Inside Trading Signals Groups: 5 Pressure Tactics

You’re scrolling through social media, seeing people post screenshots of massive trading gains, and thinking you should join one of those signal groups everyone’s talking about. Before you do, let us tell you what we found after spending weeks inside these rooms – following their trades and documenting results.

Headline: Most beginners are losing money because these groups create an environment where you’re constantly second-guessing yourself, rushing into trades, and feeling like you’re always one step behind.

Key Takeaways

- What we did: We joined 7 trading signal groups (5 Discord, 2 Telegram) for 4 weeks and followed 112 signals on US stock trades. We logged time of alert, entry, stop/target, edits/deletions, and outcome.

- What we found: Unethical behavior, high-pressure sales tactics, inflated wins, concealed losses:

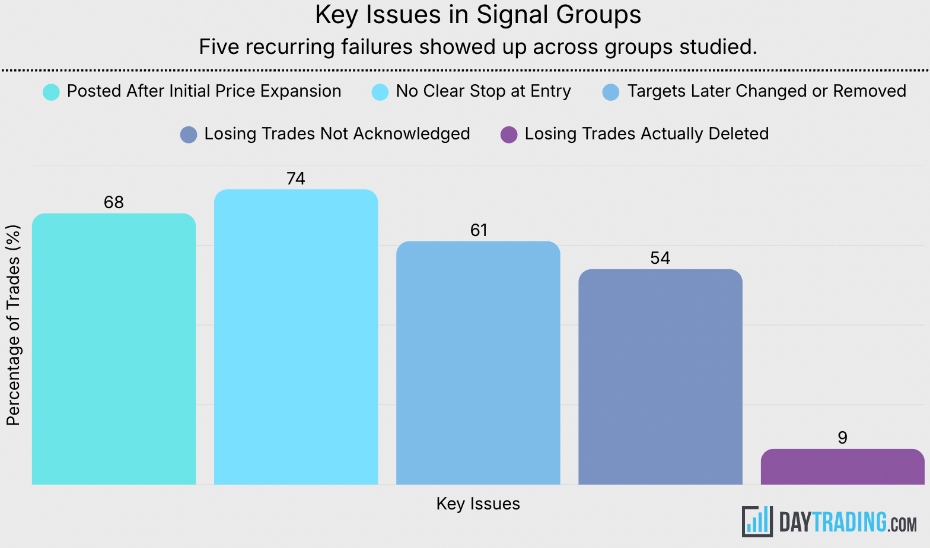

- You’re often buying late. 68% of signals were posted after the initial price expansion, meaning members are frequently chasing already-moving prices.

- Risk is usually undefined. 74% of signals had no stop loss at entry (only 26% had a stop clearly defined pre-entry; 43% never had one discussed at all).

- “URGENT” is harmful. Urgent alerts averaged –0.42R expectancy vs +0.07R for non-urgent – urgency actually made entries worse, not better.

- Targets get rewritten mid-trade. Of 69 trades posted with an initial target, 42 were later changed/softened/removed (overall 61% had targets altered), basically leaving traders without a plan.

- Results are selectively shown. 54% of losing trades were never acknowledged, 9% were deleted, while 100% of winners were highlighted – creating a ‘public’ win rate that looks far better (46% in our log vs 62% after deleted losses are excluded).

- How to protect yourself: Don’t join signals groups. If you do, stick to your risk tolerance and use tools like stop losses. If the setup changes, the trade idea might be invalidated. If you’re only seeing wins posted, question where the losses are – there’s always losses. Don’t be pushed into upgrading to a ‘VIP’ group during open positions.

What We Tested

We joined several Discord and Telegram trading signals groups – the free public ones and the ‘VIP’ paid rooms. We followed their calls exactly as posted. No modifications, no personal judgment calls. Just pure, unfiltered experience of what a new trader would go through.

