EuropeFX Review 2024

EuropeFX Review

EuropeFX offers multiple trading instruments on a choice of desktop and mobile apps. Our reviews weigh up the pros and cons of each broker, uncovering account safety, withdrawal fees, support and more. Find out if you should login and start trading with EuropeFX today.

EuropeFX Details

EuropeFX is owned and operated by Maxiflex Ltd, a company registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker holds an STP trade execution license.

EuropeFX offers trading on over 300 forex and CFDs on the MetaTrader 4 platform as well as the broker’s EuroTrader platform and FXGO! mobile app. Traders can also choose from 5 accounts offering various perks suited to both beginners and experienced traders.

Trading Platforms

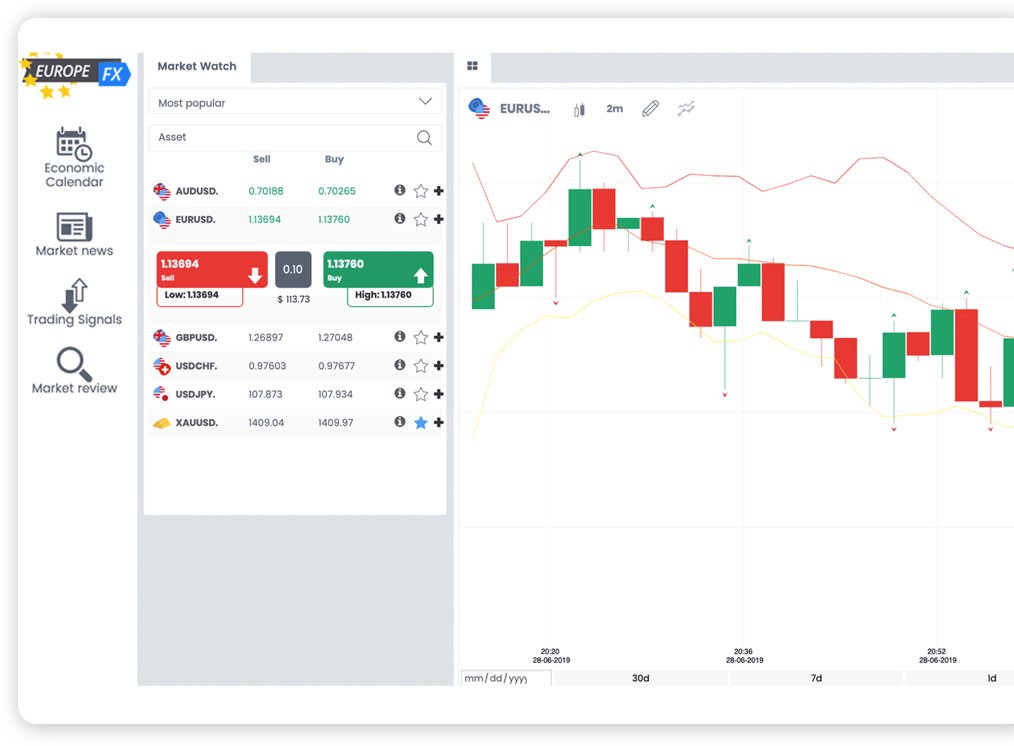

EuroTrader 2.0

EuroTrader is EuropeFX’s own web-based trading solution. The attractive interface hosts a suite of features, where users can access real-time quotes in the Market Watch window and trade straight from the chart. The platform also comes with multiple timeframes, as well as a range of custom indicators for technical analysis. Traders can also conveniently switch to market news or the economic calendar to keep up with market trends.

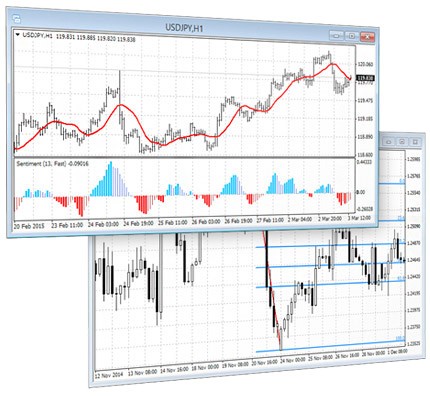

MetaTrader 4

For advanced automated trading features, the MT4 platform is an excellent option. The platform is available both as a downloadable desktop terminal (suitable for Mac and Windows PCs), as well as a webtrader.

MT4 includes a built-in library of 50 technical indicators and analytical tools, advanced order types, and a historical data feed. Traders also have access to trading robots (Expert Advisors) on the global online community. The web dashboard is also fully-featured and can be opened easily from an internet browser after registration.

