Empower Review 2024

Awards

- America’s Best Customer Service 2019 - Newsweek

Pros

- Intelligent budgeting and portfolio management tools

- Award-winning customer support team

- Empower's advisory services are regulated by the SEC

Cons

- Limited choice of payment methods with only wire transfer

- $100,000 is needed for the robo-advisor service

- 0.49% - 0.89% management fees are high vs alternatives

Empower Review

Empower, previously known as Personal Capital, is a US financial services firm that provides personalized investment solutions. This includes fully managed investment profiles and retirement brokerage accounts such as IRAs. This Empower review will unpack account fees, trading opportunities, login security, and customer service options. Find out if Empower is a good brokerage for US investors.

Company History & Overview

Empower is a US-based wealth management company with a long history dating back to 1891. It originated under the trading name Great-West Lifeco. Since then, the brand has undergone extensive modernization, including acquiring Personal Capital for $825 million in June 2020.

Empower offers a range of services to US residents, including full wealth management support with the provision of investment accounts and retirement profiles. Its award-winning tools, including a user-friendly app and intuitive desktop dashboard, have made the brand popular with 17+ million customers.

Empower’s advisory services are provided by Personal Capital Advisors Corporation (PCAC) and Empower Advisory Group, LLC (EAG), both of which are registered with the US Securities & Exchange Commission (SEC).

Empower’s head office is in Greenwood Village, Colorado.

Accounts & Products

Empower offers several brokerage, investment, retirement, and savings accounts. They all offer varying features and services, broken down and analyzed in more detail below.

Accounts are available to US residents only, though US citizens residing in other countries can open an account at the broker’s discretion.

Investment Account

A flexible and low-cost way to invest money in pursuit of financial goals. This profile is intended for investors with previous trading knowledge who are aware of the risks associated with brokerage accounts.

Key benefits:

- Access your funds at any time

- No account opening or maintenance fees

- No minimum or maximum investment limits

- Exclusive benefits based on investment level

- Commission-free ETF and stock investments up to 1000 trades

- Thousands of investment products including mutual funds, stocks, and ETFs

On the downside, margin trading is not permitted.

Premier Investment Account

The Premier solution provides additional support and guidance from a professional account manager. It is available as a fully managed profile or may suit individuals looking for the flexibility to invest how they want, though with support on-hand in case they need it.

Key benefits:

- Access your funds at any time

- Commission-free mutual fund trading

- No account opening or maintenance fees

- No minimum or maximum investment limits

- A professional account manager at no additional cost

On the downside, only mutual funds are available.

IRAs

The Empower IRA accounts are available as traditional or Roth:

- The Traditional IRA provides tax breaks today with no personal income penalties. Withdrawals are required at the age of 72.

- The Roth IRA provides tax breaks upon retirement. There are some contribution restrictions based on annual income but withdrawals are not required at any age.

Brokerage IRA

The Empower Brokerage IRA account is an individually managed investment profile, suitable for experienced traders. The account provides opportunities across a range of investment products with tax-saving advantages.

Key benefits:

- No initial investment amount

- Access to investment planning tools

- Commission-free ETF and stock investments up to 1000 trades

- Invest in thousands of equities, ETFs, mutual funds, and fixed-income securities

Premier IRA

The Empower Premier IRA account enables customers to invest in a diverse selection of mutual funds. The profile also comes with personalized guidance from an Empower advisor as needed. A fully managed, hands-off option is also available. As with all IRA accounts, customers get tax-free potential growth.

Key benefits:

- Invest in 140+ mutual funds

- No initial investment amount

- Access to investment planning tools

- Commission-free mutual fund trading

- Low-cost or complimentary access to a certified financial professional

Empower Personal Cash

Empower Personal Cash is a high-interest-rate cash account. The profile offers 4.10% APY with FDIC insurance up to $2 million vs the typical $250,000 protection offered by major banks.

Key features:

- $25,000 daily withdrawal limit

- No minimum balance requirement

- Paycheck direct deposits permitted

- Daily accrued interest with monthly payments

- Unlimited transfers per month with a $250,000 maximum deposit limit per transaction

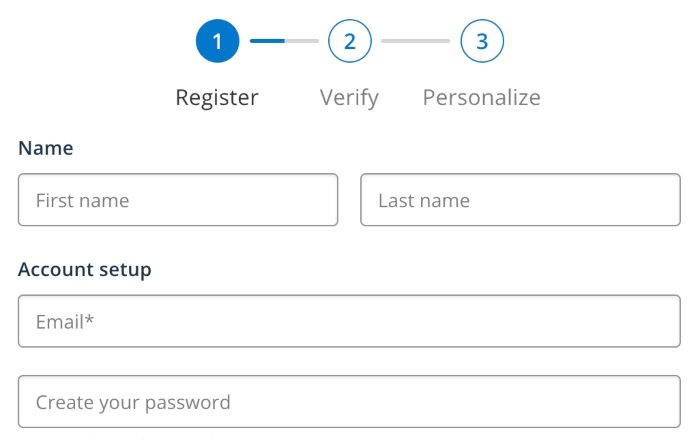

How To Open An Empower Account

Investment and retirement accounts can be opened using an online form or over the phone. Although the company states that the registration document will take just a few minutes to complete, when we used Empower, we found the documents and requirements relatively lengthy.

