AskoBID Review 2024

AskoBID Review

AskoBID offers a proprietary trading platform, providing access to popular instruments such as currency pairs, crude oil and Bitcoin. This review dives into the desktop app, the account login process, deposits and withdrawals. We’ll also look at customer reviews to answer the question ‘is AskoBID legit or a scam?’

AskoBID Details

AskoBID is an unregulated broker established in 2009. The company offers an all-inclusive trading service across 4 accounts to suit different experience levels. A range of resources are available, including market analysis and webinars.

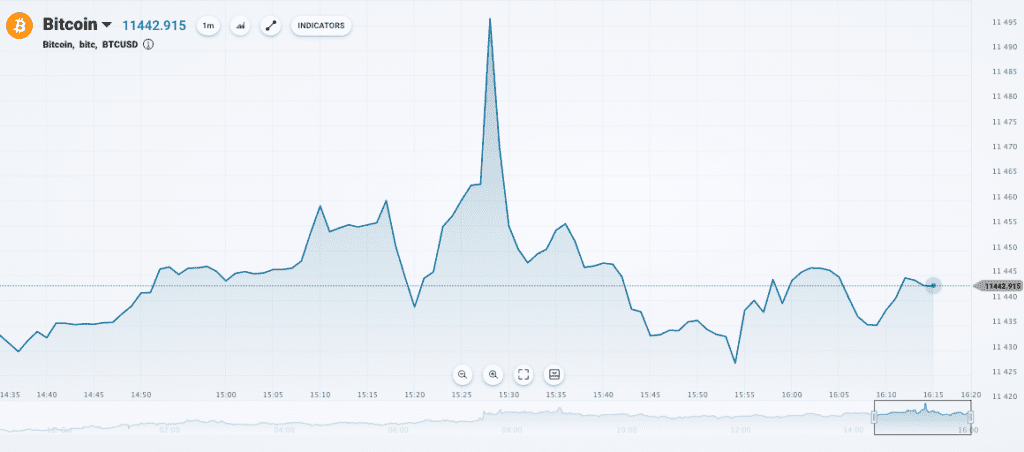

Trading Platform

AskoBID only offers its proprietary platform to clients, which is directly accessible from the website.

The platform offers most of the essentials, including 11 timeframes, 3 chart types, financial news and video tutorials. There are also 21 drawing tools and 17 technical indicators, including MACD. Unfortunately the software is missing some popular indicators, however, such as Bollinger Bands and Stochastics.

Overall, the platform may work well for beginners, but it lacks the advanced trading tools and usability of better-known industry contenders.

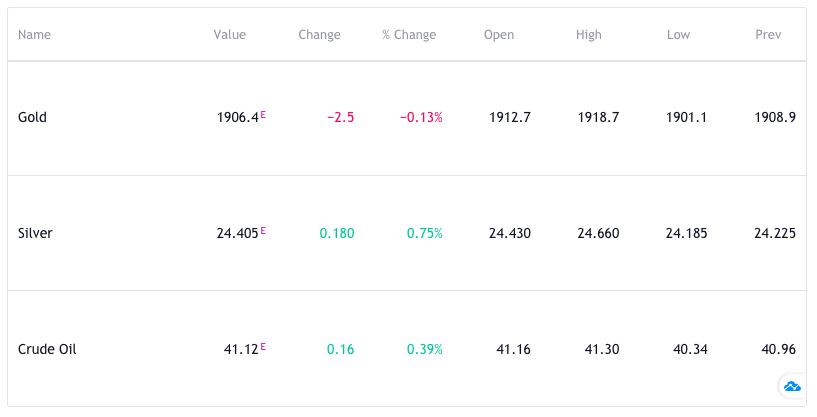

Markets

Traders can access 24 currency pairs such as EUR/USD and GBP/USD, as well as 9 stocks, including Google and Coca-Cola. There are also 4 indices available (S&P 500, NASDAQ, Dow Jones, and DAX), 9 crypto pairs, including Bitcoin and Litecoin, plus commodities.

Trading Fees

The broker offers floating spreads across all asset classes. Unfortunately this review was disappointed to see average spreads aren’t made available, which does point to a lack of transparency.

There are some additional charges, including a 10% inactivity fee based on available account balance following 90 days of no use. There are also overnight financing fees on positions rolled over into the next day.

Leverage

Leverage is available up to a maximum of 1:500. New traders should thoroughly research the risks involved when trading on leverage.

Mobile Trading

Unfortunately, AskoBID doesn’t offer any mobile trading options. This could be a deal-breaker for many prospective users, as most brokers offer accessible and convenient trading via a mobile app.

