DirectFX Review 2024

DirectFX Review

DirectFX is a forex and CFD broker that works with the MetaTrader 4 trading platform. This review of Direct FX explores any forex signals, account options and tradeable instruments offered. Read on to find out key information regarding the broker’s licensing, payment options and security measures.

DirectFX Company Details

Established in 2019, DirectFX is a forex broker with headquarters in St. Vincent and the Grenadines. The broker follows a straight-through processing (STP) model, rather than direct market access (DMA). As a result, Direct FX has price quotes in real-time, though less depth and traders cannot deal directly with liquidity providers.

Unfortunately, the broker is unregulated, which isn’t a good sign for the security of client funds.

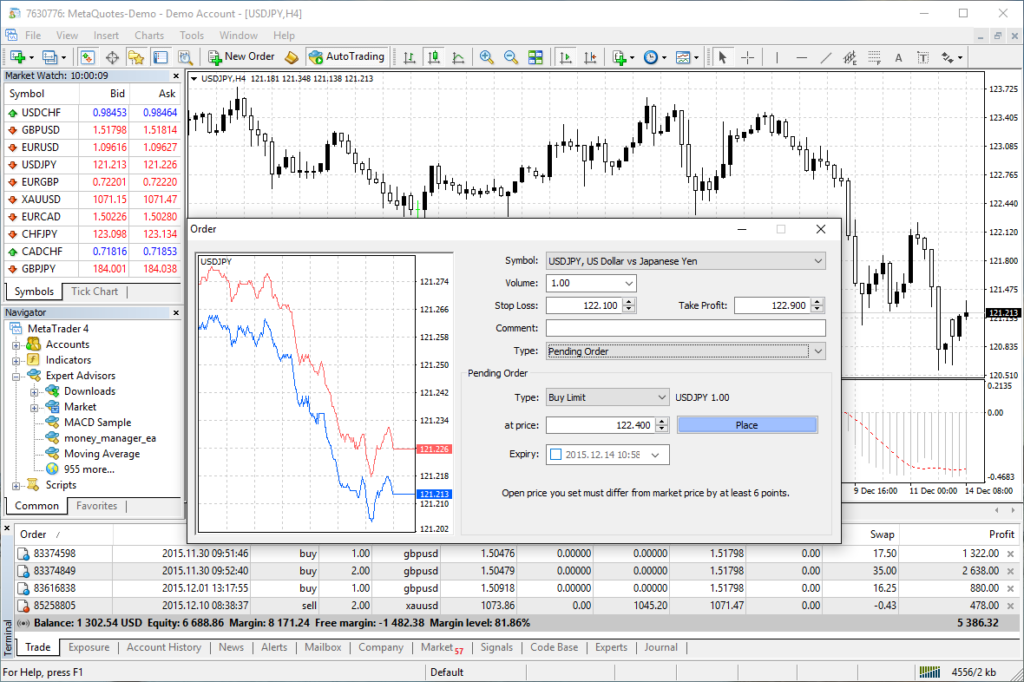

MetaTrader 4 Platform

DirectFX provides access to MetaTrader 4, one of the industry’s top trading platforms. MT4 supports 40 languages and offers over 50 technical indicators, 30 charting tools and nine timeframes. There is also the capability to create custom indicators and analysis tools.

The platform can be downloaded from the DirectFX website for both Windows and Mac computers.

Assets

DirectFX offers a range of tradeable instruments, including 68 forex pairs, of which 7 are majors, 21 are minors and 40 are exotic. Clients can also trade futures, 24 global indices, 7 precious metals and 140 stock CFDs from the US, UK, French and German markets.

Spreads & Commission

The spreads offered by Direct FX are not very competitive. The Standard account has variable spreads that average 2.39 pips for GBP/USD, 1.58 pips for EUR/USD and 1.74 pips for EUR/GBP.

The Premium account offers fixed spreads that are the minimum possible value of the Standard account’s spreads. These are 1.6 pips for GBP/USD, 1.4 pips for EUR/USD and 1.3 pips for EUR/GBP.

Commissions aren’t charged, but the broker isn’t transparent about additional trading fees, so it’s worth checking with the customer support team when registering for an account.

Leverage

Leverage rates for DirectFX clients reach a maximum of 1:400. However, the top cap does not need to be applied and traders should fully understand the risks that come with using leverage in forex trading.

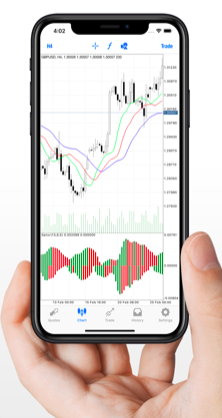

Mobile Apps

There are dedicated mobile versions of the MetaTrader 4 platform, designed for both iOS and Android devices. The MT4 app requires login credentials and has excellent ratings and reviews on both the App Store and the Play Store. The app offers every order type and tradeable asset available through the desktop client, though with only three chart types and a limited selection of indicators and analysis tools.

