Alvexo Review 2025

See the Top 3 Alternatives in your location.

Pros

- Broad range of assets and markets including forex and stocks

- CySEC oversight improves the broker's trust rating

- ECN pricing with tight spreads on premium accounts

Cons

- Some bad customer reviews

- High minimum deposit

- No MetaTrader 4 platform available

Alvexo Review

Alvexo is an online forex broker offering a range of tradable assets, multiple accounts, and varied educational resources. In this review, we will evaluate the broker’s trading platform, mobile app, signals offering, and more. Find out whether Alvexo is trustworthy and right for you.

Company Overview

Alvexo was founded in 2014 and is owned by VPR Safe Financial Group Ltd. Its headquarters are in Limassol, Cyprus, but the company also has an office in Paris.

Alvexo boasts over 450 tradeable instruments and has thousands of clients worldwide, from France to Singapore and the UAE. The broker is the official partner of Norwich City FC.

Alvexo is regulated by the Cyprus Securities & Exchange Commission (CySEC).

Trading Platform

Alvexo offers an award-winning web trader platform with no download required. The web-based solution is available on any device with an internet browser while the interface is user-friendly and easy to navigate.

Features include:

- Technical indicators & multiple timeframes

- Graph & chart tracking

- Customization tools

- Multiple order types

- Instant execution

- Real-time alerts

- Market signals

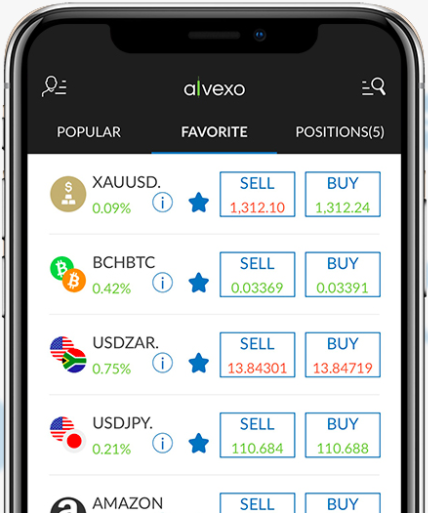

Alvexo offers a mobile app to facilitate on-the-go trading. The iOS and Android apps are available to download free of charge from the App Store or the Google PlayStore.

Once you have your member login details, you can trade commodities, indices, forex, and cryptocurrency.

The app generally receives positive customer reviews and features include:

- Daily signals

- Charting suites

- Real-time alerts

- Risk management tools

Assets

Alvexo clients can trade in multiple financial markets:

- Forex – 50+ currency pairs including GBP/USD and EUR/GBP

- Indices – Trade on the world’s leading indices including the FTSE and DAX

- Shares – Major shares available from a host of international companies such as Alibaba, IBM and Netflix

- Commodities – Trade Brent Oil, Copper and Natural Gas

Spreads & Fees

Spreads vary according to the account, however, they are competitive. The EUR/USD spread starts at 2.9 pips for Classic account holders and drops as low as 0.1 pips with the Elite option.

Classic, Gold and Prime members enjoy a commission-free structure. Other costs include an inactivity fee equal to 10 units of the base currency and swap fees on positions left overnight.

Leverage

Leverage for those trading in Europe is capped at 1:30.

Leverage should be utilised only when traders understand the risks involved.

Payment Methods

Clients can finance trading using credit cards, debit cards, PayPal, Apple Pay, Google Pay, plus popular e-wallets.

The minimum deposit is specific to the type of account held. For a Classic account, the requirement is $500, for a Gold account it’s $10,000, and for a Prime account, it’s $50,000. The broker does not charge any deposit or withdrawal fees.

Withdrawals take a minimum of 3-5 business days and wire transfers may take longer. Alvexo only enables transactions in US Dollars and Euros.

Demo Account

Alvexo offers a free demo of their web platform. Users will be credited with a $50,000 virtual balance. The practice simulator is a great way for traders to try new strategies and platforms in a risk-free environment.

Bonuses & Promotions

There were no bonuses at the time of testing. However, always check bonus terms and conditions before you start trading.

Regulation & Licensing

Alvexo is a legitimate broker that is safe to trade with and not a scam. Alvexo (Europe), is operated by VPR Safe Financial Group Limited and regulated by the Cyprus Securities and Exchange Commission (CySEC).