Payment Methods

AskoBID offers four main funding methods: credit and debit cards, AlphaExchange e-wallet, international bank transfer, and local bank transfer. Funding is only available in Euro.

Deposit processing times are instant for cards and e-wallets and up to 5 working days for international bank transfer. It can take up to 7 business days for withdrawn funds to appear in your account. As indicated in the broker’s refund policy, clients are subject to a 4% withdrawal fee.

Demo Account Review

AskoBID does not offer a demo or trial account at this time. This is disappointing as most brokers offer this for beginners who want to try out the platform, or for experienced traders who want to improve their trading strategies without risking real cash.

Bonuses

AskoBID offers a 50% on-deposit welcome bonus to new traders, though the broker isn’t clear in terms of how much you need to initially deposit to be eligible. Traders can check the broker’s website for upcoming deals.

Regulation

AskoBID is an unregulated brokerage, so if you are scammed you won’t have the legal protection offered by the likes of the FCA. The offshore nature and lack of transparency on the broker’s website should serve as a warning to potential clients.

Additional Features

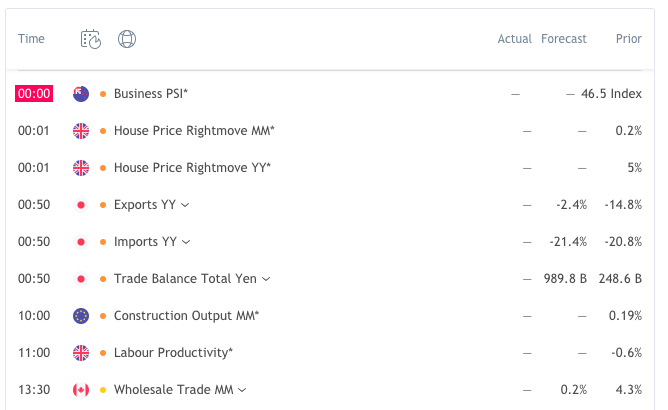

AskoBID offers some additional resources, including regular market insights and daily news in video format. There’s a handful of basic educational videos and webinars, as well as some trading calculators and an economic calendar. Overall, the offering does not compete with other brokers.

Trading Accounts

There are four account types on offer at AskoBID: Basic, Professional, Gold, and VIP.

The minimum initial deposit is €250. All accounts offer leverage up to 1:500 (which is fixed for the Gold and VIP accounts). Spreads are also fixed in the Gold and VIP accounts. As you move from Basic to VIP, clients benefit from account managers, special events, signals, and webinars.

Benefits

Benefits of trading with AskoBID include:

- Webinars

- Leverage up to 1:500

- Access to TradingView

Drawbacks

This review also found several disadvantages:

- Unregulated

- No choice of platform

- Limited trading assets

- Lack of transparency around fees

Trading Hours

Forex is a 24-hour market, however platform trading sessions vary from broker to broker. Trading sessions at AskoBID can be found by hovering over the instrument symbol within the platform.

Customer Support

You can contact customer service by filling in the online contact form, emailing support@askobid.fm, or by calling one of the international contact numbers on the website. There’s also responsive live chat support, plus Telegram.

Head to the broker’s website for office address details.

Security

AskoBID displays an SSL badge on the website, which means their platform supports safe industry-standard encryption systems. All transactions are also managed by Level 1 PCI-compliant payment processors.

AskoBID Verdict

AskoBID has unfortunately provided several reasons for us to question if they are legit. Certain red flags suggest that the broker could be a scam, for example the contradictory information and the lack of transparency on the website. The absence of a demo account, mobile app, or choice of trading platforms at AskoBID is also not a good sign.

Top 3 Alternatives to AskoBID

Compare AskoBID with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

AskoBID Comparison Table

| AskoBID | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 1.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | €250 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 1 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by AskoBID and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| AskoBID | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

AskoBID vs Other Brokers

Compare AskoBID with any other broker by selecting the other broker below.

FAQ

Is AskoBID genuine?

Our review of the website and platform uncovered several concerns regarding transparency and regulation. Some online customer reviews have also complained about being scammed by AskoBID.

Does AskoBID offer any deals?

AskoBID offers a 50% deposit bonus for new clients. News of future deals can be found on the broker’s website.

Is AskoBID regulated?

AskoBID is an unregulated broker and will therefore not provide the level of client protection that you would get with regulated bodies such as the FCA or CySEC.

How do I open an account with AskoBID?

You can register for an account by filling in the online form and creating your sign-in credentials. You will then need to follow the instructions to verify your identity.

What leverage is available at AskoBID?

The maximum leverage available at AskoBID is 1:500 across all account types.

Customer Reviews

There are no customer reviews of AskoBID yet, will you be the first to help fellow traders decide if they should trade with AskoBID or not?