Deposits & Withdrawals

DirectFX gives no information regarding the payment options that can be used to fund and empty trading accounts. This is not a good sign, particularly from a safety point of view, as there are security requirements that need to be met for a broker to list and use a payment method. In our reviews, we do not recommend brokers unable to provide clear information on deposits and withdrawals.

Demo Account

DirectFX does not offer clients the opportunity to trial their services with a demo account. This is a big downside as demo accounts are a great way to familiarise yourself with the MT4 trading platform, test strategies and explore new markets.

Deals & Bonuses

At the time of writing, there are no deposit bonuses or welcome deals offered. Even though EU brokers cannot offer bonuses, DirectFX loses some competitive edge against non-EU brokers that do offer deals.

Regulation

There is no mention of any legal authorisation or regulation on the Prodirect FX broker’s website and it is not listed in the local Financial Service Authority’s (FSA) database.

Regulation is an important factor when choosing a forex provider as it helps to protect against scams and broker bankruptcy. Without regulation, clients have very little legal recourse.

Additional Tools

This review was disappointed by the extra features available. Most brokers offer educational resources and market analysis, but DirectFX provides nothing more than raw forex and CFD trading.

Accounts

There are two Direct FX trading accounts. The Standard account is aimed at less experienced traders while the Premium account offers lower fees in return for larger deposits and trading volumes.

Standard Account

- $100 minimum deposit

- Spreads from 1 pip

- No commissions

- All instruments

- 1:400 leverage

- MT4 access

Premium Account

- $500 minimum deposit

- No commissions

- 1:400 leverage

- Fixed spreads

- MT4 access

- No stocks

Islamic swap-free accounts are available through the customer support team.

Benefits

Despite the limited time it’s been around, the broker provides a competitive service in some areas, notably:

- Good instrument range

- Good leverage rates

- No commissions

- MT4 platform

Drawbacks

ProdirectFX could improve in several areas:

- Limited deposit & withdrawal information

- Unlicensed & unregulated

- No educational resources

- No live chat support

- No demo account

Trading Hours

Forex markets are open 24 hours a day, 5 days a week. They open at 09:00 GMT on Mondays and close at 21:00 GMT on Fridays. Other instruments have different trading hours, especially stocks and indices, which follow local market opening times.

Customer Support

The DirectFX customer support team can be contacted via telephone or email, though no details of office hours are given on the website.

- Telephone – +421 911 610000

- Email – support@prodirectfx.com

Unfortunately Direct FX doesn’t provide live chat support. This is a major drawback as a reliable chat service is often praised in customer reviews.

Client Safety

The transfer of data through the website is not protected via Hypertext Transfer Protocol Secure (HTTPS) or Secure Sockets Layer (SSL) encryptions. The site also doesn’t have a validated certificate and is therefore branded ‘not secure’ by internet browsers. In addition, the lack of any payment methods, even bank transfers and payment cards, is indicative of poor security measures.

For security and regulation reasons, many brokers segregate their own capital from client funds. Direct FX keeps all capital together, reducing the safeguards between the company and trader capital.

DirectFX Verdict

DirectFX is an unregulated broker with limited information available around payments and client security. So despite a good product range and the MT4 platform, we’re not comfortable that DirectFX is safe to trade with. Instead, we’d recommend considering more trustworthy and regulated providers.

Top 3 Alternatives to DirectFX

Compare DirectFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

DirectFX Comparison Table

| DirectFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 1.3 | 4.4 | 4.3 | 4 |

| Markets | Forex, futures, indices, shares, metals | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:400 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | – | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by DirectFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| DirectFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

DirectFX vs Other Brokers

Compare DirectFX with any other broker by selecting the other broker below.

The most popular DirectFX comparisons:

FAQ

Can you trade with DirectFX in New Zealand?

The broker is unlicensed, this means there are no regulations blocking certain jurisdictions. You can open an account with DirectFX in New Zealand, Australia, the UK, Kenya and more. It should be noted, however, that a lack of regulation reduces traders’ legal protection.

What instruments can be traded with DirectFX?

The broker offers forex and CFD trading in a large number of markets. There are 68 forex pairs, 140 stock CFDs, 24 indices and 7 precious metals to be traded.

How much leverage does DirectFX offer?

The broker offers leverage rates of up to 1:400 across all asset types. However, trading with leverage magnifies the risks as well as profit potential, so it should be approached with caution.

Does DirectFX have Islamic accounts?

Even though the standard accounts come with overnight swap charges, there is the possibility to open an Islamic account, which waives these fees.

Can you open more than one DirectFX account?

Clients can have several trading accounts open simultaneously with DirectFX. To do this, though, you need to contact the broker using the details provided in this review.

What trading platforms does DirectFX provide?

MetaTrader 4, a strong, well-rounded platform is available through DirectFX. The platform has a range of capabilities and customisation options.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of DirectFX yet, will you be the first to help fellow traders decide if they should trade with DirectFX or not?