Viral Investing Tweets: 61% of Trade Calls Result in Losses

From confident Tweets about the S&P 500 “about to rip” to the late-day “dip buy opportunity”, X, formerly Twitter, is rife with posts that may make retail investors rush to open positions with limited due diligence.

We wanted to know what actually happens when you pay attention to these posts, so we tracked and evaluated 50 of the most viral trading suggestions on X. We didn’t look at the obviously fake stuff, nor the crypto moonshot garbage. Instead, we focused regular posts about US stocks and ETFs – respected financial assets – that got enough traction in our timeline.

What emerged in our analysis was worrying inaccuracies, missing risk information, and claims that couldn’t be verified.

Key Takeaways

- What we did: We analyzed 50 viral trading posts on X (Twitter) in January 2026:

- We concentrated exclusively on US stocks and US index ETFs.

- We logged the same-session price action to record outcomes.

- We scored each post based on three factors: verifiability, result accuracy, and risk disclosure.

- What we found: Most viral trading posts failed even basic accuracy checks:

- Claims without clear levels or timeframes were hard to verify.

- Posts that hid or skipped risk details were more likely to lose.

- Screenshots and confident language replaced explanation.

- Price sometimes moved the ‘right’ way, but clarity was still missing.

- What the data told us: Most trade suggestion posts resulted in losing positions:

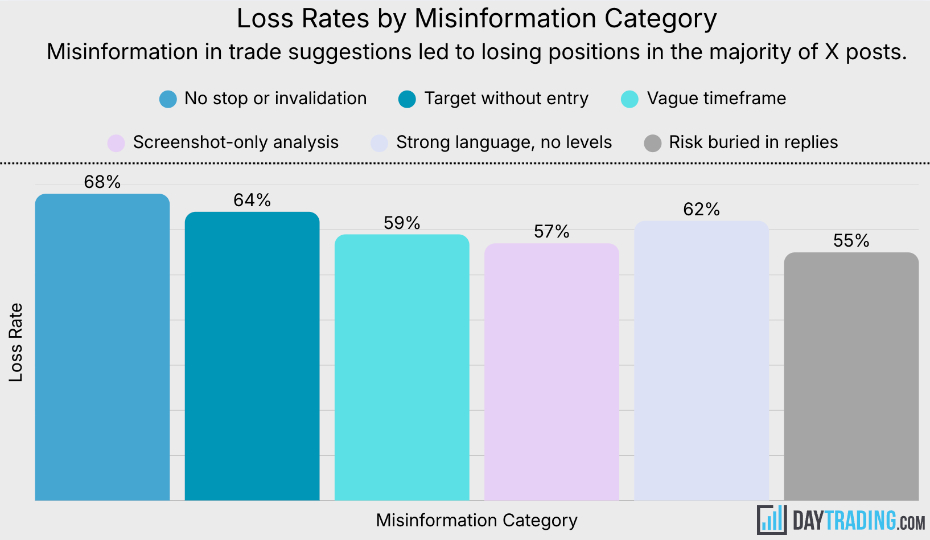

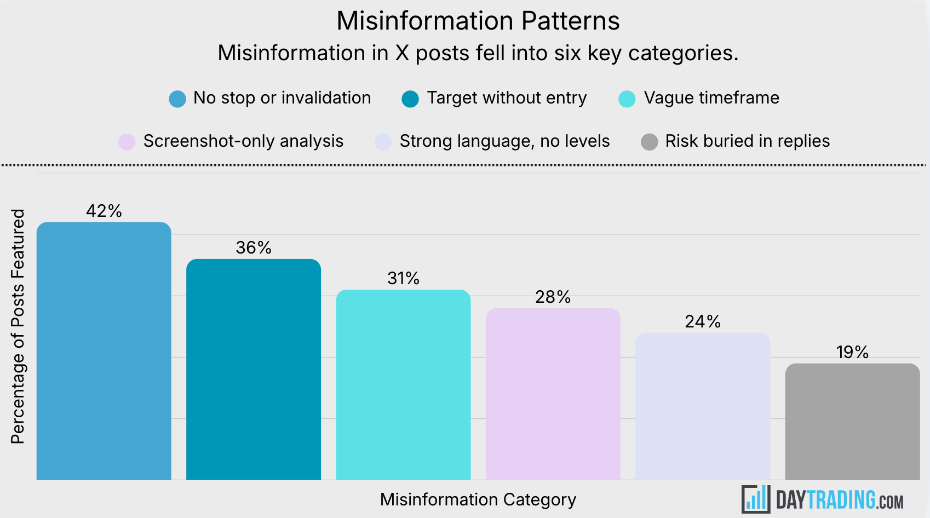

- On average, viral trading calls lose more often than they win: across our six common misinformation themes, the average loss rate was about 61%.

- Even the least bad misinformation category still lost 55% of the time, and the worst lost 68% of the time, so every problem area is a net loser.

- The biggest red flag is also the most common: posts with no stop-loss/invalidation level made up 42% of our data set and they lost 68% of the time.

- Most viral trading posts lack basic details: the most common issues are leaving out the stop-loss, the entry, or the timeframe, and posts with these gaps lost roughly 60% of the time.

- How to protect yourself: Approach every Tweet/X post with skepticism:

- Treat social media trading posts as ideas warranting careful validation, not simple trade instructions.

- Ignore likes and engagement metrics when assessing accuracy, as these could be bots or disingenuous, and always look for clear price levels and timeframes.

- Be cautious of claims that can’t be tested later, and if no downside is mentioned, assume one exists.

Methodology

What We Tracked

Every X post had to:

- Call out a specific US stock or US index ETF.

- Make a clear directional claim (price going up, breaking out, bouncing…).

- Get enough engagement that we actually noticed it in our feed.

- Drop during market hours or right before the open.

We skipped the memes and joke posts. We also ignored accounts that were obviously trolling.

We made every account anonymous because this isn’t about calling anyone out – it’s about finding the patterns that show up almost everywhere on trading posts.

One thing we noticed right away is that most trading posts don’t tell you when to get in. They just assume you’ll figure it out.That’s not a bug in our experiment – that’s exactly what we wanted to test because it will catch out some retail traders, especially beginners.

How We Judged Each Post

We weren’t trying to rate trading strategies. We were checking something simpler: Could we even tell if a post was right or wrong?

Here’s what we looked for:

1. Could We Check This Later?

Did the post give us:

- A clear ticker symbol.

- A timeframe that makes sense.

- A price level where we’d know if it worked.

Posts that just said “soon” or “setting up nicely” without anything concrete failed immediately.

If we couldn’t verify a claim, it was useless.

2. What Happened That Same Day?

We only cared about the session it was posted in. Not the next day. Not after earnings. Not after the poster clarified in replies.

If the price went against the call before the closing bell, we marked it as a loss.

This is because that’s when you would’ve gotten hurt. Most people who see these posts act on them that day.

3. Did They Mention Risk At All?

We weren’t looking for perfect risk management. Just one simple thing: Did they say what happens if they’re wrong?

Was there a stop loss? An invalidation level? Any mention of downside?

If the risk stuff was buried in replies that nobody reads, we counted it as missing. Because let’s be honest, you’re not digging through 47 replies before making a trade.

Results

Example Posts

Lets walk through some notable examples from the posts we evaluated:

SPY “Ready to Rip”

- Posted: 09:37 ET.

- The Call: SPY “looks ready to rip.”

- Why It Spread: Futures were green, everyone was bullish, and this felt like confirmation.

- What Actually Happened: SPY pushed higher for around 15 minutes. Then it rolled over. Drifted lower all morning. Never got back to the price when that post went out.

- What They Didn’t Say: No price level. No timeframe. No “I’m wrong if…”

- Reality Check: The confidence lasted longer than the move.