Regardless of the account type, you will need to provide:

- Registered US address

- Your Social Security number

- Details of employment history

Fees

There is no cost to register for an Empower account or to access the services on the financial dashboard.

Users can place 1000 trades online per year with no commission fees on the Empower Investment Account and the Brokerage IRA. All trades executed over this amount will be liable for a $6.95 fee per position.

An annual fee also applies for advisory services and wealth management guidance, which is notably higher than many alternatives. Empower employs a percentage-based fee schedule according to the value of assets under management:

- Up to $1 million – 0.89% fee

- Between $1 million and $3 million – 0.79% fee

- Between $3 million and $5 million – 0.69% fee

- Between $5 million and $10 million – 0.59% fee

- Over $10 million – 0.49% fee

Financial Dashboard

Empower offers a sleek financial dashboard. The terminal is available on computer devices or can be downloaded to iOS and Android smartphones and tablets from the Apple App Store or Google Play.

While using Empower, our experts found the dashboard user-friendly and suitable for investors of all experience levels. We particularly liked that you could quickly get a total account breakdown from the homepage.

Key features:

- Budget Planner – Organize your personal finances by spending and saving categories. Customers can create detailed budgets, view a full spending breakdown and track their financial goals.

- Retirement Planner – Find out if your retirement plan is on track. The tool can be used to gain perspectives on different scenarios, the impact of large purchases, or to create a spending plan for earned funds.

- Net Worth Calculator – Link existing bank accounts, investments, retirement profiles, and your employment status to create a real-time net worth financial picture. The financial health checker can also be used to understand the impact of assets and liabilities, plus changes you can make to improve your prospects in the long term.

- Calculators – The financial dashboard offers several additional calculators for all your wealth management needs. This includes calculators for education savings, monthly budgeting, investment returns, debt payoffs, pensions, and 401(k) early withdrawals.

- Investment Checkup – This feature provides full portfolio analysis. This can be used to review your existing investments vs your current goals and risk tolerance. The feature also uses Q&A-based analysis to provide alternative investment allocation suggestions. Additionally, it helps identify where changes need to be made to reduce product fees and can compare your portfolio vs benchmarks and future projections.

Mobile App

The Empower mobile app is easy-to-use software that can be downloaded to iOS and Android devices. The app is an effective way to stay up to date with your portfolio performance while on the go.

The application provides all the features of the financial dashboard. You can open an account, manage your money and access all the resources needed to improve your financial health. Our experts particularly liked that the app can be integrated into other electronic devices, such as Apple Watches.

The app also has a decent 4.1/5 rating on Google Play, though some recent customer reviews indicate page glitches and login issues.

Additional Features

Personal Strategy

The Empower Personal Strategy tool combines intuitive technology with the expertise of a professional team to provide diverse, multi-asset portfolios for customers. Users can request support with portfolio building, asset allocation weightings, tax optimization, and account monitoring based on their goals and attitude to risk. Customers also benefit from a dedicated financial professional.

The broker also offers a socially responsible Personal Strategy tool, ideal for users looking to invest in organizations with a strong stance towards environmental, social, and governance (ESG) issues.

There is a one to three-business-day settlement period when withdrawing personal capital.

‘The Currency’

Empower offers article-based market information in a blog-style forum named ‘The Currency’. The educational content is suitable for investors of all experience levels.

The online resource center provides comprehensive, yet easy-to-read pages separated into four categories; money, life, work and play. Although there are not currently a large number of posts, more guides and forum-style posts are likely to be published in the future.

In addition, the broker regularly releases videos on a range of topics to support with financial planning and budgeting, including managing debt.

Empower Regulation

Securities are offered and distributed by Empower Financial Services Inc. The company is a registered member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). The Personal Cash Account is covered by FDIC insurance up to $2 million. The company’s advisory services are provided by entities regulated by the Securities & Exchange Commission (SEC).

Overall, Empower is a trustworthy brokerage and financial services company with up-to-date licenses and robust regulatory oversight in the US.

Security & Safety

All customers are protected by the Empower Security Guarantee. The broker-dealer will restore losses incurred in an account that are created as a result of unauthorized access. Real-time security alerts and notifications can also be sent to an additional phone number or email address outside of the one used for registration.