We wanted to see if our gut feeling was right. It was, but not quite as we expected. Here’s precisely how this was done:

- We joined 7 signal groups (5 Discord, 2 Telegram)

- We followed and traded 112 signals issued

- We focused on signals covering US stocks

- We used a fixed fractional risk per trade

- We executed using market orders when urgency was implied

For each trade, we logged key data:

- Timestamp of alert

- Entry price

- Stop (if provided)

- Target (if provided)

- Subsequent edits or deletions

- Outcome

We didn’t exclude trades. If it was posted as a signal, it was logged.

| Trade | Group | Stock Type | Alert Time (ET) | Entry | Stop/Target | Result | Follow-up |

|---|---|---|---|---|---|---|---|

| Trade A | Discord group | Mid-cap momentum stock | 09:41 | Market order | Stop: Never posted | -1.1R loss | Deleted from the daily recap |

| Trade B | Telegram group | Large-cap tech stock | 10:18 | ”Breakout confirmed” | Target: 2R (later removed from message) | -0.8R loss | Reframed as “runner we missed” |

| Trade C | Discord group | Small-cap gainer | 11:02 | Late momentum push | — | +0.6R gain | Screenshot posted, no position sizing shown |

What The Data Showed

Across 112 traded signals, we saw worryingly high rates of several key issues that leave traders with partial, misleading or entirely omitted information, often going against the basic principles of a trading plan. And these weren’t edge cases – they were standard behavior.

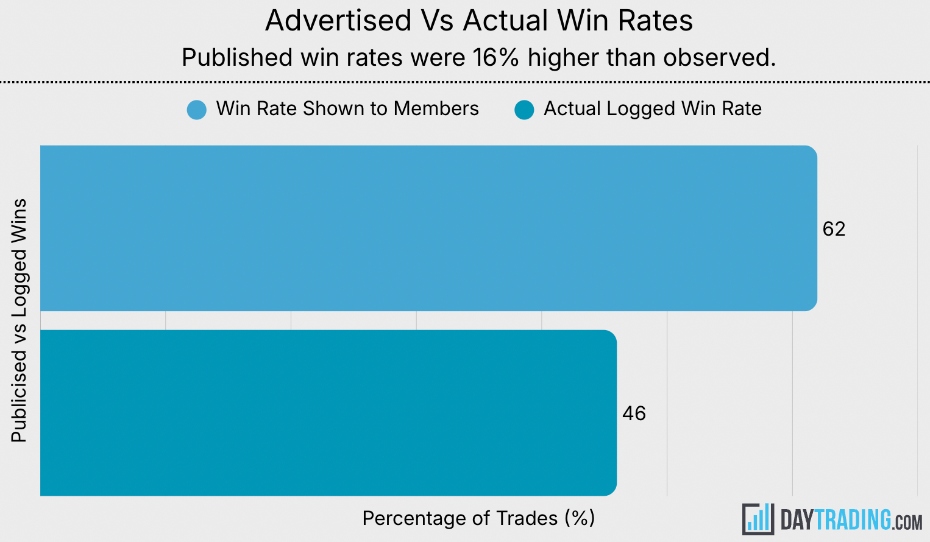

We also saw concerning gaps between the win rates publicised in groups and the actual win rate based on our logs. The effect is an artificially inflated win rate that may encourage members to trade, and most worryingly, lose more.

What It Actually Feels Like

The moment you’re in these groups with real money on the line, everything changes. Alerts ping your phone mid-day. You’re at work, checking Discord, trying to figure out if ‘BUY NOW’ means right this second or if you have a minute to pull up your broker app.

When a trade wins, the chat explodes with celebration. Green screenshots everywhere. But when trades go south? Crickets. You’re sitting there watching your position bleed, scrolling up through messages trying to find where they said to cut it, and there’s… nothing.

The Pressure Tactics We Kept Seeing

1. Everything’s ‘URGENT’ (But You’re Already Late)

We’d get an alert screaming ‘BREAKOUT CONFIRMED—ENTRY NOW.’ We’d scramble to open the position. By the time our order filled – literally 23 seconds later – the move was already reversing.

One Telegram alert hit at 9:41:03. We got filled at 9:41:26. Price topped out at 9:42:10. No stop loss was ever posted. We just sat there wondering when to cut it.

Result:

- Urgent alerts had an average –0.42R expectancy

- Non-urgent alerts averaged +0.07R

Urgency didn’t improve results. It made the entries worse. This lines up with research on time pressure degrading decision quality.

2. Wins Get Plastered Everywhere, Losses Disappear

After winning trades, the screenshots flood in. Multiple posts, celebration emojis, ‘EASY MONEY’ in all caps. But after a loss? The trade… vanishes.