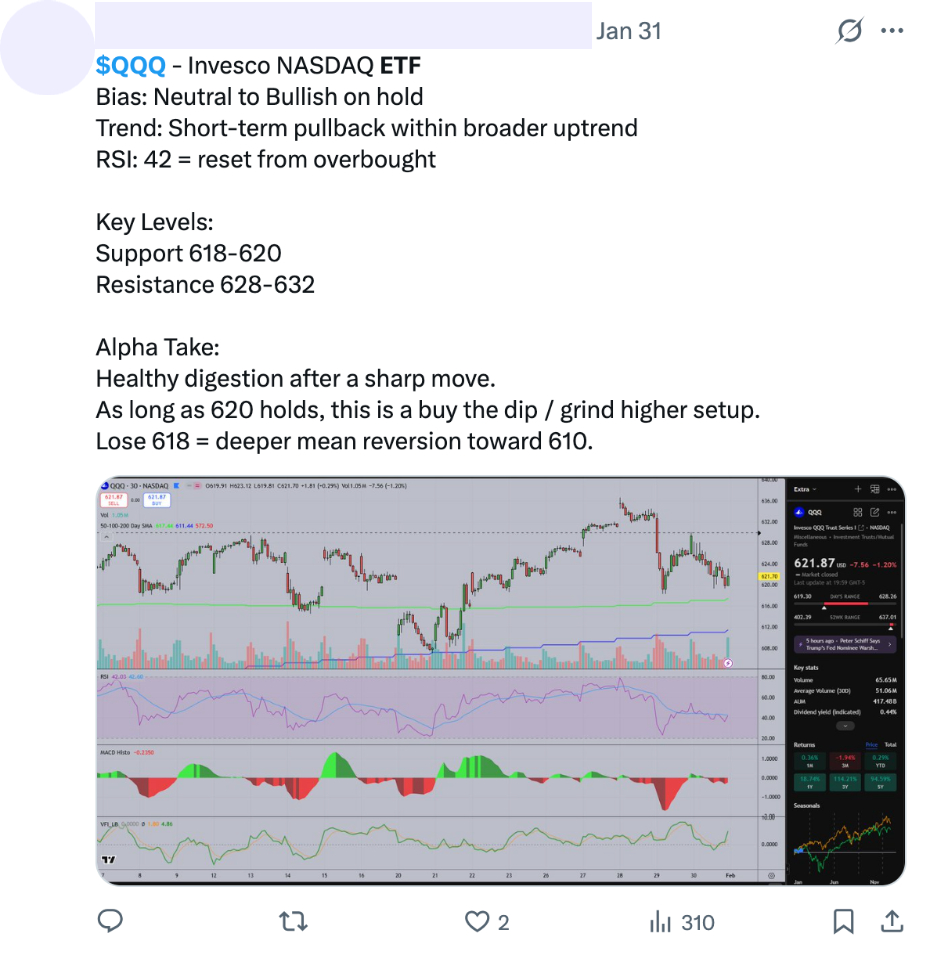

Mid-Morning Screenshot Special

- Posted: 10:18 ET.

- The Call: “Breakout confirmed.” Just a chart. No words.

- Why It Spread: Clean chart, big-name stock, easy to retweet.

- What Actually Happened: Tiny push above the morning high. Stalled out. Faded into the close. Finished red.

- What They Didn’t Say: Why that level mattered. What failure looks like. Anything, really.

- Reality Check: The image did all the talking. And images don’t explain risk.

The Lunch Hour Phantom Target

- Posted: 11:06 ET.

- The Call: QQQ price target posted. No entry price. No stop.

- Why It Spread: Numbers feel official. Targets feel planned.

- What Actually Happened: Got partway there. Reversed before noon. Never came close again.

- What They Didn’t Say: When you’re supposed to get in. When the idea is dead.

- Reality Check: A target without rules just becomes an argument later.