Markets

Asset classes available at EuropeFX include:

- Stocks – Dozens of blue-chip stocks, including pharma and cannabis stocks

- Commodities – Trade on precious metals, agriculturals, and energies

- Cryptocurrencies – 6 cryptos available including Bitcoin

- Forex – 50 major, minor, and exotic pairs available

- Indices – 13 well-known stock indices and futures

Spreads & Commission

The broker promotes spreads as low as 0.1 pips but isn’t transparent with specific spreads on their website. The contract specifications document details some trading costs, including commissions from €20 per lot for currency pairs with the Bronze account, which drops to €10 per lot with higher account levels.

Other fees include overnight swap fees and a 50 EUR/USD/GBP inactivity fee after 3 months of account dormancy.

Leverage Review

Leverage is available up to 1:30 for forex, up to 1:20 for indices, 1:5 for stocks, 1:10 for commodities, and 1:1 for cryptos. Professional traders can apply for leverage up to 1:200. Details of the margin requirements are provided in the contract specifications document.

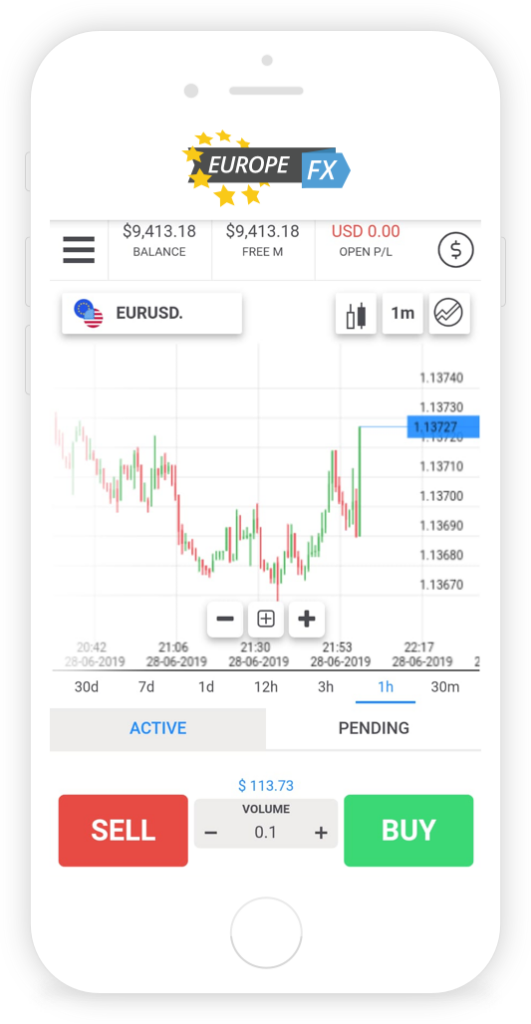

Mobile Apps

For mobile traders, EuropeFX offers its FXGO! app for iOS and Android. The app offers a standalone trading suite with a user-friendly client area and synchronisation to EuropeFX accounts. The app also comes with real-time market data, advanced charting tools, and in-app access to the EuropeFX Analysis portal.

Traders can also enjoy a seamless transition between MetaTrader platforms, with the MT4 mobile and tablet app. The app offers all order types and execution modes, full trade history, interactive charts, and custom indicators. You can also set push notifications and utilise the mobile chat forum to stay on top of your account. The app generally receives good reviews online, though there are some minor complaints of technical issues.

Payment Methods

EuropeFX offers a number of funding methods including bank transfers, credit cards, and e-wallets. All methods are authorised by European regulators including the FCA and BaFIN. Card payments and e-wallets are processed straight away, whilst bank transfers generally take 24 – 48 hours. There are no deposit fees charged by EuropeFX.

The minimum withdrawal amount allowed is 1 EUR/USD/GBP and the maximum is the available equity in your account. Withdrawal fees are 25 EUR/USD/GBP and requests take 24 hours to process on the broker’s side.

Demo Account

Anyone can open a risk-free demo account with EuropeFX, which credits users with €100,000 in virtual money. The demo account is a great tool for beginners who want to practice their skills in a virtual environment and test out the platform’s features. The account will expire 30 days after registration.

Bonus Review

Apart from the VIP program, which offers commissions and swap discounts for professional traders, the broker does not offer any other deposit bonus deals or promotions. This restriction is common for CySEC and other top-tier regulated brokers.

If EuropeFX does introduce bonuses, always check the terms and conditions before you start trading.

Regulation

Maxiflex Ltd (EuropeFX) is registered as a Cyprus Investment Firm (CIF) and is regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 258/14.

In line with CySEC regulations, the broker holds client funds at segregated European bank accounts and also provides negative balance protection. The broker also insures clients up to 20,000 EUR in the event of insolvency, as part of the Investor Compensation Fund.

