Fake SEC Approval For Spot Bitcoin ETFs Boosts Crypto Price

The price of Bitcoin spiked on Tuesday as the US Securities and Exchange Commission’s X account was compromised, falsely announcing approval for new cryptocurrency exchange-traded funds (ETFs).

Key Takeaways

- A post on the SEC’s X account just after 16:00 EST falsely claimed it “grants approval for #Bitcoin ETFs for listing on all registered national securities exchanges.”

- Bitcoin briefly surged to nearly $48,000 before settling around $46,000 in response to the announcement.

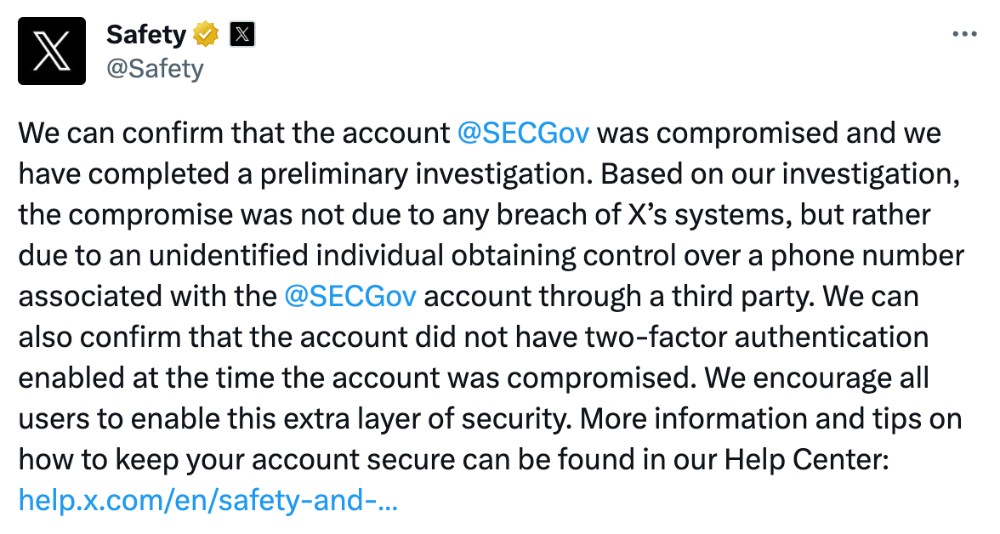

- Investigations are ongoing to uncover the details of the unauthorized access to the SEC’s X account, with confirmation that two-factor authentication was not enabled.

Another Eventful Day For A Controversial Cryptocurrency

SEC Chair, Gary Gensler, swiftly responded to the incident, stating on his personal X account: “The @SECGov Twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot Bitcoin exchange-traded products.”

The SEC has since deleted the compromised post, acknowledging the breach and initiating investigations to determine the cause.

X has already clarified that the compromise was not due to a breach in its systems but rather an individual gaining control over the @SECGov account through unauthorized access to a phone number via a third party.

An Announcement On Spot Bitcoin ETFs Expected

The SEC is expected to make an announcement this week regarding spot Bitcoin ETFs.

If greenlit, these ETFs could signal the integration of cryptocurrencies into traditional financial markets.

Prominent asset managers such as BlackRock and Fidelity have sought SEC approval to offer spot Bitcoin ETFs.

ETFs enable traders to speculate on diverse assets without direct ownership. Traded on stock exchanges like shares, their value correlates with the overall portfolio performance.

Unlike some ETFs indirectly containing Bitcoin, spot Bitcoin ETFs would directly acquire the cryptocurrency at its current market price throughout the day.