We had a position get stopped out, resulting in a solid loss. Later that day, we saw it reframed in the daily recap as ‘still green if you sized correctly.’ Except the original alert never mentioned position sizing. There was no stop level. It was just a ticker and ‘BUY.’

In one Discord group, they posted a win showing +1.8R profit (1:1.8, or 1.8 times the initial risk). We scrolled back and found the same ticker from earlier in the week – deleted message, but we had it logged – where it stopped out at -1R. Same setup. Just selective memory.

Result:

On paper, several groups claimed win rates above 70%. In our logs:

- Raw win rate: 46%

- Win rate after deleted losses are excluded (what members see): 62%

Same trades. Different story. This gap exists because most members never see the full record.

3. Ask Questions During A Loss? You’ll Regret It

Once you’re in a losing position, the vibe shifts. We asked in Discord during a rough trade: “What invalidates this if price loses VWAP?” The moderator’s response: “You shouldn’t be trading size if you don’t see it.”

That was it. No actual answer. Just a subtle jab that made us feel stupid for asking. You learn fast that questioning the setup means you “don’t understand” or “aren’t ready.” So people stop asking and hold, hoping someone else knows what’s going on.

Result:

We tracked how often stops were discussed before entry.

- Stops clearly defined pre-entry: 26% of trades

- Stops discussed only after entry: 31%

- No stop ever discussed: 43%

This behavior taps into authority bias, a documented tendency to defer to perceived experts even in the face of evidence.

4. Cutting Losses = Weak, Holding Drawdowns = Strong

This one messed with us. We closed a losing trade early for a manageable -0.6R loss. A moderator replied: “This is why most people fail.”

Meanwhile, someone else was being praised in the chat for holding through an 18% drawdown. Replies like “STRONG HANDS 💎” and “This is what separates winners from losers.”

No one mentioned account size, risk tolerance, or whether this person could actually afford to lose that much.

Risk management gets twisted into a character flaw. That’s dangerous.

5. The Target That Keeps Moving

This happened way more than we expected. A trade gets posted with a clear target – let’s say 1.5R. You enter. Then things get weird.

- First update: “Holding runner for higher target.”

- Second update: “Market conditions shifting.”

- Final update: Exit posted after the reversal already happened.

We’d go back to the pinned message where the original setup was, and the target would just be… gone and edited out. Now you’re stuck in a position with no plan because the plan changed three times while you were in it.

Result:

In 112 trades:

- 69 trades were posted with an initial target

- 42 of those targets were later changed, softened, or removed

Once targets move, results can be reframed. A –1R loss becomes “managed wrong.” A scratch becomes “runner potential.” The trade didn’t change. The narrative did.

