CPT Markets Review 2024

Pros

- FCA-regulated with FSCS protection and negative balance protection

- Beginner and intermediate level educational resources, plus weekly research bulletins

- Competitive range of 100 currency pairs, as well as futures and options

Cons

- No live chat customer support

- Limited additional trading tools

- Wider spreads than many brokers

CPT Markets Review

CPT Markets is an FCA-regulated broker specialising in CFDs and forex trading. The broker strives to offer bespoke solutions for clients of all levels and abilities. Our CPT Markets review covers account types and login, payment methods, additional features and more.

CPT Markets Details

CPT Markets is part of CPT Markets Limited, registered in Belize and licensed under the International Financial Services Commission of Belize. Originally named Citypoint Trading Ltd, the UK branch was established in 2008 with headquarters in London.

More recently, CPT Markets UK joined the London Stock Exchange as a non-clearing member in an ongoing expansion of its services.

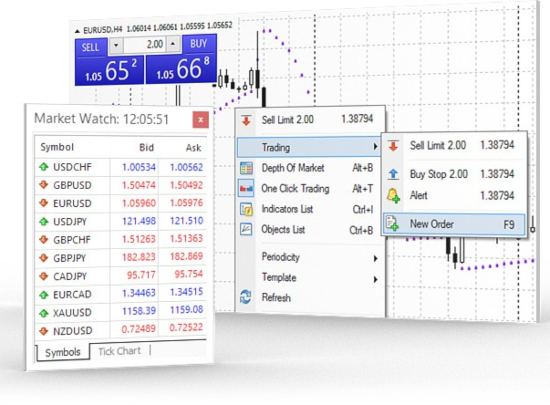

MetaTrader 4 Platform

The broker offers the globally recognised MetaTrader 4 (MT4) platform. You can download MT4 to desktop devices or trade through major web browsers. MT4 also offers a mobile trading application.

Highlights of the MT4 trading platform:

- Full customisation features

- Highly secure with encryption protocols

- Advanced real-time communication tools

- Over 50 built-in powerful indicators & charting tools

- Easy to use navigation, suitable for traders of all experience levels

- Unrestricted use of expert advisors, with support in over 30 languages

Refer to the broker’s website for full details on the installation of the CPT Markets MT4 trading platform, account login, navigation, and tools.

Instruments

Forex & CFD trading markets include:

- 100 forex pairs

- Precious metals

- Major European and US indices

Futures & options market access include:

- Metals

- Energies

- Currencies

- Agricultures

- Equity Index

- Fixed Income

- Volatility Futures

Fees

The broker offers variable, floating spreads, starting from 1.8 pips in retail trading accounts. Unfortunately CPT Markets doesn’t provide details of average spreads.

The broker does not charge any retail trading commissions, however, fees may apply if a client needs a specific setup or customisation. A finance adjustment fee is charged for positions held overnight.

Leverage

Leverage rates are capped at 1:30 for retail forex trading in line with ESMA guidelines.

- Forex – 1:30

- Indices – 1:20

- Commodities – 1:20

Mobile Apps

MetaTrader 4 is available as a mobile trading tool, compatible with iOS and Android devices. The application allows for complete account management and price analysis from your mobile or tablet device. The easy to use platform picks up positive customer reviews online and allows for powerful analysis of the markets and rapid order execution.

Payments

Deposits

The minimum deposit is $100. CPT Markets offers several payment methods for live account deposits:

- Wire bank transfers

- Card payments

- Neteller

- Skrill

Withdrawals

Requests are submitted via an online form on the broker’s website and are generally processed within 1 business day with no fees. Withdrawals must be made back to the initial bank account and will be rejected if they bring accounts below margin levels.

Demo Account

The broker offers a demo account where users can test their strategies on the MetaTrader 4 platform. A simple online registration form needs to be completed when opening an account. The trial account is a great place to start if you’re unsure about signing up for real-money trading.

CPT Markets Bonus

At the time of writing, CPT Markets does not offer any promotions to new clients, this includes no deposit bonuses.

Regulation Review

CPT Markets is authorised and regulated by the Financial Conduct Authority (FCA) meaning the broke operates with a high level of reliability following regulatory standards. The broker also works with reputable credit institutions and legal houses that help to oversee trades and maintain a robust financial standing.

The global brokerage is also licensed with the International Financial Services Commission of Belize.

Additional Features

CPT Markets Ltd offers online educational courses split between beginner and intermediate levels. Various topics are covered such as trading caps, managing risk, market indices, basic terms, and MT4 installation, all with training videos.

The broker also provides weekly research bulletins with updated market information and global trading news on both their website and Facebook account.

Account Types

The online application to open a live trading account is extensive. Users must submit information such as their trading experience and investment objectives, along with identity documents and FATCA.

The brokerage offers two accounts:

- Retail – $100 minimum deposit requirement

- Professional – eligibility criteria must be met, including sufficient evidence of 12 month trading history

Both retail and professional accounts share features such as best execution for orders, clear and transparent information, and FSCS protection. The retail account also offers negative balance protection, client money segregation protection, and access to a Financial Ombudsman.

Trading Hours

CPT Markets follows standard office and trading hours, however timings do vary by instrument. Forex trading, for example, is available 24/5 on the MetaTrader platform.

Customer Support

CPT Markets Ltd offers customer support via:

- Email – info@cptmarkets.co.uk

- Telephone – 44(0)203 9882277 (7am – 10pm Monday to Friday)

- Address – 40 Bank Street, 30th Floor Canary Wharf, London, England, E14 5NR

Security

CPT Markets prides itself on its handling of personal information and its robust data policy. Users are also entitled to call upon the Financial Ombudsman for any trading issues associated with CPT Markets UK. The MT4 platform assures high-tech encryptions, secure logins, and industry-standard data privacy.

CPT Markets Verdict

CPT Markets provides opportunities for traders of different abilities on the established MT4 platform along with FCA regulation and FSCS protection. The decent breath of learning resources and payment options also helps to make CPT Markets a strong contender.

Top 3 Alternatives to CPT Markets

Compare CPT Markets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

CPT Markets Comparison Table

| CPT Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 3 | 4.4 | 4.3 | 4 |

| Markets | CFDs, futures, options | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, IFSC (Belize) | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by CPT Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| CPT Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

CPT Markets vs Other Brokers

Compare CPT Markets with any other broker by selecting the other broker below.

FAQ

Is CPT Markets regulated?

Yes, the broker is regulated by the Financial Conduct Authority (FCA) in the UK and the International Financial Services Commission (IFSC) of Belize. This indicates a trustworthy brokerage.

What trading platforms does CPT Markets use?

The broker offers the well-known industry platform MetaTrader 4, available to download to desktop or to trade on major web browsers. MT4 mobile app can also be downloaded from respective app stores with compatibility on iOS and Android devices.

Does CPT Markets offer a demo account?

Yes, traders can complete a simple online registration form to access a fully featured demo account.

How do I open an account with CPT Markets?

You can complete an online account application form, requiring information such as personal details and trading experience. Alternatively, contact the broker using the customer support telephone number or email address.

What are the payment options to fund my CPT Markets account?

Once you have registered for an account, you can make deposits via card payments, bank wire transfers, Skrill, Neteller and UnionPay, among others.

Customer Reviews

There are no customer reviews of CPT Markets yet, will you be the first to help fellow traders decide if they should trade with CPT Markets or not?