The company encrypts all stored personal data and information that is used in transit, meaning third-party intrusion is prevented. The mobile app also offers biometric identification login and multi-factor authentication to help protect your identity, assets, and data.

Additionally, Empower employs third-party firms to test the company’s security measures, including cybersecurity protocols, dark web monitoring, and annual penetration testing. Previous results have been rated as ‘excellent’.

Customer Service

Empower offers responsive customer support, earning it “America’s Best Customer Service 2019” from Newsweek. On the downside, it is only available via telephone and there is no 24-hour service.

There are dedicated phone contact numbers depending on the service required. This includes the main helpline available Monday to Friday, 8 am to 8 am (ET). Telephone representatives are available for account support at 855-756-4738. This service is available Monday to Friday, 6 am to 6 am (ET), and Saturday 7 am to 3:30 am (ET).

The brokerage also provides Empower advisors who can help new users create comprehensive retirement plans or investment accounts with their individual goals in mind. Contact 877-534-4569 for support.

For quick guidance or frequently asked questions, it may be worth reviewing the broker’s social media channels on Facebook, Twitter, or LinkedIn.

Empower Verdict

Empower offers a one-stop solution for US customers looking to manage their personal funds and plan for their future. The free financial dashboard provides an easy-to-understand analysis of investment portfolios with useful calculators, budget planners, retirement funding, and investment account functions.

Overall, Empower is a good fit for experienced investors looking for intuitive tools to support investment decisions and retirement planning. Regulatory oversight from trusted financial agencies is also a good indicator that the firm is trustworthy. However, the large minimum investment requirement for wealth management services and relatively high fees mean the company isn’t the best fit for beginners.

FAQs

Is Empower Safe?

Empower is a safe and secure financial services provider. The company is registered with the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). The company’s advisory services are also regulated by the Securities & Exchange Commission (SEC). In addition, Empower offers several login security measures, including biometric authorization and multi-factor authentication.

Is Empower A Good Brokerage Firm?

Empower offers competitive brokerage conditions including commission-free stocks and ETFs on the first 1000 trades per year. Clients also retain full access to their personal funds at all times through the financial dashboard and mobile app.

With that said, management fees are fairly high and the registration process is cumbersome. In addition, there is no demo account, trading on margin, or access to markets like forex and cryptos.

What Is Empower Financial Services?

Empower is a financial services company founded in the US in 1891. The firm aims to create financial freedom for its clients through personalized investment solutions and individual savings and spending accounts. Registered clients can use investment, retirement, and alternative wealth management profiles to build a stable financial future.

Does Empower Have A Competitive Fee Schedule?

Retail investors benefit from commission-free investing in certain products, including the first thousand trades on stocks and ETFs each year. However, the firm’s wealth management services come at a cost. This is charged as an annual advisory fee based on the value of assets under management. Retail investors with an account balance of less than $1 million will be liable for a 0.89% fee, which is notably higher than some competitors.

Is Empower A Broker-Dealer?

Empower Financial Services Inc provides broker-dealer services through the brand’s investment account solution. This includes access to thousands of trading assets such as stocks, ETFs, and mutual funds. On the downside, users cannot trade popular financial assets like forex, commodities or cryptocurrencies.

Empower Personal Wealth, LLC (“EPW”) compensates Boleyn SEO Ltd for new leads. Boleyn SEO Ltd is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

Top 3 Alternatives to Empower

Compare Empower with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Personal Capital – Empower (formerly Personal Capital) is a popular, SEC-regulated US financial advisory and investment platform that offers pensions, ready-made investment plans and do-it-yourself, commission-free investing through a large range of mutual funds, ETFs, individual equities and fixed-income securities. The broker has an impressive 3.4 million clients.

Empower Comparison Table

| Empower | Interactive Brokers | IG | Personal Capital | |

|---|---|---|---|---|

| Rating | 2.8 | 4.3 | 4.4 | 3.3 |

| Markets | Stocks, ETFs, Mutual Funds, Fixed Income | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, ETFs, Mutual Funds, Fixed Income |

| Demo Account | No | Yes | Yes | No |

| Minimum Deposit | $1 (Cash), $100,000 (Robo Advisor) | $0 | $0 | $1 (Cash), $100,000 (Robo Advisor) |

| Minimum Trade | Variable | $100 | 0.01 Lots | Variable |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SEC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Own |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | – |

| Payment Methods | 1 | 6 | 6 | 1 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

Personal Capital Review |

Compare Trading Instruments

Compare the markets and instruments offered by Empower and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Empower | Interactive Brokers | IG | Personal Capital | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Empower vs Other Brokers

Compare Empower with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Empower yet, will you be the first to help fellow traders decide if they should trade with Empower or not?