Here’s How The Scam Actually Works

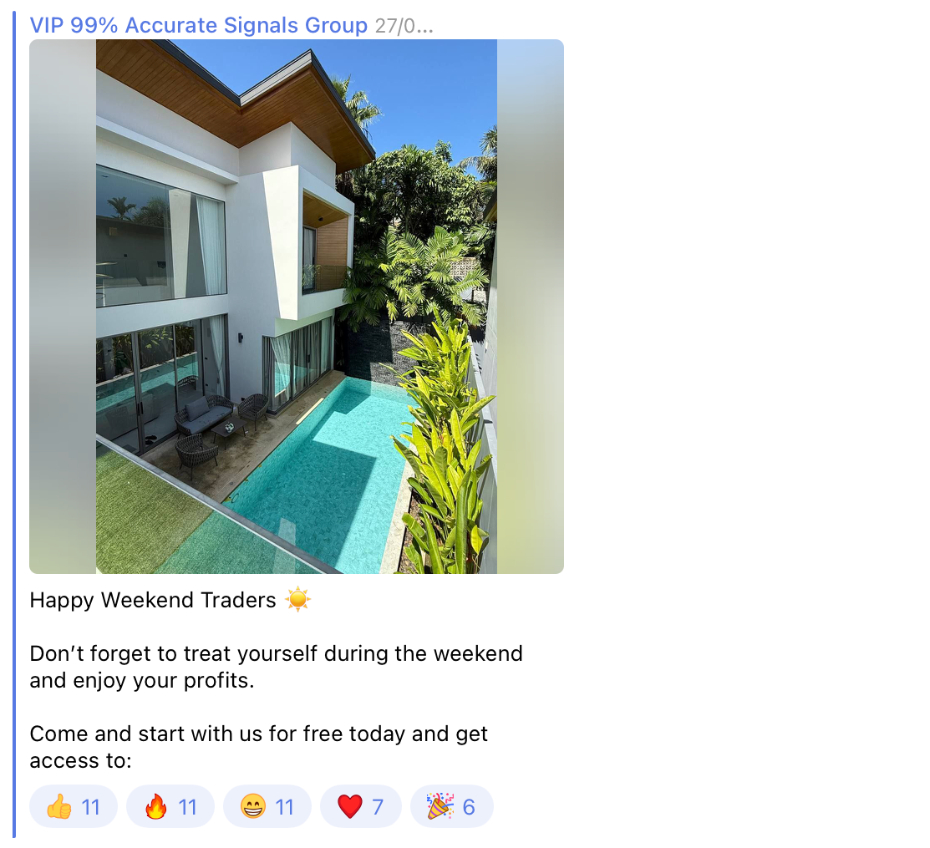

They sell you this in a few key steps:

- “High-probability setup”

- “Enter now”

- “Target 1.5–2R”

What actually happens:

- Entry comes after the initial move

- No stop is defined

- Target gets adjusted or removed mid-trade

- Exit signal comes late

- When it fails, they blame your execution

This pattern repeated across multiple groups. Different moderators, different tickers, same playbook.

The Psychological Trap

Even trading a small size to test this, we felt it creeping in:

- You take a loss → Wait for the next signal to “get it back”

- You get a win → Trust in the system increases

- You ask questions → Get shut down

- Your position size → Slowly creeps up

Losses are framed as your personal failure. Wins are proof that the system works. That mental loop keeps you subscribed, keeps you checking your phone, keeps you believing the next one will be different.

That attribution loop is well-documented in other finance research.

How To Actually Protect Yourself

If you’re still thinking about joining one of these groups, watch for these:

- Stop losses should be posted before or at the time of entry. Not later. Not “use your own risk tolerance.” Clear numbers.

- Targets shouldn’t move without a legitimate reason. If the setup changes, the trade idea might be invalidated. That’s fine. But don’t just shift the goalpost to avoid admitting a loss.

- Losses should be posted publicly, just as wins are. If a group only shares screenshots of their best trades, you’re seeing marketing, not results.

- No pressure to upgrade during market hours. If they’re pushing the VIP group while you’re in an open position, they care more about subscriptions than your money.

If a signals group needs urgency and FOMO to function, it’s not a trading system. It’s a retention system.Have spent countless hours in trading signals groups – my recommendation to beginners especially is to steer clear. They are not a shortcut.

Bottom Line

We ran these tests over four weeks to remove any remaining doubt. Maybe we were just being cynical. These groups may have improved. They haven’t.

The problem isn’t that markets are complex—it’s that these groups replace structure with pressure, replace planning with panic, and replace accountability with blame.

Good trading is boring. It’s repetitive. It’s quiet. Signals groups sell you excitement, community, and the feeling that you’re ‘in the game.’

But excitement drains accounts. And when your position goes red, no one in that signals group feels it but you.

Disclaimers

- This was an observational test. Our results reflect what happened when we followed posted signals in a specific set of rooms during a specific four-week window. Different market regimes, instruments, or execution conditions may produce different outcomes.

- Our sample size was focused on 7 groups and 112 signals, concentrated on US equities. This is meaningful, but it is not a definitive measure of the entire ‘signals’ ecosystem.

- We intentionally executed signals exactly as posted and used market orders when urgency was implied. Slippage, fills, and timing vary by broker, liquidity, and device latency, which may change results.

- Data is based on what was publicly visible in the rooms at the time. We logged posts, edits, deletions, and recaps as observed. Some moderation actions or private messages may not be visible to all members, and we cannot independently verify intent behind edits/deletions.

- We are not publishing the specific groups, moderators, or leaders involved. The goal of this study is not to target individuals, but to highlight systemic behaviors that we believe can make trading signals dangerous for beginners.

- Past performance is not indicative of future results. Any examples, screenshots, or trade outcomes discussed are historical observations and do not predict future performance.