regarded financial regulators, so traders should have a good level of trust in this broker.

The broker also complies with strict rules and regulatory standards, including the use of segregated accounts to keep client money safe. The broker is also a member of the Financial Services Compensation Scheme (FSCS).

Additional Features

Traders won’t find a very comprehensive selection of analysis tools or additional features compared to many online brokers. There is some brief guidance on spread betting and CFD trading on the website, as well as content on guaranteed stop losses and rolling markets.

Trading Accounts

Financial Spreads offers only one account type, which provides access to all available CFD and spread betting assets, with trading costs rolled into the fixed spreads. The minimum initial deposit to open an account is £250.

Benefits

Advantages of choosing Financial Spreads include:

- Licensed by FCA

- Competitive spreads

- 30-day demo account

- Spread betting products

Drawbacks

Disadvantages of opening an online account include:

- Web and mobile trading only

- Limited resources and tools

- No choice of platforms

- No live chat support

Trading Hours

Forex trading sessions open at 22:05 on Sunday and close at 22:00 on Friday, UK time. All other trading products have varying trading hours, which are listed on the market information sheets on the website.

Customer Support

Financial spreads only offers customer support via telephone, at +44 (0) 203 475 4830, or via email, at enquiries@finsaeurope.com. Most other brokers also offer a live chat service as a convenient and quick support tool, so it’s disappointing to see that this isn’t provided here.

The broker’s head office is located at 9th Floor, 30 Crown Place, London EC2A 4ES, United Kingdom.

Security

Most trading platforms come with standard SSL security and encryption features, as well as one-time passwords or two-factor authentication protocols. Financial Spreads is not transparent with the security of their platform, however, so get in touch with customer support if you have any questions.

Financial Spreads Verdict

Traders can access a wide selection of assets at Financial Spreads, with mobile trading and spread betting opportunities. Users can also feel comfortable signing up with the broker due its robust licensing. However, the lack of live chat customer support, limited educational resources and no choice of platforms may disappoint some.

Top 3 Alternatives to Financial Spreads

Compare Financial Spreads with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Financial Spreads Comparison Table

| Financial Spreads | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Spread betting, CFDs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | £250 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 4 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Financial Spreads and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Financial Spreads | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Financial Spreads vs Other Brokers

Compare Financial Spreads with any other broker by selecting the other broker below.

FAQ

What markets are available at Financial Spreads?

Financial Spreads offers over 1,000 CFD and spread betting instruments across forex, cryptocurrencies, indices and commodities, as well as UK, US and European shares.

What platforms does Financial Spreads offer?

Financial Spreads offers a proprietary web and mobile platform which supports spread betting and CFD trading strategies. The platforms can be downloaded onto iOS and Android smartphones.

Does Financial Spreads offer a demo account?

Yes, the broker offers a 30-day demo account which includes £10,000 in virtual money. Beginners and experienced traders can practice their trading skills and place simulated orders.

Is Financial Spreads regulated?

Yes, Financial Spreads is licensed by the UK Financial Conduct Authority (FCA) under license number 525164.

Is Financial Spreads a good broker?

FinancialSpreads is an established spread betting and CFD trading brokerage, which is covered by a strong regulatory framework. Traders should check online customer reviews or compare with other similar brokers before making a decision.

Customer Reviews

There are no customer reviews of Financial Spreads yet, will you be the first to help fellow traders decide if they should trade with Financial Spreads or not?