Capital Index Review 2024

Capital Index Review

Capital Index is a global broker that offers trading on forex, CFDs and spread betting. We look at user reviews to uncover the main aspects of trading with Capital Index, including login and withdrawal, leverage rates and demo accounts.

Capital Index Headlines

Capital Index was established in 2014 and has expanded into an international brokerage firm. The brand is made up of three entities:

- Capital Index (UK) Limited is authorised by the Financial Conduct Authority (FCA)

- ForexCFDs, or Sirius Financial Markets Pty Ltd, authorised by the Australian Securities and Investment Commission (ASIC)

- Capital Index (Global) Limited, authorised by the Securities Commission of the Bahamas (SCB)

This broker serves clients from multiple countries and has offices in London, Sydney, and Nassau in the Bahamas.

Trading Platforms

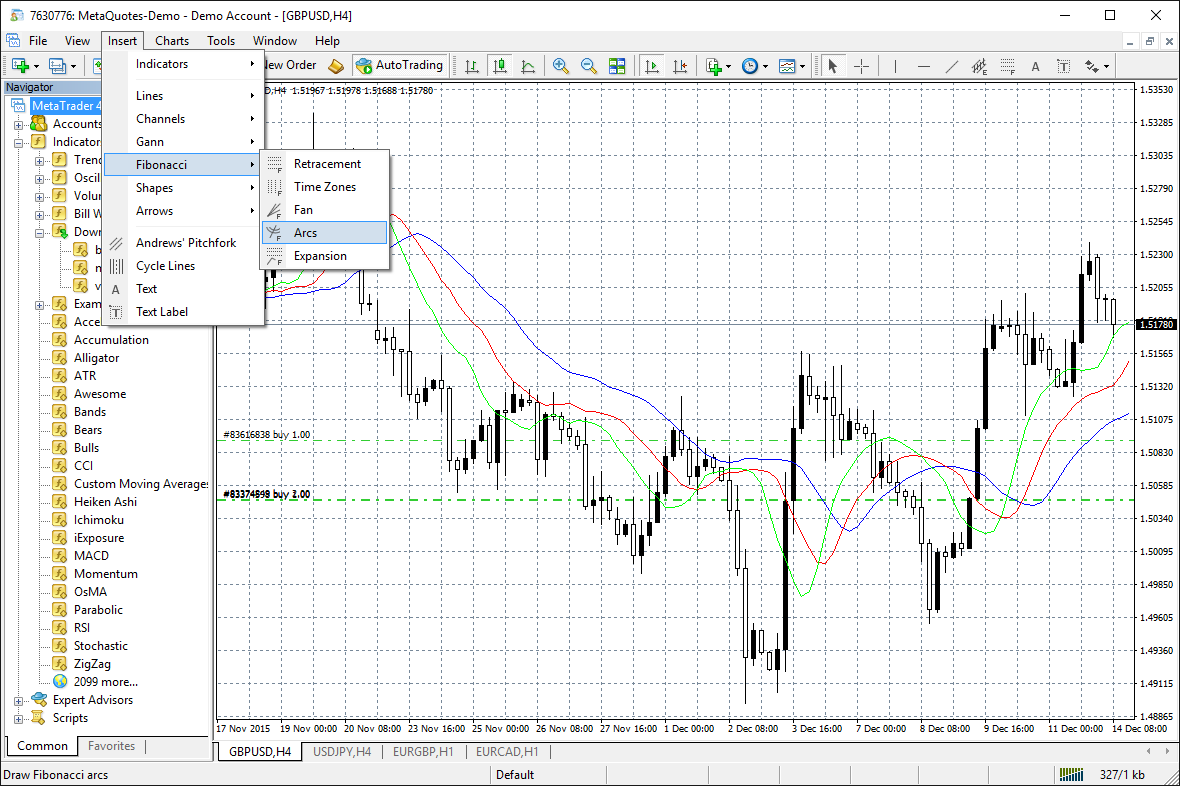

MetaTrader 4

All branches of Capital Index including the UK and Global use the MetaTrader 4 (MT4) trading platform. Once traders have opened an account they can access the MT4 portal with their login credentials. The software provides a user-friendly interface to execute trades and the terminal is industry-leading.