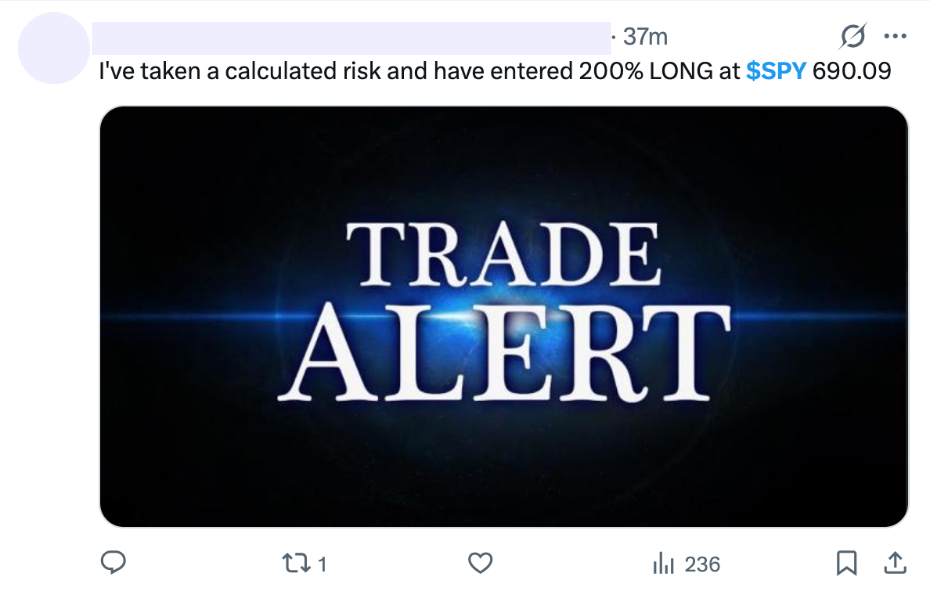

“Strong Buy Here” Afternoon Trap

- Posted: 13:42 ET.

- The Call: “Strong buy here” on DraftKings (DKNG), a mid-cap stock.

- Why It Spread: Short. Aggressive. Sounds like someone knows something.

- What Actually Happened: Went nowhere for two hours. Sold off into the close. Finished near the lows.

- What They Didn’t Say: Why here? What’s the risk? What’s the plan?

- Reality Check: It didn’t blow up fast. It just bled out quietly while everyone stopped watching.

Buried Risk in the Power Hour

- Posted: 15:11 ET.

- The Call: “Dip buy opportunity” on QQQ.

- Why It Spread: Everyone’s watching the late-day action. This felt like the play.

- What Actually Happened: Small bounce. Rolled over again before close. Finished below where the post came out.

- What They Didn’t Say (Upfront): Risk was mentioned in a reply. Which means 90% of people never saw it.

- Reality Check: If the risk isn’t in the main post, it might as well not exist.

This pattern repeated in all the posts we evaluated – quiet failures that nobody followed up on. That’s how most trading misinformation actually works. It doesn’t scream at you. It just fades while everyone moves to the next chart.

The Red Flags That Kept Showing Up

We saw the same issues over and over:

- Strong words replaced actual structure (“this is THE setup”)

- Screenshots stood in for explanations (chart + rocket emoji = analysis?)

- Timeframes got vague or shifted later (“I meant by the end of the week”)

- Important details live in replies (where nobody looks)

The Numbers

After scoring all 50 posts, here’s what we found:

| Category Number | Misinformation Pattern | % of Posts | Loss Rate | What’s Missing Technically | How It Fails Short-Term |

|---|---|---|---|---|---|

| 1 | No stop or invalidation | 42% | 68% | No defined level where the thesis breaks | Price drifts past key VWAP or prior low with no reference point, leaving readers frozen |

| 2 | Target without entry | 36% | 64% | No entry context, no risk-to-reward framework | Small pullbacks invalidate the idea emotionally even if the target isn’t hit |

| 3 | Vague timeframe | 31% | 59% | No session bias or time-based expectation | Normal intraday noise looks like failure because “when” was never stated |

| 4 | Screenshot-only analysis | 28% | 57% | No explanation of levels, volume, or structure | Readers can’t tell whether the setup failed or was never valid |

| 5 | Strong language, no levels | 24% | 62% | No support, resistance, or reference price | Confidence collapses once price moves a few ticks the wrong way |

| 6 | Risk buried in replies | 19% | 55% | Risk not visible at decision time | Most readers never see the downside until it’s already hit |

The biggest problem wasn’t wild predictions. It was posts you couldn’t even test properly.