But while regulated by the CySEC, the owner has found themselves under investigation by the Australian Securities and Investments Commission (ASIC) for running an online scam where clients didn’t get their money back. As a result, the broker has had to cease its operations based in Hornsby, Australia. This should serve as a warning and traders may want to consider other brokers first.

Additional Features

There’s a good selection of additional resources available for traders, including an extensive video section as well as an interactive and customisable economic calendar that receives positive customer reviews. The webinars section is a little limited and could do with some improvement, but the market news and blogs are fairly comprehensive.

EuropeFX also provides several additional trading tools:

- TipRanks – Stock analysis widgets consisting of price targets, hedge fund activity, and insider transactions

- Trading Central – Technical analysis and research plugin for MT4

- Trading signals – Daily signals provided via a streaming widget

- RoboFX – Automated trading algorithm plugin

- MirrorTrader – Copy-trading plugin

EuropeFX Accounts

There are 5 live account levels: Bronze, Silver, Gold, Platinum, and Premium. The accounts differ mostly in terms of the minimum deposit and access to additional features such as private trading sessions and VIP services. The recommended minimum deposit starts at €1,000 for the Bronze account (though €200 is also permitted) and this goes up to €50,000 for the Premium account.

All account types come with variable spreads from 0.1 pips, maximum leverage of 1:30, and a 50% stop out level. The training centre and online chat support are also available to all accounts.

Benefits

There are some good reasons to open an account with EuropeFX:

- MetaTrader 4 platform & mobile app

- Cannabis & pharma stocks

- Extensive video education

- Tradeworks software

- CySEC regulation

- Bitcoin trading

Drawbacks

Drawbacks of trading with this broker include:

- US and UK clients not allowed

- Not transparent with spreads

- Some bad customer reviews

- No Islamic accounts

Trading Hours

EuropeFX’s platform opening hours are 24/6, Monday to Saturday, but timings for specific instruments vary depending on the market. These can be found within the trading platforms or in the asset index on the website. All times are in GMT+2/GMT+3 DST.

Customer Support

There are several ways you can get in touch with EuropeFX, including the live chat service which is accessible by clicking the logo in the bottom corner of the website. You could also use the Whatsapp, Viber, or Telegram chat services, though these are only used for the submission of documents. Support is also available via:

- Email – support@europefx.com

- Telephone contact numbers – +357 24 022 444 (CY) / +44 870 8200 300 (UK) / +49 303 080 7676 (DE)

- Address – 46 Ayiou Athanasiou Avenue, Floor 1, Office 101, 4102 Limassol, Cyprus

The customer service team can assist with a range of queries, from Bitcoin rush trading to how to close and delete an account.

Security

EuropeFX ensures data exchanges are secured using 128-bit encryption on all platforms. All financial transactions are also carried out using regulated payment processors on PCI-compliant servers.

EuropeFX Verdict

EuropeFX offers desktop and app trading services with a variety of assets and additional tools, including Trading Central and Mirror Trader. The broker is also regulated by the CySEC, though there have been some scam concerns with opinions split on how trustworthy the broker is. A little more transparency around spreads may help to lessen concerns around legitimacy.

Top 3 Alternatives to EuropeFX

Compare EuropeFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

EuropeFX Comparison Table

| EuropeFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cannabis stocks, pharma stocks, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | €200 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by EuropeFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| EuropeFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

EuropeFX vs Other Brokers

Compare EuropeFX with any other broker by selecting the other broker below.

Customer Reviews

1 / 5This average customer rating is based on 1 EuropeFX customer reviews submitted by our visitors.

If you have traded with EuropeFX we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of EuropeFX

FAQ

Is EuropeFX a legitimate company?

EuropeFX is registered and regulated as a legitimate company in Cyprus, however there have been a small number of bad reviews on TrustPilot, with customers warning that it could be a scam and a fake trading provider.

Where is EuropeFX based?

EuropeFX has offices in Limassol, Cyprus, and Berlin, Germany, plus Malta. The broker’s clients, however, span countries around the world.

How do I delete my EuropeFX account?

You can close your demo or live account either by contacting customer support or from within the client dashboard.

How do I register an account with EuropeFX?

You can register for a live account by filling in your personal details and submitting your identity verification documents. You will then be able to set up your client login details.

What countries does EuropeFX not accept?

EuropeFX does not accept clients from certain restricted jurisdictions, including the United Kingdom, the USA, Australia, New Zealand, Israel, and North Korea. A full list can be provided by customer support.

My partner was trading through this company, and they took all my profits and I lost everything. We followed it up, however they just seemed to have disappeared. We haven’t been able to track them down or get our profits back at this stage. I would recommend people be very careful if trading with this company.