The downloadable MT4 platform for Windows and Mac comes equipped with ample features to help traders make informed decisions:

- High-level technical analysis, with over 50 analytical tools

- A signals service alongside copy trading and automated trading

- Several execution modes, order types, and time frames including tick charts

- High-security standards to protect personal and transactional information

WebTrader

Traders can also access the markets through WebTrader, the desktop version of MT4 that includes all the functionality of the original program but with the convenience of trading through any browser on any device.

Products

Capital Index offers a range of assets for trading:

- Forex – Trade over 50 forex pairs including majors and minors alongside 16 exotics

- CFDs – More than 10 indices are available including the FTSE, plus 5 precious metals and crude oil

- Spread betting – Clients of the UK branch can also place flexible spread bets on the financial markets

Capital Index has a good rating in our review for its spread betting products in addition to the forex and CFD instruments found at most brokers. To improve further, we’d like to see trading in shares and cryptocurrencies.

Trading Costs

At Capital Index, spreads vary by account. EURUSD rates range from 1 pip with the Pro account to 1.4 with the Advanced option. Competitive spreads from 1.4 pips are also available with the copy trading solution. For the tightest spreads of just 0.4 pips, you need an invitation to open a Black account and will need to meet larger deposit and volume requirements, detailed further below.

The broker also charges a standard overnight swap fee plus a monthly inactivity payment of £15 following six months of inactivity.

Leveraged Trading Review

Capital Index offers leveraged trading options, which vary depending on where you’re trading from:

- Capital Index UK – 1:30

- ForexCFDs – 1:200

- Capital Index Global – 1:500

Mobile App

Capital Index has MT4 integration, and clients can download the mobile app from Apple and Android app stores. The app incorporates the key aspects of the platform such as one-click trading and also includes chat functionality and notifications so clients can stay on top of the markets.

Deposits & Withdrawals

Capital Index offers the following minimum deposits:

- Advanced – £100

- Pro – £5,000

- Black (invitation only) – £50,000

- Copy Trading (Global only) – £500

From the client portal, traders can fund their account using prepaid debit or credit cards. Capital Index charges £15 if clients request a same-day service but otherwise there is no fee. Withdrawals are limited to two per day, and additional identity verification may be required.

Demo Account

Prospective clients can sign up for a demo account to learn how to trade the financial markets and use the MT4 platform. To try forex or CFD trading and to test out execution times, customer support and copy trading, the practice account is a good place to start.

Note, the demo account will time out after an extended period of inactivity.

Bonuses

Capital Index Global currently advertises three promotions to new traders:

- $50 welcome bonus – Clients must deposit a minimum of $250 and meet a minimum trading requirement (5 lots forex in 30 days)

- 10% deposit contribution – Clients must deposit a minimum of $1,000, and the maximum bonus is $1,000. The bonus can be withdrawn if clients trade at least 1 lot per $5 of the bonus within 90 days

- Get 50% of your losses back – Clients must deposit a minimum of $1,000, and the maximum bonus is $1,000. Loss claims must be made within 30 days of account opening and other requirements may apply

Regulation Review

Capital Index appears to be a safe and trustworthy broker. All branches are regulated by financial authorities: Capital Index UK is authorised by the Financial Conduct Authority (FCA); Forex CFDs is authorised by the Australian Securities and Investment Commission (ASIC), and Capital Index Global is authorised by the Securities Commission of the Bahamas (SCB).

All entities segregate client funds from business capital for safeguarding purposes. The UK branch also offers negative balance protection, so traders cannot lose more than their initial deposit, and is signed up to the Financial Services Compensation Scheme to the tune of £85,000 per client. Note, professional clients do not receive negative balance protection.