The brokerage offer negative balance protection so you cannot lose more than your account balance.

Additional Features

A suite of additional features is available to facilitate education and trading. Users have access to a blog, analysis tools, market news, an economic calendar, plus market signals.

There is also an academy offering tutorials, webinars, and articles to help users identify and trade the price difference.

Account Types

Alvexo offers multiple trading accounts; Classic, Gold, Prime, and Elite.

The spread, minimum deal size and tradeable assets are specific to the account held. A Classic account offers spreads from 2.9 pips, leverage up to 1:30, and a minimum deal size of 0.01 lots. A Gold account offers spreads from 2.2 pips, leverage up to 1:30, and a broad range of tradeable assets, including European and US stocks.

Trading Hours

Clients can access the trading platform 24/7. However, trading in certain products is subject to respective market opening times. Trading out of hours can bring with it less trading volume and wider spreads.

Customer Support

Customer support is easily accessed via telephone. The contact number is +35725030482.

The broker’s customer service team is friendly, helpful, and responds quickly to queries.

User Security

Alvexo uses the standard security measures employed by online financial brokers. Trades are secured with 256-bit RapidSSL encryption and the entire system is fire-walled. Transactions are executed by the highest PCI-Certified service providers and servers are located in SAS-70 certified data centres.

Alvexo Verdict

Whilst it may not be market-leading, Alvexo is a good broker offering an immersive trading experience with easy to navigate platforms, multiple assets and accounts, plus competitive spreads.

For active traders, in particular, the higher account tiers offer low trading fees and a wide range of financial instruments.

Best Alternatives to Alvexo

Compare Alvexo with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Alvexo Comparison Table

| Alvexo | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 2 | 4.3 | 3.6 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $500 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | CySEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Anniversary Bonus |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:30 | 1:50 | 1:200 |

| Payment Methods | 7 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Alvexo and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Alvexo | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | No | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

Alvexo vs Other Brokers

Compare Alvexo with any other broker by selecting the other broker below.

Customer Reviews

2.3 / 5This average customer rating is based on 3 Alvexo customer reviews submitted by our visitors.

If you have traded with Alvexo we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Alvexo

FAQ

Where is Alvexo regulated?

Alvexo is regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker is also regulated by the Financial Services Authority (FSA) of Seychelles. Alvexo is a legitimate online broker and not a scam.

Does Alvexo offer a demo account?

Alvexo offers users a free demo account on their web platform. Users will receive a £50,000 virtual balance to test the broker’s trading services.

How much capital do I need to trade with this Alvexo?

The minimum deposit for a Classic account is $500. The higher account tiers require larger minimum deposits, in excess of $20,000.

Does Alvexo accept US clients?

No, Alvexo’s services are not available to citizens from the US. Clients from Israel are also unable to open a trading account.

How can I delete my Alvexo account?

To delete an account users will need to email a request form to info@alvexo.com. The customer support team will then process the request.

This company is a scam. Be careful and do not use it. I made a lot of supposedly profits. But then one day they said that my account is in danger and one day I opened and all my money was lost.

Dear Alvexo Users,

I want you to read this review very carefully. I have been trading with Alvexo more than a year. While signing up, customer service confirmed me that this is swap free account. I have been trading about 130k USD and have open trades for long time cause it is swap free. After a year, they suddenly sent me an e-mail saying that I am creating abuse in terms of compliance for not paying swaps and will be deducted automatically. Just after 1 hour, 44k USD swap cost was deducted and because of margin, my account is totally blown up. I was shocked, sent an e-mail to them and response was, It is free for first 45 days(as usual) and I should have read terms and conditions. Then questions I asked;

Why I was not informed by anyone regarding this eventhough I have a confirmation by e-mail that it is totally swap free? Response: You should have read terms and conditions

Why did you wait 1 year to deduct swap from account?

Response: There was technical problems and management changed also.

How are you going to compansate my loss due to company failure?

Response: We are seeking ways to do so, It is very hard.

After 3 months they dissapeared totally. So I lost 130K USD.

They are not reachable, if you have chance they call you back.

I lost all my trading portfolio now, please be aware when you consider to open an account from this company. All the complaints in reviews I already faced them all. Please stay away..

Best,

Arda Erdogru

Alvexo one of the trusted CFD which we are very close since 2 years and nothing wrong and we tried so many trading company all of they are best.