They didn’t fail because they were wrong. They failed because there was no clear way to prove them right or wrong in the first place.

That’s why posts with vague structure fail more often, even when directionally correct at some point during the session. When technical structure is missing, accuracy can’t be measured.

And if accuracy can’t be measured, learning stops.

The Tricky Part: When Price Does Move the ‘Right’ Way

A handful of posts did move in the direction the authors predicted. But they still failed our test because:

- No timeframe = you can’t define success.

- No risk level = you can’t measure failure.

- No structure = luck looks exactly like skill.

Getting the direction right is not enough when everything else is missing.

What To Know

After watching this play out in our feeds and evaluating each post, here’s what became crystal clear.

Most viral trading posts are missing the basics:

- You can’t verify them after the fact.

- Same-day results expose how weak they are.

- Confidence gets used as a substitute for detail.

- Screenshots hide the absence of risk management.

- If they don’t show downside, assume they don’t know it.

- Engagement numbers mean nothing for accuracy.

The real danger isn’t bad analysis. It’s analysis that can’t be questioned.

Why This Keeps Happening

The incentives are obvious once you see them:

- Speed beats accuracy: first post gets the engagement.

- Confidence spreads faster than nuance: “might work” doesn’t go viral.

- Corrections don’t travel: nobody retweets “I was wrong”.

How To Protect Yourself

Next time you see a viral trading post on X or any social media that makes you want to click “buy,” ask yourself three questions:

- Can I verify this later with a specific price level?

- Is there a timeframe I can actually use?

- Did they tell me what happens if they’re wrong?

If the answer to any of those is “no”, you’re not looking at trading information. You’re looking at content designed to entertain and engage. And that content doesn’t pay your bills and likely won’t improve your brokerage account balance either.

Bottom Line

Our study into viral trading posts on X isn’t saying to completely ignore trading content on this popular social media platform. But after watching 50 posts fail basic accuracy checks in real time, we can tell you that most of them aren’t scams – they’re just incomplete.

No stops. No timeframes. No clear point where the idea is officially wrong. That’s not trading information. That’s just… vibes.

When trading ideas are built on vibes instead of structure, there’s nothing concrete to review when things go wrong, because the original claim was never clear enough to test.

Accuracy turns into a matter of opinion rather than evidence. Losses get brushed aside with excuses, while wins grow larger in hindsight. And in the end, there’s no real lesson to take forward, because nothing was defined well enough to learn from.

The posts that survive scrutiny are the ones with clear levels, stated risk, and specific timeframes. The ones that don’t rely on you forgetting what was actually said.

If you can’t check it later, it can’t teach you anything.

And if it can’t teach you anything, you’re just repeating the same mistakes over and over.

Clear ideas survive review. Vague ones rely on memory. That difference matters more than most traders realize, especially when you’re just starting out.

Disclaimers

- This report documents an experiment conducted over one trading week. All X posts were observed and logged in real time, with outcomes tracked within the same session. We did not attempt to execute trades, nor do the results reflect an actionable strategy. This is a study of information quality, not trading performance.

- Same-session outcomes were the only metric recorded. We did not consider overnight gaps, news events after the post, or longer-term price action. As a result, some trades may appear to fail or succeed differently if viewed over multiple sessions.

- All social media accounts mentioned were anonymized. This is to highlight behavioral patterns in viral trading posts rather than focus on individual users.

- Stocks and index ETFs carry inherent risks, including the potential for capital loss. Even trades that appear “safe” or follow observed patterns can result in losses. Readers should apply proper risk management and never rely solely on social media content.

- Readers are responsible for their own conclusions and actions. All scoring (verifiability, risk disclosure, and outcome) is based on our methodology and observation. Differences in interpretation may arise depending on the reader’s experience, data access, or timeframe applied.

- The study is meant to teach critical thinking about viral trading information. It is designed to illustrate patterns, not guarantee outcomes. All analysis is provided as educational insight into how information can spread and may affect decision-making.