Additional Features

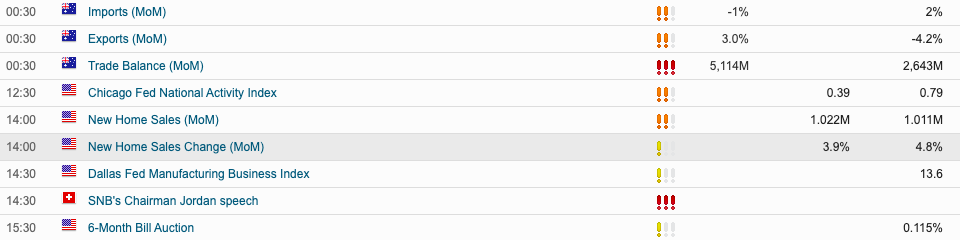

Capital Index provides market analysis and news updates on its website, plus an economic calendar. Our review was pleased to see the broker also has considerable education resources, including 15 trading guides on general trading, forex and CFD investing. Smart charts and tables to explain prices and product specifications are also available on the broker’s website.

Trading Accounts

All branches offer the Advanced, Pro, and Black accounts in three currencies (EUR, GBP and USD). Our review noted that Capital Index Global also offers a dedicated Copy Trading account, with a deposit of £500 required for spreads from 1.4 and leverage up to 1:200.

Bar the Black account, all accounts have a minimum lot size of 0.01 and are commission-free. Note the Black account is invitation-only, and the broker runs a separate website dedicated to traders with this account.

Pros

Clients at Capital Index benefit from:

- Spread betting

- Welcome deposit bonuses

- Negative balance protection

- FCA, ASIC, and SCB regulation

Cons

Disadvantages of opening an account include:

- Monthly inactivity fee

- Tight spreads reserved for higher account tiers

Trading Hours

Clients can use the customer portal and website at any time, but trading hours depend on the specific market. Capital Index lists the opening hours for each asset within its product specifications, for example, forex can be traded 24 hours a day Monday through to Friday.

Contact Support

This broker has live chat options on the UK and Global websites, and customer support can also be assessed using the following:

Capital Index UK

- Contact number – +44 207 0605120

- Email – support@capitalindex.com

- Office – King William House, 2A Eastcheap, London, EC3M 1AE

Forex CFDs

- Contact number – 02 8607 8840

- Email – clientservices@forexcfds.com.au

- Office – Level 21, 264-278 George Street, Sydney, NSW 2000

Capital Index Global

- Contact number – +1 844 8074302

- Email – info@capitalndexglobal.com

- Office – P.O. Box SP 61567, Goodman’s Bay Corporate Centre, 2nd Floor, Nassau New Providence, The Bahamas

Security

Capital Index protects its clients’ personal information from disclosure to other parties and stores this information on secure, password-protected servers. The broker uses physical and electronic methods to keep client data safe and to ensure privacy is maintained.

Capital Index Verdict

Capital Index is a forex and CFD broker that also offers spread betting in the UK. Our review was pleased with the MT4 platform, range of bonuses, and the multiple regulations and licenses. Our only real gripe is that a large minimum deposit is needed to open an account with really tight spreads.

Top 3 Alternatives to Capital Index

Compare Capital Index with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Capital Index Comparison Table

| Capital Index | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, spread betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, ASIC, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | $50 welcome bonus | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (UK), 1:200 (Forex CFDs), 1:500 (Global) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 1 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Capital Index and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Capital Index | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Capital Index vs Other Brokers

Compare Capital Index with any other broker by selecting the other broker below.

FAQ

Is Capital Index regulated?

All three entities under the Capital Index brand are regulated by respected financial authorities in their respective jurisdictions. This entails regulation from the Financial Conduct Authority (FCA), the Australian Securities and Investment Commission (ASIC), and the Securities Commission of the Bahamas (SCB).

Is Capital Index a trustworthy broker?

Capital Index appears is a relatively safe choice with multiple licenses in place. The UK branch also has negative balance protection and is signed up to a compensation scheme.

Does Capital Index offer any deals or promotions?

The Global branch of Capital Index offers three promotional schemes for new clients. This includes a $50 welcome bonus, a 10% deposit contribution, and a 50% loss rebate scheme.

What platform does Capital Index use?

Capital Index offers the MetaTrader4 (MT4) terminal. The platform is market-leading for analytics and charting and is also available via a browser as WebTrader and as a mobile app.

What is the minimum deposit amount at Capital Index?

Clients need to deposit £100 to open an Advanced account. For higher account tiers, new traders will have to load their account with up to £50,000.

Customer Reviews

There are no customer reviews of Capital Index yet, will you be the first to help fellow traders decide if they should trade with Capital Index or not?